Godrej Consumer Products expects gradual recovery in demand

Summary

On a consolidated level, company expects the quality of its profits to see improvement, led by gross margin.

Godrej Consumer Products is likely to report double-digit growth in rupee terms led by mid-single digit volume growth on a consolidated basis. The company also said that growth trends are improving sequentially as well.

In its March quarter business update, GCPL said that it saw steady demand in India, which led to double-digit volume and value growth. It also said that volume growth has exceeded expectations.

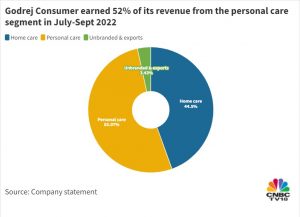

The domestic branded business of Godrej Consumer has registered volume and value growth in the teens with both home care and personal care witnessing double-digit volume and value growth.

In the international business, one of the major markets of the company, Indonesia has started to see a gradual recovery in performance, with mid-single digit constant currency sales growth.

“The growth ex-Hygiene is close to double digits. We believe building blocks in Indonesia are in place to drive steady-to-strong performance in the next fiscal year.”

Also Read | FMCG and dairy firms betting on strong double-digit sales growth this summer

Godrej Africa, USA, and Middle East (GAUM) witnessed a temporary pause in its strong double-digit sales growth momentum, clocking higher than mid-single digit sales growth in constant currency terms.

“This was due to elections and the impact of demonetisation in Nigeria. However, we have seen a strong sales recovery in March”, the company statement said.

Also Read | Adani Wilmar launches ‘Kohinoor Biryani Kit’ to heat up ready-to-eat market

On a consolidated level, company expects the quality of its profits to see improvement, led by gross margin.

The stock is trading around the 52-week high level of Rs 973, which it hit on March 31. Shares of the company are up 7 percent so far this year. In contrast, shares of peer companies like HUL, Dabur, Marico are down 1-5 percent so far.

Shares of GCPL are off the day’s low, currently trading 0.2 percent lower at Rs 963.15.

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter