DCB Bank shares rise over 13% on ₹1,000-crore fundraising plan, strong Q4FY24 results

Summary

The lender’s profit after tax (PAT) stood at ₹156 crore, up 9% from the ₹142 crore in the year-ago quarter. Similarly, for the entire fiscal year 2024, the bank reported PAT of ₹536 crore, marking a growth of 15% compared to FY23.

Shares of DCB Bank Ltd surged more than 13% on Wednesday, April 24, following the announcement of a ₹1,000-crore fund-raising plan and healthy growth in net profit in the March quarter.

In an exchange filing, DCB Bank disclosed plans to raise funds amounting to ₹1,000 crore through various financial instruments, including debt securities and equity shares.

At the meeting of the Board of Directors, held on April 23, the bank approved an enabling resolution for fund-raising activities. This includes issuing debt securities, including Unsecured Redeemable Non-Convertible Subordinated Basel III compliant Tier-2 Bonds, up to ₹500 crore. These bonds will be issued through private placement in one or more tranches over the next year, subject to approval from the bank’s shareholders and regulatory authorities.

Additionally, the board approved another resolution proposing to raise funds up to ₹500 crore by issuing equity shares or other securities convertible into equity shares through a Qualified Institutions Placement (QIP), the private lender informed the stock exchanges.

DCB Bank also reported a healthy growth in profit and improvement in asset class for the quarter ended March 31, 2024.

The lender’s profit after tax (PAT) stood at ₹156 crore, up 9% from the ₹142 crore in the year-ago quarter. Similarly, for the entire fiscal year 2024, the bank reported PAT of ₹536 crore, marking a growth of 15% compared to FY23.

DCB Bank’s loan portfolio saw significant expansion, with a year-on-year (YoY) growth of 19%, due to strong growth across segments such as mortgages, co-lending, construction finance, and agri and inclusive banking. Deposit growth also surged by 20% YoY.

DCB Bank also maintained a healthy asset quality, as the Gross NPA stood at 3.23% and Net NPA at 1.11% as of March 31, 2024. The bank’s Provision Coverage Ratio (PCR) stood at 77.30%, and PCR excluding Gold Loans NPAs was 78.18%. DCB Bank’s Capital Adequacy Ratio was at 16.59%.

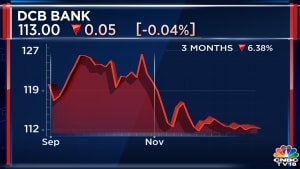

Shares of DCB Banks closed at ₹136.45 apiece, up 10.17%, on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter