Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

May wheat inventories are higher than April stocks of 7.5 million metric tons after new season purchases by the Food Corporation of India bumped up reserves.

Wheat stocks in India’s government warehouses on May 1 were down 10.3% year on year to their lowest since 2008 after two years of low crops prompted the sale of record volumes to boost domestic supplies and lower local prices.

At the start of the month wheat reserves in state stores totalled 26 million metric tons, down from 29 million metric tons in May 2023, according to the state-run Food Corporation of India.

May wheat inventories are higher than April stocks of 7.5 million metric tons after new season purchases by the Food Corporation of India bumped up reserves.

Higher temperatures clipped output in 2022 and 2023.

Despite the tight supply, New Delhi has resisted calls to encourage imports by cutting or removing the current 40% tax on imports or by buying directly from leading suppliers such as Russia.

Instead, it has dipped into state reserves to sell to bulk consumers, such as flour millers and biscuit makers, to try to curb domestic prices that have been above the state-fixed minimum buying price since the past crop was harvested.

The Food Corporation of India began selling wheat to private players in June 2023 and has so far sold a little more than 10 million tons, a record from state reserves.

India grows only one wheat crop a year, with planting in October and November and harvesting from March. The new season purchases start in April, augmenting state stocks from May.

Although this year’s May stocks are lower than last year, inventories are higher than the government buffer and strategic reserve target that requires wheat stocks to be held at or above 7.46 million tons for the quarter beginning April 1.

India failed to achieve its wheat purchase target in 2022 and 2023, followed by a slow start to this year’s purchases.

New Delhi banned wheat exports in 2022 despite a rise in export demand as the Russia-Ukraine conflict led to a global shortfall.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Food inflation, which has a 39.1% weight in the CPI gauge, has remained well above 8% for six months now. Pressure on food prices continues, including due to the ongoing heatwaves. But fuel and light, with a 6.8% weight, has been reducing the pressure on the headline for eight months, points out CRISIL’s Chief Economist Dharmakirti Joshi.

Food inflation edged up in April to 8.7% from 8.5% in March, driven by costlier cereals and meat, while vegetables, which have been sticky at elevated levels, softened a touch. Despite the uptick in food, non-food components helped curtail Consumer Price Index or CPI-based inflation gauge to 4.83% in April, two basis points lower than in March.

Fuel inflation fell to 4.2%, compared with 3.4% in March, whereas core inflation softened further to 3.2% from 3.3%. This is the lowest ever recorded for core.

While the mild easing of the headline number in April is encouraging, acceleration of this downtrend is what matters, especially since recent swings have been worrying.

Food inflation, which has a 39.1% weight in the CPI gauge, has remained well above 8% for six months now. Pressure on food prices continues, including due to the ongoing heatwaves.

Our base case is that the upcoming monsoon rains can offer respite, assuming they are well distributed in terms of time and geography.

Fuel and light, with a 6.8% weight in the CPI gauge, has been reducing the pressure on the headline for eight months led by retail fuel price relaxations by the government. But if crude oil prices rise substantially and stay elevated in the wake of geopolitical stress, the gains to inflation could be reversed.

Meanwhile, core inflation with a weight of 47.3% has been low for most of this period but the expected rise in commodity prices together with a low base effect will put upward pressure on core inflation in the current fiscal. Net-net for fiscal 2025, we expect CPI inflation to broadly ease this fiscal to 4.5% from 5.4% last fiscal.

—The author, Dharmakirti Joshi, is Chief Economist at leading analytics and rating firm CRISIL. The views expressed are personal.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The Indian government released the wholesale price index (WPI) data for April on Tuesday, May 14. The April WPI came at a 13-month high of 1.26% against the estimated 1%. According to a CNBC-TV18 poll, the WPI is estimated in the range of 0.8% to 1.1%.

The Indian government released the wholesale price index (WPI) data for April on Tuesday, May 14. The April WPI came at a 13-month high of 1.26% against the estimated 1%. The government attributes the positive rate of inflation to an increase in prices of food articles, electricity, crude petroleum and natural gas, manufacture of food products, and other manufacturing.

According to a CNBC-TV18 poll, the WPI is estimated in the range of 0.8% to 1.1%. The WPI in March came at 0.53% against 0.20. In January, the wholesale index stood at 0.27%.

The Wholesale Price Index or WPI measures the change in prices of goods wholesale businesses sell to and trade in bulk with other companies. Unlike the CPI which tracks prices of goods and services purchased by consumers, WPI tracks factory gate prices before retail prices.

In the year-ago period, India’s annual WPI-based inflation declined to a 34-month low of 0.92%, largely due to the base effect, turning negative for the first time since July 2020.

The Ministry of Commerce and Industry releases WPI. Under the index, commodities are categorised into three groups — primary articles (which are further divided into food and non-food articles), fuel and power and manufactured products, and the base year for the index is 2011-12.

The prices of crude petroleum and natural gas (3.56%), food articles (2.67%), and mineral oils (0.06%) increased in April 2024 as compared to March 2024. On the other hand, the price of non-food articles (-1.19%), minerals (-1.55%), and electricity (-1.20%) declined in April as compared to the previous month.

Out of the 22 National Industrial Classification (NIC) two-digit groups for manufactured products, 15 groups witnessed an increase in prices whereas five groups witnessed a decrease in prices. Two of the groups showed no change.

Basic metals, other manufacturing, textiles, food products, and chemical & chemical products etc witnessed month-over-month increases in prices. Other non-metallic mineral products, paper & paper products, motor vehicles, trailers & semi-trailers, furniture, and leather & related products reported a decline in prices.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Vegetable, pulses and to some extent cereal price inflation has probably pushed food price inflation to over 8.7% in April, higher than even the February food price index which rose by 8.66%.

In April 2024, vegetable prices went up by 27%, a tad below the 28.3% inflation clocked in March, but it’s the fourth consecutive month when vegetable prices have grown over 27%.

Prices of pulses and other products went up over 16% in April, lower than the previous months but still very much on the higher side, prompting the government to take actions like scrapping import duty on chickpeas and extending duty-free imports of yellow peas.

Prices of cereals have continued to rise by over 8% in the last two months. While prices of meat and fish have grown steadily over the last 3 months, prices of eggs and spices have come off from their highs.

Vegetable, pulses and to some extent cereal price inflation has probably pushed food price inflation to over 8.7% in April, higher than even the February food price index which rose by 8.66%. While food & beverage prices rose 7.87% in April, higher than March’s 7.69% and 7.76% rise witnessed in February. Food & beverages comprise close to 46% of the retail inflation basket.

Also Read: India receives $111.22 bn in remittances in 2022, first country to surpass $100 billion mark

Madhavi Arora, Chief Economist, Emkay Global, said, “Considerable uncertainty prevails in the food price outlook. Despite healthy progress in Rabi production, uneven seasonality in vegetable prices together with increasing incidence of climate shocks warrant careful monitoring. The RBI cannot do much to influence food supply management, but this puts pressure to stay vigilant on domestic dynamics.”

This could also be impeding a sharper decline in headline retail inflation, with retail inflation for April registered an easing of 2 basis points over March. In the last MPC meeting, RBI Governor Shaktikanta Das indicated stubborn food inflation may be preventing a quicker easing of CPI inflation. The governor’s observations may have dimmed hopes of an early rate cut by the central bank.

Sanjeev Agrawal, President of PHD Chamber of Commerce & Industry, said, “In the recent months, inflation has come down significantly due to continuous softening in housing inflation from 3.2% in January 2024 to 2.6 in April 2024, fuel and light from -0.6% in January 2024 to -4.2 % in April 2024, clothing and footwear categories from 3.3% in January 2024 to 2.8% in April 2024 and pan, tobacco and intoxicants from 3.2% in January 2024 to 2.9% April 2024.

Also Read: India must prepare for a US stagflation, says Sanjeev Sanyal

However, inflation is still sticky in food and beverages at 7.8 in April 2024. Going forward, the inflation trajectory is expected to become normal by September/October 2024 as many of the Kharif crops will be entering the mandis and supplementing the existing supply.”

Rajani Sinha, Chief Economist, CareEdge Ratings, said, “Reversing last month’s trend, food inflation inched up to 7.9% as the ongoing deflation in the oil and fat category fell to a single-digit after 12 months.

The high inflation in specific food categories, including vegetables and pulses, remains a concern. While the outlook for food inflation has brightened due to anticipations of a normal monsoon, the temporal and spatial distribution of monsoon would be critical factors.

Apart from elevated food inflation, the incremental risk to inflation stems from the uptick in global commodity prices, especially industrial metals. Industrial metal prices are up ~20% in the past three months. This warrants closer attention as the rise in input prices can be passed on to the consumption basket.”

Also Read: Kumar Mangalam Birla says Indian economy ‘just looking like a wow’

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The brokerage expects India’s blue-chip NSE Nifty 50 index to rise 7% between now and the end of the current financial year ending March 2025, setting a target of 23,900.

Citigroup analysts upgraded India to “overweight” from “neutral” in their emerging markets allocation on Friday, citing strong earnings and economic growth momentum.

The brokerage expects India’s blue-chip NSE Nifty 50 index to rise 7% between now and the end of the current financial year ending March 2025, setting a target of 23,900.

The Nifty 50 closed at 22,055.20 on Friday. The benchmark has underperformed the MSCI Emerging Market Index in 2024 so far.

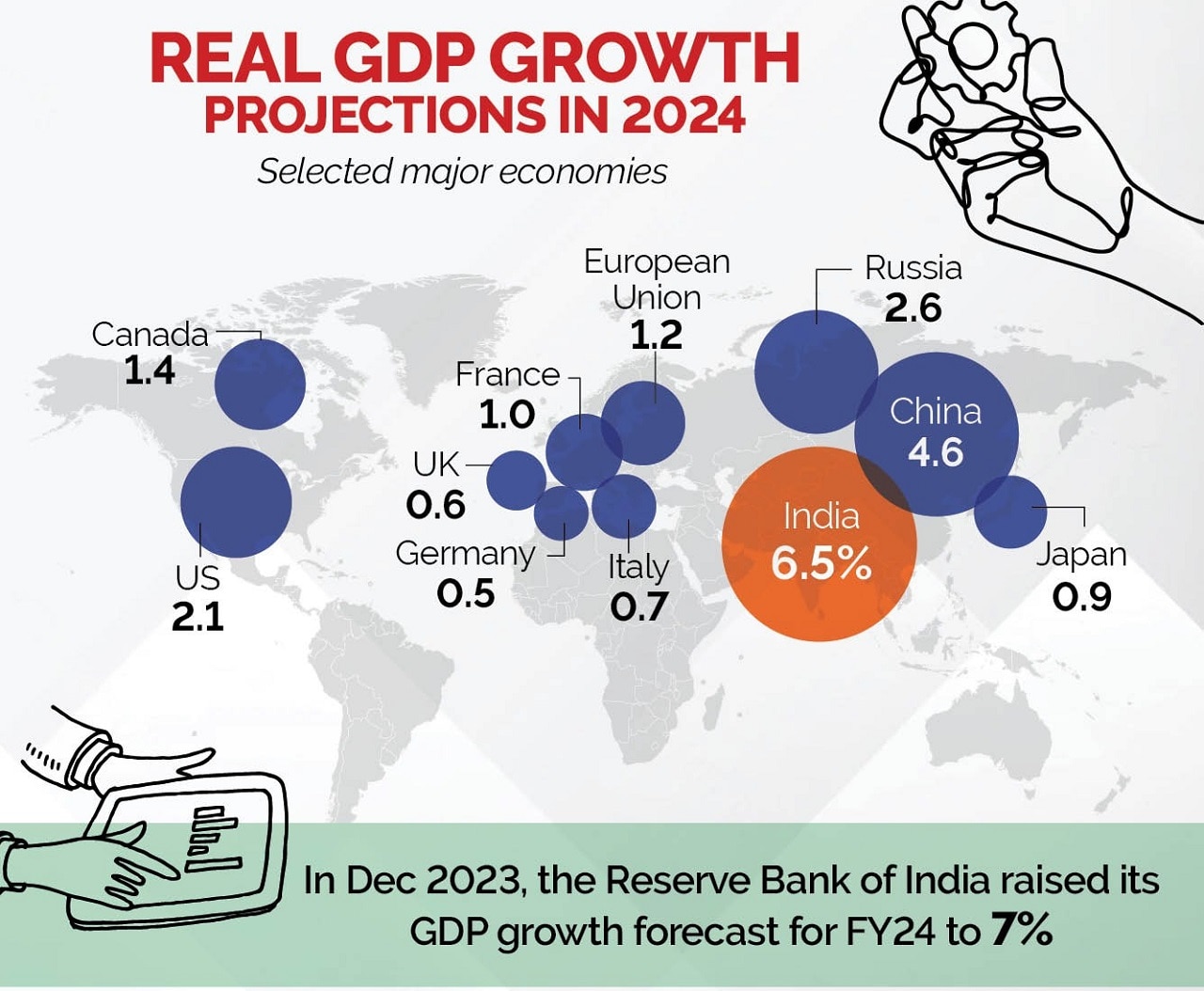

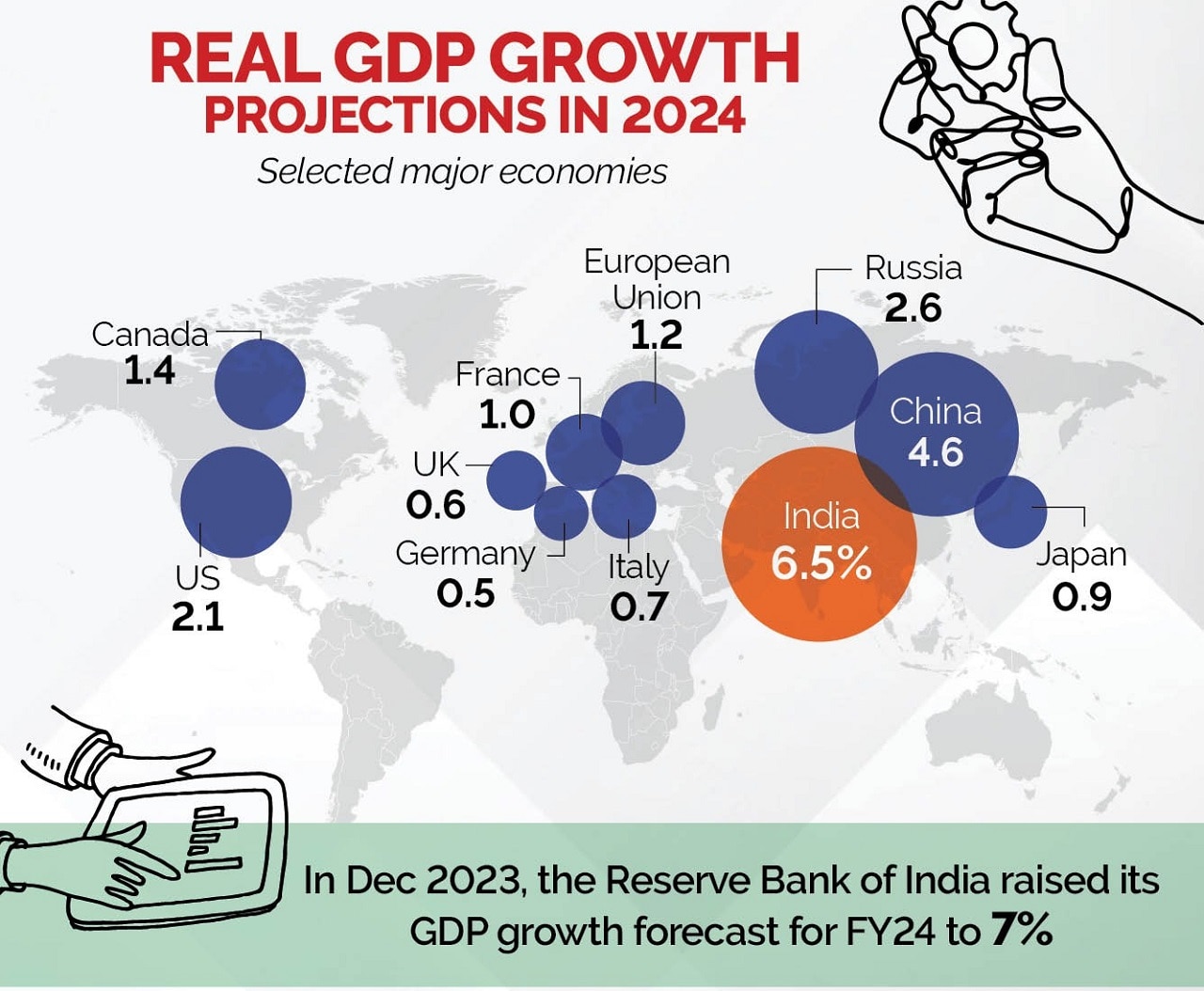

Citi’s view is underpinned by the expectation that India’s economy – the fastest growing among major peers – will remain strong, growing at 6.8% in the current fiscal.

The brokerage’s estimates imply an earnings CAGR of 13% for FY24-FY26, with the trajectory broadly stable, Surendra Goyal, managing director and head of Indian research at Citigroup, said in a note on Friday, while also attributing the India upgrade to sustained economic growth.

It also attributed India’s one-year forward price-to-earnings (P/E) of 20x, which is slightly higher than the long-term averages, to a stable earnings trajectory.

Also Read: India’s forex reserves jump $3.66 billion to $641.59 billion

The brokerage remains “overweight” on India’s banks, insurers, public sector enterprises, autos and capital goods companies among others. It recommends “underweight” on information technology firms, metals, consumer durables and discretionary as well as paint companies.

Citi downgraded China to “neutral” from “overweight”, saying the recent rally in its stock markets occurred despite weakening fundamentals.

Foreign portfolio investors have sold Indian shares since the beginning of April, aggregating to about 191 billion rupees ($2.29 billion).

China’s markets, however, have benefitted from a rising share of foreign inflows, helped by valuations that are relatively cheaper than India’s.

Citi’s downgrade of China is in contrast to the actions of global brokerage Jefferies, which raised China’s weighting in its Asia Pacific ex-Japan relative-return portfolio.

Citi reiterated its “overweight” rating on Taiwan and Korea, maintaining “underweight” on Latin American countries.

Also Read: UK recession ends with strongest growth since lockdown’s end

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

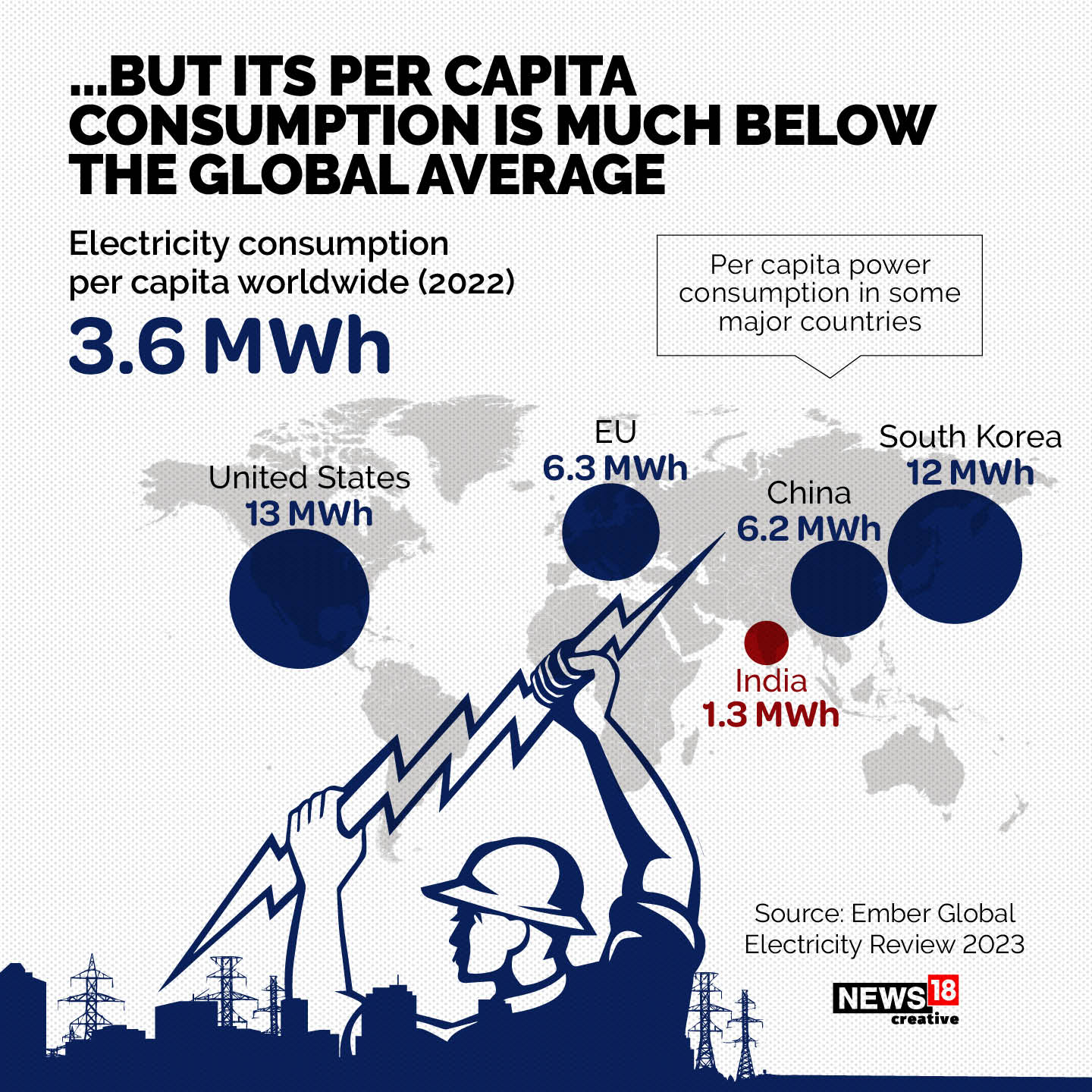

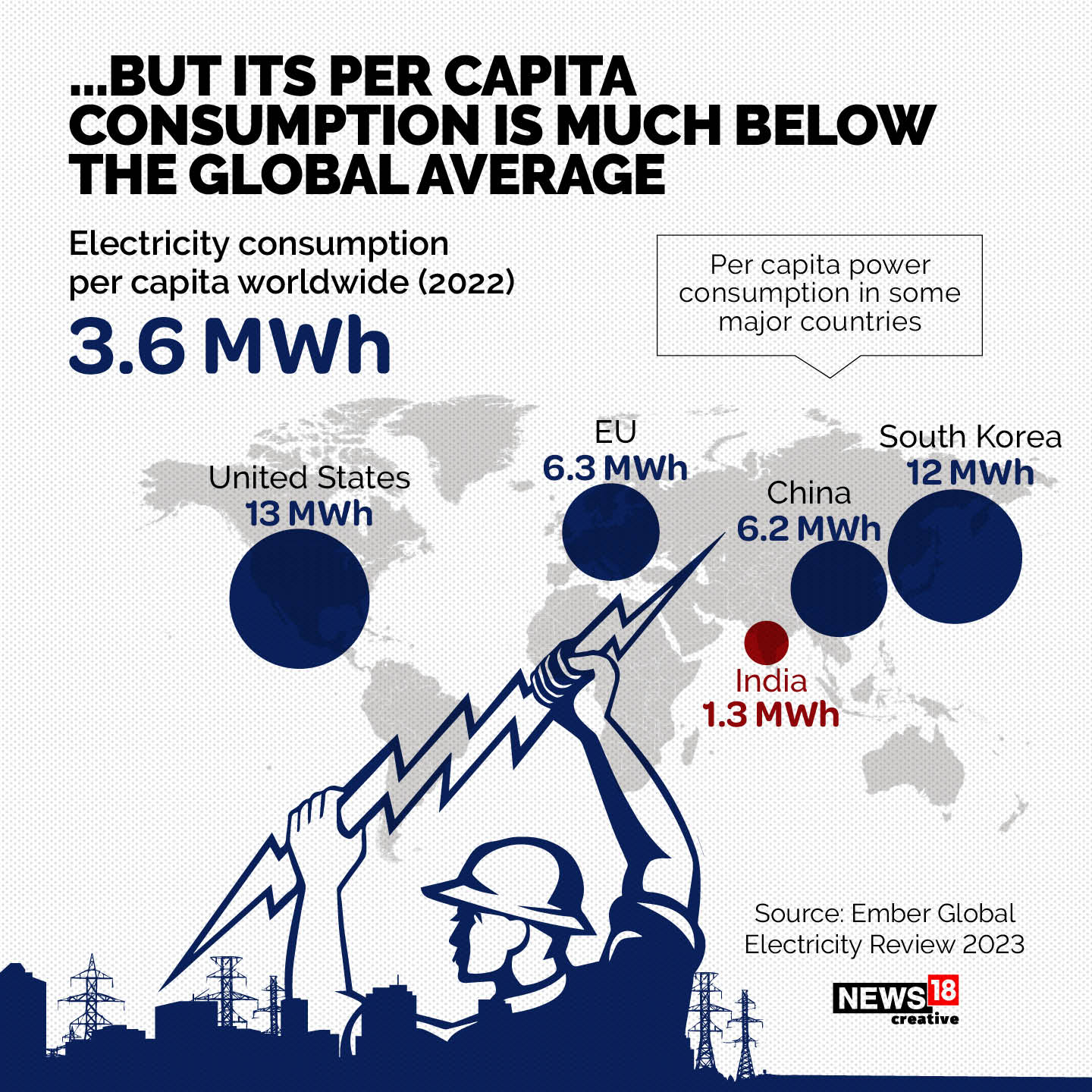

The gap is the widest since 2009-10, according to publicly available government data. India’s hydroelectricity output fell at the steepest pace in four decades in the year ended March 31, while renewable energy generation was flat.

India is projecting its biggest power shortfall in 14 years in June after a slump in hydropower generation, the government told Reuters and is racing to avoid outages by deferring planned plant maintenance and re-opening idled units.

The deficit also follows delays, a government source said, in the commissioning of 3.6 gigawatts (GW) of new coal-fired plants that had been targeted to be operational before March.

A peak shortage of 14 GW is forecast in June during nighttime hours, when solar capacity is offline, the Central Electricity Authority, the country’s planning body for the power sector, told Reuters in a statement.

“The planning process relies on worst-case scenarios,” it said.

The gap is the widest since 2009-10, according to publicly available government data. India’s hydroelectricity output fell at the steepest pace in four decades in the year ended March 31, while renewable energy generation was flat.

Power Minister RK Singh held an emergency meeting last week to take stock of the situation, and decided to defer shutting down power plants for planned maintenance during June and revive 5 GW of idled coal plant capacity, two separate government sources present in the meeting said.

“All efforts have been made to maximise generation, and with the measures in place it is expected that the power demand would be adequately met during the day and the non-solar hours in the coming months including June 2024,” the statement said.

Grid administrator Grid-India projects maximum night-time demand of 235 GW in June, the statement said. On the supply side, nearly 187 GW of thermal capacity is available, and about 34 GW from renewable sources, according to government sources.

The figures on power demand and capacity projections have not been previously reported.

In April, the power ministry invoked emergency rights for the first time to direct gas-based and imported coal-based power plants to operate at full capacity.

India has long defended the use of coal but Prime Minister Narendra Modi’s administration had slowed capacity growth based on the heavily polluting fuel to focus on the green energy transition, with an eye to meeting 2070 net zero emission goals.

Plans to set up new coal power plants in the country, which is under pressure from rich economies to stop coal use, gathered momentum last year, but they will take a minimum of four years to start generation.

Existing coal-fired power plants and solar plants will help the nation meet its electricity demand during daytime hours, one of the government sources said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The global remittance landscape showed a strong recovery in 2022 from the impact of the COVID-19 pandemic in 2020. Migrants worldwide sent an estimated $831 billion in remittances, a substantial increase from $791 billion in 2021 and $717 billion in 2020.

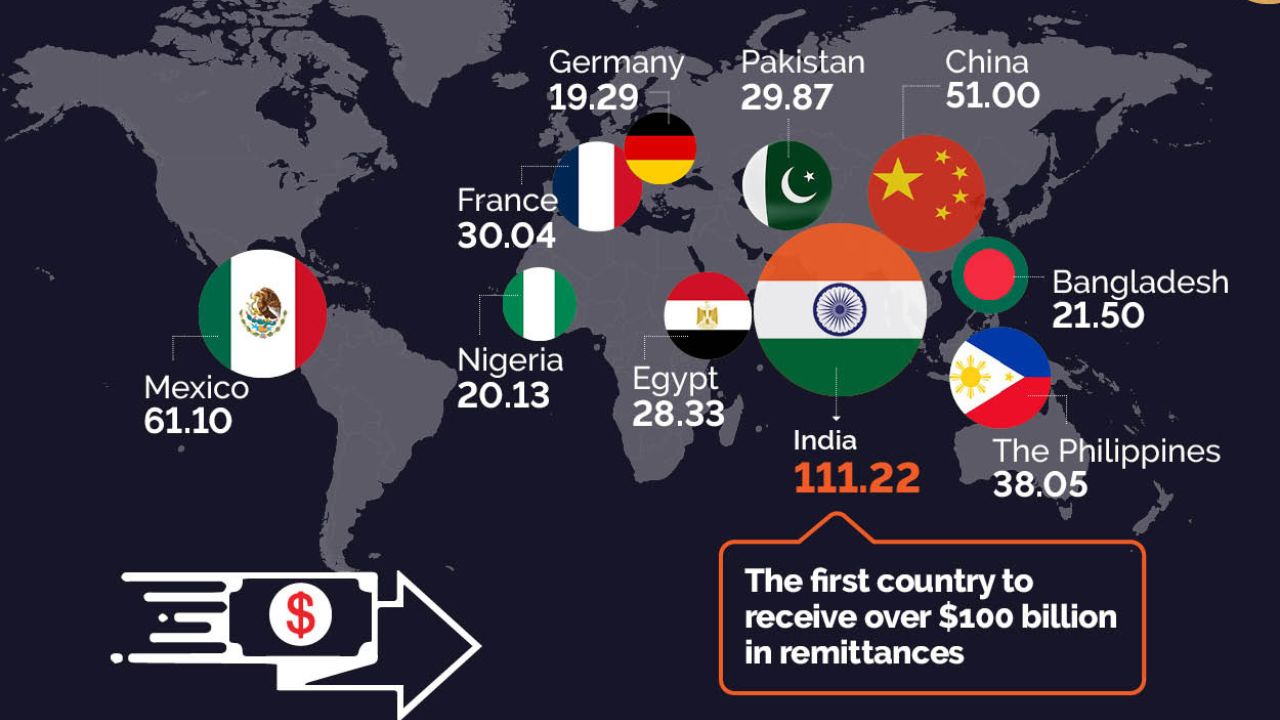

In 2022, India topped the list of countries receiving the highest remittances, with over $111 billion, setting a historic milestone by surpassing the $100 billion mark. India, was followed by Mexico, China, the Philippines, and France.

This achievement was noted in the World Migration Report 2024, unveiled by the United Nations migration agency on Tuesday.

The global remittance landscape showed a strong recovery in 2022 from the impact of the COVID-19 pandemic in 2020.

Migrants worldwide sent an estimated $831 billion in remittances, a substantial increase from $791 billion in 2021 and $717 billion in 2020.

Mexico maintained its position as the second-largest recipient of remittances in 2022, surpassing China, historically in that spot since India. France and Germany, part of the G7 nations, remained among the top 10 remittance-receiving countries globally, a trend continuing for over a decade.

The report also emphasises the reliance of certain countries on remittances, measured by the ratio of remittances to their gross domestic product (GDP). In 2022, Tajikistan led this list, followed by Tonga, Lebanon, Samoa, and Kyrgyzstan, underlining the significant role of remittances in these economies.

| Countries | 2010 | 2022 |

| India | $53.48 billion | $111.22 billion |

| China | $52.46 billion | $61.10 billion |

| Mexico | $22.08 billion | $51.00 billion |

| The Philippines | $21.56 billion | $38.05 billion |

| France | $19.90 billion | $30.04 billion |

| Nigeria | $19.75 billion | $29.87 billion |

| Germany | $12.79 billion | $28.33 billion |

| Egypt | $12.45 billion | $21.50 billion |

| Belgium | $10.99 billion | $20.13 billion |

| Bangladesh | $10.85 billion | $19.29 billion |

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The International Monetary Fund had recently pegged India’s growth projection for FY24 at 7.8%, slightly more than the government’s projection of 7.6%.

India’s Chief Economic Advisor V Anantha Nageswaran on Wednesday, May 8, said the possibility of growth touching 8% in the fiscal is quite high. “India is aiming at maintaining growth in the 6.5-7% range in the coming years,” he said. The International Monetary Fund had recently pegged India’s growth projection for FY24 at 7.8%, slightly more than the government’s projection of 7.6%.

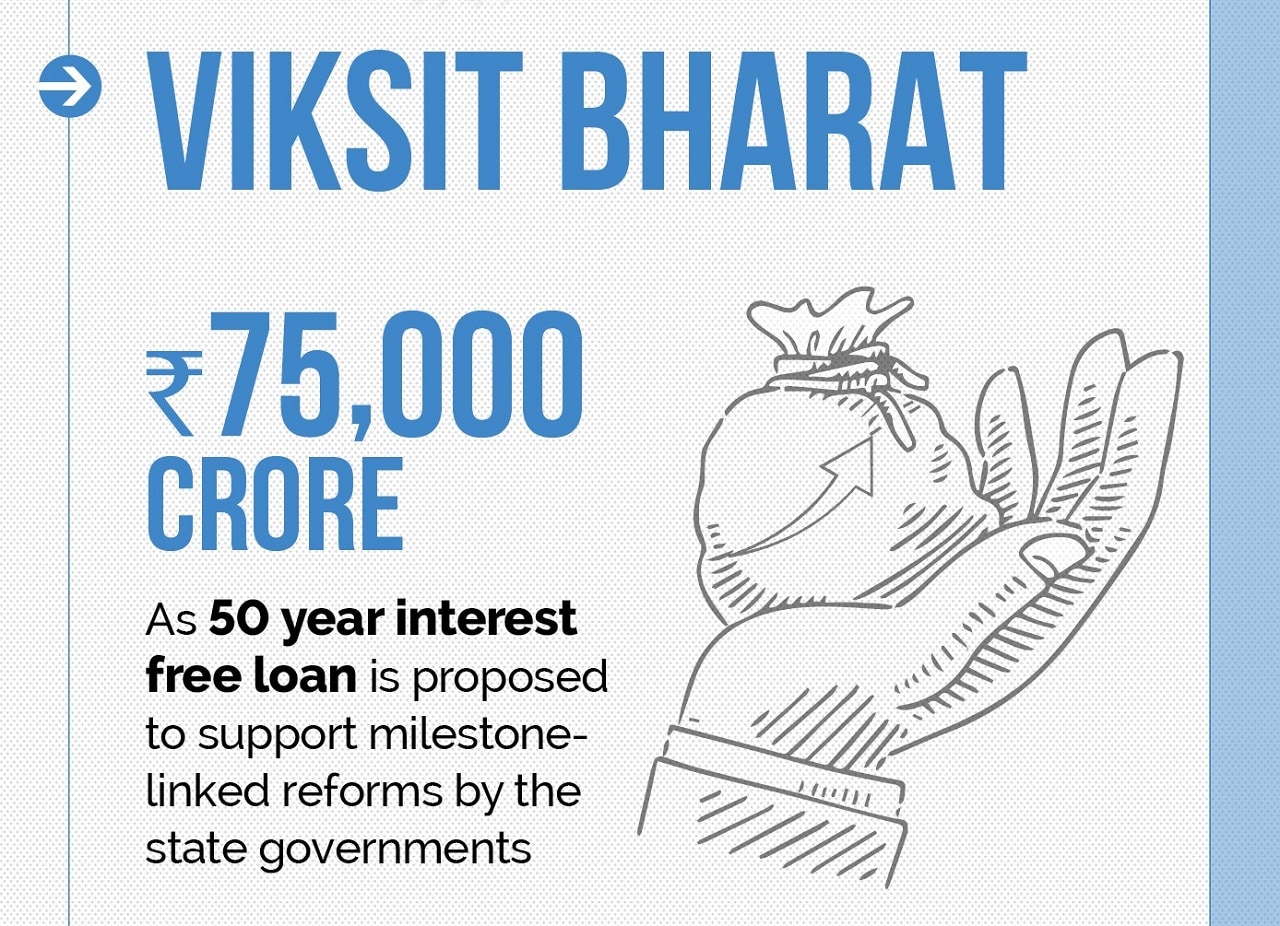

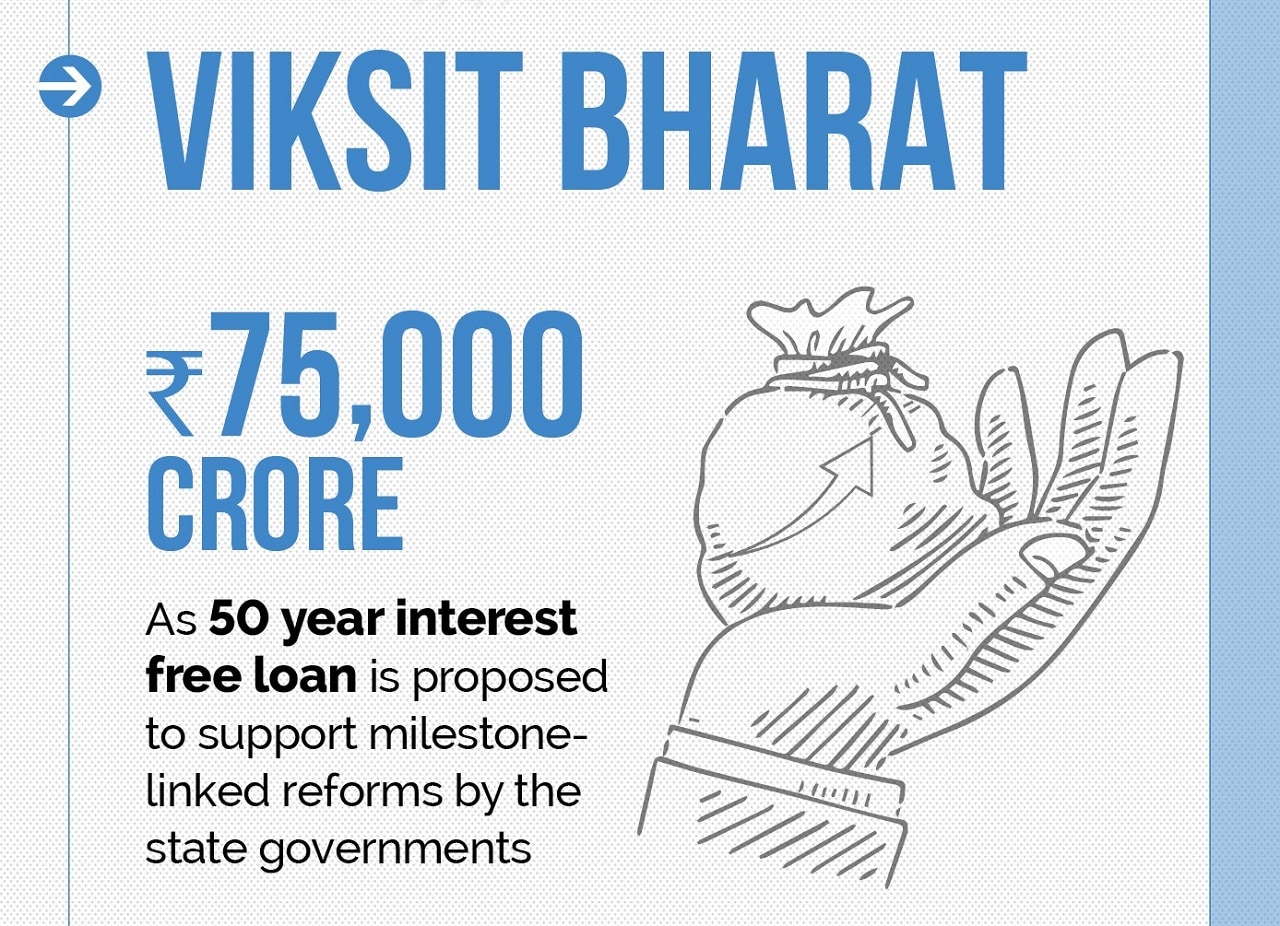

If the growth remains above 7%, this would be the second consecutive year after COVID-19 that the economy would have grown over 7%. As of now, the IMF estimates a 6.8% for FY25, lower than the Reserve Bank of India’s expectation of a 7% growth. “If FY25 growth projection of RBI turns out to be correct or even an underestimate it would be the fourth consecutive year of 7% or higher growth rate.”

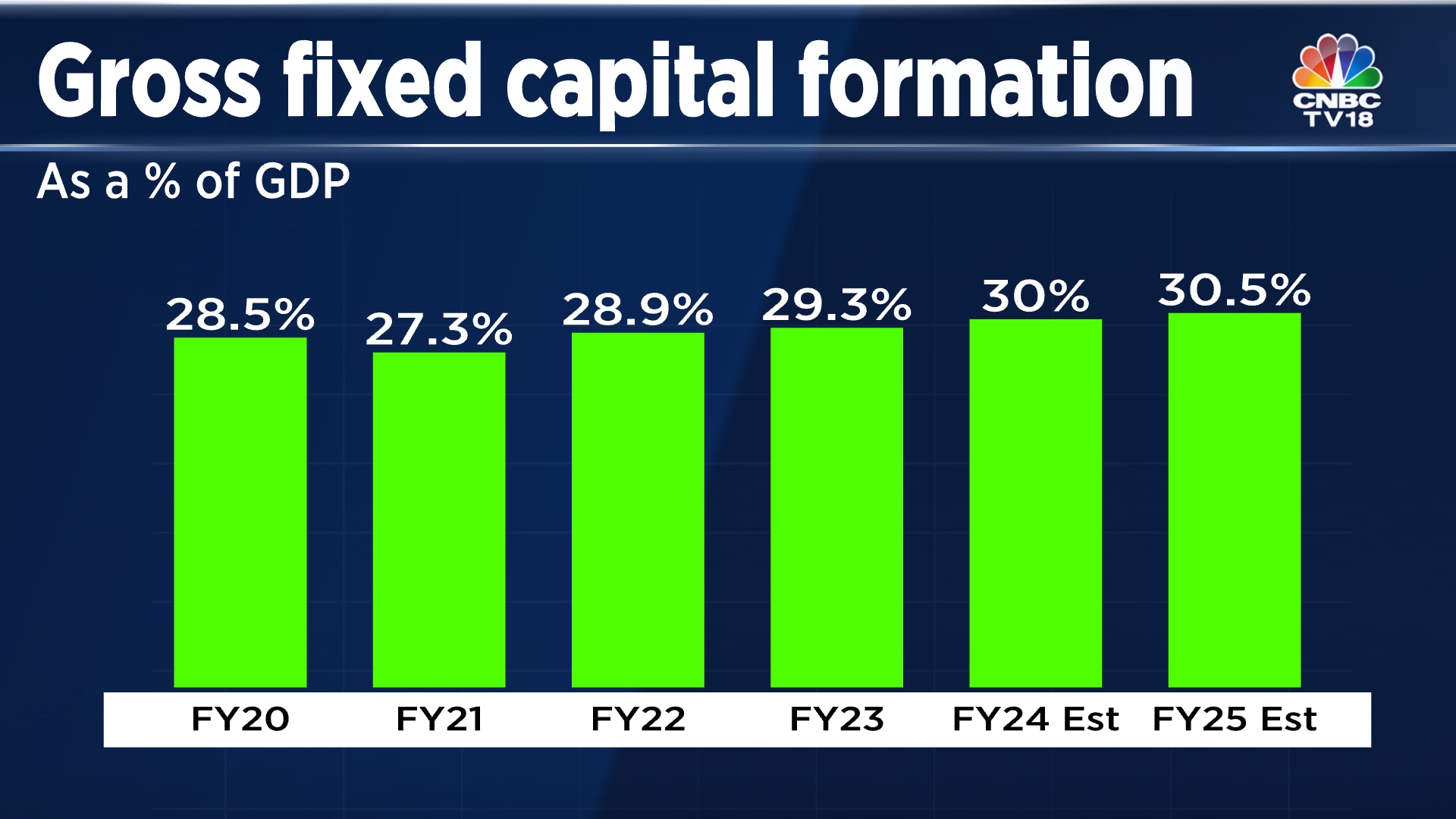

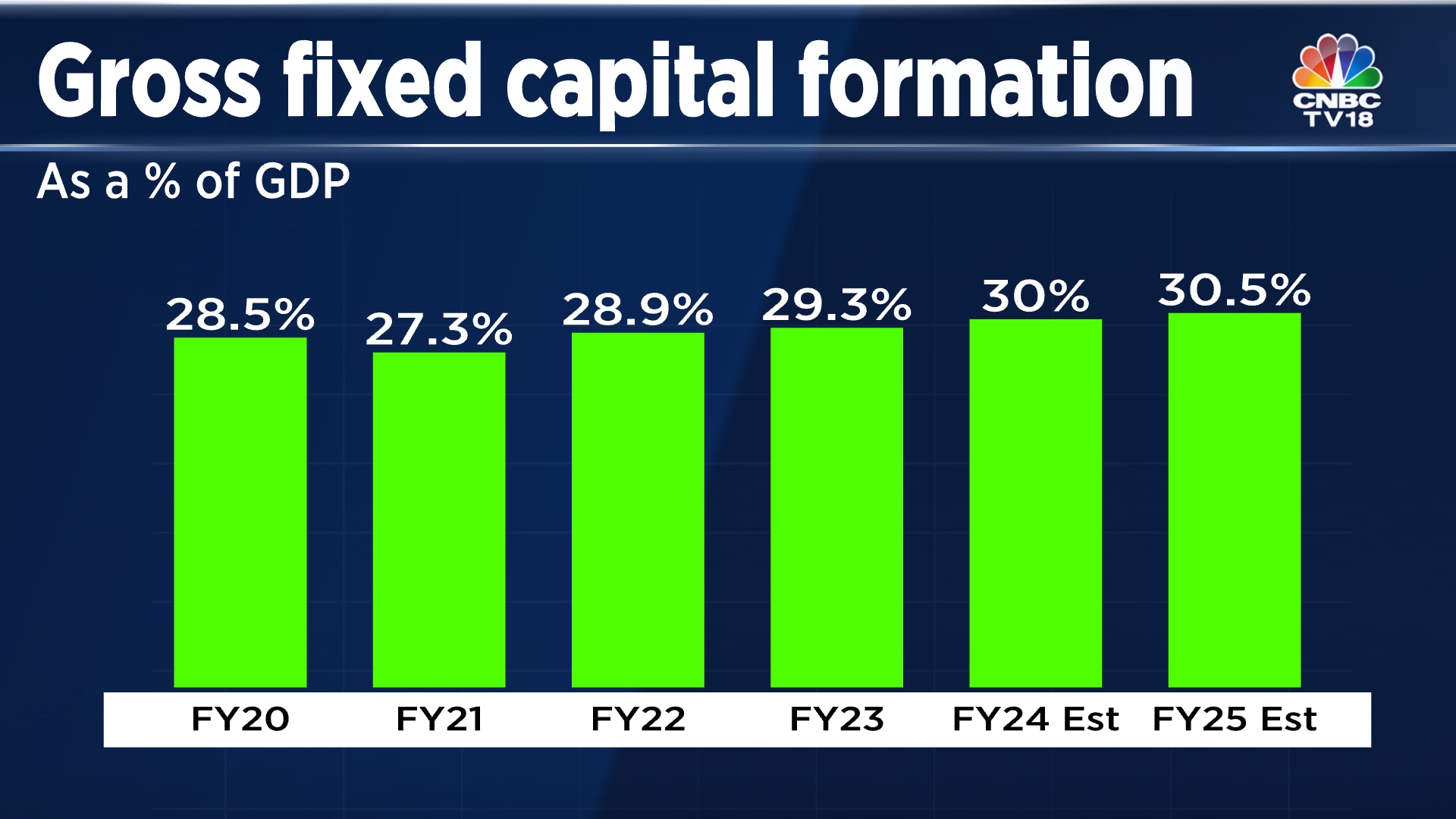

India’s gross fixed capital formation (GFCF) declined for two years. However, the CEA highlighted that there has been a significant pickup in FY22 and FY23, and the trend continues in FY24. GFCF represents the total value of physical assets (such as machinery, equipment, buildings, and infrastructure) produced for use in the production process over a specific period within an economy. It measures the net increase in the stock of fixed assets in an economy.

Also Read: IBA chief weighs in on RBI’s new stricter rules for project financing

Nageswaran said, “An ideal growth rate for the economy will be between 9.5% and 10% like China’s for over three decades after 1979 but the geopolitical context has shifted and, therefore, we need to be able to grow on the basis of domestic economy strengths, and whatever impediments are still there, we should look to remove them.”

According to the CEA, the tax GDP ratio has been improving steadily, which is commensurate with the per capita income, in line with nominal GDP growth. He stressed that there is a need to allow the organic evolution of these trends. “At the moment inflation is well within RBI reference range; with normal monsoon inflation to head to target range.”

Compliance burdens, rules and regulations at the state level need to be worked on for manufacturing to grow. “The economy is better placed than before to pursue non-inflationary growth,” he said.

The CEA highlighted that the private sector has come off its balance sheet. There has been a shrinking in the net savings surplus for the private corporate sector, which implies that they are investing. On the other hand, households seem to be saving less but savings are channelised into physical assets. The external sector balance, CEA said, remains quite comfortable.

Also Read: India’s April fuel consumption climbs up 6.1% year-on-year

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

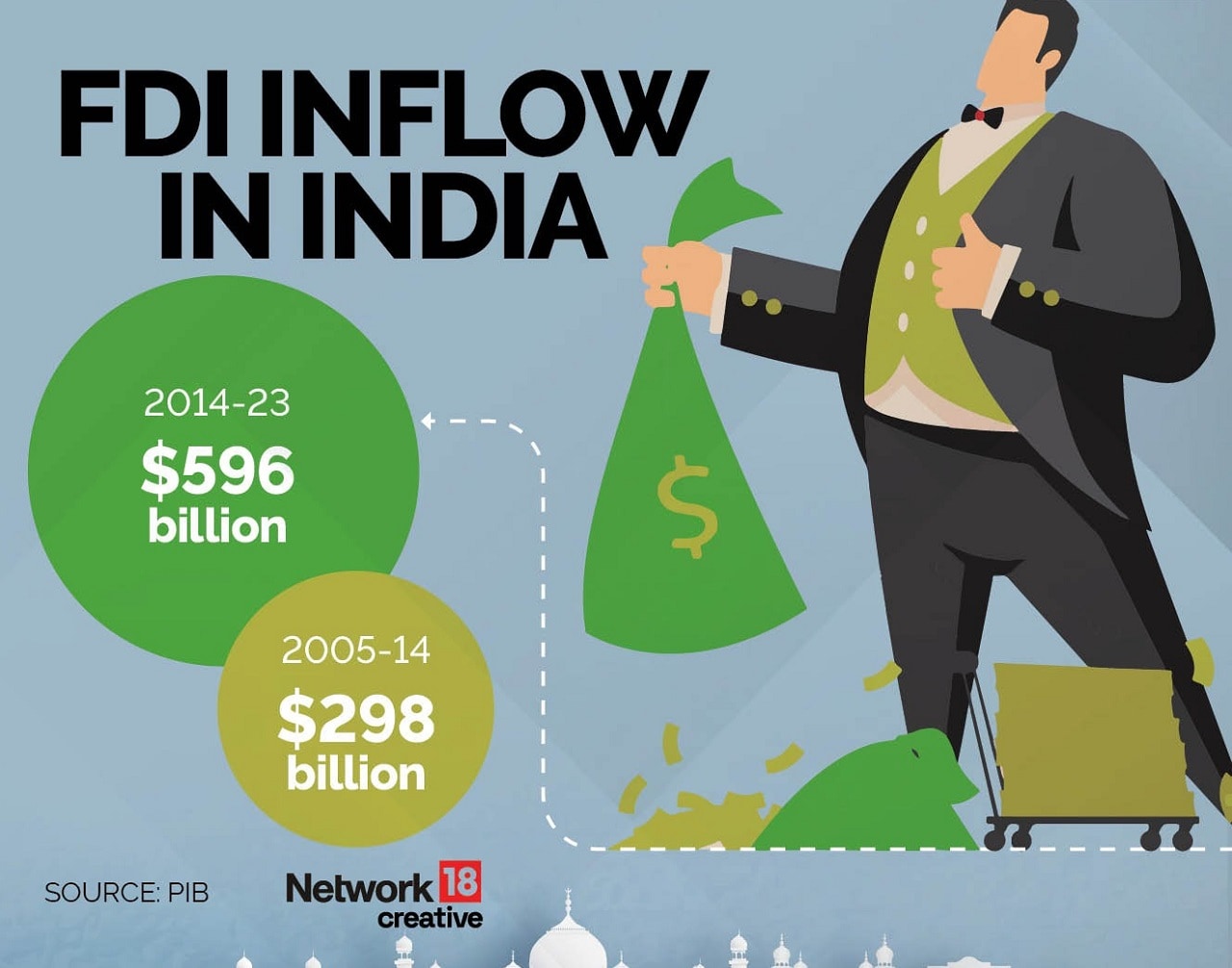

At the heart of India’s robust economic stability lie several growth drivers, each running on full steam to power the nation’s upward trajectory. These growth pillars, in my opinion, include infrastructure, digital ecosystem, rising middle-income and progressive reforms, writes IPM India’s Managing Director Navaneel Kar in his exclusive column.

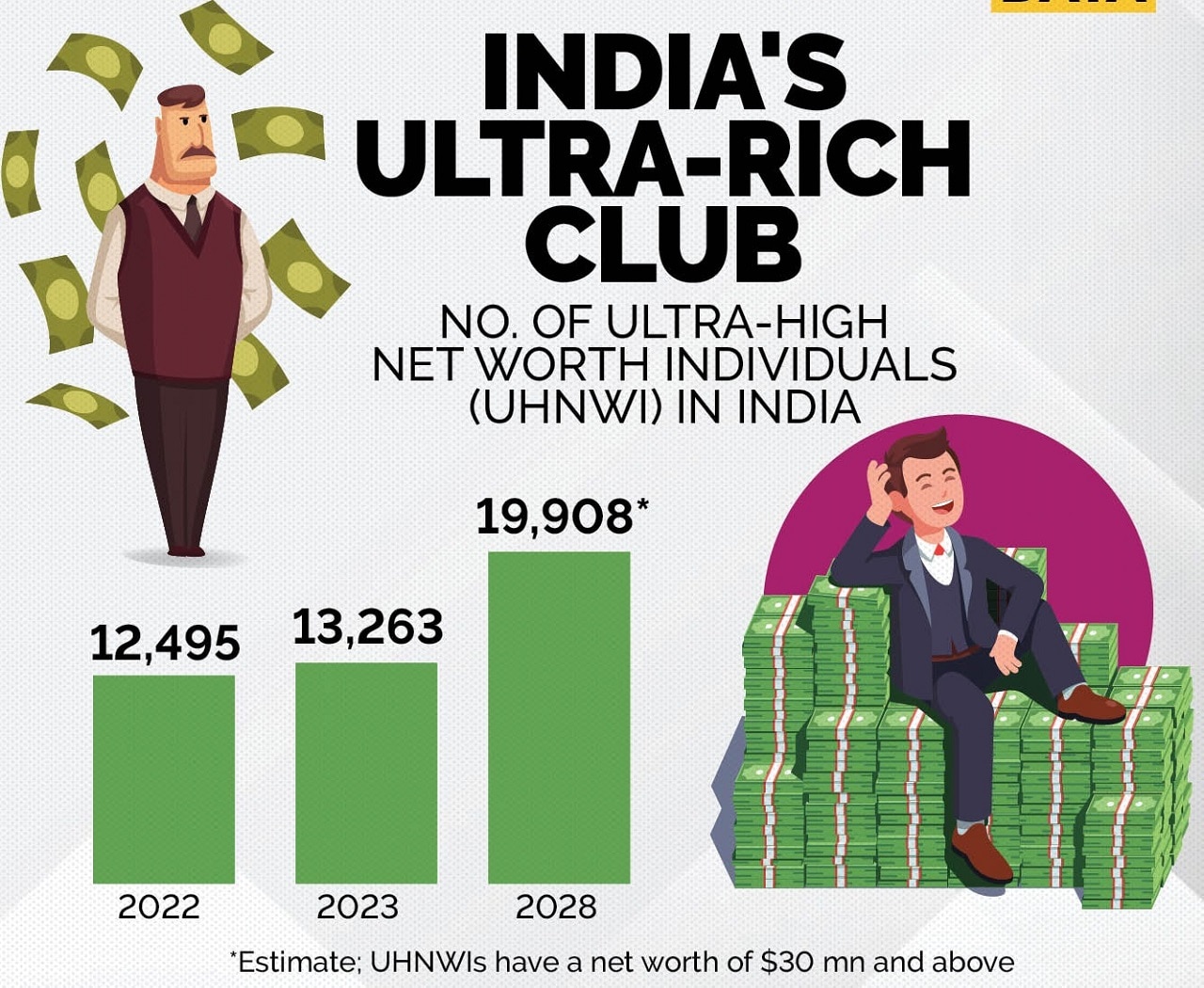

A decade back, India was the 10th largest economy in the world. However, today, with a $4.11 trillion GDP, we are aiming to be the 3rd largest by 2030. As someone who has actively witnessed the country’s economy flourish, especially over the last decade, I am inspired by the dynamism of the Indian economy.

Today, as we stand at the precipice of a new era, it is evident that India’s resilient economy is poised to propel the nation even further towards prosperity. At the heart of India’s robust economic stability lie several growth drivers, each running on full steam to power the nation’s upward trajectory. So, what are these growth pillars? In my opinion, the critical areas are infrastructure, digital ecosystem, rising middle-income & progressive reforms. Let’s delve a bit on how these pillars are enabling India leapfrog from ‘Good’ to ‘Great’.

Infrastructure Drive

India has taken significant strides in modernising infrastructure with major push in building roads, highways, railways, waterways, and air connectivity. Laying a solid foundation for sustained growth, the government launched the ambitious GatiShakti followed by National Logistics Policy enhancing the infrastructure and building efficiencies for logistics.

The pace of road building in India improved to 27 km daily on average, from 24 km per day over the last two years. Recently, the minister of civil aviation stated that the plan is to increase the number of airports from 148 to 200 in next four years.

Global economies must sit up and acknowledge the potential of this growing economy — the strides are apparent as India ranked 38 out of 139 countries, improving its ranking by six places in World Bank’s Logistics Performance.

Digital highway to prosperity

India has shifted gears by preparing for the new frontier of digital ecosystem. The country has built a world-class digital infrastructure by embracing technology thereby witnessing rapid transformation. The central nervous system was the ‘Digital India Initiative’ which played a pivotal role in breaking barriers and bringing all citizens into the digital mainstream.

One of the key achievements has been UPI which has revolutionised the way India transacts. Another significant development is the Aadhar-based identification and verification system bringing authenticity and ease for individuals to access government services. It has also enabled the government to touch the lives of millions of individuals from the lower economic group through direct transfers to beneficiaries.

This digital infrastructure is what helped the country provide large scale vaccination drive even during the pandemic through its CoWin platform. However, the highlight is that this platform was deployed in other countries such as Indonesia, Philippines, Sri Lanka etc. While several measures have been undertaken to overcome certain challenges such as digital literacy, improvements for a robust cyber security ecosystem and infrastructure development will unleash the full potential of the nation.

Rising consumption powerhouse

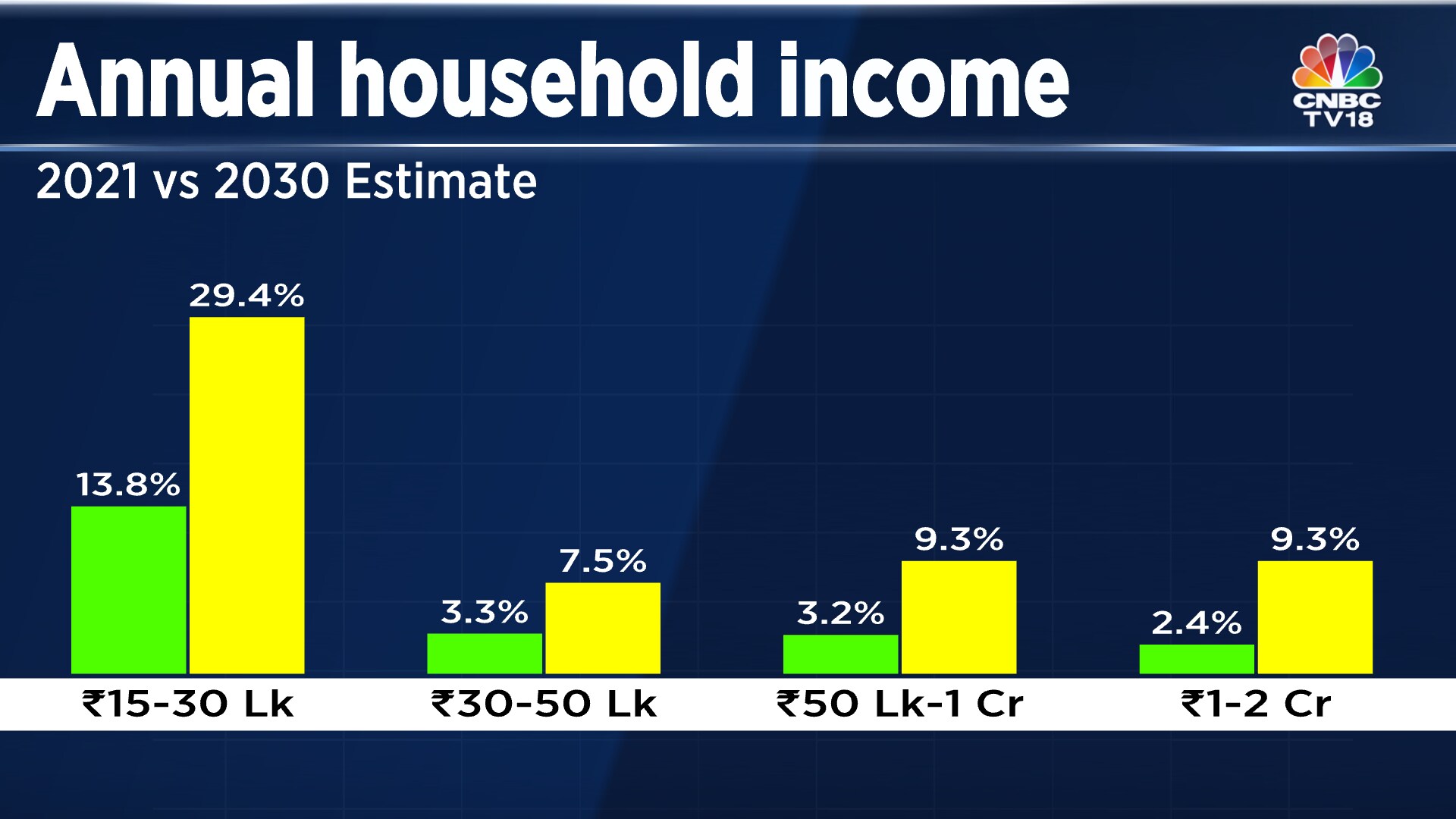

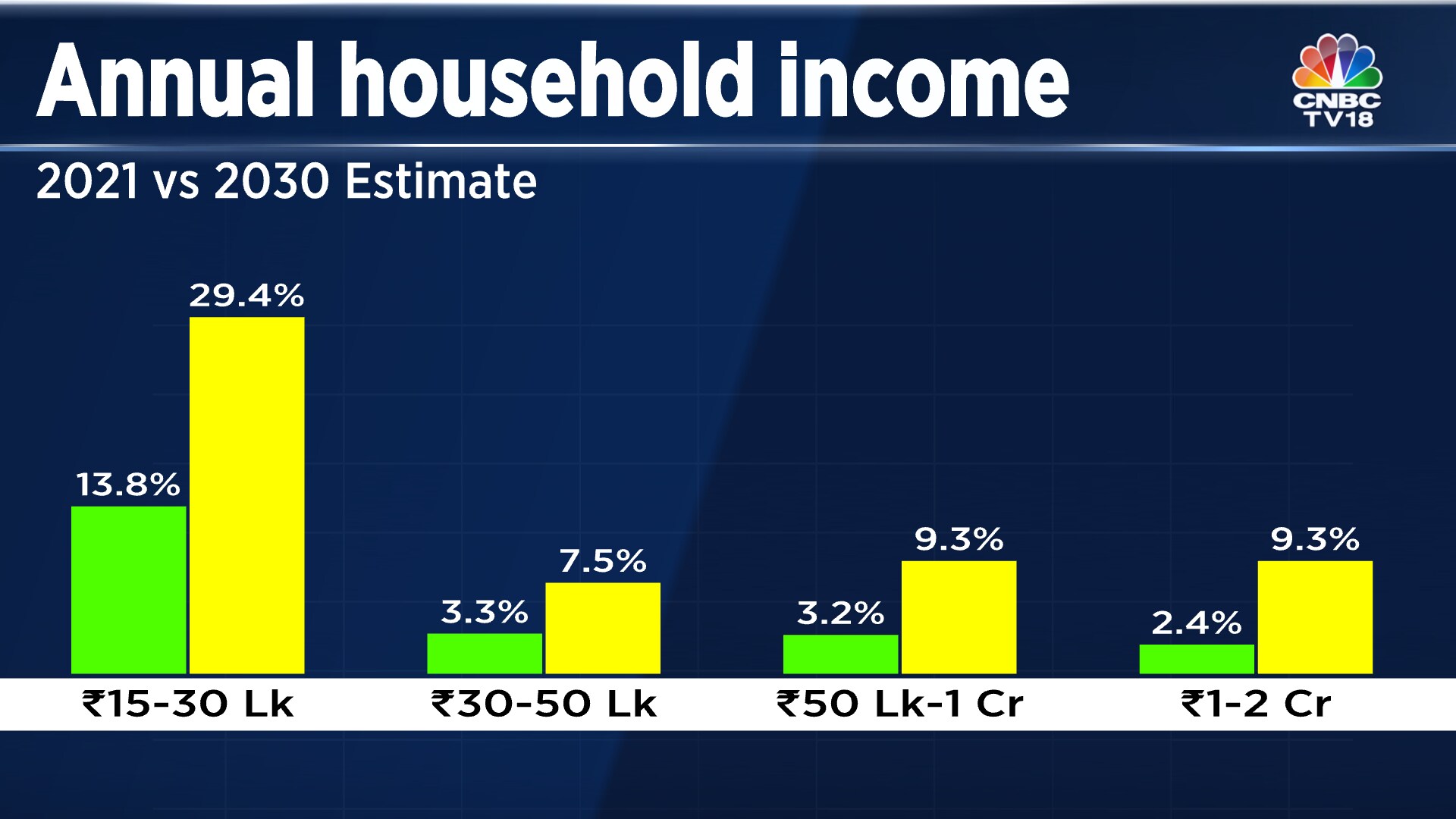

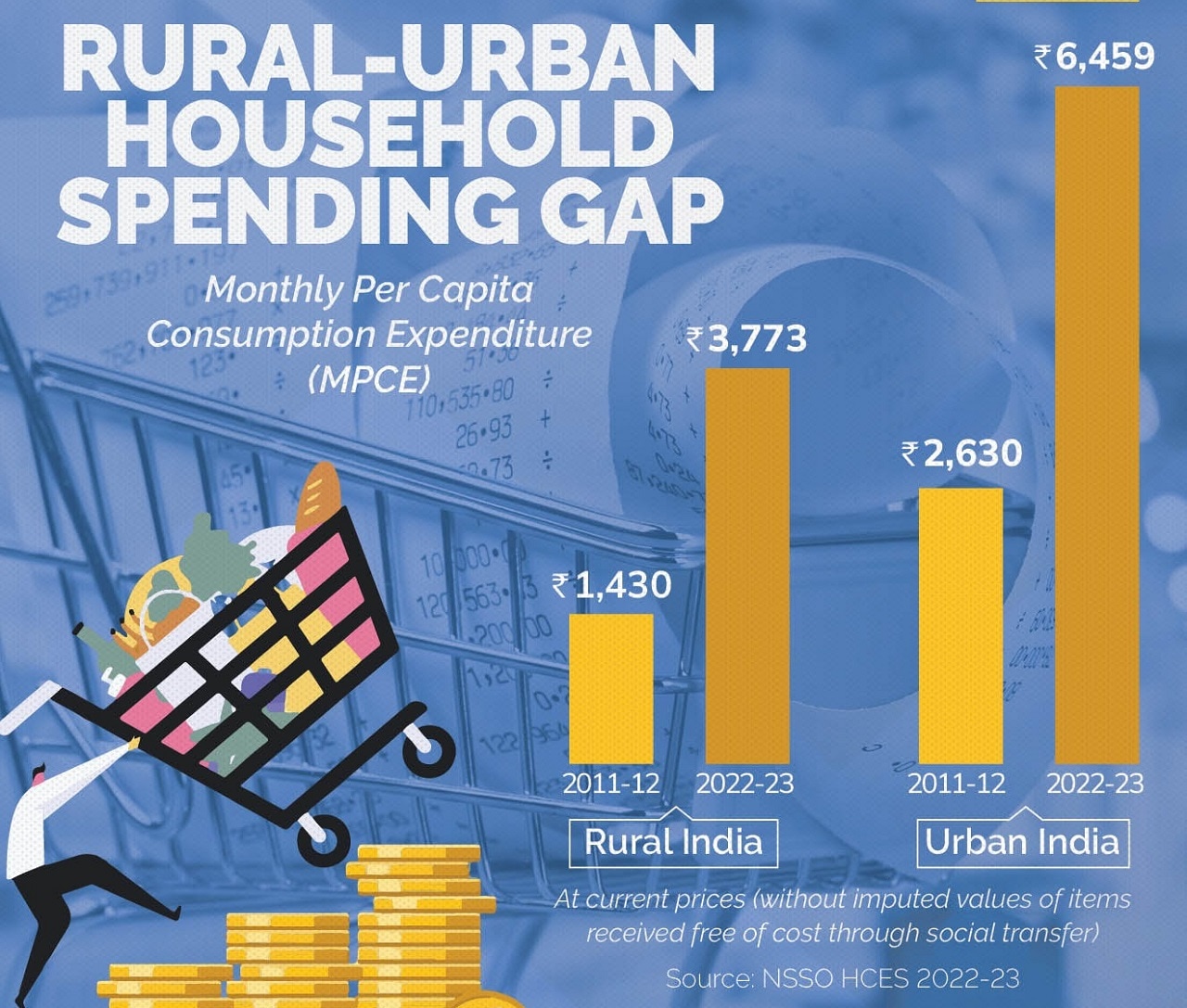

Interestingly, while the world is struggling with inflation led woes, India has found a market within, rising middle income group, and increasing purchasing power are fueling economic growth. According to the findings of the People Research on India’s Consumer Economy (PRICE), the size of India’s middle class will nearly double to 61% to its total population by 2047 from 31% in 2020-21.

The burgeoning middle class in India represents a vast consumer base with evolving aspirations and demands. This not only stimulates domestic investment but also attracts foreign investments, driving economic expansion and fostering innovation. India is poised to become a major player on the global stage in the coming years, and the rising middle income and increasing purchasing power parity are sure to play a key role in this transformation.

Reforms shaping economic resurgence

The government has certainly made the country a lucrative investment destination thanks to the progressive reforms undertaken. The particular one that stands out is the Ease of Doing Business, the sheer meteoric rise of 79 ranks from 142 to ranking 63 in 2020 in World Bank’s Doing Business Report speaks volumes of the mammoth undertaking.

The government in 2023 announced the scrapping of 39,000 compliances and 1,500 archaic laws, and in 2017, introduced GST as to ensure standard indirect tax rates and structures which further helped make India a viable growth market for global companies.

These initiatives showcase a commitment towards fostering business-friendly environment and making India a lucrative investment destination. Additionally, initiatives like the Make-in-India campaign, aimed at promoting manufacturing and entrepreneurship, and the Startup India program, which offers incentives and support to budding entrepreneurs, underscore India’s shift towards harbouring innovation and entrepreneurship.

India’s economy has shown remarkable strength in the face of global challenges. By focusing on infrastructure, digital infrastructure, and increased purchasing power, we can unlock the full potential of the economy and create a brighter future for all Indians and a beacon of global development.

—The author, Navaneel Kar, is Managing Director, Philip Morris International Inc’s India affiliate, IPM India Wholesale Trading Pvt. Ltd (IPM India). The views expressed are personal.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously