Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Maruti Suzuki India, which will declare its results this Friday (April 26), is expected to report over 20% revenue growth for the January to March quarter. Ceat, Escorts, Tata Motors and Bosch will be reporting their earnings over the next fortnight.

The auto sector is expected to report strong growth in the January to March 2024 quarter led by volume recovery in both domestic and export markets, especially for two-wheelers.

Analysts are, however, skeptical about a growth recovery in the heavy commercial vehicle (HCV) and will wait for comments from CV players on the future trends.

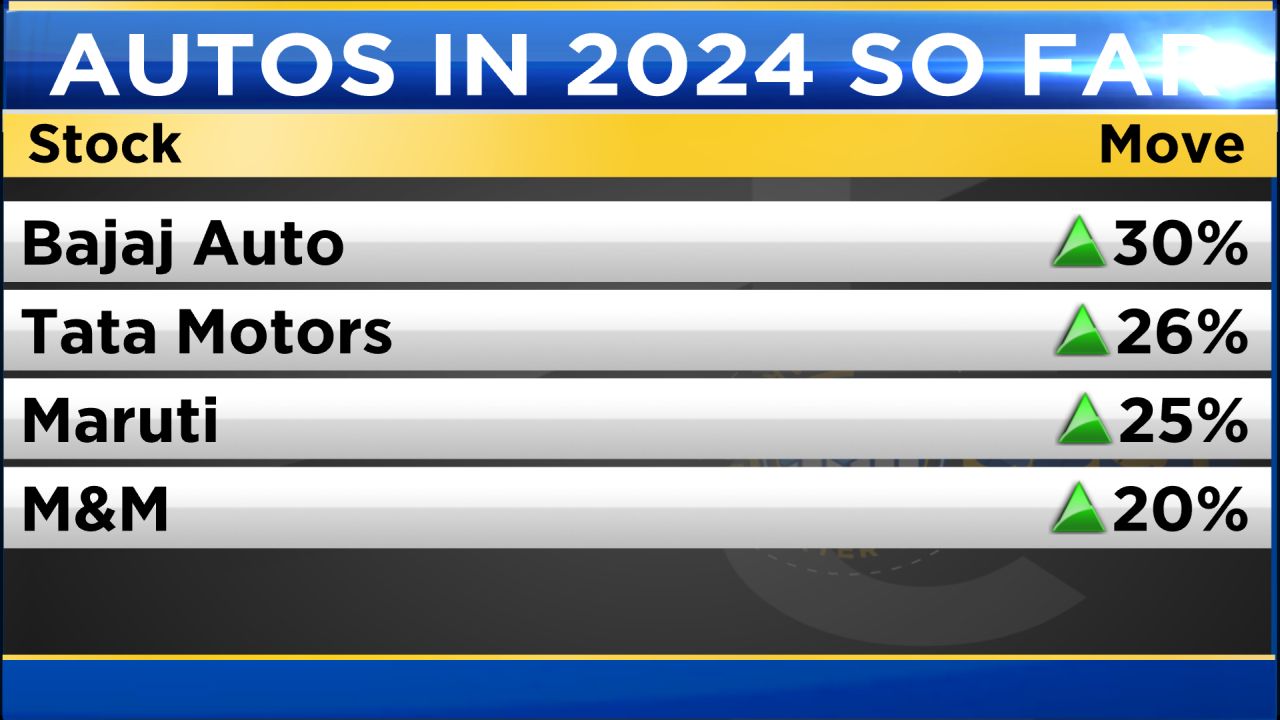

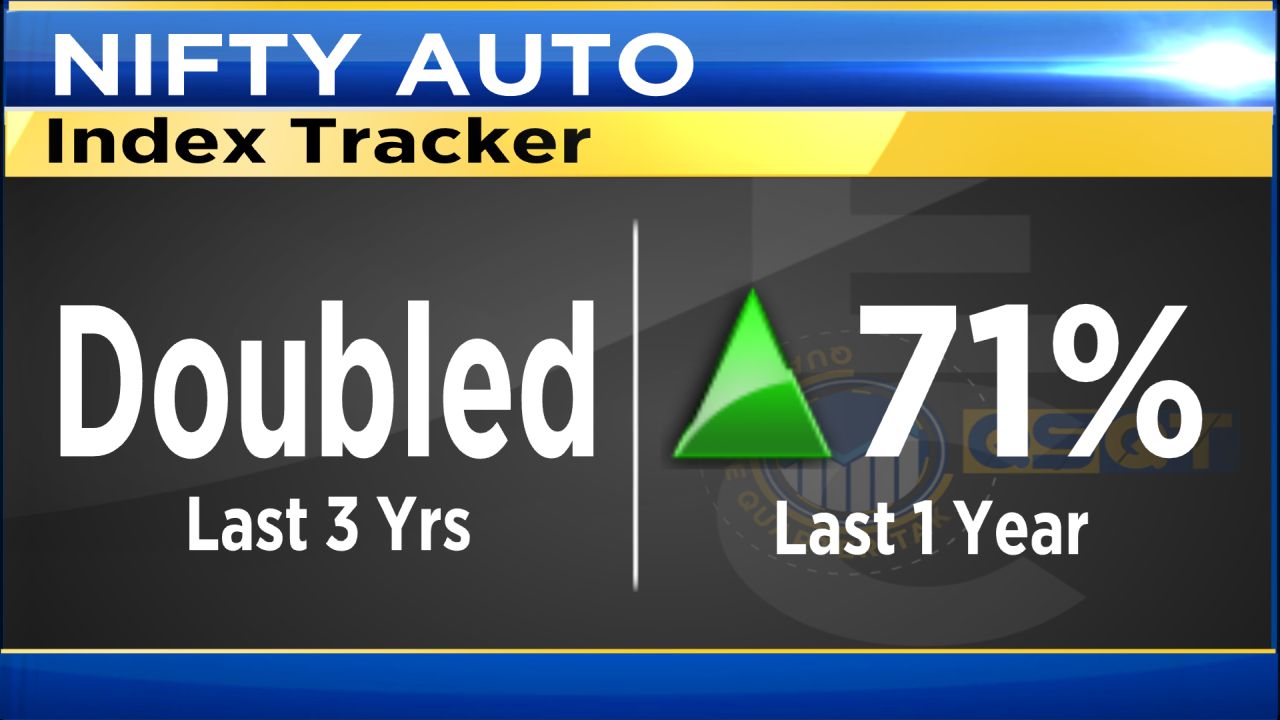

Auto stocks have outperformed the market this year, with the Nifty Auto Index gaining 71% for the year, and doubling over the past three years.

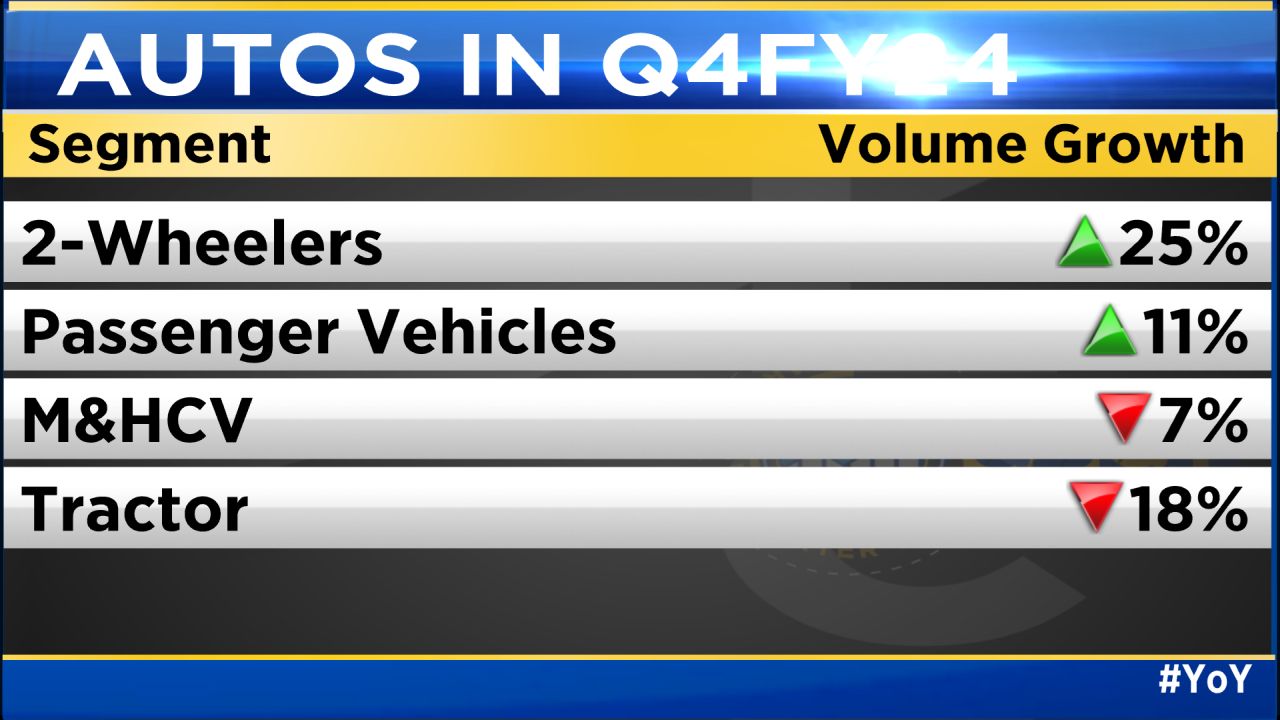

Segment-wise volume growth expected in January-March 2024

The two-wheeler segment had a healthy volume growth of 25% year-on-year (YoY) in the fourth quarter, while passenger vehicles (PVs) grew 11% YoY.

Medium and heavy commercial vehicle (MHCV) volumes declined 7% YoY while tractor volumes declined 18% YoY during the quarter.

Overall, lower commodity costs are expected to support the earnings before interest, tax, depreciation, and amortisation (EBITDA) margins.

However, the spike in crude oil and rubber prices over the past couple of months may weigh on the profitability of tyre companies.

Also Read | Bajaj Auto expects to grow faster than the industry as it nears entering Europe

Result calendar:

Bajaj Auto has already released its numbers, reporting a solid 35% jump in net profit.

The two-wheeler major posted a recovery in the export markets, which aided performance.

Maruti Suzuki India will declare its results this Friday, April 26.

The car maker is expected to report revenue growth of over 20% aided by volume growth of around 13%, and the recent price hikes.

Also Read | Maruti Suzuki shares cross ₹13,000 for the first time, extend 2024 gains to 26%

Operating leverage, benign commodity prices and lower discounts will aid margins for Maruti.

Ceat, Escorts, Tata Motors and Bosch will be reporting their earnings over the next fortnight.

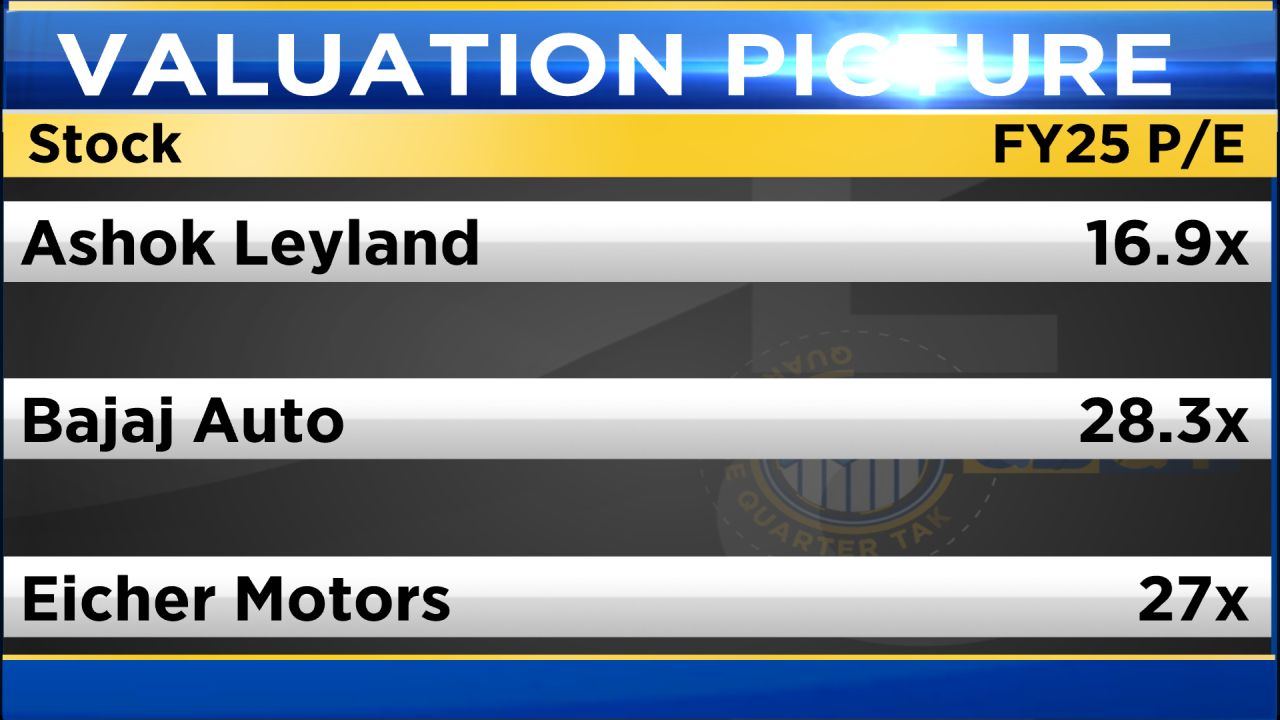

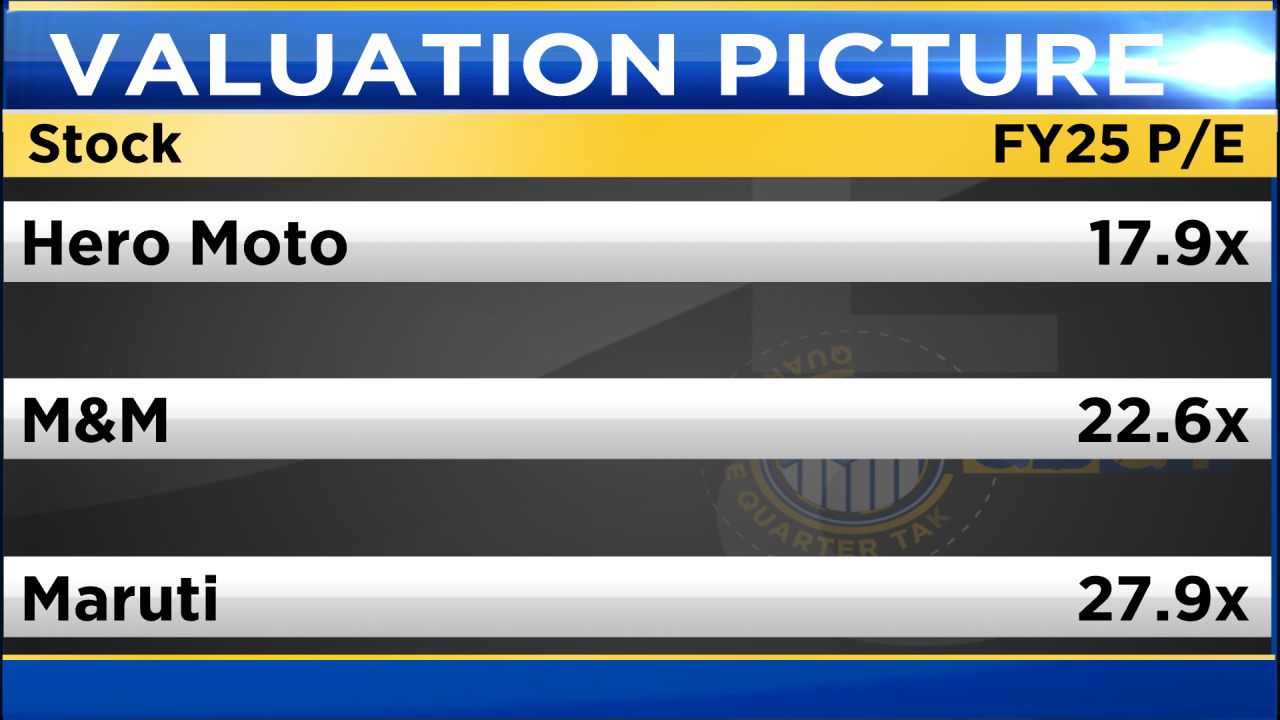

Valuation table

Bajaj Auto is currently the most expensive auto stock followed by Maruti and Eicher Motors.

“We think that this quarter is going to be a strong quarter both on revenue growth front as well as on market expansion. Barring from the companies which are primarily exposed to CV and tractor segments, we would expect rest of the companies reporting strong double-digit revenue growth and that should translate into sequential margin expansion as well,” said Kumar Rakesh, India Analyst, BNP Paribas in an interview with CNBC-TV18.

Maruti Suzuki is his top pick in the sector, he added.

For more, watch the accompanying video

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Naveen Philip, the Managing Director of the Kerala-based automobile dealer said that used car sales are approximately 2-3% higher than new car sales.

Naveen Philip, the Managing Director of Popular Vehicles and Services, expects the company’s revenue to continue growing at around 20%.

“If you look at a compound annual growth rate (CAGR) for the last three years, even if you look at this year with the last year, we’ve been going about 19 to 20% CAGR. We hope to hold that in the future too,” he said.

The Kerala-based automobile dealer with presence across the automotive retail value chain, including the sale of new and used passenger and commercial vehicles, services and repairs, spare parts, among other things operates passenger vehicle dealerships of Maruti Suzuki, Honda, and JLR and the commercial vehicle dealership of Tata Motors.

In a conversation with CNBC-TV18, he pointed out that the growth in used car sales is surpassing that of new car sales by 2-3% while highlighting the subdued growth in small commercial vehicles over the past 18 months.

Philip said, “We have a mix of both small commercial vehicles and construction. So small commercial vehicles have been muted in the last 18 months. So, we are expecting growth in the small commercial vehicles to a much larger extent,” said Philip.

The company reported its October-December 2023 financial results following the stock’s listing on March 19.

The stock debuted at ₹289.20 on NSE at a 2% discount to the issue price.

Also Read | Popular Vehicles and Services shares list at 2% discount to IPO price

The company’s revenue grew 20% during the April to December 2023, the earnings before interest, taxes, depreciation, and amortisation (EBITDA) increased by 23% to ₹216 crore during the same period, while the profit after tax (PAT) rose 12% to ₹56 crore.

In terms of the revenue mix in the third quarter, ₹750 crores was in the passenger vehicles segment that grew about 2%, luxury car segment grew . 100% to ₹113 crore and the commercial vehicle segment grew 35% to ₹465 crore.

The market capitalisation of Popular Vehicles and Services is around ₹ 1,897.79 crore. Its shares have gained close to 3% in the last five days.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Arya said, “2023 was a great year for the commercial vehicle industry in India, the truck market had a growth of 10%, and the bus market had a growth of 70%.” However, he noted that 2024 has started differently, with the medium and heavy commercial vehicle industry going down by about 10 to 11% in the first two months.

Daimler India Commercial Vehicles has announced the launch of 14 new products in 2024, including a completely new range of long-haul rigid trucks and a whole new range of construction trucks.

Satyakam Arya, MD and CEO of Daimler India, in an exclusive interview with CNBC-TV18, stated that these launches are expected to significantly change the fleet-level fuel efficiencies in the market.

The company also plans to introduce a 12-speed Automated Manual Transmission (AMT) from its global portfolio, a technology that has been delivered to more than half a million customers worldwide.

Arya said, “2023 was a great year for the commercial vehicle industry in India, the truck market had a growth of 10%, and the bus market had a growth of 70%.”

Also Read: Nissan turns to aggressive electrification to drive down costs and increase sales

However, he noted that 2024 has started differently, with the medium and heavy commercial vehicle industry going down by about 10 to 11% in the first two months.

Arya expects the market to recover only after the general elections, with a strong third and fourth quarter. “Post the elections we expect and the market will come back very strong,” he added.

The company has announced the launch of 14 new products in 2024, all of which will be available before the end of the next quarter. This includes a completely new range of long-haul rigid trucks with a renewed powertrain to increase the total cost of ownership (TCO) benefit to the customer.

A significant announcement was the launch of the 12-speed AMT in India, a Mercedes Benz AMT, which has been delivered to more than half a million customers around the world. “We believe this will completely change the paradigm of the fleet level fuel efficiencies we have seen in the market,” Arya said.

Also Read: Bajaj Auto may launch its biggest Pulsar ever on May 3

On the topic of powertrains, Arya stated, “As of now, quite a substantial portion of our investments go into Diesel Powertrain because that is the main powertrain in use. But going forward, we will step by step switch our investments to electric or hybrid.” He believes that diesel still has a long life until the switch to decarbonisation.

Arya appreciated the government’s efforts in bringing PLI or EV-related policies like FAME one, two, and now FAME three. He believes these will go a long way in increasing the adoption of electric vehicles. He also emphasised the need for incentivisation to encourage a sustainable adoption and switch to electric vehicles.

Also Read: Chinese firms may flood domestic market due to India’s EV push: GTRI

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Despite reporting positive numbers for the past two quarters, GreenEdge Wealth Services founder Digant Haria anticipated a phase of consolidation for Bajaj Finance.

GreenEdge Wealth Services founder Digant Haria on Wednesday, January 17, expressed caution on Bajaj Finance while being optimistic about the commercial vehicle (CV) finance sector.

According to Haria, Bajaj Finance has been a champion in the traditional lending space, reaching new customers with loans.

However, the digital world is bringing new challenges and competitors.

Haria highlighted concerns raised by the Reserve Bank of India (RBI) about the personal loan space.

He pointed out that Bajaj Finance faced hurdles, such as a credit card extension restriction with RBL partnership.

Despite reporting positive numbers for the past two quarters, Haria anticipated a phase of consolidation for Bajaj Finance.

He suggested that the company might stabilise without significant growth in the coming quarters.

However, he said, “There’s no reason to be negative on Bajaj Finance in my view, nor should we expect any magic from Bajaj Finance.”

In contrast, Haria expressed bullish sentiments towards the commercial vehicle (CV) finance space. He identified Shriram Finance and M&M Finance as promising players in this sector.

Haria cited the strong prices of used trucks and increased rural infrastructure activities as positive factors.

With these conditions, the cash flows for individuals using trucks and tractors are expected to improve.

Haria further pointed out that gold is poised to reach a lifetime high, providing tailwinds for gold finance companies.

In the current heated market, he added that investing in housing finance could offer a favourable risk-reward balance for medium to long-term investors.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Tata Motors also informed that the price increase will be applied across the entire range of commercial vehicles, with the exact amount varying according to the individual model and variant.

Homegrown automaker Tata Motors on Tuesday announced price increase of up to 5 percent for commercial vehicles starting from April 1, 2023. According to the vehicle manufacturer, the decision to increase prices is a result of the company’s efforts to comply with the more stringent BS6 phase II emission norms.

The company, in a statement, said, “As Tata Motors transitions its entire vehicle portfolio to meet these standards, customers and fleet owners can expect a range of cleaner, greener, and technologically superior offerings that deliver higher benefits and lower total cost of ownership.”

Tata Motors also informed that the price increase will be applied across the entire range of commercial vehicles, with the exact amount varying according to the individual model and variant.

Tata Motors, in February 2023, had clocked a decline of 3 percent in commercial vehicle sales at 36,565 units against 37,552 units during the same period the previous year.

On January 27, the Indian automaker announced raising prices across all its internal combustion engine (ICE) passenger vehicles. According to Tata Motors, “It had been absorbing a significant portion of the increased costs on account of regulatory changes & rise in overall input costs and is hence passing on some portion through this hike.”

On February 10, Tata Motors hiked the price of the Tiago EV by around Rs 20,000. At that time, the company had additionally, increased the prices of the Nexon (internal combustion engine) by up to Rs 15,000 in the current week and has also made some changes to the variant line-up.

In the same month, the homegrown automaker completed BS6 Phase II Transition and refreshed its passenger vehicle portfolio with enhanced features. The shares of Tata Motors ended 0.4 percent higher at Rs 412.5 on Tuesday.

Also Read: FAME scheme: Centre to take a call on action against Hero Electric and Okinawa soon

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The auto sector has been facing challenges due to rising commodity prices in recent times. However, with a stable commodity environment, the sector is expected to recover and continue to grow.

Motilal Oswal Financial Services has written an interesting report where they talk about how the automobile sector is back from the brink after five years of a downturn. The going was not good for a long stretch, but now things are improving, headwinds are receding, and demand is moving up.

The auto sector has been facing challenges due to rising commodity prices in recent times. However, with a stable commodity environment, the sector is expected to recover and continue to grow. This is great news for the auto industry, which has been struggling to stay afloat amidst the COVID-19 pandemic.

In an interview with CNBC-TV18, Jinesh Gandhi, Deputy Head of Research and Auto Analyst-Institutional Equities at Motilal Oswal Financial Services, and one of the co-authors of the report said that after the release, he believes that the auto sector is poised for growth in the coming months as stable commodity environment will support the industry.

Also Read | Bajaj Auto launches Chetak Premium 2023 Edition, initiates bookings and expands EV supply chain

He said, “From the tailwinds going forward, we see upside to the demand, which in turn will also be a driver of operating leverage for most of the companies, along with that stable commodity environment is also going to support the margin improvement for the auto sector.”

Gandhi also highlighted the fact that the auto sector is already showing signs of improvement. He noted that margins for the sector have been improving steadily, bouncing back from their lows. This is a promising sign for investors and stakeholders, who have been keeping a close eye on the industry’s recovery.

Also Read | Motilal Oswal trims Nifty 50 earnings estimates after modest quarter, keeps next year estimates intact

Another area where the auto sector is expected to see growth is in commercial vehicle (CV) demand. According to Gandhi, there is continued traction in the CV demand, which will drive growth in the industry. This is particularly relevant as the demand for CVs is often considered a leading indicator of economic activity. As such, the continued growth in CV demand is a positive sign for the overall economy.

For more details, watch the accompanying video

Also, catch all the live updates on markets with CNBC-TV18.com’s blog

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Industry growth in FY24 is likely to be in single digits when compared to this fiscal’s 25 percent rise, revealed Shailesh Chandra of Tata Motors while adding that as the market demands more SUVs, the company’s focus will continue on passenger vehicles and EVs.

Homegrown automotive manufacturer Tata Motors, which has the biggest stall at the expo this year, launched a range across the electric vehicle, passenger vehicle, and commercial vehicle segments, along with new concepts for the future.

Tata Motors’ passenger vehicle division showcased Avinya EV, Harrier.EV, Sierra.EV, Taigo.EV Blitz, Curvv concept, Altroz Racer, Altroz iCNG, Punch iCNG and dark editions of its existing SUVs, Harrier and Safari. Furthermore, its commercial vehicle segment revealed Magic EV, the Prime e28, ultra e.9 as well as the Hydrogen Fuel Cell truck at the Auto Expo 2023.

New mobility and future

Natarajan Chandrasekaran, Chairperson of the Tata Group, in an interview with CNBCtv18, said, “Both in commercial vehicles and passenger cars, we are driving towards new mobility, and we are investing in several technologies. You have seen us launch many electric vehicles, passenger cars and commercial vehicles. You must see what we do in fuel cell and hydrogen-powered internal combustion engine vehicles.”

“We are looking at urban mobility as well as long-distance trucking. In passenger cars, we are investing both in internal combustion and electric vehicles. We had a lot of product gaps which we are trying to address. So, it’s a question of safety and a question of taking a bet on electric mobility, which we took in 2018-19. Since then, we have only doubled and tripled our efforts,” added Chandrasekaran.

Also Read | Auto Expo 2023: Maruti Suzuki unveils concept electric SUV eVX with 550 km driving range

When asked about the company’s plans to bring down costs of its electric mobility products, the chairperson of the Tata Group said, “We need to do play in all ranges, not just sub-10-lahk. We need to have higher-end models as customers have different choices, and there are different segments of customers. We need to continue working on batteries and new technologies. Currently, we are working with lithium-ion, and we need to look at other technologies as well. We are working with startups and innovators, and this space will evolve.”

Passenger vehicles

Shailesh Chandra, President of Tata Motors Passenger Vehicles, in conversation with CNBCtv18, said that a lot of pent-up demand in the market has been released and therefore, the company sees more demand than supply. He added that with bookings sustaining for popular models.

Industry growth in FY24 is likely to be in single digits when compared to this fiscal’s 25 percent rise, revealed Chandra adding that as the market demands more SUVs, the company’s focus will continue on passenger vehicles and EVs.

He also stated that Tata Motors is looking to launch Avinya towards the end of 2025, Harrier.EV in 2024 and Sierra.EV in 2025. Both Curvv EV and its ICE (internal combustion engine) versions will be launched in 2024.

Also Read: Tata Motors at Auto Expo 2023: Auto major unveils Sierra, Harrier EVs and more

Tata Punch CNG And Altroz CNG, on the other hand, will be launched in 2023. Chandra also revealed that the company had given higher boot space in Punch CNG to avoid any comprise in the vehicle’s luggage space.

Commercial vehicles

Girish Wagh, Executive Director of Tata Motors Commercial Vehicles, while talking to CNBC-TV18, said that the logistics industry contributes 18 percent to greenhouse emissions globally. He added, “With our goal to achieve net-zero emissions by 2045, we are transforming mobility by re-imagining our entire product portfolio, value chain and operations.”

The company is uniquely positioned to offer in every segment multiple green fuel options — natural gas, electric, and hydrogen, he added. Wagh stated that Tata Motors aims to lead the EV journey while adding that it looks like India will balance the energy basket as it moves from conventional fuel to hydrogen.

While hydrogen is an exciting possibility in commercial vehicles, battery EVs will most likely be introduced to the market first, revealed Wagh and added that fuel cell electric buses will start running commercially from the next financial year.

Wagh said that “We are very optimistic about the Green Hydrogen Mission and have been investing Rs 1,500-2,000 crore per year in our CV business. Every year, our tech spend is increasing.”

FY23 has been a good year for the CV industry, and the industry has seen volume growth of 45 percent this year, he added while remaining optimistic about growth next year.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Society of Manufacturers of Electric Vehicles on Tuesday sought extension of subsidies for EVs under the FAME II scheme and also include light to heavy commercial vehicles in it to promote electric mobility.

Society of Manufacturers of Electric Vehicles, on Tuesday, sought an extension of subsidies for EVs under the FAME II scheme and also include light to heavy commercial vehicles in it to promote electric mobility.

In its pre-Budget recommendations, the industry body also called for a uniform 5 per cent GST on spare parts for electric vehicles.

”The validity of FAME II is set to expire on March 31, 2024. We believe FAME’s validity needs to be extended since we have yet to meet the penetration the subsidy was supposed to catalyse,” the Society of Manufacturers of Electric Vehicles (SMEV) said in a statement.

The new FAME II scheme should be linked to e-mobility conversion rather than being time-based, it added.

The EV industry body said market trends suggest that e-mobility, particularly electric two-wheelers (E2W) has the potential to continue growing once it reaches 20 per cent of the total two-wheeler market.

”The subsidy can be tapered thereafter,” it said, adding the FAME II scheme should have provisions to directly transfer the subsidy to customers.

SMEV also suggested the inclusion of light commercial vehicles (LCV) and medium and heavy commercial vehicles (M&HCV) on a project-mode basis as India must prepare for the transition to e-mobility in trucks and heavy commercial vehicles in three to four years.

For this, it said, ”Increase the scope of FAME to include commercial vehicles on a project mode basis. Today, trucks account for over 40 per cent of India’s fuel consumption and over 40 per cent of the greenhouse gas emissions across the road transport sector.” Further, SMEV also sought expansion of the FAME II subsidy to electric tractors. On taxation, SMEV said while a 5 per cent GST is levied on electric vehicles, for spare parts, there is no clarity and the industry ends up paying 28 per cent, except for batteries.

”The request, therefore, is for levying a uniform 5 per cent GST for all EV spare parts,” it said.

SMEV also asked the government to consider reducing the basic customs duty on cells to zero until these are manufactured in India as ”the manufacturing of Lithium-Ion cells within the country is still in its nascency ’’.

It also said the PLI (production-linked incentive) scheme drafted for the promotion of electric mobility ”is not designed for startups and MSMEs to benefit from it” and asked for their inclusion in the PLI ambit.

”With the PLI scheme favouring only established big corporates and multinationals, startups and MSMEs tend to lose because they are already struggling for capital,” it added.

SMEV also asked the government to allow pure EV companies to trade credits acquired through production with internal combustion engine OEMs (original equipment manufacturers) as pure EV OEMs are not incentivised under CAFE (corporate average fuel efficiency) II norms.

To further accelerate electric mobility in the country, SMEV said EV financing needs to be included as part of priority sector lending to ensure more pools of capital are unlocked, while also drawing the government’s attention to help reduce the interest rates charged to EV customers.

”For EV penetration, a critical requirement is to enable a wide network of charging infrastructure. The government is required to provide a CAPEX subsidy of 50 per cent for setting up charging infrastructure across the country,” SMEV added.

With Union Budget 2023–24 to be presented at a crucial juncture of geo-political uncertainties, high inflation, and slowing world economic growth, SMEV hoped that it would help the EV industry move forward on its way towards faster adoption of EVs.

”Calibrated steps will be needed to maintain the ongoing positive economic growth curve. The industry can further go through a phase of an unstable supply chain if a recession hits the major markets and the extremely rigid stand taken on some of the policies like FAME on premature localisation,” it added.

The EV industry is looking forward to enhanced support for battery manufacturing in India and further reductions in import duties on raw materials, SMEV said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

YS Chakravarti, MD and CEO at Shriram Transport Finance Company, said that most of the new CV buyers, who are now running a 7-8 year-old vehicle, are moving into a 3-4 year-old vehicle to replace their existing vehicle.

India’s transport and commercial vehicles (CV) industry has started to see some upcycle in the market, indicating the start of a multi-year up-cycle. According to the Federation of Automobile Dealers Associations (FADA), 77,993 new CVs were sold in November 2022, as against 49,737 in the same period last year.

YS Chakravarti, MD and CEO at Shriram Transport Finance Company (STFC), in a CNBC TV18 interview, talked about the transport finance vertical and the trends shaping up the industry and said that there is also a lot of demand coming in for used vehicles in the market as of now.

“We are seeing this across segments. In fact, we are seeing this pickup in demand right from small commercial vehicles to medium and heavy commercial vehicles. We are also seeing demand coming up in construction equipment machinery,” he added.

Also Read | SUVs emerge as biggest selling models in India — Tata, Mahindra and Hyundai top players

The CEO further added that most of the new CV buyers, who are now running a 7-8 year-old vehicle, are moving into a 3-4 year-old vehicle to replace their existing vehicle. With this, the used vehicle stock has also started to arrive in the market, Chakravarti added.

The demand for used CVs could be attributed to two things – one is that diesel prices remain quite high and the second is the cost of a commercial vehicle. Even though international oil prices have started to cool off, diesel prices in the country remain largely the same as there’s not been a major correction.

Chakravarti stated that the cost of new CVs now stands at an average of around 40-50 lakhs. This is mostly due to the supply side shortage and less availability of parts, similar to the passenger vehicle industry. Therefore, for an individual customer, who is in the market for one vehicle or two trucks, the cost will already reach a crore plus.

Chakravarti said, “The costs for an individual truck owner to go and buy a new truck is becoming a very expensive proposition and becoming difficult for them to break even. So what’s happening today is our existing customers are increasingly also moving towards replacing it with a slightly newer vehicle.”

Also Read | 25 car launches in 2023 from Maruti, Hyundai, Tata, Mahindra and other carmakers

The CEO of Shriram Finance also revealed that almost about 20-25 percent of the company’s customers are in some kind of a business where they’re using these commercial vehicles for capital use. Chakravarti stated that these are the customers that we are targeting for our business loans and vice versa.

Despite the demand for used vehicles being quite robust, the cost of the new heavy vehicles is probably being only met mostly by the fleet operators as they can pass the increased cost of the vehicle and the fuel over to the rate contracts.

Chakravarti also revealed that Shriram Finance is looking at a minimum AUM growth of around 15 percent for FY23-24, while the credit cost will be in the range of about 2.4 -2.5 percent.

Also Read | Govt push sees EV sales rise over 2,000% since 2019

New CV sales

In terms of new CVs sold in India, Tata Motors was the highest-selling CV maker in November 2022 and sold 30,282 units as against 26,469 units in November 2021.

Mahindra & Mahindra stood in second place with its CV sales at 20,081 units in the last month, up from 12,044 units in November 2021. Ashok Leyland is at the third spot with 13,084 units sold in November 2022 as against 7,879 units sold in the same period last month.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously