Britannia Q4 Results: Profit dips 3% to ₹537 crore, annual revenue up 3%

Summary

Britannia reported mixed Q4FY24 results with slightly lower profits but increased revenue. The company declared a substantial final dividend and saw growth in key channels, despite facing economic headwinds and inflationary pressures.

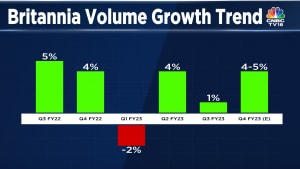

Britannia, a leading player in the fast-moving consumer goods (FMCG) sector, reported its quarterly financial performance for the period ending March 2024 (Q4FY24) on Friday, May 3. The conglomerate witnessed a 3.2% decline in consolidated net profit, amounting to ₹536.61 crore as compared to ₹557.60 crore in the same period last year. Despite this downturn, the company experienced a 3% in revenue from operations, reaching ₹4,069.36 crore, up from ₹4,023.18 crore reported in the corresponding period of the previous fiscal year.

In a regulatory filing to the stock exchanges, Britannia disclosed its recommendation for a final dividend of 7,350%, translating to ₹73.5 per equity share for the fiscal year 2023-24. This decision is scheduled to be formalised at the company’s upcoming 105th annual general meeting (AGM) slated for August 12, 2024.

Commenting on the financial results, Britannia’s Vice Chairman and Managing Director Varun Berry expressed satisfaction with the company’s resilience in a challenging economic climate. Berry highlighted the strategic pricing measures undertaken to maintain competitiveness and emphasised the expansion of distribution channels, particularly in rural areas.

“In a tepid consumption scenario, our performance this year signifies resilience and competitiveness. Over the past 24 months, we have achieved a strong 19% growth in revenue, accompanied by a notable 43% increase in operating profit. Our market share rebounded as the year progressed as a result of strategic pricing actions to maintain competitiveness and intensified investments in brands, supported by distribution expansion,” Berry said.

Also read: MRPL Q4 net profit slumps 40%, company declares dividend of ₹2

Despite facing headwinds in certain markets, Britannia reported robust growth in key regions, surpassing expectations. The company made significant strides in modern trade and e-commerce channels, both witnessing double-digit growth compared to the previous fiscal year.

However, on the operational front, Britannia experienced a slight decline in earnings before interest, taxes, depreciation, and amortisation (EBITDA) during the March quarter, dropping 1.7% to ₹785.5 crore compared to ₹800.9 crore in the corresponding period last year. Margins also experienced a marginal decrease, falling by 50 basis points to 19.4%.

Looking ahead, Britannia remains cautiously optimistic, keeping a close eye on commodity prices and global geopolitical developments. The company intends to maintain its focus on cost-efficiency initiatives while continuing to invest in brand building and market share expansion.

Also read: Q4 results: NSE to give ₹90 dividend per share and 4 bonus shares for every 1 share held

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter