HSBC says this microfinance institution is now attractive post recent correction

Summary

HSBC said CreditAccess Grameen’s fourth quarter profit was marginally ahead of its estimates on stable margins and lower expenses. The brokerage said it has a solid franchise with ability to deliver high profitability and earnings growth.

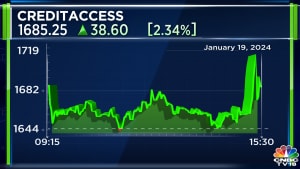

Shares of CreditAccess Grameen Ltd. climbed nearly 8% to hit a day’s high of ₹1,523.40 on Wednesday after the non-banking financial company-micro finance institution reported a 34% year-on-year (YoY) jump in March quarter profit at ₹397 crore on the back of its business expansion.

The CreditAccess Grameen stock has declined over 9% on a year-to-date basis. Post correction, the stock is trading at attractive levels, at 2.8 times its FY26 book value per share (BVPS), said global brokerage firm HSBC.

The brokerage has recommended a ‘buy’ rating but reduced its target price to ₹1,800 per share from ₹1,820 apiece earlier.

HSBC said CreditAccess Grameen’s fourth-quarter profit was marginally ahead of its estimates on stable margins and lower expenses. The brokerage said it has a solid franchise with the ability to deliver high profitability and earnings growth.

“Portfolio at risk 30/60/90 rose, as did credit cost guidance for FY25,” the brokerage said.

At 98.3%, the company’s collection efficiency is healthy, HSBC noted.

Emkay Global said CredAG remains its preferred pick in the MFI space, given its superior return ratios and well-placed management succession, unlike peers.

The brokerage has retained a ‘buy’ call with a target price of ₹2,000 per share

The company’s net interest margin for the quarter improved 91 basis points to 13.1%, compared to 12.2% in the same period last year.

The lender’s pre-provision operating profit was 36% higher at ₹683 crore, backed by a 34% rise in net interest income at ₹922 crore. Total income rose 37% year-on-year at ₹1,459 crore.

Its gross loan portfolio expanded 27% year-on-year to ₹26,714 crore at the end of March with gross non-performing assets ratio marginally tumbling to 1.18% from 1.21% a year back.

“We ended FY24, completing 25 years of our operations, on a solid footing. The growth was well supported by a healthy increase in the customer base by 15% year-on-year to 49.18 lakh. We added over 13.6 lakh customers during FY24,” said Managing Director Udaya Kumar Hebbar.

“Our NIM remained steady at 13% for FY24 while being the lowest-cost lender in the microfinance industry,” Hebbar said.

The company has also proposed a dividend of ₹10 per share.

CA Grameen (CREDAG) is a non-bank-finance company focused on the micro-finance business (MFI), predominantly in the rural areas of India.

At 11.08 am, the scrip was trading 2.03% higher at ₹1,449.65 on the NSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter