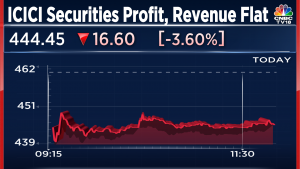

ICICI Securities Q2 Results | Net profit zooms 41%, interim dividend of ₹12 per share declared

Summary

In the quarter, total revenue stood at ₹1,249 crore, up 45.5% YoY. Shares of ICICI Securities Ltd ended at ₹629.60, down by ₹1.20, or 0.19%, t on the BSE.

Brokerage house ICICI Securities Ltd on Monday (October 16) reported a 41% year-on-year (YoY) jump in net profit at ₹423.6 crore for the second quarter that ended September 30, 2023.

In the corresponding quarter last year, ICICI Securities posted a net profit of ₹300 crore, the company said in a regulatory filing.

In the quarter, total revenue stood at ₹1,249 crore, up 45.5% against ₹858.5 crore in the corresponding period of the preceding fiscal.

At the operating level, EBITDA jumped 54.8% to ₹810.1 crore in the second quarter of this fiscal over ₹ 523.3 crore in the corresponding period in the previous fiscal.

The EBITDA margin stood at 64.9% in the reporting quarter compared to 61% in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation, and amortisation.

The company declared an interim dividend of ₹12 per equity share of face value of ₹5 each to the shareholders of the company, ICICI Securities said.

The company’s retail equities and allied revenue stood at ₹701 crore, marking a 39% year-on-year increase, within which equity revenue grew by 44% YoY to ₹270 crore and derivative revenue grew by 37% year-on-year to ₹137 crore.

Distribution income reached ₹176 crore, demonstrating a 13% YoY growth. Private Wealth Management revenue stood at ₹361 crore, up 37% year-on-year.

On the institutional side, Issuer Services and Advisory revenue escalated to ₹79 crore, reflecting a healthy 62% year-on-year increase while Institutional Equity & Allied Revenue reached ₹105 crore, a noteworthy increase of 147% year-on-year.

MF and other distribution revenue grew by 14% year-on-year and 27% year-on-year respectively, loans distributed for Q2 stood at ₹1,460 crore, up 66% year-on-year.

In the current quarter, ICICI Securities’ retail cash equity market share improved from 10.6% to 12.8% year-on-year. The company has continued to improve its market share in the commodity market segment from 5.5% to 7.8% YoY. Furthermore, ICICI Securities has maintained its leadership position in the MTF (Margin Trading Fund) segment with a 22% market share.

ICICI Securities added 2.24 lakh clients during the quarter, expanding its customer base to 95 lakh. The company also added 7,000 Private Wealth Management (PWM) clients, increasing its PWM client base to 91,000+.

As of September 30, 2023, ICICI Direct’s total client assets reached approximately 6.5 lakh crore, marking a significant 12% year-on-year increase. The PWM Assets Under Management (AUM) reached 3.7 lakh crore, reflecting a strong 20% growth.

The results came after the close of the market hours. Shares of ICICI Securities Ltd ended at ₹629.60, down by ₹1.20, or 0.19%, on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter