India to drive growth in emerging markets, needs to boost infrastructure, says Mark Mobius — Read the interview here

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Emerging markets fund manager and founder of Mobius Capital Partners LLP Mark Mobius remains positive on India and China. “India and China will continue to drive growth higher in emerging markets,” he told CNBC-TV18 in an interview.

Emerging markets fund manager and founder of Mobius Capital Partners LLP, Mark Mobius remains positive on India and China. “India and China will continue to drive growth higher in emerging markets,” he says.

“Because of India and China and some other countries, the growth of EMs is double that of developing countries and it is unlikely that it will change any time soon,” he said in an exclusive interview with CNBC-TV18.

Talking specifically about India, he said he is upbeat about domestic-oriented manufacturing of infrastructure and consumer-spending, as per capita income is going up.

However, he said the Indian government needs to take certain measures to push growth. He said the number one issue was infrastructure spending. “India has to get into international markets, issue bonds, even foreign currency bonds, which they will pay back at these low-interest rates and develop infrastructure which will create an ability to grow and export,” he said.

He noted that globally too a lot of high-risk countries were issuing bonds at low rates. “One must remember that euro is now at negative rates, so the situation is that you have to pay the bank to keep the money, so this is an opportunistic opportunity for India,” Mobius added.

On the currency market front, he said dollar continues to be strong because the equity markets in the US were strong and are getting stronger. Moreover, some of the other countries have gotten into trouble and dollar has become a safe-haven.

Talking about rupee, he said, “Rupee on a recent historical level has not been too bad, it has been relatively stable because the RBI has been quite conservative, reserves are good and so people see that it is relatively safe.”

“I am bullish on gold. I am not saying that gold is not going to go down because it is going to fluctuate but people should have at least 10 percent of their portfolio in physical gold,” added Mobius.

Edited excerpts from the interview:

The latest in India has been about Moody’s downgrading India from ‘stable’ to ‘negative’ and they have given a list of reasons on why they have done that; but what has been your reaction because for the longest time you have been bullish on India?

I think its unwarranted because India has a very stable position in terms of the entire financial system, more and more money will be coming into India for investments and frankly I believe that India would be very well qualified to issue a century bond on the international markets which is what they should do in order to build up the infrastructure. So it’s quite puzzling from my point of view.

What is your sense? One of course is the domestic slowdown but the other is the global friction as well. What is the impact of that that you see in India?

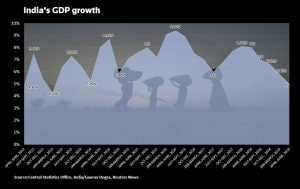

When we talk about slowdown, 5 percent growth is incredible when you compare with what is happening in other parts of the world and even if you say that’s overstated, let’s say 4 percent; still that’s very good growth for a country this size. So I think perhaps Moody’s has been too sensitive to the ideas that perhaps India is not going to be growing at the rate that it has been in the past, but I do not believe that. I believe India will pick up its growth and a lot of the Narendra Modi-led government’s reforms are going to be kicking in gradually and will have a big impact.

In the recent past, we have seen a corporate tax cut, there has been a move on the real estate as well. How do you read all these measures coming in from the government?

It’s part of this reform package and reform emphasis of the Modi administration which is very good. Cutting the corporate tax makes a lot of sense because it puts India on level with other emerging market countries around the world and will attract more investment, not only internationally but domestically and I believe now with the trade war between China and US, India has a good chance to pick up some of this trade and some of this manufacturing that is taking place in different parts of the world – that is coming out of China into other countries. So there are number of factors like this which I think are going to have a positive influence on India.

That was the expectation when the trade tariff war broke out between the US and China, there was an expectation that India perhaps could actually come out as a major beneficiary. We haven’t seen that happen in last 16 or18 months. Would you say there has been a delayed response, do you still expect India to benefit out of that?

Yes, it’s a delayed response. Let’s say if you are manufacturing shoes in China and you want to move to India, it is going to take you at least a year to establish yourself get the proper licences etc., so this is going to be a delayed reaction going forward, but I think this is going to happen. I must say it’s going to be a massive move but you are going to find more Chinese manufacturers who are coming to India because they cannot export to the US because of their problems in exporting to the US and also because of lower cost.

How have you seen the whole US and China trade dispute and the conversations and going back and forth on statements etc. what do you make of that?

What I make of it is the multilateral trade agreements are pretty much over. In other words, weakening of World Trade Organisation, multi-lateral structure, is not going to be what it was previously and now it is going to be more bilateral agreements simply because US President Donald Trump has finally said ‘look it is unfair’. What is happening with China and with some other countries and well, the country is now following suit and they have begun saying now ‘wait a minute why do we sign this multi-lateral agreement which puts us in such a bad situation’. So I think international trade is not going to stop but it is going to be at a different level.

What is your sense on how soon do we see an agreement happen and if this is going to go on for another year into 2020, till November perhaps, that is when the US presidential elections are happening, how long can the global markets sustain this?

It is going to be on-going, it is not going to end at a certain day. Simply because it involves not only trade, not only physical trade but intelligence trade, in other words all of the technology transfer issues that China and the US have, it is going to be on-going, it is not going to end overnight. Then of course you got to think of the strategic issues that are taking place with China expanding, with belted roads projects and all kinds of investments in Africa and so forth, so the conversation or negotiation is going to continue for quite some time.

When you say that India can stand as a beneficiary between all of these trade disputes what sector in India do you see actually taking charge of that?

First of all manufacturing, there is very much opportunities for low cost manufacturing in India. That requires of course special economic zones which will allow free imports of parts and tools so that they can be re-exported after being re-engineered and manufactured and the Indian government is working on that. So it is going to take time to develop and it is definitely going to develop and be a big part. The other aspect is intellectual exports and the US already have that, you have the outsourcing firms in India that are very big and will be growing more, there will be more of that going forward.

How have you also read India not wanting to be part of RCEP in its current avatar that of course was doubted as a huge one? That would have actually led to a lot of coming together of major powers, a lot of world global trade actually could have been a part of this. With India walking away what does that mean for India and RCEP without India?

I could see the reason why India walked away from that because they saw that with China in that grouping, the Indian market would be forced open for Chinese goods which could be detrimental to the growth of the Indian market. You must remember at the end of the day China was able grow on the back of the high restrictions on imports into China during its growth phase. I think India is on that phase as well, so it makes sense for them to be very cautious about opening the market to Chinese goods and services. But that does not mean that they cannot create bi-lateral agreements which each of the ASEAN countries and there is a lot of room for that going forward.

Another thing is there is an economic slowdown globally; when you look at that what is the sense on what Indian government needs to do from hereon to push growth forward, to ensure that the consumer demand comes back?

The number one issue is infrastructure spending. I am reminded, if you recall the history of the United States during creative Franklin Roosevelt, the president during depression, very high unemployment, I think it was 20 percent unemployment and what he did was he started the Works Projects Administration, which was spending billions of dollars – in those days it was millions of dollars but today it is billions on infrastructure. The Central government said for each of the states if you come to us with a viable project to build a road, bridge, parks we will give you the money provided that you put people to work in building those. There was some criticism at that time because they said it was a lot of waste because you could have done the project cheaper but what they were doing is they were saying that we want to employ people, so it may not be as efficient but we have bigger employment and that really helped a great deal first of all in employing people and second building incredible infrastructure.

By the way it was not only physical infrastructure, it was artistic infrastructure – in other words they build theatres, they funded actors and actresses and dance troupes and so forth. It was a very successful programme.

That is the reason why I believe that India has got to get into international market, issue bonds, even foreign currency bonds, which they will pay back at these low interest rates and develop this infrastructure which will create an ability to the country to grow and export.

How do you look at emerging markets right now and if India were to a launch a bond like that do you see a lot of acceptance and lot of funding coming?

You can see globally too a lot of high risk countries are issuing bonds at low rates. You must remember that euro has now at negative rates, so the situation is that you have to pay the bank to keep the money, so this is a very strange and opportunistic possibility for India.

Coming back to emerging markets, how do you see the EM growth numbers right now? What is your sense on where are we headed and how would you look at India vis-à-vis the other EMs?

Again because of India and China, the growth of EMs and other countries as well, particular those countries the growth is double that of developing countries and I don’t see that changing any time soon. You are seeing other countries coming up at pretty fast pace as a result of reforms – Brazil and Russia are not doing badly and a number of other countries.

Within India, what sectors look attractive to you?

I would say first of all manufacturing and not necessarily export-oriented manufacturing but domestic-oriented manufacturing connected to infrastructure spending. You see infrastructure spending is moving ahead, and anything to do with consumer spending because per capita income is going up, those would be the two areas.

I heard you speak about responsible investment, what would you mean by that and how would you pattern it out?

Responsible investment involves the ESG – the environmental, the social and governance factors. For my way of thinking and again in the book Invest for Good, we outline the fact that you have to improve governance first. You have to get companies to have good governance, independent directors for example, one share class, etc., which would then enable them to attack social and environmental challenges.

What is your sense the way countries are going with a lot of protectionism coming back, is that the way to go forward or would you say that the global village as we continue to call, is that how we would evolve?

I don’t think the way to go is to have closed markets and no trade, you have to have global trade and I believe this will continue, simply because the internet is covering the globe and people would be trading with each other regardless of what governments may want to do – you are going to get packages moving from one place to another and trade taking place and now with the growth of cryptocurrencies, the growth is going to be even further enhanced people paying each other in this digital currencies. So, I don’t see global trade declining very much going forward.

What is your sense on currencies, you spoke about euro and how that was misbehaving but the dollar index continues to be the choice of safe haven currency given what we have seen this year as well, what is your sense on where is the dollar headed?

Dollar continues to be strong mainly because the equity markets in the US are still strong and getting strong, that is one reason and the other reason is that some of the other countries have gotten into trouble for one reason or other and there is a desire by a lot of people in these other countries to get US dollar as a safe haven but that does not mean that other countries are not going to recover, you will see recovery of so many of these other currencies.

We have seen Chinese yuan gain in the recent past but cannot say the same about the Indian rupee where we have seen some decline coming in this week itself?

Yes, it is interesting; Indian rupee from a recent historical level has not been too bad. It has been relatively stable. I think one of the reasons for that is the Reserve Bank of India has been quite conservative, reserves are good and so people see that it is relatively safe.

I personally believe that India could issue an international bond and therefore we will put India on the international financial market so to speak. It will become pretty well known and that will be beneficial for India generally.

We have also seen gold prices give very good returns in this year and the expectation that we are perhaps into yet another bull cycle here, what is your sense on gold, where is it headed, how much should one be investing into that?

I am bullish on gold as you can imagine. I am not saying that gold is not going to go down, of course it is going to fluctuate but I believe that people should have at least 10 percent of their portfolio in physical gold.

As I have been saying that with the rise of cryptocurrencies no one really knows what the money supply is. You add that to the fact that the Europeans and the Americans and other countries have been printing like crazy, means that money supply has gone through the roof and therefore the value of gold has to increase because it is a kind of a currency with limited supply.

Since you are bullish on gold, do you have a target on that?

I was saying that – people ask me what is your target for 10 years, I would say it will be double the price it is now.

What is the best way to invest, is it specific stock, do you look at countries, do you look at sectors, is it exchange traded funds (ETFs), how should one really be putting out their portfolio?

ETFs have become very popular and ETFs have a role in portfolio because you can get the access to various sectors and various countries through the ETFs but I believe that active funds are very important as well. You have to have actively managed funds simply because it gives you an opportunity to get involved in ESG factors because active investors are becoming much more involved with improving ESG and also the fact that active investors will not go with the ESG indexes. They would be doing something different. So it is kind of a hedge in the event that the index funds go down, you have a chance to diversify.

You have told me that the gold prices will double in the next ten years, what is your sense about the Indian equity markets, where are we headed on that because we have recently seen all-time highs here?

I think it will continue to do very well. It is going to continue to go up. You can see the history, it has been almost like a straight line going up and I think that will continue. It is interesting, the fact that you have had all these crisis here in India, you have the bank problems, so on and so forth but the index is still continuing to go up. Imagine how it will do if the things are getting better.

Since you keep talking about manufacturing and infrastructure and that would mean core commodities like iron ore, steel, nickel and copper, these are a few metals which we haven’t seen do very well in this year. If you look at the bar graph, it is only nickel which is up by 50 percent, rest every other metal is perhaps flat or just about in the green. How would you look at some of these core commodities performing?

If you look at the variety – let us look at cobalt for example, it has gone through the roof. Copper is moving up again.

That is an electric vehicle (EV) story altogether.

Yes, again it is EV story because more of these electric vehicles means more demand for cobalt and copper. So we have to look at each individual commodity. Generally speaking, the fact that commodities are denominated in dollars means that when the dollar gets weaker, which it will eventually, these commodity prices will go up.

Right now you have a hard situation where you have got a strong US dollar and some of these commodities are doing very well. So that means that the demand for these commodities are doing well as well. Of course, there is tremendous variety, some are down, some are up but there is no question that these commodities will continue to do fairly well.

What is your sense on the interest rates because as of now in this year it really has been a trend of lower interest rates globally and in India as well we have seen a lot of cuts? What is your sense going forward, especially for India?

I think India’s interest rates are too high considering the global environment. We are looking at 5-7 percent like that and of course in the retail market much higher. I believe these interest rates should go down. I know that it is kind of not a good thing to say in front of the central bank who wants to raise interest rates, but I believe that India deserves lower rates.

What has been your sense, how would you look at – since we are closer to the end of 2019, how has the year been because there has been so much, there has been the US-China trade talks, there has been the global central banks cutting interest rates, Brexit is something that we continue to keep an eye on even now. How would you summarise the year gone by?

It has been a rough year, it has been a very confusing year because when you have all these crisis, particularly the trade crisis, the US-China trade thing, the Trump administration, very difficult to assess what is happening there and then what is happening in Europe with the Europeans continuing to pump euros into the market with no real effect, then Japan the same thing. So, you have a lot of things going on in these financial markets which makes it amazing when you can see that some of these markets have done fairly well, it is quite surprising.

I also want to talk to you about the crude oil prices because that also has been a buzzing one this year. There is an Organisation of the Petroleum Exporting Countries (Opec) meeting coming in December where markets are expecting some more aggression perhaps from Opec, but what is your sense on the energy markets?

The US is now the largest producer of oil in the world, they are larger than Saudi Arabia and Russia and that tells you something. It means that around the world there is plenty of oil, many of these fields which have not been discovered yet and I believe here in India there could be oil that has not been found yet. So, I believe that given the fact that you have this price level, there is an opportunity to find more oil.

India’s dependence on oil imports right now is 84 percent, and there are reports that it could go to 90 percent and beyond as we get into the next decade. Do you see that kind of demand continuing from Asia, from India?

I think India and other countries are going to be increasing their wind, solar, nuclear use, and so forth. India’s biggest source of electric energy is from coal, and as the demand for cleaner air comes in, you will see a big growth in these alternative energy sources which will put a dampener on the demand for coal and oil.

Road ahead for 2020, what are your expectations from various asset classes, various markets, where would you advise putting money on?

Emerging markets of course because emerging markets are growing double the rate of developed countries. However, you have got to diversify, you should have something in the developed countries, in the US, in the Europe, but larger part should be in emerging markets particularly India and some of these other fast growing countries.

Within that as well, how would you want to put it across sectors, in commodities, equities, currency, interest rates?

We favour equities because equities keep up with inflation. However, you cannot put all your eggs in one basket. You should have something in commodities such as gold, you have got to have something in fixed income because fixed income is very difficult now given the environment, but you got to be diversified. However, I would say number one should be equities.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter