The Dutch disease and its role in the current Venezuela crisis, explained

Summary

As Venezuela, once the richest country in South America, plunges further into political and financial chaos, the term ‘Dutch disease’ has come into general notice. Experts, as well as the general public, are looking at how this economic phenomenon sheds light towards the economic disaster that is being witnessed by the country with the largest petroleum …

Continue reading “The Dutch disease and its role in the current Venezuela crisis, explained”

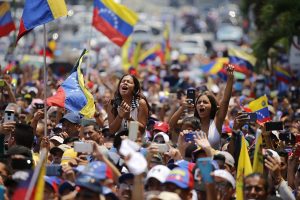

As Venezuela, once the richest country in South America, plunges further into political and financial chaos, the term ‘Dutch disease’ has come into general notice. Experts, as well as the general public, are looking at how this economic phenomenon sheds light towards the economic disaster that is being witnessed by the country with the largest petroleum reserves in the planet.

What is the Dutch disease?

In economics, the term Dutch disease points towards a situation where an increase in the prominence of a particular sector within an economy leads to a decline in the prominence of other sectors.

When a particular sector grows unprecedentedly, it often leads to rise in foreign revenue in the form of exports originating from this sector. This, in turn, leads to the strengthening of the currency of a particular country. However, it also has serious side effects. The rise in currency value along with the focus on a single sector leads to a fall in exports of other products and a rise in imports from outside. This further leads to a phenomenon where an economy is highly dependent on a selected sector for revenue generation and trade.

The rise of a single sector can be due to many factors that range from the sudden discovery of a valuable natural resource, increase in price and demand of a particular resource or even sudden surge in foreign aid leading to the rise in currency value.

Origin of the term

The economic phenomenon was named after the economic change transformation that took place in the Netherlands in the 70s following the discovery of natural gas. This, in turn, had led to the decline of the nation’s thriving manufacturing sector.

How is it linked to the crisis in Venezuela?

The steep rise in the price of oil during the last decade led to growth in oil revenue of Venezuela, a prime source for oil. This, in turn, led to the rise in revenues of the country that the government led by leftist Hugo Chavez spend lavishly on welfare policies aimed at creating a socialist state. The large scale dependence on oil revenue led to the decline of other sectors including business.

However, with a fall in global oil prices, revenue took a hit, seriously affecting the Latin American nation that depended on the black gold for revenue. This, in turn, led to the virtual end of export revenue and paved the way for inflation, lack of even basic necessities and poverty among others.

How does this influence other countries?

The crisis in Venezuela points towards the ill effects of having total dependence on a particular sector. This is also alarming to many nations across the globe who depend heavily on oil revenue. With alternative energy sources being made popular across the globe, questions have been raised about the future of several countries, particularly the Gulf. Also the crisis points on how unregulated social welfare measures and perks may end up becoming counter-productive even if they may come with mass appeal.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter