Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The Chinese foreign ministry said in a statement on one of its social media pages that Qin urged the United States to respect “China’s core concerns”.

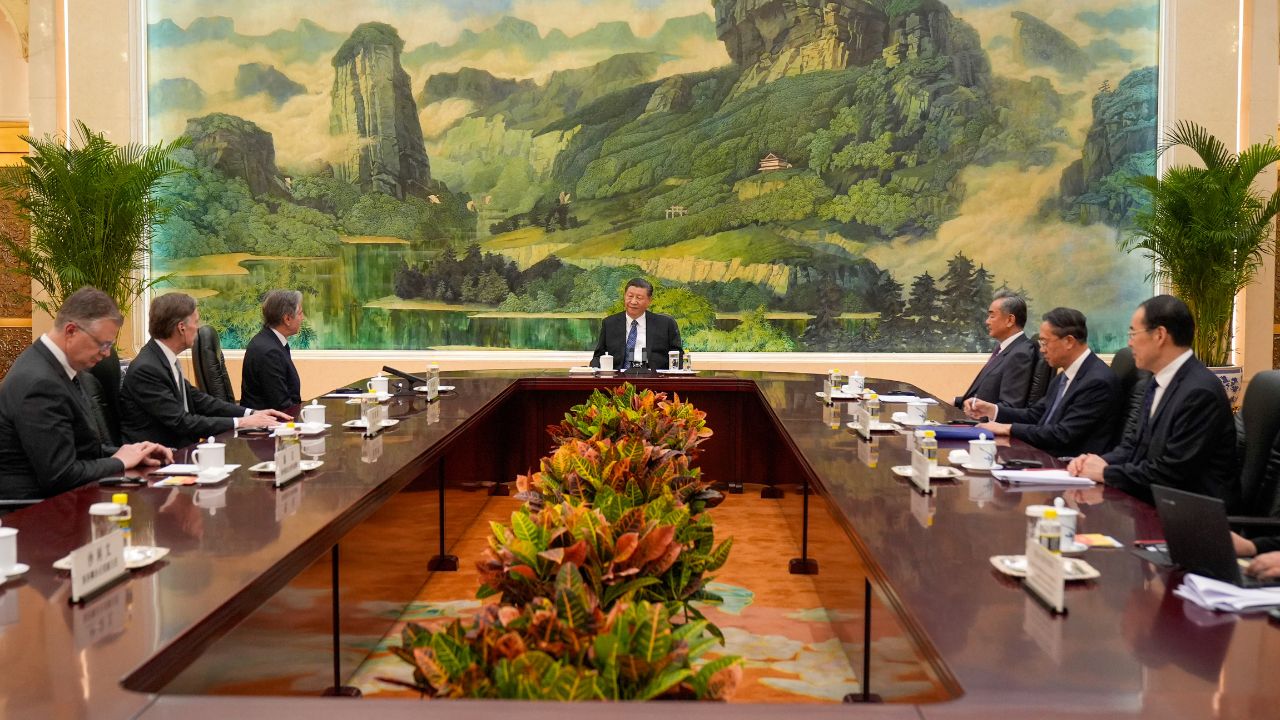

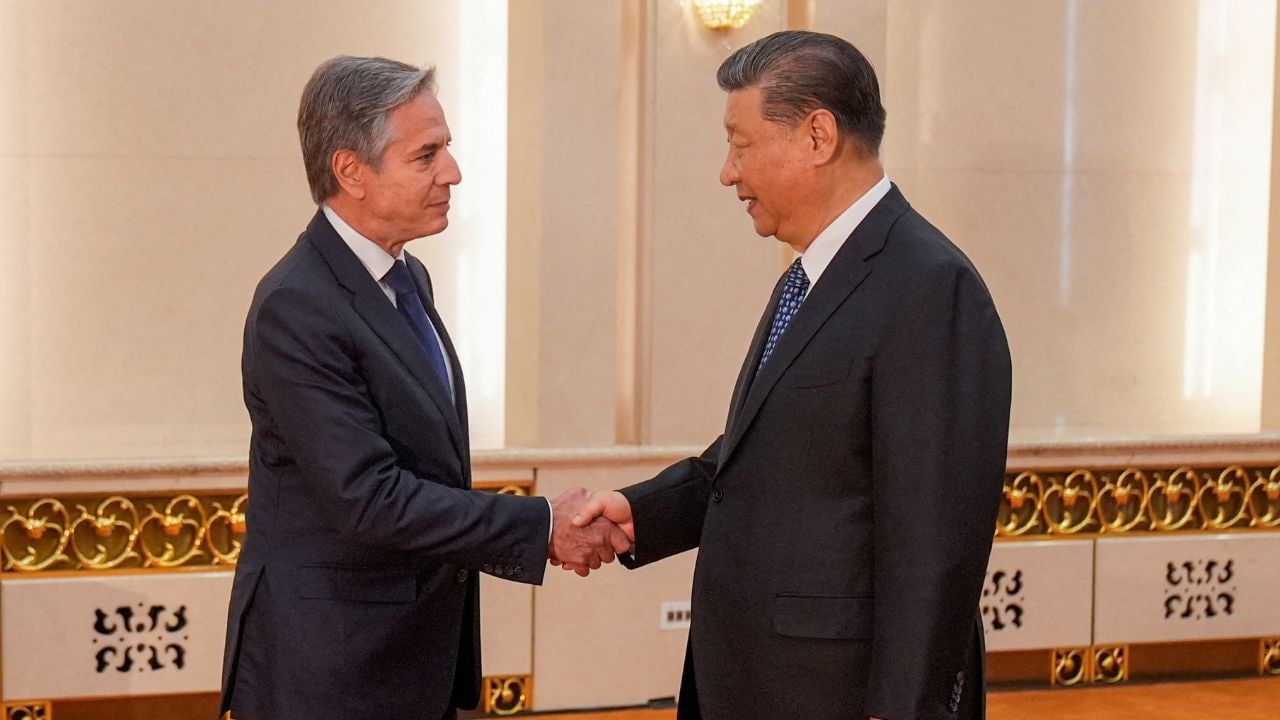

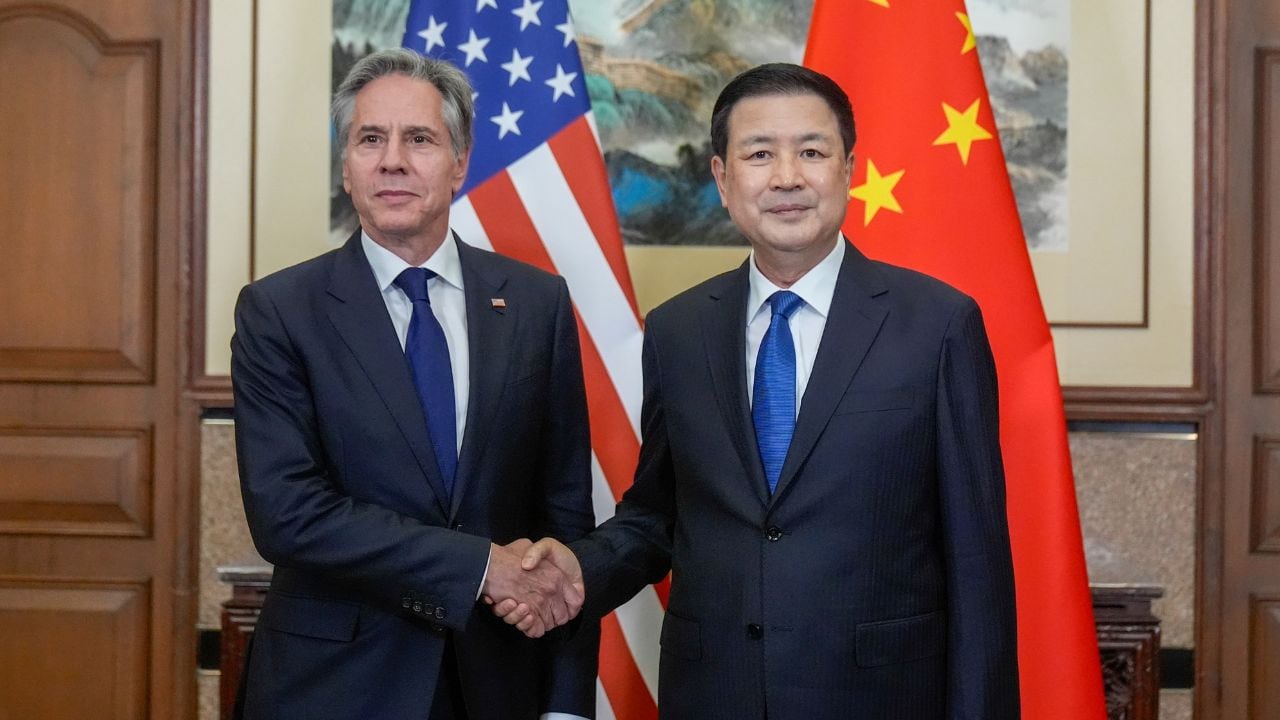

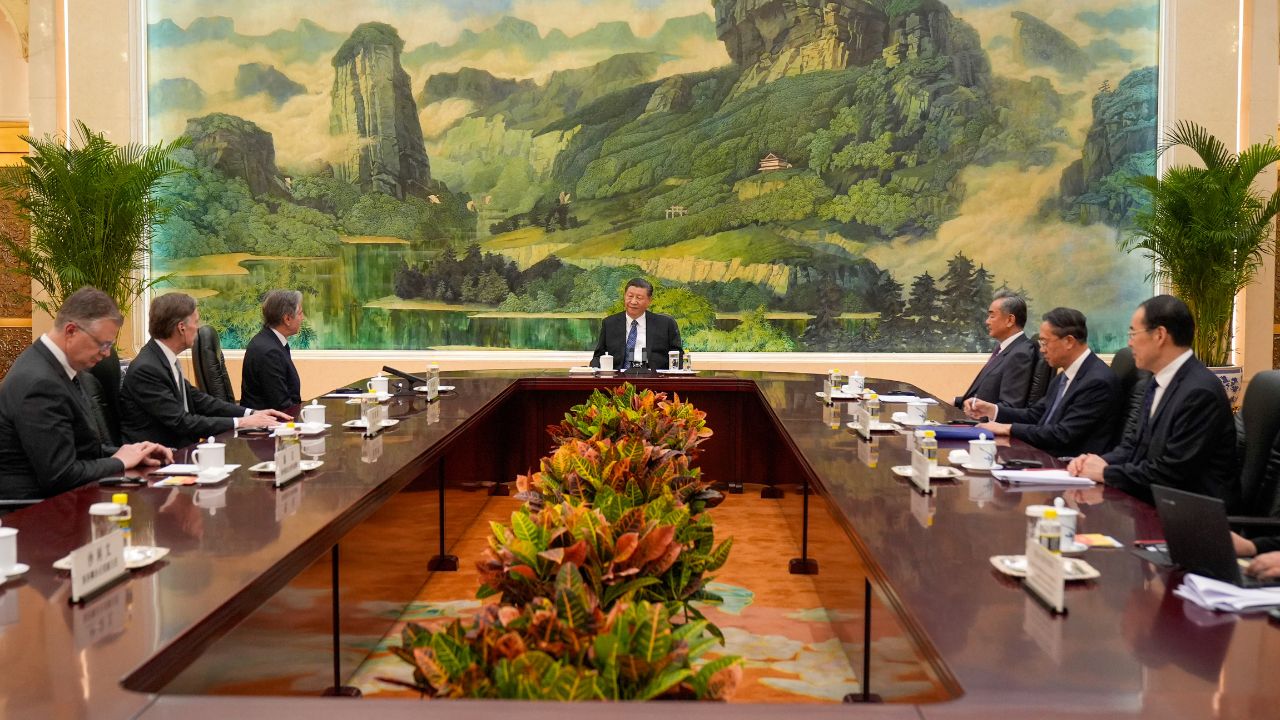

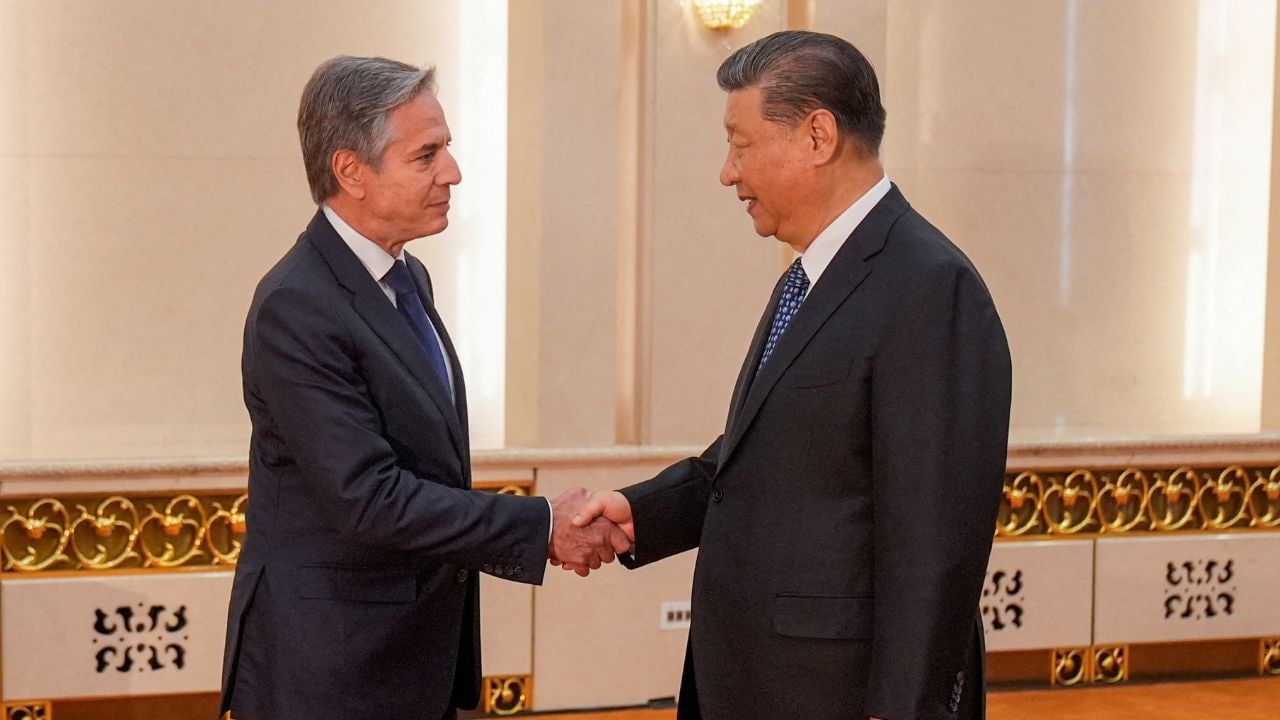

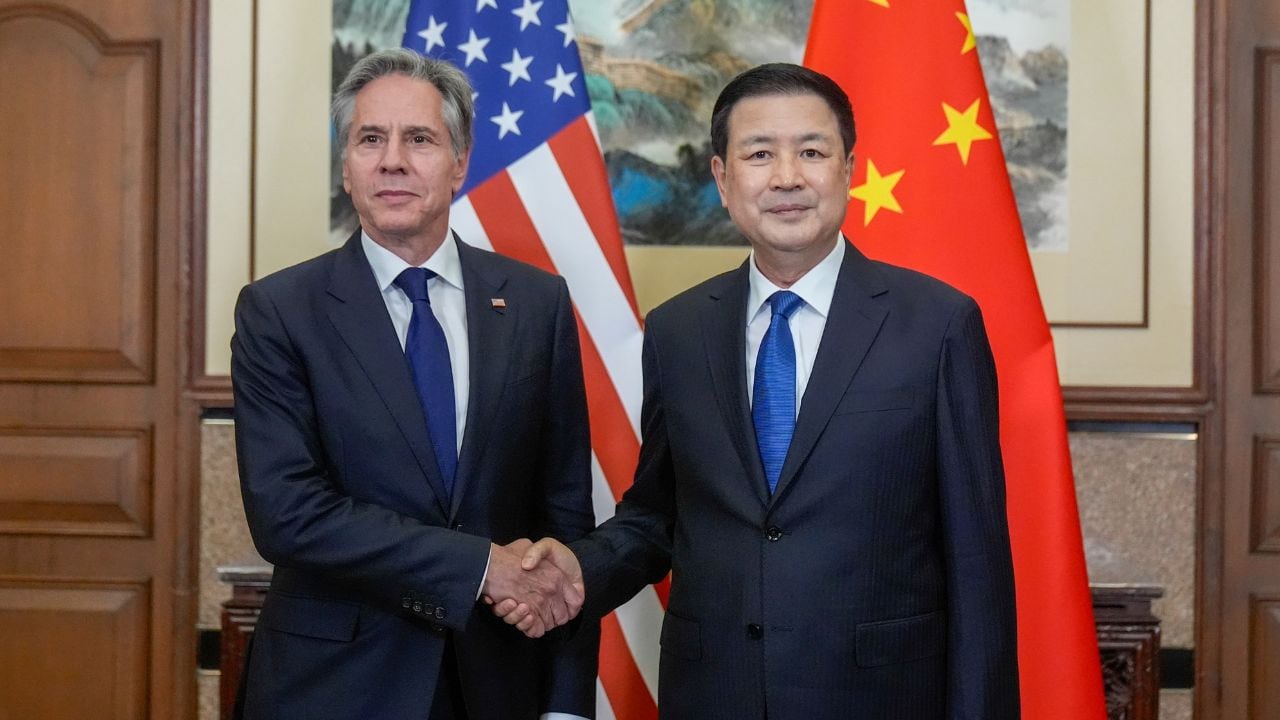

United States Secretary of State Antony Blinken and Chinese Foreign Minister Qin Gang shared concerns on a phone call Wednesday ahead of a planned visit by the US official to China meant to shore up relations.

“Spoke tonight with PRC State Councilor and Foreign Minister Qin Gang by phone,” Blinken’s official Twitter account read. “Discussed ongoing efforts to maintain open channels of communication as well as bilateral and global issues.”

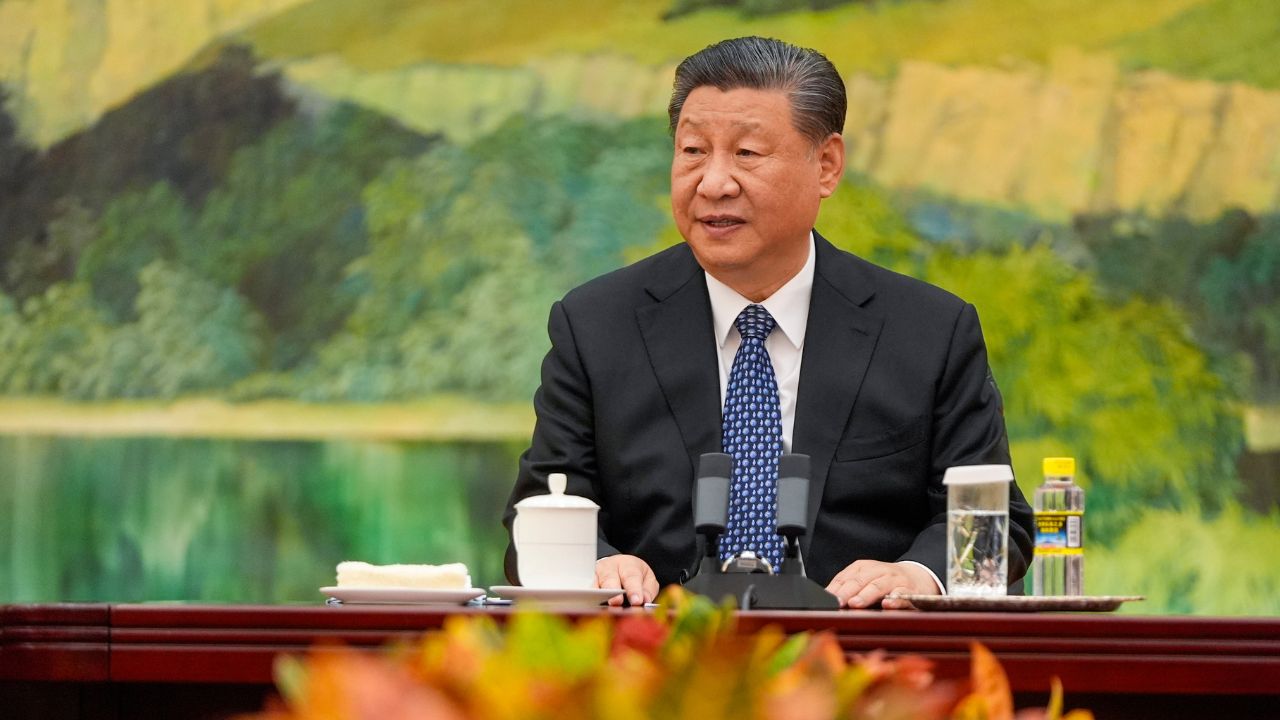

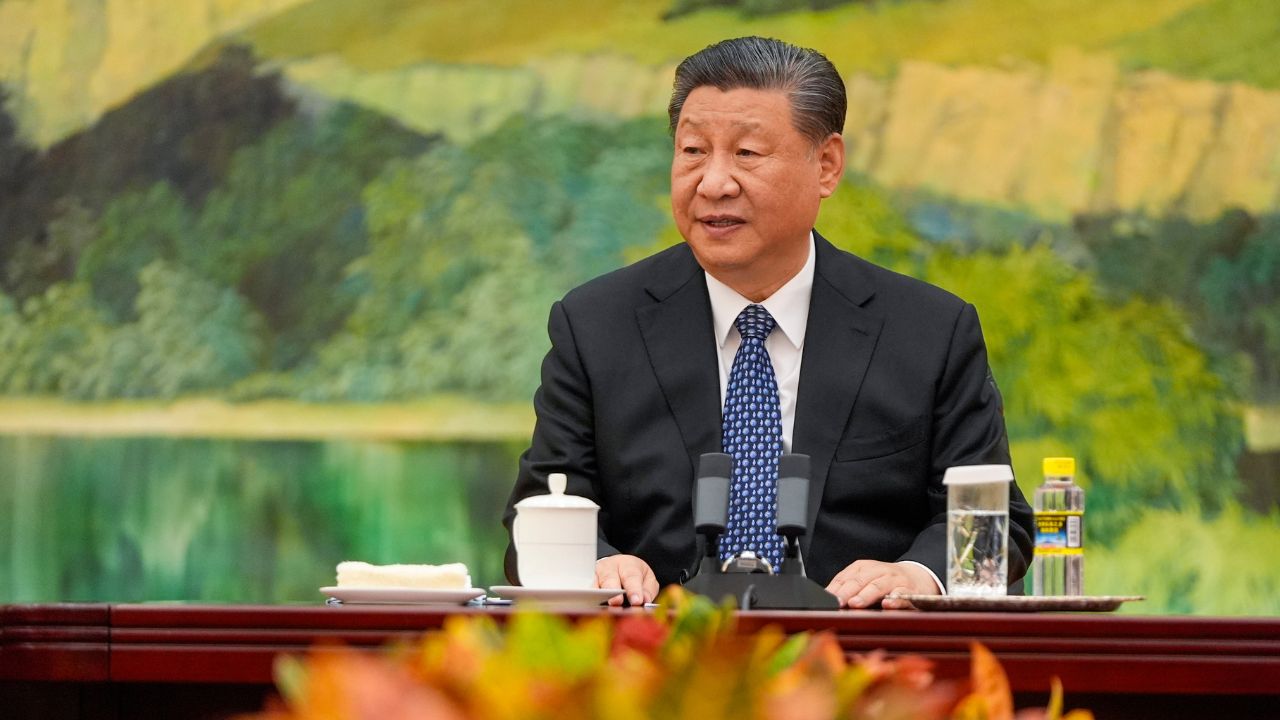

The Chinese foreign ministry said in a statement on one of its social media pages that Qin urged the United States to respect “China’s core concerns” such as the issue of Taiwan’s self-rule, “stop interfering in China’s internal affairs, and stop harming China’s sovereignty, security and development interests in the name of competition.”

Qin noted China-US ties “have encountered new difficulties and challenges” since the beginning of the year, and the two sides’ responsibility is to work together to properly manage differences, promote exchanges and cooperation and stabilize relations.

Blinken is reportedly planning a trip to China this week, after several weeks in which the two countries made diplomatic overtures to one another in an attempt to ease tensions. Blinken had scrapped a trip to Beijing in February after a suspected Chinese spy balloon flew over US territory.

China has since largely rejected US attempts at official exchanges, but some overtures were made. Last week, Daniel Kritenbrink, assistant U.S. secretary of state for East Asian and Pacific Affairs, was the highest-ranking U.S. official to visit China since the downing of the balloon.

In May, US Secretary of Commerce Gina Raimondo met her Chinese counterpart Wang Wentao in Washington to discuss trade.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Beijing plans to roll out what will be one of its biggest fiscal incentive packages over five years, mainly as subsidies and tax credits to bolster semiconductor production and research activities at home to counter US moves aimed at slowing its technological advances.

China is working on a more than 1 trillion yuan ($143 billion) support package for its semiconductor industry, three sources said, in a major step towards self sufficiency in chips and to counter US moves aimed at slowing its technological advances.

Beijing plans to roll out what will be one of its biggest fiscal incentive packages over five years, mainly as subsidies and tax credits to bolster semiconductor production and research activities at home, said the sources.

It signals, as analysts have expected, a more direct approach by China in shaping the future of an industry, which has become a geopolitical hot button due to soaring demand for chips and which Beijing regards as a cornerstone of its technological might.

The plan could be implemented as soon as the first quarter of next year, said two of the sources who declined to be named as they were not authorised to speak to media.

The majority of the financial assistance would be used to subsidise the purchases of domestic semiconductor equipment by Chinese firms, mainly semiconductor fabrication plants, or fabs, they said.

Such companies would be entitled to a 20 percent subsidy on the cost of purchases, the three sources said.

Also Read: Apple supplier Foxconn hires former top executive at chip makers TSMC, SMIC

The fiscal support plan comes after the US Commerce Department passed in October a sweeping set of regulations, which could bar research labs and commercial data centres’ access to advanced AI chips, among other curbs.

The United States has also been lobbying some of its partners, including Japan and the Netherlands, to tighten exports to China of equipment used to make semiconductors.

And US President Joe Biden in August signed a landmark bill to provide $52.7 billion in grants for US semiconductor production and research as well as tax credit for chip plants estimated to be worth $24 billion.

With the incentive package, Beijing aims to step up support for Chinese chip firms to build, expand or modernise domestic facilities for fabrication, assembly, packaging, and research and development, the sources said.

Beijing’s latest plan also includes preferential tax policies for the country’s semiconductor industry, they said. China’s State Council Information Office did not immediately respond to a request for comment.

Likely Beneficiaries

The beneficiaries will be both state-owned and private enterprises in the industry, notably large semiconductor equipment firms like NAURA Technology Group, Advanced Micro-Fabrication Equipment Inc China and Kingsemi, the sources added.

Some Chinese chip shares in Hong Kong rose sharply after news of the package. Semiconductor Manufacturing International Corp (SMIC) added more than 8 percent, sending its daily gain to nearly 10 percent. Hua Hong Semiconductor Ltd closed up 17 percent, while mainland markets were closed when the report was published.

Achieving self-reliance in technology featured prominently in President Xi Jinping’s full work report at the Communist Party Congress in October. The term ‘technology’ was referred to 40 times, up from 17 times in the report from the 2017 congress.

Xi’s call for China to “win the battle” in core technologies could signal an overhaul in Beijing’s approach to advancing its tech industry, with more state-led spending and intervention to counter US pressures, analysts have said.

The US sanctions published in October have caused major overseas-based chip manufacturing equipment companies to cease supplying key Chinese chipmakers, including Yangtze memory Technologies Co (YMTC) and SMIC, and makers of advanced artificial intelligence chips to cease supplying companies and laboratories.

The world’s second-largest economy has launched a trade dispute at the World Trade Organization against the United States over its chip export control measures, China’s commerce ministry said on Monday.

China has long lagged the rest of the world in the chip manufacturing equipment sector, which remains dominated by companies based in the United States, Japan, and the Netherlands.

A number of domestic firms have emerged in the past twenty years, but most remain behind their rivals in terms of ability to produce advanced chips.

NAURA’s etching and thermal process equipment, for example, can only produce 28-nanometer and above chips, relatively mature technologies.

Shanghai Micro Electronics Equipment Group Co. Ltd (SMEE), China’s only lithography company, can produce 90-nanometers chips, well behind that of the Netherlands’ ASML, which is producing those as low as 3 nanometers.

($1 = 6.9796 Chinese yuan renminbi)

Also Read: Mahindra to continue facing semiconductor shortage in December

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Social media app TikTok apologised to a user on Thursday for removing a video that criticised China’s treatment of Muslims, blaming a “human moderation error” and saying the images had been restored within less than an hour.

Social media app TikTok apologised to a user on Thursday for removing a video that criticised China’s treatment of Muslims, blaming a “human moderation error” and saying the images had been restored within less than an hour.

The controversy over the video, viewed 1.6 million times, comes as TikTok’s Chinese owner, ByteDance, faces an inquiry by a US national security panel over its handling of personal data, while US lawmakers fear it may be censoring politically sensitive content.

In the video she posted last week, the user, who identifies herself as Feroza Aziz, gave a tutorial on eyelash curling, while talking about how Muslims were being treated, and saying she wanted to spread awareness of the situation.

But on Twitter this week she said she had been blocked from posting on TikTok for a month, and on Wednesday posted that her viral video had been taken down, only to be restored later.

The video was offline for 50 minutes, TikTok said on its website.

“We would like to apologise to the user for the error on our part,” said Eric Han, the app’s US head of safety.

“Due to a human moderation error, the viral video from November 23 was removed. It’s important to clarify that nothing in our community guidelines precludes content such as this video, and it should not have been removed.”

The TikTok user did not immediately respond to requests from Reuters for additional comment.

China’s foreign ministry said it had no specifics of the case, when queried by Reuters about the incident on Wednesday.

But it added that it required Chinese firms to operate in a way that respected international norms and local laws and regulations, and hoped that relevant countries also provided a fair and non-discriminatory environment.

TikTok is not available in China, but ByteDance has a domestic version called Douyin.

The user did not mention Uighurs in the video, but said later on Twitter she had been referring to the minority ethnic group.

United Nations experts and rights groups estimate more than a million Uighurs and members of other ethnic groups have been detained in camps in China’s far western region of Xinjiang, which has triggered international condemnation.

>> US criticizes China for Xinjiang abuses revealed by leaked cables

China says the camps are re-education and training centres.

ByteDance has stepped up efforts to ring-fence TikTok, popular with US teenagers and those in their 20s, from much of its Chinese operations, Reuters reported on Thursday.

In a timeline on its blog post, TikTok said it had blocked another account set up by Aziz that had posted an image of Osama Bin Laden which violated its content policies regarding “terrorist imagery”.

On Monday, it enforced a device ban on accounts associated with violations. This affected the new account from which Aziz had posted the eyelash curling video and sent from the same device, it said.

It said it had decided to override the device ban and was directly contacting her to do so.

Aziz confirmed on Twitter that TikTok had restored her account but said other past videos had been deleted.

“Do I believe they took it away because of an unrelated satirical video that was deleted on a previous deleted account of mine? Right after I finished posting a three-part video about the Uyghurs? No,” she posted on Twitter.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

A prominent Federal Reserve official’s comments about the path of interest rate hikes added to the uncertainty for investors, as did setbacks for Britain’s plans to leave the European Union.

Wall Street tumbled more than 3 percent on Tuesday, led lower by bank and industrial shares, as the US bond market sent unsettling signs about economic growth and investors worried anew about global trade.

A prominent Federal Reserve official’s comments about the path of interest rate hikes added to the uncertainty for investors, as did setbacks for Britain’s plans to leave the European Union.

The S&P 500 posted its biggest single-day percentage drop in about two months, giving back some gains from Monday and a week earlier, when the benchmark index tallied its largest weekly percentage gain in nearly seven years.

The small-cap Russell 2000 dropped 4.4 percent, its biggest one-day plunge in more than seven years.

Investors were focused on US Treasury yields, where the benchmark 10-year yield fell to its lowest point since mid-September. The spread between the 10-year yield over its two-year counterpart also shrank to the smallest in over a decade, a closely watched signal because a so-called yield curve “inversion,” when the two-year yields more than the 10-year bond, preceded all the recessions of the past 50 years.

Part of the curve did invert, with two-year and three-year yields holding above the five-year yield for a second day.

“It’s fears about the inverted yield curve and what that means for the economy and is it a precursor to a recession,” said Chuck Carlson, chief executive officer at Horizon Investment Services in Hammond, Indiana.

The Dow Jones Industrial Average fell 799.36 points, or 3.1 percent, to 25,027.07, the S&P 500 lost 90.31 points, or 3.24 percent, to 2,700.06 and the Nasdaq Composite dropped 283.09 points, or 3.8 percent, to 7,158.43.

The New York Stock Exchange and Nasdaq will be closed on Wednesday, for a day of mourning for former President George H.W. Bush, who died on Friday at the age of 94.

Stocks had rallied on Monday following a truce between US President Donald Trump and Chinese President Xi Jinping on their trade dispute following weekend talks in Argentina, but investor optimism over a resolution faded on Tuesday. Trump himself warned he would revert to tariffs if the two sides could not resolve their differences.

“The sell-off that we have seen throughout the day is really about taking a look at the tariff conversation and realizing that nothing has been resolved and that there is still some work to do and some of the euphoria that we felt yesterday was more on the headline than on the substance,” said Delores Rubin, senior equities trader at Deutsche Bank Wealth Management in New York.

Financial shares, which are particularly sensitive to bond market swings, dropped 4.4 percent.

The trade-sensitive industrial sector fell 4.4 percent, with Boeing and Caterpillar declining 4.9 percent and 6.9 percent, respectively.

The Dow Jones Transport Average declined 4.4 percent, its biggest one-day percentage drop since June 2016.

Defensive Utilities eked out a 0.2 percent gain, the only one of the 11 major S&P 500 sectors in positive territory.

In comments on Tuesday, New York Fed President John Williams said the US central bank should expect to continue raising interest rates “over the next year or so” even while it pays close attention to possible risks highlighted by financial markets.

The comments came after those from Fed chair Jerome Powell last week, which lifted stocks as they were interpreted as suggesting a less aggressive path of rate hikes.

“Maybe we’re not going to get as dovish a Fed as some think,” said Joseph LaVorgna, chief economist, Americas at Natixis in New York.

Declining issues outnumbered advancing ones on the NYSE by a 4.24-to-1 ratio; on Nasdaq, a 5.96-to-1 ratio favoured decliners.

The S&P 500 posted 40 new 52-week highs and 29 new lows; the Nasdaq Composite recorded 36 new highs and 220 new lows.

About 9 billion shares changed hands in US exchanges, above the 7.7 billion-share daily average over the last 20 sessions.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

On Monday, Trump said he expected to move ahead with raising tariffs on $200 billion in Chinese imports to 25 percent from the current 10 percent and repeated his threat to slap tariffs on all remaining imports from China.

US options traders have their eyes firmly fixed on Buenos Aires this week, and they are increasingly confident the meeting there of the heads of the world’s 20 largest economies means one thing: more volatility.

The persistent trade tensions between the United States and China are likely to dominate the G20 summit hosted by Argentina on November 30 and December 1, with US President Donald Trump and Chinese Premier Xi Jinping set for direct talks on Saturday.

On Monday, Trump said he expected to move ahead with raising tariffs on $200 billion in Chinese imports to 25 percent from the current 10 percent and repeated his threat to slap tariffs on all remaining imports from China.

Given the sensitivity US stocks have displayed of late to any trade-related headlines, traders are braced for an additional dose of volatility around the meeting. After their biggest gain in more than two weeks on Monday, Trump’s salvo after the market closed has re-established an air of caution on Wall Street, and on Tuesday stocks were weak.

The options tied to the S&P 500 Index’s tracking fund, known as the SPDR S&P 500 ETF Trust are exhibiting higher volatility in the short-term expirations ahead of the G20 meeting, according Chicago-based volatility and options data firm ORATS.

“The elevated levels suggest a market expected move of 2 percent this week,” said ORATS founder Matt Amberson.

S&P 500 contracts expiring on December 7 also exhibit elevated volatility levels, data from Trade Alert showed.

While a 2 percent move is roughly in line with the S&P 500 Index’s weekly gyrations over the last 10 weeks, the volatility premium embedded in these near-term contracts underlines how important the summit could be to shaping expectations for how the fraught trade relationship between the United States and China will weigh on equities.

Stocks have already had a rough two months, with major US benchmarks sliding back into their second correction of the year and rising worries over the trade scene a big contributor to investor unease.

“If the US still continues on a path towards escalation of the trade dispute with China after the G20 meetings, we can infer that economic considerations are slipping in the administration’s policy agenda,” UBS Global Wealth Management Chief Investment Officer Mark Haefele said in a note on Monday.

“Against such a backdrop, investors would be right to demand higher risk premia,” he said.

To be sure, the summit might not be the only event on traders’ minds.

Close attention will be paid to a speech on Wednesday by US Federal Reserve Chairman Jerome Powell and to minutes from the central bank’s November 7-8 meeting to be released on Thursday for clues to the path of future interest rate hikes.

“What I look for is volatility to begin to increase as we head into Fed minutes and then the G20. Those back-to-back events will be the primary volatility driver this week,” said J.J. Kinahan, chief market strategist at TD Ameritrade in Chicago.

“I would look for more premium buyers on both sides as many start to collar their risk,” he said.

While it was difficult to say whether anxiety ahead of the G20 meeting was wholly responsible for the volatility premium embedded in the near-term options, the summit certainly was one thing playing on options traders’ minds, said Jon Cherry, global head of options at Northern Trust Capital Markets in Chicago.

“Our clients in particular have been proactively hedging over several months of 2018 and we see that trend continue,” he said. “Hedging out to the end of the year and protecting gains is definitely something we have seen.”

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

All three of Wall Street’s major indexes reversed losses following Kudlow’s comments days ahead of the high-stakes dinner between Trump and Xi Jinping after the G20 summit in Buenos Aires.

The S&P 500 and the Dow Jones Industrial Average edged higher on Tuesday after White House economic adviser Larry Kudlow said a meeting between President Donald Trump and his Chinese counterpart on Saturday was an opportunity to “turn the page” on a trade war.

All three of Wall Street’s major indexes reversed losses following Kudlow’s comments days ahead of the high-stakes dinner between Trump and Xi Jinping after the G20 summit in Buenos Aires.

But Kudlow also said the White House has been disappointed so far in China’s response to trade issues with the United States. On Monday, Trump threatened to move ahead with additional tariffs on Chinese goods, due to take effect on January 1.

“The volatility we’re seeing this afternoon is related to Kudlow’s comments,” said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York. “Across all sectors you see the market bouncing up and down and being very unsettled. And it’s primarily the tariff issue overhanging the market.”

General Motors Co shares dropped 2.5 percent after Trump warned subsidies could be cut after the automaker said it would shutter US plants and lay off thousands of workers.

“The GM thing is a war of words,” Ghriskey said. “Here’s a company trying to react to the market environment … and they’re being criticized for it.”

The Dow Jones Industrial Average rose 108.49 points, or 0.44 percent, to 24,748.73, the S&P 500 gained 8.75 points, or 0.33 percent, to 2,682.2 and the Nasdaq Composite added 0.85 point, or 0.01 percent, to 7,082.70.

Of the 11 major sectors in the S&P 500, all but three closed the session in positive territory. Healthcare was the biggest percentage gainer with a 0.99 percent increase, followed by gains in defensive sectors such as consumer staples, utilities and real estate.

Trade-sensitive industrials and materials sectors were down, as was energy.

US steel company stocks dropped as China’s steel sector slid into bear territory, with the benchmark rebar contract down more than 20 percent from its 2018 peak. US Steel Corp slid 8.3 percent, while AK Steel Holdings fell 4.6 percent.

Budget airline Spirit Airlines Inc took off, its stock rising 15.3 percent after hiking fourth-quarter unit revenue guidance.

Shares of drugmaker Bristol-Myers Squibb Co fell after its lung cancer therapy fell short of goals in a late-stage trial. Its shares closed down 3.0 percent.

United Technologies Corp dropped 4.1 percent following its announcement late Monday that it would divide its aerospace, elevators and building segments into three discrete companies.

Federal Reserve Chairman Jerome Powell is expected to speak on Wednesday, and investors will scrutinize his comments over US economic health and trade concerns.

Declining issues outnumbered advancing ones on the NYSE by a 1.57-to-1 ratio; on Nasdaq, a 1.94-to-1 ratio favoured decliners.

The S&P 500 posted four new 52-week highs and nine new lows; the Nasdaq Composite recorded 15 new highs and 144 new lows.

Volume on US exchanges was 6.79 billion shares, compared with the 7.90 billion-share average over the last 20 trading days.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously