Home First Finance shares rise after company denies reports of Warburg’s exit plans

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Home First Finance share price: The stock held on to the green after the housing finance firm’s management denied reports that certain shareholders are planning to exit the company.

[wealthdesk shortname=”Home First” isinid=”INE481N01025″ bseid=”543259″ nseid=”HOMEFIRST” sector=”Finance – Housing” exchange=”nse”]

Home First Finance shares held on to the green on Thursday after the company’s management denied reports that certain shareholders are planning to exit the company. The housing finance company’s CEO and MD, Manoj Viswanathan, told CNBC-TV18: “I don’t think any of the investors are looking to exit the company completely. We are not privy or party to any such discussions.”

He also said he is not aware if Warburg wants to sell a part of its stake in the company. Earlier, the Hindu Business Line had reported that Warburg was looking to sell 28.73 percent in the company.

“We have four large private equity investors from whom we have raised capital over the last several years. We have Bessemer Venture Partners, which holds about eight percent of the company, True North and GIC, whose combined holding is 33 percent, and we have Warburg Pincus, which holds about 29 percent,” he said.

Out of these four, True North and Aether are the company’s promoters, and 20 percent of the promoter holding is locked in till February 2024, he said.

“So 20 percent out of 33 percent is locked in…. Only the balance 13 percent is available at this point of time. However for any partial stake sale the company would not be privy to these kind of transactions as they would happen in the market,” he said.

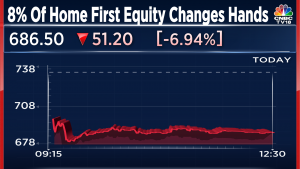

The stock rose by as much as Rs 42.1 or 4.9 percent to Rs 907 apiece on NSE on Thursday.

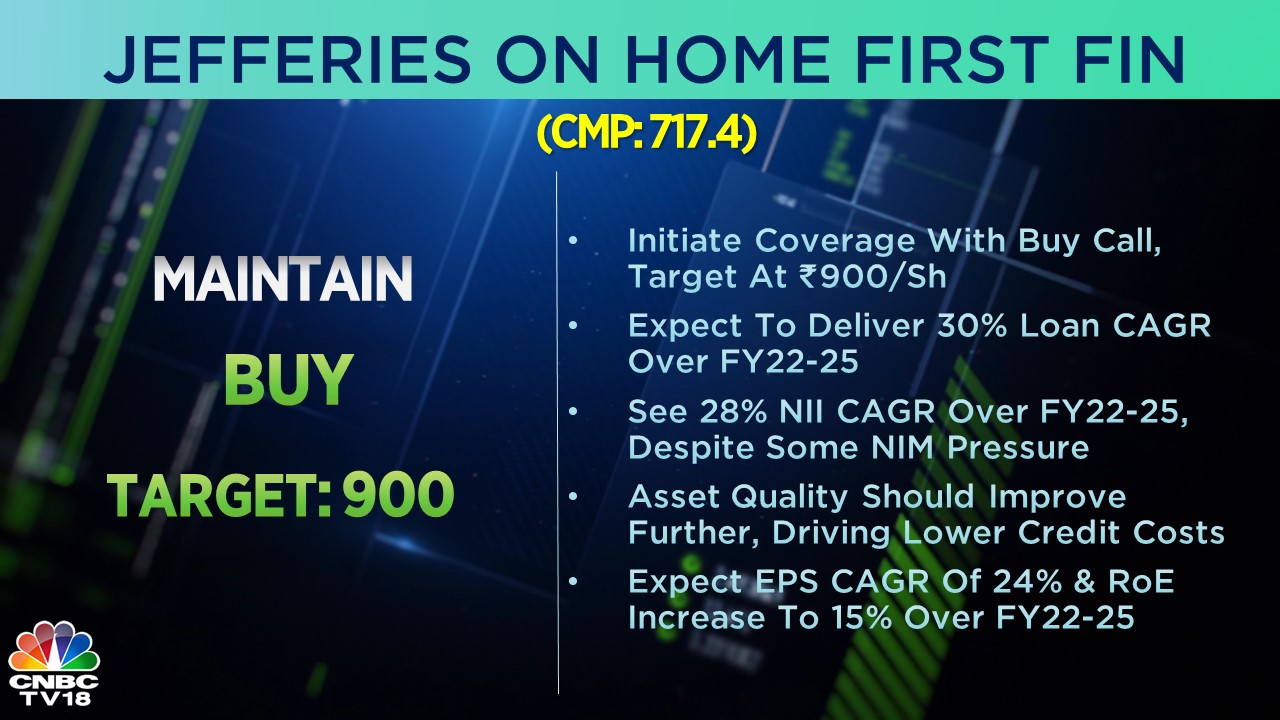

Home First Finance, Viswanathan said, is targeting growth of 30 percent in its assets under management (AUMs), a level the management finds comfortable to achieve. The company is seeing strong demand from the affordable housing segment, he said.

“When we go down to our branches, we are seeing that there is a lot of movement or migration of people from smaller villages to larger towns and looking for livelihood… These are the people who end up building or buying their first home,” he said.

Last week, Motilal Oswal Financial Services initiated coverage on Home First Finance with a ‘buy’ rating and a target price of Rs 1,020. The brokerage’s target implies upside potential of almost 18 percent from its closing price on Wednesday.

“Home First has the best productivity metrics among its peers… The company’s strong execution on the asset quality front over the next two years will speak for itself and convince investors further about the quality of this franchise,” according to Motilal Oswal Financial Services.

Home First shares have underperformed the market in the recent past, falling more than seven period in the past one month — a period in which the Nifty50 benchmark has risen two percent.

Catch latest market updates with CNBCTV18.com’s blog

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter