April to December fiscal deficit increases to Rs 9.93 lakh crore

Summary

For December, India reported a fiscal deficit of Rs 14,800 crore compared to last year’s Rs 63,800 crore.

India’s fiscal deficit for the April to December period increased to Rs 9.93 lakh crore, which was 59.8 percent of the 2022-23 fiscal year target. India’s fiscal deficit in the same period last year had come in at Rs 7.59 lakh crore.

For December, India reported a fiscal deficit of Rs 14,800 crore compared to last year’s Rs 63,800 crore.

A country’s fiscal deficit is the difference between the total expenditure and revenue of the government in a year.

For the nine-month period ending December 2022, the net tax revenue came in at Rs 15.55 lakh crore, which was 80.4 percent of the entire financial year’s estimate.

Combined with the non-tax revenue, the total revenue receipts for the April-December period stood at Rs 17.69 lakh crore, which is 80.3 percent of the Budget estimate for FY23.

The April to December capital expenditure increased to Rs 4.9 lakh crore from last fiscal’s Rs 3.9 lakh crore, while the receipts came in at Rs 18.3 lakh crore.

The government spent a total of Rs 28.2 lakh crore in the first nine months, an increase from Rs 25.2 lakh crore in the same period last year.

A Rs 5.6 lakh crore April to December revenue gap was reported from last fiscal’s Rs 3.9 lakh crore.

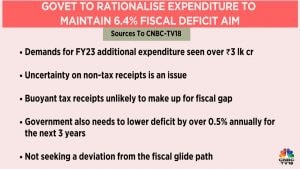

The Central government is targeting a Rs 16.61 lakh crore fiscal deficit for the present fiscal year, which is 6.4 percent of the GDP.

Also Read: Economic Survey: India’s progress in tackling climate change

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter