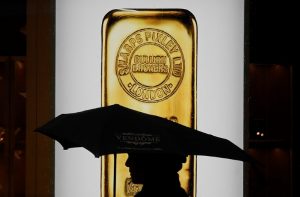

Gold up, touches 2-week peak but still near December lows

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The euro hit a session high after European Central Bank Governing Council member Ewald Nowotny said the bank could decide this month to end bond buying by the end of this year.

Gold rose on Monday, touching its highest in two weeks as the dollar weakened and the Chinese yuan recovered from June’s lows, and gold stayed higher even as the dollar bounced up, as some investors bought bullion to cover short positions.

Some traders noted that gold was still mired near lows hit in December.

Spot gold increased 0.3%, to $1,258.52 per ounce by 1:36 p.m. EDT (1736 GMT). The session high of 1,265.87 was its highest since June 26.

US gold futures for August delivery settled up $3.80, or 0.3%, at $1,259.60 per ounce.

“Most likely the yuan will remain volatile but (I don’t expect …) aggressive weakness, so that means the only thing that is driving gold at the moment is the dollar, which is somewhat weaker,” said Georgette Boele, commodity strategist at ABN AMRO.

The yuan rose in offshore markets against the dollar, further off the lows hit in June when it notched its biggest ever monthly fall. The US dollar index weakened early and the euro gained, but the dollar bounced higher in later trading.

A weak dollar makes greenback-denominated gold cheaper for holders of other currencies, especially in Europe when the euro rises.

The euro hit a session high after European Central Bank Governing Council member Ewald Nowotny said the bank could decide this month to end bond buying by the end of this year.

Some investors had bought gold to cover their short positions, said OCBC analyst Barnabas Gan.

Additionally, Britain’s Brexit Secretary David Davis said he resigned to try to stop Prime Minister Theresa May from handing too much power to the European Union.

“A little buying could’ve also come from the North Korea meeting that didn’t exactly go great,” said RJO Futures’ Josh Graves.

Donald Trump raised concerns that Beijing may be seeking to derail North Korea denuclearization efforts, though said he was confident Pyongyang leader Kim Jong Un will uphold his end of the deal.

Graves said Monday’s gold price increase will likely be temporary.

“It’s running into lows we saw in December–$1,275. Until we see some moves above there, I don’t think gold has the strength to get (higher),” Graves said.

Meanwhile, silver rose 0.6% at $16.10 an ounce and platinum gained 0.4% at $844. Both metals earlier hit their highest since June 27.

Palladium gained 0.5% to $958 an ounce, reaching $967.50, its highest since June 21.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article

Daily Newsletter

Daily Newsletter