The rally in diagnostic stocks may be over but you can still ride the wave

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Stocks such as Dr Lal Pathlabs, Thyrocare and Metropolis have corrected in the past few months, after a near one-sided rally powered by higher demand for diagnostic tests thanks to the COVID pandemic. Should you have these stocks — and their newer peers Vijaya and Krsnaa — in your portfolio now?

Diagnostic stocks such as Dr Lal Pathlabs, Thyrocare and Metropolis are in focus once again after a lull that lasted months, following a near one-sided rally in the depths of the pandemic.

| Stock |

Return (%) |

PE (TTM) |

| One month |

Three months |

Six months |

| Dr Lal Pathlabs |

-10 |

-18.8 |

-40 |

51.4 |

| Thyrocare |

-9.2 |

-16.8 |

-37.1 |

23.1 |

| Metropolis |

-25.6 |

-19.2 |

-51.3 |

40.6 |

| Vijaya |

-18 |

-22.1 |

-42 |

|

| Krsnaa |

-1.7 |

1.9 |

-22 |

|

With a rise in daily COVID-19 infections in the country, analysts say it may be an opportune time for investors to take positions in these stocks — especially those who missed the bus in the heart of the pandemic.

Hemang Jani, Retail Equity Strategist at Motilal Oswal Financial Services, views the recent correction in diagnostic companies as a good opportunity for long-term investors.

“You had COVID and even otherwise, due to lifestyle changes, there is going to be a fair bit of growth that one can really look at for next few years. However, in the interim, because of the kind of valuations that some of these companies have got due to the IPO boom etc., we are going through a process of adjustment of that price increase that we had seen,” he told CNBC-TV18.

He suggests avoiding the pocket from a near-term perspective.

ALSO READ: Why diagnostic stocks have retreated from peaks

Does the COVID situation make diagnostic stocks attractive given the recent correction?

Complete Circle Consultants’ Managing Partner and CIO, Gurmeet Chadha, is not impressed. The diagnostic space is up for consolidation given its unorganised nature, he told CNBC-TV18.

“Buying something just because COVID tests will go up may not be a great idea. For example, Dr Lal Pathlabs has almost 1,300 odd centers and has been trying to work on a digital presence as well. You can look at integrated players like Apollo (Hospitals), which are both into hospitals and pharmacy, and trying to do digital integration,” he said.

India’s daily COVID cases hit a more than three-month high of 7,240 on Thursday — remaining above the 5,000 mark for a second straight day. Maharashtra recorded 2,701 new cases on Wednesday — the highest in nearly four months.

Diagnostic valuations are not cheap despite the sharp correction, with the pricing of Dr Lal, Metropolis and SRL 2-4 times higher than that of their cheapest organised alternatives across cities be it specialised or even semi-specialised tests, Purvi Shah, DVP (Fundamental Research)-Pharma Analyst at Kotak securities, told CNBCTV18.com.

“Incumbents are banking on lesser reliability, lower specialised test options, limited doctor connect and operational challenges in expanding geographical presence as key growth barriers for newer entrants. But there there can still be a further downside risk to our flattish long-term pricing assumptions if the new entrants stay aggressive beyond the next few quarters,” she said.

Analysts prefer companies that can cater to COVID- as well as non-COVID-related demand.

The COVID pricing has come down significantly from Rs 4,500 to Rs 400, so even a fourth wave of the pandemic is “not going to be too meaningful”, Shah said.

Here’s what they make of the top players in the country’s diagnostics space:

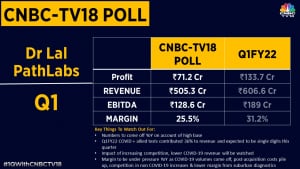

Dr Lal Pathlabs

Geojit recommends accumulating Dr Lal Pathlabs stock for a target of Rs 3,058 apiece, which indicates a 43.5 percent upside at the current price.

The brokerage is positive on the company strong recovery in its non-COVID business, which it believes to be more sustainable.

“Higher traction in sales volumes due to the pandemic coupled with steady growth in the home-based sample collection business and cost optimisation

measures support growth prospects. Enhanced focus on driving volumes while maintaining prices coupled with tactical penetration in West and South through modular cluster city approach is playing out well,” Geojit said in a report in February.

Metropolis

Edelweiss has a ‘buy’ call on Metropolis Healthcare with a target price of Rs 3,400 — more than double given its current price.

However, the entry of Dr Lal through Suburban Diagnostics in Mumbai will create some challenges for Metropolis, according to the brokerage.

ALSO READ: Good time to add diagnostics stocks to your portfolio?

Dalal Street also saw two players join the secondary market in 2021: Vijaya Diagnostics and Krsnaa Diagnostics.

Vijaya Diagnostics

ICICI Securities has a ‘buy’ call on Vijaya with a target price of Rs 379, which implies a 14.7 percent upside from its current stock price.

The brokerage remains positive on Vijaya for its:

- B2C focus

- highest margin within the industry

- continuous focus on deeper expansion in dominant regions

It, however, believes that intense competition may affect its performance in the near term.

Krsnaa Diagnostics

Khambatta Securities has a ‘buy’ call on Krsnaa with a target price of Rs 1,117, citing the company’s unique business model driven by a niche and cost competitiveness.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter