These two brokerages raise target price on HDFC Bank: Should you buy now?

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Despite HDFC Bank’s numbers falling below estimates, brokerage houses are optimistic about its future prospects.

Brokerage firms Jefferies and Nomura have raised their target price on HDFC Bank after the lender reported results for the fourth quarter of FY24 on Saturday (April 20). Despite the bank’s numbers falling below estimates, the brokerage houses are optimistic about its prospects.

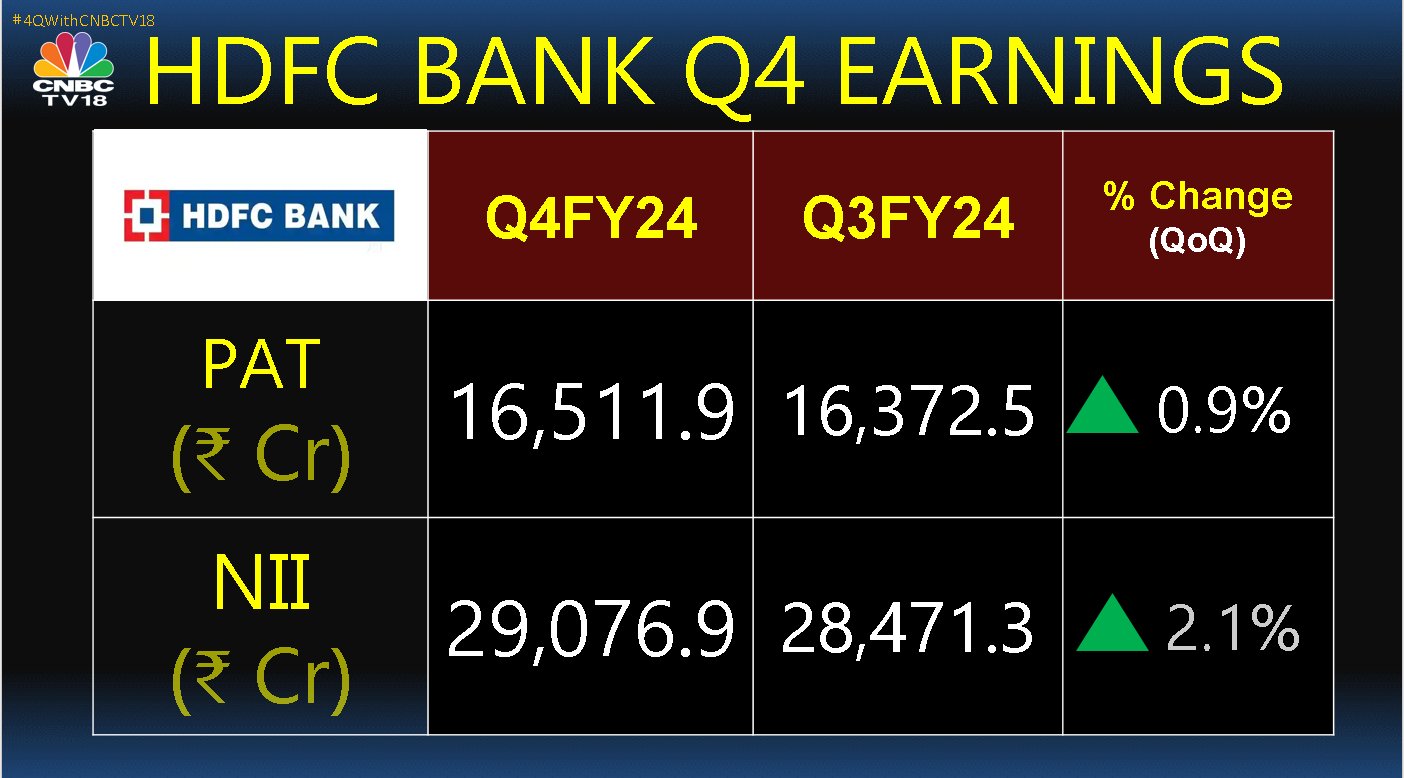

HDFC Bank reported a 0.9% sequential increase in net profit, totalling ₹16,511.9 crore for the fourth quarter of FY24.

Year-on-year numbers were not comparable due to the bank’s merger with Housing Development Finance Corporation (HDFC) on July 1, 2023.

Here’s a table summarising the target prices and recommendations of all brokerage firms regarding HDFC Bank:

| Brokerage Firm |

Recommendation |

Target Price (₹/Share) |

| Jefferies |

Buy |

₹1,880 |

| Nomura |

Neutral |

₹1,660 |

| ICICI Securities |

Buy |

₹1,850 |

| Motilal Oswal |

Buy |

₹1,950 |

| Morgan Stanley |

Overweight |

₹1,900 |

Jefferies has issued a recommendation to ‘buy’ HDFC Bank shares, with an increased target price of ₹1,880 per share.

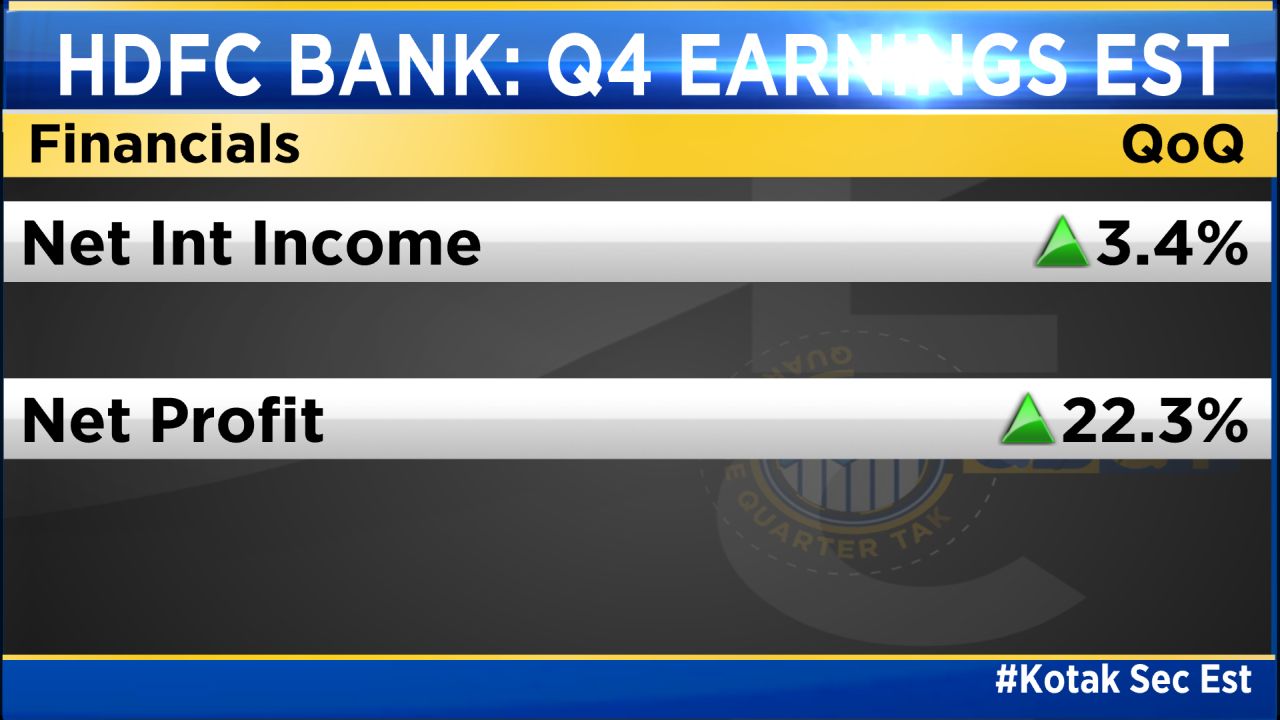

The firm believes that the bank’s pre-provision operating profit (PPOP) was in line with estimates.

Jefferies also noted a slight increase in net interest margins (NIMs), despite a rise in the liquidity coverage ratio. Additionally, it highlighted strong deposit growth of 17%.

Nomura, on the other hand, adjusted its stance on HDFC Bank to ‘neutral’ and raised the target price to ₹1,660 per share from the previous ₹1,625 per share.

Nomura noted a gradual adjustment phase currently underway.

The firm now anticipates a loan growth of 12-13%, down from the earlier projection of 15%, with deposits expected to grow at a 17% compound annual growth rate (CAGR) over the fiscal years 2024 to 2026.

Nomura estimates a return on equity (RoE) of approximately 14-15% for the financial years 2025 to 2026.

Notably, the bank’s loan-to-deposit ratio saw a decrease to 104% from 110% in Q3FY24, with deposits outpacing loans significantly in a seasonally strong Q4.

Management has stated its intention to prioritise profitability over growth.

Nomura anticipates a gradual improvement in the trajectory of net interest margins (NIMs) and has adjusted the estimates downward for the financial years 2025 to 2026 earnings per share (EPS) by nearly 3% due to softer loan growth.

Meanwhile, brokerages such as ICICI Securities and Motilal Oswal are also bullish on HDFC Bank.

ICICI Securities has upgraded HDFC Bank to ‘buy’ from ‘add’, setting a target of ₹1,850 per share.

The firm highlighted the bank’s strong reported and adjusted Return on Assets (ROA) for Q4.

Additionally, it anticipates a gradual re-rating of the bank’s stock based on sustained deposit growth, supported by a significant reduction in borrowings, down 10% QoQ.

Moreover, the quarter-on-quarter rise in Net Interest Margin (NIM) and Liquidity Coverage Ratio (LCR) further strengthened the positive outlook.

Despite these optimistic indicators, ICICI Securities has revised downward their estimate for loan growth to 13%, citing potential challenges in this area.

This adjustment is mirrored in the lowered earnings per share (EPS) estimates for the financial years 2025 and 2026.

However, the firm still expects HDFC Bank to maintain a healthy RoA of nearly 1.7% for FY25/26, with a respectable Return on Equity (RoE) of 14%-15%.

Motilal Oswal also shares a bullish perspective on HDFC Bank, issuing a ‘buy’ call with a target price of ₹1,950 per share.

The firm found the bank’s Q4 core performance to be in line with expectations, with an improvement in margins compared to the previous quarter.

The prudent deployment of one-off gains to boost floating provisions has contributed positively to the bank’s financial health, it said.

Additionally, Motilal Oswal anticipates growth rates for HDFC Bank over the financial years 2024 to 2026, estimating a Compound Annual Growth Rate (CAGR) of 13.5% to 18% in loans and deposits.

This growth trajectory is expected to translate into a 16% CAGR in earnings, resulting in a RoA/RoE of 1.9%/15.5% by FY26.

On the other hand, Morgan Stanley echoed this sentiment, maintaining an ‘overweight’ call with a target of ₹1,900 per share. The firm emphasised strong bounce-backs in the liquidity coverage ratio and improved margins.

Despite these calls, the share of HDFC Bank opened higher on Monday (April 22) but turned red soon. It fell nearly 1% on BSE to ₹1516.05 apiece.

Meanwhile, the shares of HDFC Bank opened higher on Monday (April 22) but soon turned red, falling nearly 1% on BSE to ₹1516.05 apiece.

At the time of writing this report, the stock was down 0.97% at ₹1516.40 on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter