Smart Money: Best themes and stocks to own in Samvat 2078

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

In a CNBC-TV18 special Smart Money, Gurmeet Chadha, Co-Founder and CEO at Complete Circle Consultants shared all the top stocks and themes that one needs to own between this Diwali and the next.

In a CNBC-TV18 special Smart Money, Gurmeet Chadha, Co-Founder and CEO at Complete Circle Consultants shared all the top stocks and themes that one needs to own between this Diwali and the next.

Chadha spoke about the stocks and sectors that one can invest into this Diwali and reap the benefits for years. He is bullish on various themes – changing energy theme, housing revival theme, financialisation of savings theme, speciality chemicals space and digital platform plays.

Also Read: Muhurat trading 2021: Key tips you should know before investing

Gurmeet has been extremely positive about the way the energy mix and the entire ecosystem is changing.

He likes Reliance, Indian Energy Exchange and Tata Power in this green energy theme.

“The energy mix of Reliance makes me very optimistic for the long run. They are building an entire ecosystem around it. They have a roadmap of 100 gigawatts of green electricity portfolio, which they want to convert into carbon-free green hydrogen, very bullish on that. That is something I would look at. It makes me very constructive on Reliance,” he said.

Tata Power’s focus on renewable portfolio impresses Chadha the most. He believes it is an integrated power play that gives access to solar, EV and the way this entire transition is working out

“The solar EPC order book continues to grow, so does their solar panel and solar rooftop projects,” he stated.

Also Read: Larsen & Toubro, State Bank of India, Trent and more: Key stocks that moved the most on Nov 3

Real estate and housing is a very broad sector and this theme will continue to play probably for a few more samvats, not just from this Diwali to next.

According to him, there are multiple ways to play this sector, he is betting on the entire building material play.

“Since it is a long theme, I will restrict myself to companies which are into wires and cables and fast moving electrical goods,” he said.

He picks Polycab. It is a clear leader in wires and cables.

“Between Havells and Polycab, probably Polycab looks more reasonable in valuation,” he said.

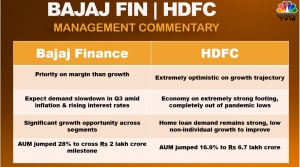

Housing finance is the other play he is betting on.

“HDFC is relatively underperformer vis-à-vis other financials, great value in all subsidiaries including life insurance, asset management business etc and now individual loans almost make up 78-79 percent of the book. My sense is this entity can deliver 2 percent RoA and 14-15 percent RoE for probably next three-four years,” he said.

Chadha likes Central Depository Services Ltd (CDSL), Computer Age Management Services (CAMS) from the financialisation of savings theme.

Deepak Nitrite and PI Industries are two stocks he likes from specialty chemical space.

He also likes Mindtree from the digital platform plays.

Advertising tech as a theme will play up. “Excluding Google and Facebook, Affle India has 10 percent market share. I like its proprietary model which is an RoE centric model where they only charge on deliverables,” he mentioned.

For the full interview, watch the accompanying video.

Disclosure: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article

Daily Newsletter

Daily Newsletter