HUL analysts expect a gradual recovery in volume growth in FY25; Stock falls over 2%

Summary

Analysts have slashed their FY25 and FY26 EPS estimates by 7% and 5.5%, respectively, and said that they will watch out for a gradual rural recovery and a likely good monsoon.

Shares of Hindustan Unilever Ltd. (HUL) fell up to 2% in Thursday’s trade even after the company’s March quarter numbers came in line with the Street expectations. HUL reported a decline in revenue and profit while domestic volume grew about 2% for the fourth quarter.

The commentary by a couple of brokerages was uninspiring for investors with HSBC and Jefferies reiterating ‘Hold’ recommendations, while Nuvama trimmed earnings per share (EPS) estimates even as it retained a ‘Buy’ stance on the HUL stock.

Nuvama analysts have slashed their FY25 and FY26 EPS estimates by 7% and 5.5%, respectively, and said that they will watch out for a gradual rural recovery and a likely good monsoon.

However, Motilal Oswal said there is no material change in its EPS estimates for FY25 and FY26.

“The valuation at <45 times FY26E EPS is reasonable given its last five-year average P/E (price-earnings) of 60 times on one-year forward earnings,” the brokerage said while reiterating a ‘Buy’ rating and a target price of ₹2,900 per share, considering favourable risk-reward.

In the transition phase of the last 12 months, volume growth was weak and value growth was affected by price cuts, Motilal noted.

The brokerage expects a gradual recovery in volume growth in the current financial year, driven by its own initiatives and gradual improvement in demand.

The impact of price cuts is expected to persist in the first half of FY25, but the volume print should improve during this phase and the full revenue recovery will be visible in H2FY25, as highlighted by Motilal in its report.

According to Amnish Aggarwal of Prabhudas Lilladher, risk-reward looks favourable after little returns in the last four years; however, significant re-rating looks unlikely given valuations at 44.6 times FY26 and market momentum in favour of cyclicals.

The brokerage has upgraded the stock to ‘Accumulate’ from ‘Hold’ earlier for moderate returns over the next 12-15 months.

Analysts at Emkay Global said HUL’s struggle to revive growth and recoup margin from 23% is reflected in the stock’s valuation, which has seen a steady de-rating.

The management commentary in the earnings call suggests actions are in place, though with a lag, which is where it continues to see hiccups.

Going ahead, the brokerage said it remains concerned about the demand slum, its inability to drive in-time innovation, competitive stress, and weak business mix.

HUL posted a net profit of ₹2,406 crore, which was in line with the CNBC-TV18’s poll of ₹2,438 crore. The company’s revenue also stood in line with expectations for the quarter.

EBITDA or Earnings before Interest, Tax, Depreciation and Amortisation came in at ₹3,435 crore, which was also in line with expectations of ₹3,430 crore. EBITDA margin stood at 23.1%, also meeting estimates.

The management expects FMCG demand to continue to improve gradually. They also remain optimistic about the mid-term impact of better monsoons and improving macro-economic conditions.

In case commodity prices remain where they are, HUL expects price growth to be a negative low-single digit.

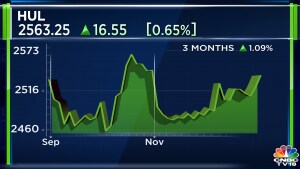

At 11:24 am, the scrip was trading 1.77% lower at ₹2,220.30 apiece on the NSE. The stock has declined more than 16% so far this year and is down 10% over the last 12 months.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter