BCG anticipates FMCG volume uptick aided by stable pricing, more products

Summary

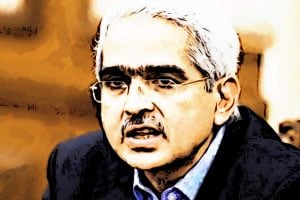

Abheek Singhi, MD & Senior Partner of Boston Consulting Group (BCG) discussed the opportunities and challenges for the FMCG industry.

Abheek Singhi, MD & Senior Partner of Boston Consulting Group (BCG) believes there could be an uptick in volumes for the fast moving consumer goods (FMCG) sector over the next 12 months.

“There is a set of supply-side or industry actions that will drive some of this growth in the next 6-12 months,” he said highlighting the softening of commodity prices, leading to less product price increases, and the industry’s focus in expanding product categories.

In its latest report on the FMCG industry, presented at the Confederation of Indian Industry’s (CII) FMCG Summit, BCG pointed out that the FMCG sector’s volume growth has not kept pace with the country’s GDP growth over the past 15 years.

From 2007 to 2023, while India’s GDP grew at an average rate of 5.9%, FMCG volume growth was only 3.4%. A more significant slowdown was observed between 2017 and 2023, where FMCG volume growth declined from 3.5% to 2.9%, impacted by various disruptive events like the implementation of GST, demonetisation, and the COVID-19 pandemic.

The report also highlighted consumer spending patterns, revealing that the affluent 16% of the population accounts for 32% of total consumption, with the middle-income households contributing the rest. Another factor affecting FMCG volume growth is the sharp rise in consumer staple prices since 2012, which has led to a reduction in FMCG product consumption relative to other items.

Also Read | 3 of 4 households in India have ITC products, analysts expect FMCG focus to drive growth

Abheek Singhi, MD & Senior Partner at Boston Consulting Group, remains optimistic about the sector’s future. He predicts an upturn in FMCG volume growth in the next 12 months, driven by supply-side actions and industry efforts. This expected improvement comes as a welcome sign for the industry, which is looking to rebound from a period of slower growth.

Also Read | The fifth ‘P’ in FMCG: How politics shapes what we consume

For the entire explanation, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter