Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

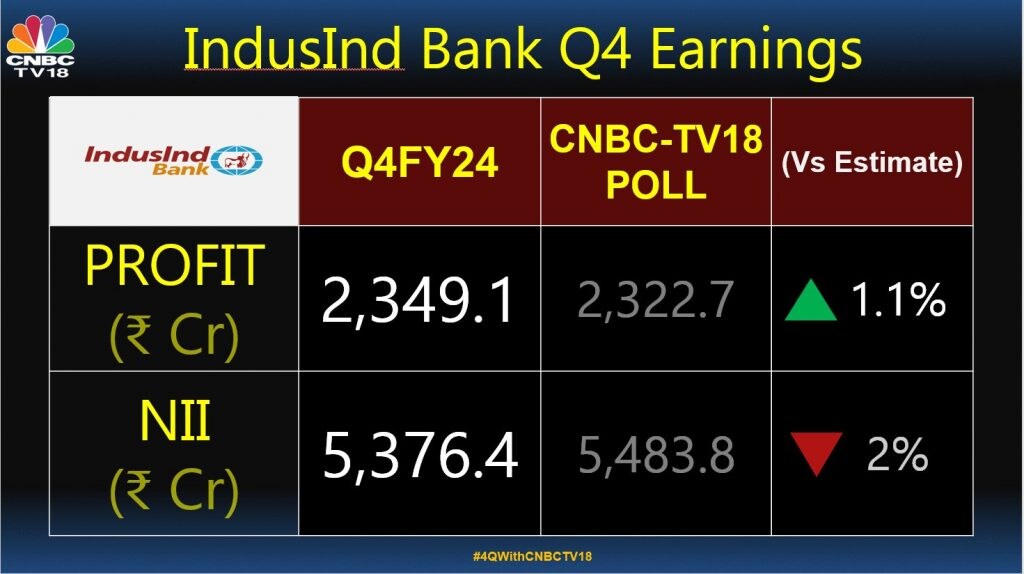

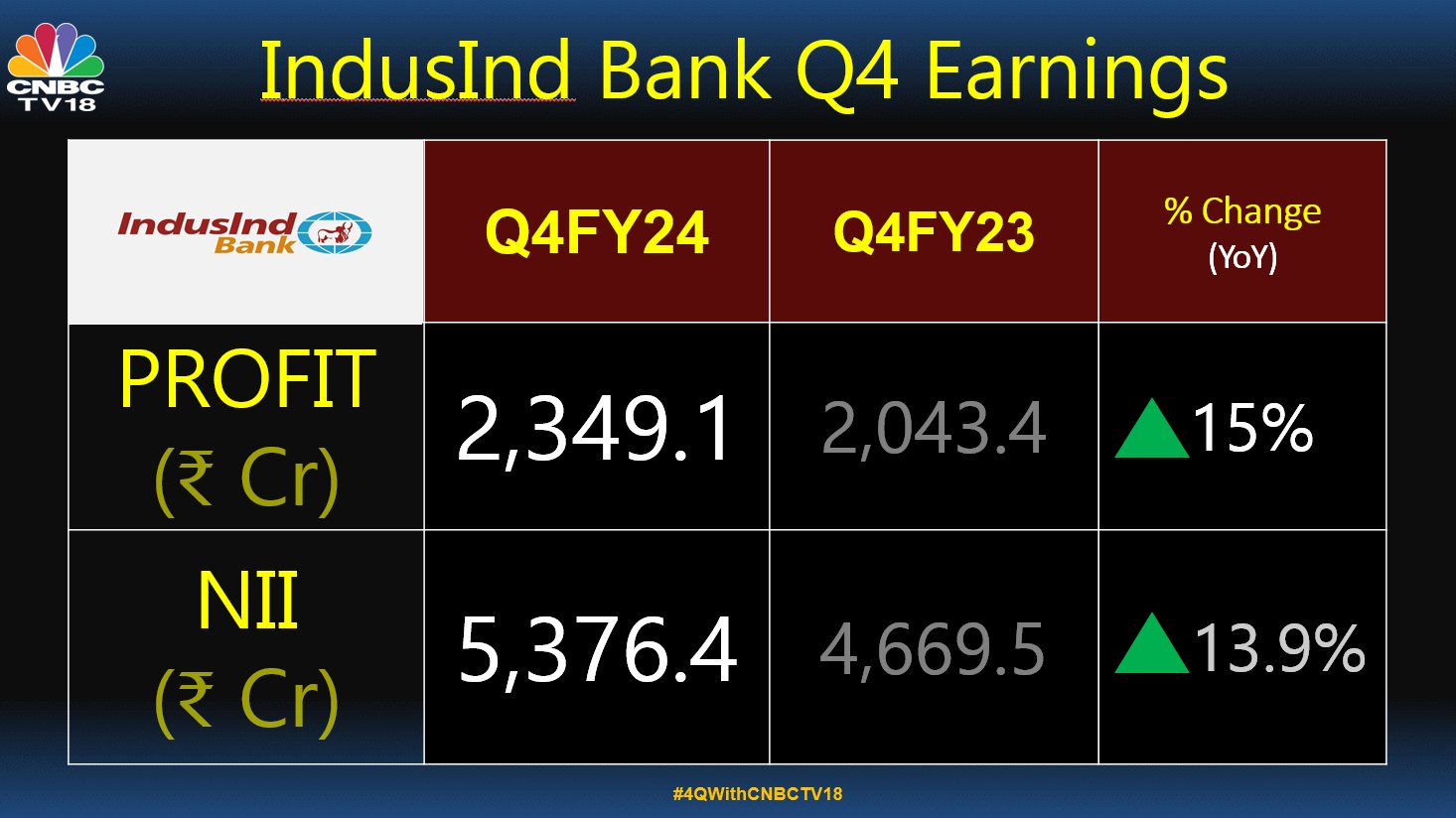

The bank’s net interest income (NII) stood at ₹5,376.4 crore, up by 13.9% from ₹4,669.5 crore in the corresponding quarter of the previous financial year.

Private sector lender IndusInd Bank on Thursday (April 25) reported 15% rise in net profit to ₹2,349 crore for the January-March quarter of financial year (FY) 2023-24. This figure exceeded the expectations outlined in a CNBC-TV18 poll, which had projected a profit of ₹2,322.7 crore.

The bank’s net interest income (NII) stood at ₹5,376.4 crore, up by 13.9% from ₹4,669.5 crore in the corresponding quarter of the previous financial year.

IndusInd Bank’s performance was propelled by an 18% growth in net loans, outpacing the 14% growth in deposits.

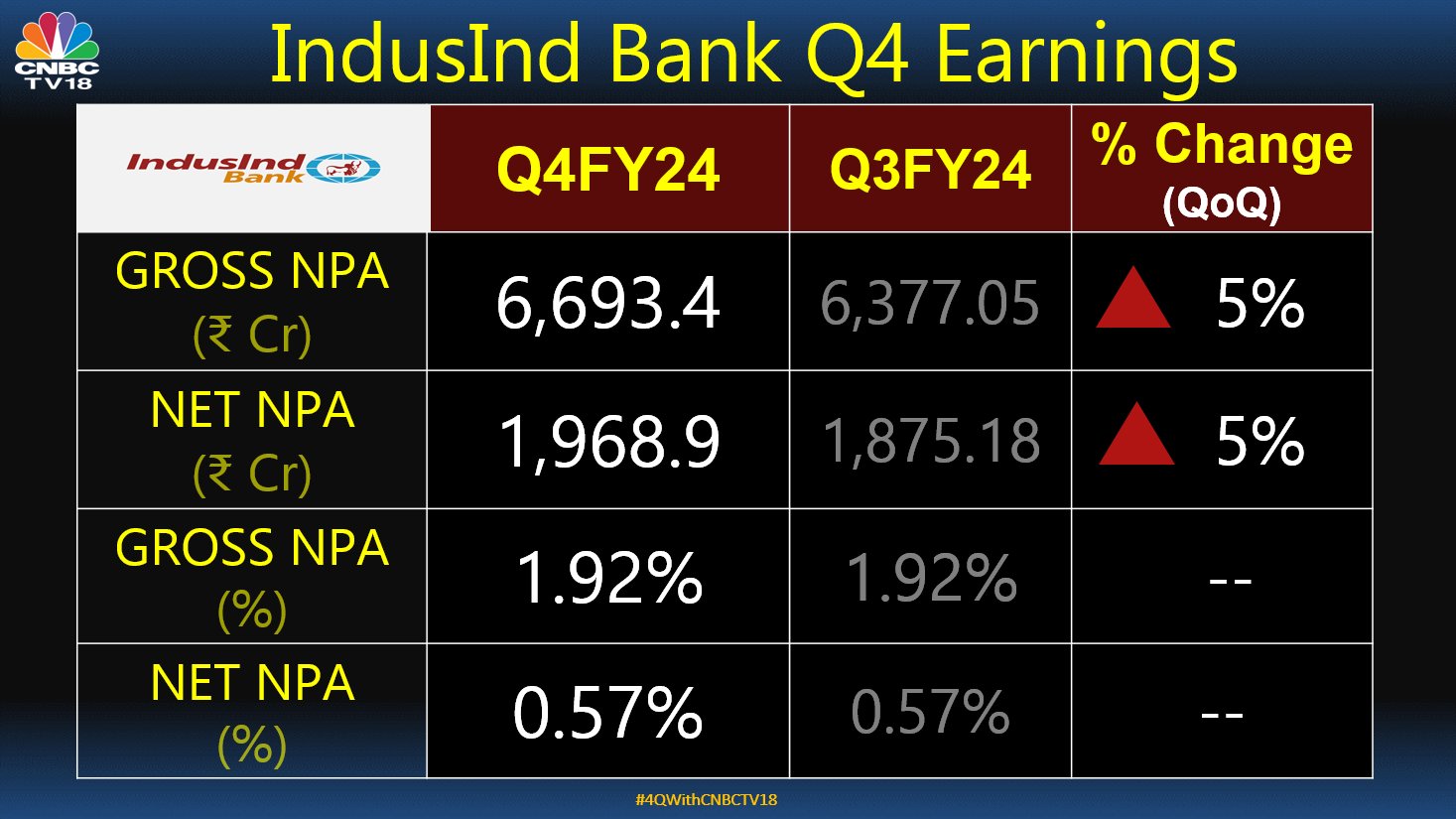

The gross non-performing asset (NPA) ratio stood at 1.92%, showing a decline from 1.98% recorded in the same quarter last year.

Similarly, the net NPA ratio improved to 0.57%, down from 0.59% on a year-on-year basis.

Operating expenses for the quarter ended March 31, 2024 increased by 24% to ₹3,803 crore as against ₹3,066 crore for the corresponding quarter of previous year.

Further, IndusInd Bank announced a dividend of ₹16.50 per equity share of ₹10 face value.

The bank’s shares closed 1.5% higher at ₹1,496.85 apiece on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The bank kept up its momentum despite challenges in the retail segment due to regulatory actions on a fintech partner. Shares of Indusind Bank Ltd ended at ₹1,545.60, up by ₹2.70, or 0.17%, on the BSE.

Private sector IndusInd Bank on Thursday (April 4) released its fourth quarter update, which revealed increases in deposits and advances despite challenges in the retail segment due to regulatory actions on a fintech partner.

According to the update, the bank’s deposits stood at ₹3.85 lakh crore, marking a 4% quarter-on-quarter (QoQ) increase and a 14% year-on-year (YoY) growth. Similarly, net advances rose to ₹3.43 lakh crore, reflecting a 5% QoQ increase and an 18% surge over Q4 of FY23.

While the bank experienced steady growth in deposits and advances, there was a marginal decline in the CASA (current account savings account) ratio, which stood at 37.9% compared to 38.5% QoQ and 40.1% YoY.

Also Read: South Indian Bank Q4 Business Update: Gross advances, deposits see quarterly growth

Despite this slight decrease, IndusInd Bank maintains a healthy CASA ratio, reflecting a stable mix of low-cost deposits. However, the bank faced a one-time net outflow of ₹2,759 crore in retail deposits as per the LCR (liquidity coverage ratio) during the quarter, attributable to regulatory actions on a fintech partner.

Despite this, the bank’s retail deposits and deposits from small business customers amounted to ₹1,69,441 crore as of March 31, 2024, compared to ₹1,65,371 crore at the end of December 31, 2023.

Q3

IndusInd Bank reported around a 17.3% rise in net profit to reach ₹2,297.9 crore for the October–December quarter, compared to ₹1,959.2 crore in the same period last year. The lender’s net interest income (NII) registered a growth of 17.8% year-on-year to reach ₹5,295.7 crore. The lender had posted NII at ₹4,495 crore in the corresponding period of the previous year.

The gross non-performing assets (NPAa) stood at 1.92%, a marginal improvement from the previous quarter’s 1.93%. Similarly, the net NPAs remained stable at 0.57%.

Also Read: Suryoday SFB Q4 Update: Gross advances up 41%, total deposits jump 50%

As per Basel III norms, the lender recorded a capital adequacy ratio of 17.86%, which is a slight decline from 18.21% in the previous quarter and 18.01% in the same quarter of the previous year.

Shares of Indusind Bank Ltd ended at ₹1,545.60, up by ₹2.70, or 0.17%, on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Indus PayWear will facilitate swift and secure tap-and-pay transactions at any contactless Point-of-Sale (PoS) terminal across the globe.

IndusInd Bank on Monday (March 11) announced the launch of its contactless payments wearables, ‘Indus PayWear’. This is India’s first all-in-one tokenisable wearables for both debit and credit cards on Mastercard, with the offering to be extended to other card networks shortly, the lender said.

Indus PayWear will facilitate swift and secure tap-and-pay transactions at any contactless Point-of-Sale (PoS) terminal across the globe.

The three versatile wearables, i.e. ring, watch clasp, and stickers, cater to diverse preferences of customers, with a price ranging from ₹499 to ₹2,999, the lender said.

The Indus PayWear mobile app will allow the customer to switch between cards, thereby making it “All-in-One” wearable.

In addition, the app will provide transaction monitoring and management/blocking of the wearable device for enhanced security, the bank said.

Furthermore, Indus PayWear transactions will offer the rewards and security of the underlying debit or credit card.

“While transactions below ₹5,000 will be done as a tap-and-pay using the wearable, transactions exceeding ₹5,000 will necessitate the added security of the PIN of the linked card to be entered on the PoS machine, as per RBI guidelines,” IndusInd Bank said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

This revision in FD rates occurs despite the Reserve Bank of India (RBI) Governor Shaktikanta Das-led Monetary Policy Committee (MPC) keeping repo rate unchanged at 6.5%.

Major banks have announced revisions in their fixed deposit (FD) interest rates this February, aiming to provide investors with better options. Axis Bank, Punjab National Bank (PNB), HDFC Bank, and IndusInd Bank have all adjusted their FD rates.

This revision in FD rates occurs despite the Reserve Bank of India (RBI) Governor Shaktikanta Das-led Monetary Policy Committee (MPC) keeping repo rate unchanged at 6.5%.

Here’s a look at recent interest rates offered by these banks on their FDs:

Axis Bank

The lender adjusted its FD rates, effective from February 5, 2024.

The bank now offers FD rates in the range of 3.50% to 7.20% per annum for general customers on fixed deposits maturing over seven days to ten years.

An increase of 10 basis points is observed in the rates for tenors from 17 months to less than 18 months, reaching 7.20%.

Here are the revised interest rates of the bank on deposits below ₹2 crore:

| Maturity period | Interest rate (per annum) | Senior citizen rates (per annum) |

|---|---|---|

| 7 – 14 days | 3.00% | 3.50% |

| 15 – 29 days | 3.00% | 3.50% |

| 30 – 45 days | 3.50% | 4.00% |

| 46 – 60 days | 4.25% | 4.75% |

| 61 days < 3 months | 4.50% | 5.00% |

| 3 months – 3 months 24 days | 4.75% | 5.25% |

| 3 months 25 days < 4 months | 4.75% | 5.25% |

| 4 months < 5 months | 4.75% | 5.25% |

| 5 months < 6 months | 4.75% | 5.25% |

| 6 months < 7 months | 5.75% | 6.25% |

| 7 months < 8 months | 5.75% | 6.25% |

| 8 months < 9 months | 5.75% | 6.25% |

| 9 months < 10 months | 6.00% | 6.50% |

| 10 months < 11 months | 6.00% | 6.50% |

| 11 months – 11 months 24 days | 6.00% | 6.50% |

| 11 months 25 days < 1 year | 6.00% | 6.50% |

| 1 year – 1 year 4 days | 6.70% | 7.20% |

| 1 year 5 days – 1 year 10 days | 6.70% | 7.20% |

| 1 year 11 days – 1 year 24 days | 6.70% | 7.20% |

| 1 year 25 days < 13 months | 6.70% | 7.20% |

| 13 months < 14 months | 6.70% | 7.20% |

| 14 months < 15 months | 6.70% | 7.20% |

| 15 months < 16 months | 7.10% | 7.60% |

| 16 months < 17 months | 7.10% | 7.60% |

| 17 months < 18 months | 7.20% | 7.85% |

| 18 Months < 2 years | 7.10% | 7.60% |

| 2 years < 30 months | 7.10% | 7.60% |

| 30 months < 3 years | 7.10% | 7.60% |

| 3 years < 5 years | 7.10% | 7.60% |

| 5 years to 10 years | 7.00% | 7.75% |

(Source: Axis Bank)

Punjab National Bank (PNB)

After the revision, Punjab National Bank (PNB) provides FD rates in the range 3.50% to 7.25% per annum for the general public and 4.00% to 7.75% per annum for senior citizens.

These revised rates, effective from February 1, 2024, span tenures ranging from 7 days to 10 years.

Here are the revised interest rates of the bank on deposits below ₹2 crore:

| Maturity period | Interest rate (per annum) | Senior citizen rates (per annum) |

| 7 to 14 Days | 3.5% | 4% |

| 15 to 29 Days | 3.5% | 4% |

| 30 to 45 Days | 3.5% | 4% |

| 46 to 60 Days | 4.5% | 5% |

| 61 to 90 Days | 4.5% | 5% |

| 91 to 179 Days | 4.5% | 5% |

| 180 to 270 Days | 6% | 6.5% |

| 271 Days to 299 Days | 6.25% | 6.75% |

| 300 Days | 7.05% | 7.55% |

| 301 Days to < 1 Year | 6.25% | 6.75% |

| 1 Year | 6.75% | 7.25% |

| >1 Year to 399 days | 6.8% | 7.3% |

| 400 Days | 7.25% | 7.75% |

| 401 Days to 2 Years | 6.8% | 7.3% |

| above 2 years & up to 3 years | 7% | 7.5% |

| above 3 years & up to 5 years | 6.5% | 7% |

| above 5 years & up to 10 years | 6.5% | 7.3% |

(Source: PNB)

HDFC Bank

HDFC Bank has revised its bulk fixed deposit (FD) interest rates for amounts above ₹2 crore to ₹5 crore. Effective from February 3, 2024, the rates for regular citizens range from 4.75% to 7.40%, while senior citizens get an additional 0.50% interest.

The highest rates, reaching up to 7.90%, are available for terms ranging from one year to less than 15 months.

Here are the revised interest rates of the bank on deposits ranging between ₹2 crore and ₹5 crore:

| Maturity period | Interest rate (per annum) | Senior citizen rates (per annum) |

| 7 – 14 days | 4.75% | 5.25% |

| 15 – 29 days | 4.75% | 5.25% |

| 30 – 45 days | 5.50% | 6.00% |

| 46 – 60 days | 5.75% | 6.25% |

| 61 – 89 days | 6.00% | 6.50% |

| 90 days <= 6 months | 6.50% | 7.00% |

| 6 months 1 day <= 9 months | 6.65% | 7.15% |

| 9 months 1 day to < 1 Year | 6.75% | 7.25% |

| 1 Year to < 15 months | 7.40% | 7.90% |

| 15 months to < 18 months | 7.05% | 7.55% |

| 18 months to < 21 months | 7.05% | 7.55% |

| 21 months to 2 years | 7.05% | 7.55% |

| 2 years 1 day to 3 years | 7.00% | 7.50% |

| 3 years 1 day to 5 years | 7.00% | 7.50% |

| 5 years 1 day to 10 years | 7.00% | 7.75% |

(Source: HDFC Bank)

IndusInd Bank

IndusInd Bank has announced revised FD rates, effective from February 6, 2024. The rates for general customers range from 3.50% to 7.75% per annum.

Senior citizens, too, can benefit from rates ranging from 4.00% to 8.25% per annum.

Here are the revised interest rates of the bank on deposits below ₹2 crore:

| Maturity period | Interest rate (per annum) | Senior citizen rates (per annum) |

| 7 days to 14 days | 3.5% | 4% |

| 15 days to 30 days | 3.5% | 4% |

| 31 days to 45 days | 3.75% | 4.25% |

| 46 days to 60 days | 4.75% | 5.25% |

| 61 days to 90 days | 4.75% | 5.25% |

| 91 days to 120 days | 4.75% | 5.25% |

| 121 days to 180 days | 5% | 5.5% |

| 181 days to 210 days | 5.85% | 6.35% |

| 211 days to 269 days | 6.1% | 6.6% |

| 270 days to 354 days | 6.35% | 6.85% |

| 355 days or 364 days | 6.5% | 7% |

| 1 Year to below 1 Year 6 Months | 7.75% | 8.25% |

| 1 Year 6 Months to below 1 Year 7 Months | 7.75% | 8.25% |

| 1 Year 7 Months up to 2 Years | 7.75% | 8.25% |

| Above 2 Years up to 2 Years 1 Month | 7.25% | 7.75% |

| Above 2 Years 1 Month to below 2 years 6 Months | 7.25% | 7.75% |

| 2 years 6 Months to below 2 years 9 Months | 7.25% | 7.75% |

| 2 years 9 Months to 3 years 3 months | 7.25% | 7.75% |

| Above 3 years 3 months to below 61 month | 7.25% | 7.75% |

| 61 month and above | 7% | 7.5% |

| Indus Tax Saver Scheme (5 years) | 7.25% | 7.75% |

(Source: IndusInd Bank)

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

CNBC-TV18 Edge | Shares of private sector banks and Nifty heavy weights such as HDFC Bank, Kotak Mahindra Bank, Axis Bank and IndusInd Bank have corrected sharply in the past few weeks. Read on to know more:

The underperformance and correction in banking stocks has led to weightage of financials to touch a five-year low. Currently, the weightage of banking and financial services stocks on the Nifty is 33% as per the latest National Stock Exchange fact sheet. This, compared to a 38.45% weightage in April 2023, signifies a weightage fall of 5.45% to the current one.

Private sector banks lead to weightage cut

Shares of private sector banks and Nifty heavy weights such as HDFC Bank, Kotak Mahindra Bank, Axis Bank and IndusInd Bank have corrected sharply in the past few weeks.

Shares of HDFC Bank have corrected 15.5% year-to-date, making it the worst performing stock on the Nifty 50 after UPL.

Infact, all private sector bank constituents in the Nifty Bank, except ICICI Bank, have traded with losses this year, so far.

Banks and financials weightage on the Nifty has dropped from a recent high of 38.45% in April 2023 to 33.01% currently. This was last seen in 2019, resulting in the weightage for banking and financials to drop to a five-year low.

Also Read: ideaForge shares gain the most since its listing day after reporting a profit in Q3

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

IndusInd Bank on Thursday, January 18, reported around 17.3% rise in net profit to reach ₹2,297.9 crore for the October–December quarter, compared to ₹1,959.2 crore in the same period last year.

The current credit cost guidance is intact for the lender and will remain within the range of 110-130 basis points, says Sumant Kathpalia, Managing Director and CEO of IndusInd Bank. While talking exclusively to CNBC-TV18 on Tuesday, January 23, he noted that the credit cost has decreased from 157 to 119 basis points, aligning well with the guidance.

Kathpalia further said that even during quarters with elevated gross flows, the credit cost remains within the targeted range. “The gross flows are expected to range between ₹1,100 to ₹1,300 crore,” he added.

A significant portion of the gross flows is attributed to the vehicle finance segment, which is well-diversified across six categories.

IndusInd Bank has consistently maintained a net interest margin between 4.2% to 4.3%, according to Kathpalia.

The IndusInd Bank CEO attributed this stability to strategic levers, including a mix change between corporate and retail, and within retail, a diversification across microfinance, vehicle finance, and other assets.

For the third quarter, the NIM stood at 4.29%, unchanged from the preceding September quarter.

Addressing the microfinance business, Kathpalia said that despite a 20% CAGR in the joint liability group book, credit cost will remain within the range of 2.5% to 3%.

Highlighting the diversification within the vehicle finance portfolio, Kathpalia mentioned a well-diversified ₹87,000 crore book spread across six categories. The bank’s capital position was deemed strong, with internal accruals anticipated to meet growth requirements.

He specifically mentioned a credit cost reduction in the vehicle finance book, from 1.3% to an estimated 1.18% by year-end.

Looking ahead, Kathpalia mentioned that the bank is well-capitalised presently, and internal accruals should suffice for the immediate future. The capital position will be re-evaluated to determine any future capital requirements.

Kathpalia was speaking to CNBC-TV18 days after the lender reported around 17.3% rise in net profit to reach ₹2,297.9 crore for the October–December quarter, compared to ₹1,959.2 crore in the same period last year.

The lender’s Net Interest Income (NII) registered growth of 17.8% year-on-year to reach ₹5,295.7 crore.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

IndusInd Bank Q3 results: The Gross Non-Performing Assets (NPA) stood at 1.92%, a marginal improvement from the previous quarter’s 1.93%. Similarly, the Net NPA remained stable at 0.57%.

IndusInd Bank on Thursday, January 18, reported around 17.3% rise in net profit to reach ₹2,297.9 crore for the October–December quarter, compared to ₹1,959.2 crore in the same period last year. CNBC-TV18 poll had anticipated a net profit of ₹2,274 crore.

The lender’s Net Interest Income (NII) registered growth of 17.8% year-on-year to reach ₹5,295.7 crore.

The lender had posted NII at ₹4,495 crore in the corresponding period of the previous year.

The Gross Non-Performing Assets (NPA) stood at 1.92%, a marginal improvement from the previous quarter’s 1.93%. Similarly, the Net NPA remained stable at 0.57%.

As per Basel III norms, the lender recorded a capital adequacy ratio of 17.86%, showing a slight decline from 18.21% in the previous quarter and 18.01% in the same quarter of the previous year.

The Common Equity Tier 1 (CET 1) ratio for the reporting period was 16.07%. Maintaining consistency, the Provision Coverage Ratio remained at 71% as of December 2023.

The Net Interest Margin (NIM) for the third quarter held steady at 4.29%, unchanged from the preceding September quarter.

On Thursday, IndusInd Bank’s shares witnessed 1.7% decline, closing at ₹1,615.75 on the NSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Two of the country’s biggest lenders are now making less money on every rupee lent because the deposit rates are rising faster than the interest rate on new loans. How much worse can it get?

The 7% fall in HDFC Bank shares contributed more than half of what has turned out to be the worst day for India’s stock market in over a year.

Worse-than-expected earnings from India’s largest private bank (by market capitalisation) and, separately, the downgrade of State Bank of India (the country’s largest bank by the sheer size of its loan book) have dampened the mood in the stock market.

Two of the country’s biggest lenders are now making less money on every rupee lent because the deposit rates are rising faster than the interest rate on new loans.

Nifty Bank has slipped over 1900 points, with HDFC Bank contributing nearly 1,500 points towards its downfall.

Santanu Chakrabarti from BNP Paribas believes the current margin squeeze in banking may worsen until September 2024 before it starts to ease. He also believes IndusInd Bank and AU Small Finance Bank are better bets for those looking to swoop up stocks during this correction.

ALSO READ: India’s most valuable PSU remains a wealth destroyer

On the other hand, Deven Choksey, MD of DRChoksey Finserv, believes those buying shares of HDFC Bank at today’s (January 17) price (after the sharp fall) can potentially make returns of 25% to 30% in the long run.

Ashutosh Mishra, Head of Research, Institutional Equities at Ashika Stock Broking, concurs with Choksey in seeing HDFC Bank as a compelling opportunity for the next 2-3 years.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously