Devyani International shares decline in 12 out of last 13 sessions to hit a new 52-week low

Summary

Devyani International shares are down 25 percent on a year-to-date basis.

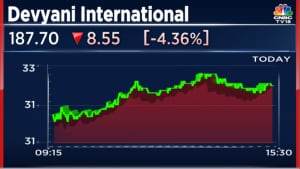

Shares of Devyani International Ltd. dropped more than 3.5 percent on Friday to hit their lowest level in 52 weeks after falling in 12 of the last 13 sessions.

The stock fell as much as 3.5 percent in intra-day trade on Friday to hit a low of Rs 136.25. Shares have fallen 10.5 percent in the last 13 sessions and over 25 percent in the last six months.

Devyani International is primarily engaged in the business of developing, managing and operating quick service restaurants and food courts for brands such as Pizza Hut, KFC, Costa Coffee, Vaango etc.

During the quarter ended December 2022, Devyani International’s revenue grew 27 percent year-on-year to Rs 790.6 crore from Rs 624.4 crore in the year-ago quarter.

The company’s profit after tax (PAT) stood at Rs 71 crore during the December quarter, an increase of 7.6 percent on a year-on-year basis.

The company also said that it opened 81 new stores during the December quarter, bringing the total number to 1,177. During this period, the company opened 17 Pizza Hut stores and 38 KFC stores and expanded its presence from 224 cities at the end of September 2022 to 227 cities at the end of December 2022.

After its results, brokerage firm KRChoksey gave a ‘buy’ call on the stock with a target price of Rs 230 per share.

“Devyani International has shown strong performance in a seasonally soft quarter and continues to add stores in core brands, which is helping the company grow at a faster rate,” the brokerage firm said in a report dated February 16.

“The company’s store additions are in line with its expansion plans, adding 250 stores every year until financial year 2026. We expect Devyani International to continue expanding its presence into new geographies and penetrate deeply into existing cities,” it added.

Shares of Devyani International are trading 3.5 percent lower at Rs 136.75.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter