Headcount at top-4 IT companies declines for the first time in over a decade

Summary

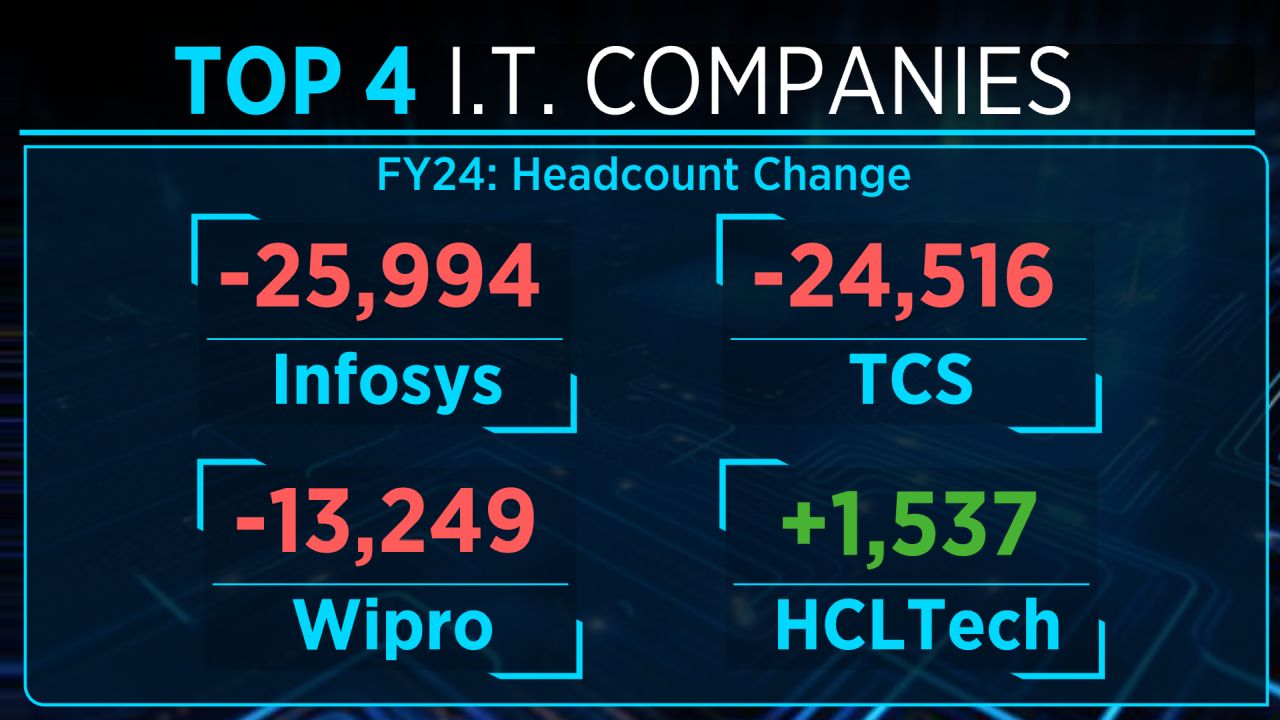

The biggest headcount cuts were seen in Wipro and Infosys at approximately 24,000-25,000 employees for the full year.

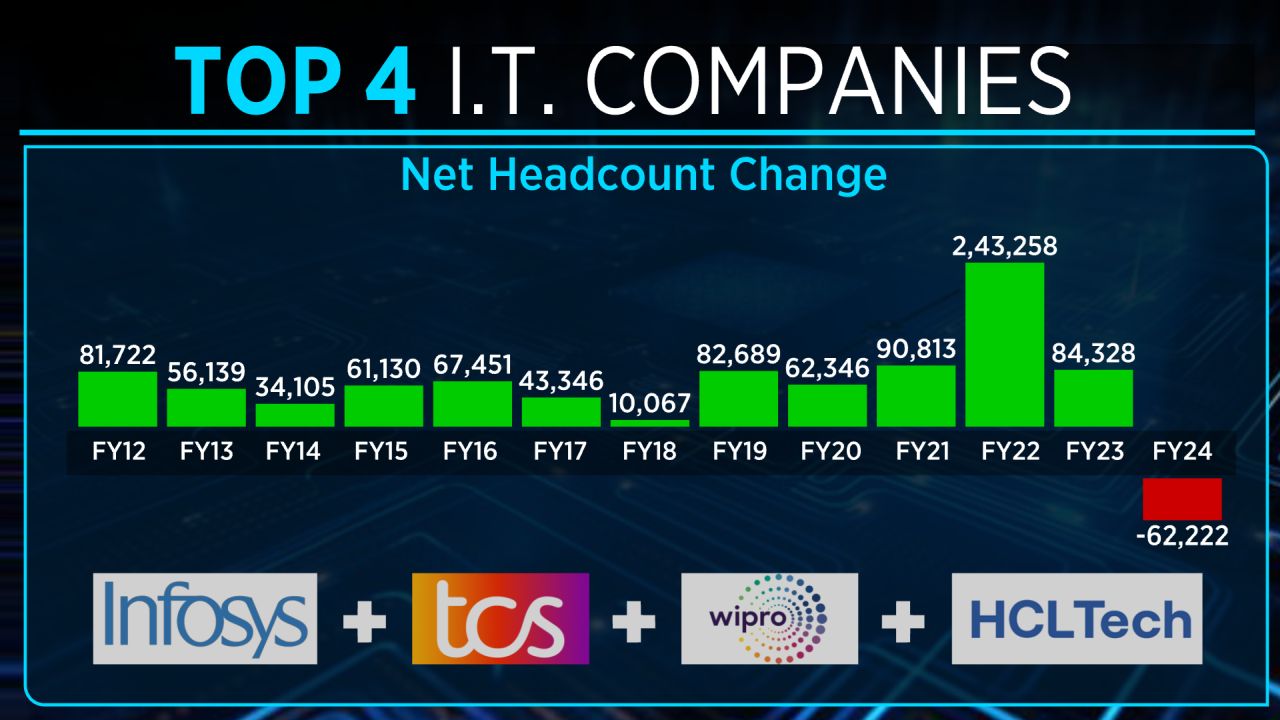

The headcount at India’s top four information technology companies–Tata Consultancy Services (TCS), Infosys, Wipro, and HCLTech–declined for the first time in over a decade.

From April 2023 to March 2024, the net headcount fell by over 62,000, following net increases of over 84,000 in FY23 and more than 240,000 in FY22–the year when IT companies hired aggressively in the post-pandemic digital boom.

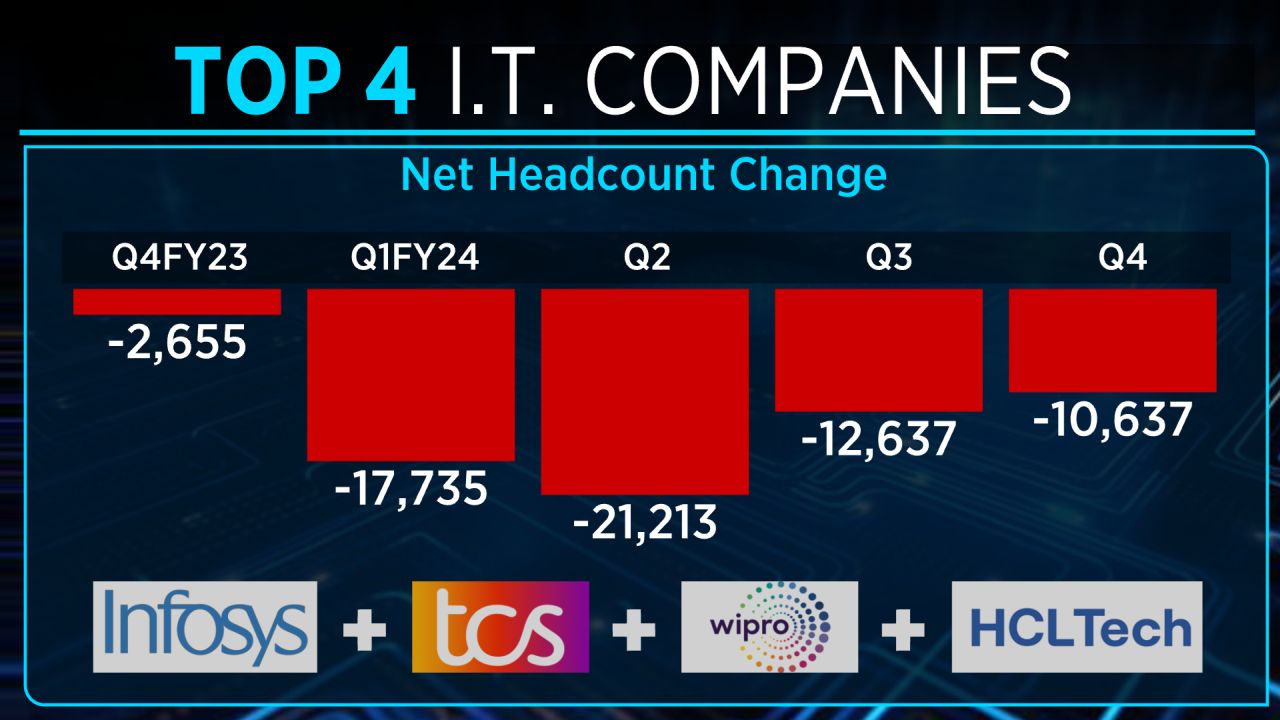

January-March was the fifth consecutive quarter when the four leading IT companies reported an aggregate decline in headcount.

Except HCLTech, all the other three IT companies – TCS, Infosys, and Wipro reported a net headcount decline in FY24.

The biggest headcount cuts were seen in Wipro and Infosys at approximately 24,000-25,000 employees for the full year.

Let’s look at the reasons for the sharp drop in headcount

Growth slowed down materially:

As the discretionary spending environment turned adverse due to high-interest rates and cautious client consumer sentiment in their mainstay markets of the US and Europe, the growth rate declined from double-digits to low-single-digits. Wipro reported a decline in its revenue in FY24.

Companies overhired in FY22:

This was primarily due to elevated demand and elevated attrition. The FY22 hiring of 240,000 employees matched the total hiring by these companies from FY18 to FY21.

Attrition has meaningfully come down:

During the COVID period the great resignation gripped the tech sector. In FY22, the attrition was high, at nearly 20%. However, attrition rates have now treaded back to normal levels around low teens. Therefore, companies need to hire less to backfill.

The growth outlook continues to remain dim:

Both HCLTech and Infosys are guiding for low single-digit growth in FY25 and the current demand can be serviced by improving the utilisation of their employee base through productivity enhancement measures. The biggest reason to hire is growth, and demand so far hasn’t been forthcoming.

What the companies said during Q4 results:

TCS: “We have commenced fresher hiring from campuses and continue to recalibrate our lateral hiring focusing more on utilising the capacity that we have built over the prior years.”

Infosys: “We started the year with 77% utilisation including trainees and the demand environment was different. Our utilization has now gone up to 82%, including trainees. There is still some headroom because we have always said 85% is achievable utilisation. Attrition has significantly come down. Plus, we got some benefit from our value-based selling in terms of pricing. So, all of that has also resulted in lesser requirement in terms of headcount.”

For more, watch the accompanying video

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter