Experts discuss latest developments in telecom and what lies ahead

Summary

In a discussion with CNBC-TV18, Sanjay Kapoor, former CEO of Airtel, and telecom expert Prashant Single, and Purushothaman KG, Partner and Head of Digital Solutions and Telecommunications Industry Leader at KPMG India shared their outlook for the industry.

The recent developments at Vodafone Idea, marked by a successful ₹18,000 crore follow-on public offer (FPO) and the Aditya Birla Group’s strategic ₹2,075 crore equity infusion, have ignited a wave of optimism in the telecom sector.

In a discussion with CNBC-TV18, Sanjay Kapoor, former CEO of Airtel, and telecom expert Prashant Single, and Purushothaman KG, Partner and Head of Digital Solutions and Telecommunications Industry Leader at KPMG India shared their views about the future of Vodafone Idea, tariffs, and the overall competitive landscape of the industry.

Kapoor calls the current situation in the space ‘enigmatic’.

“So as far as the market is concerned and the consumer is concerned, it is the right thing to have happened because three private players in a market like us gives a lot of choice to the consumers. And therefore, brings that balance on customer service and experience over a longer period,” he said.

However, he noted that despite the fresh funds, the overhang of ‘too little too late’ will still be affect Vodafone Idea till it delivers and is back into the game.

Also Read | Vodafone Idea FPO opens today: CEO explains how the funds will be used

Vodafone India plans to use 70% of the funds raised to strengthen its network infrastructure and broaden its market reach.

Prashant Singhal, a telecom expert believes there is more than enough space in the telecom market for a third player to play catch up.

“The response on the Vodafone Idea FPO clearly shows that there is a lot of interest and there is a lot of confidence in the company,” Singhal said.

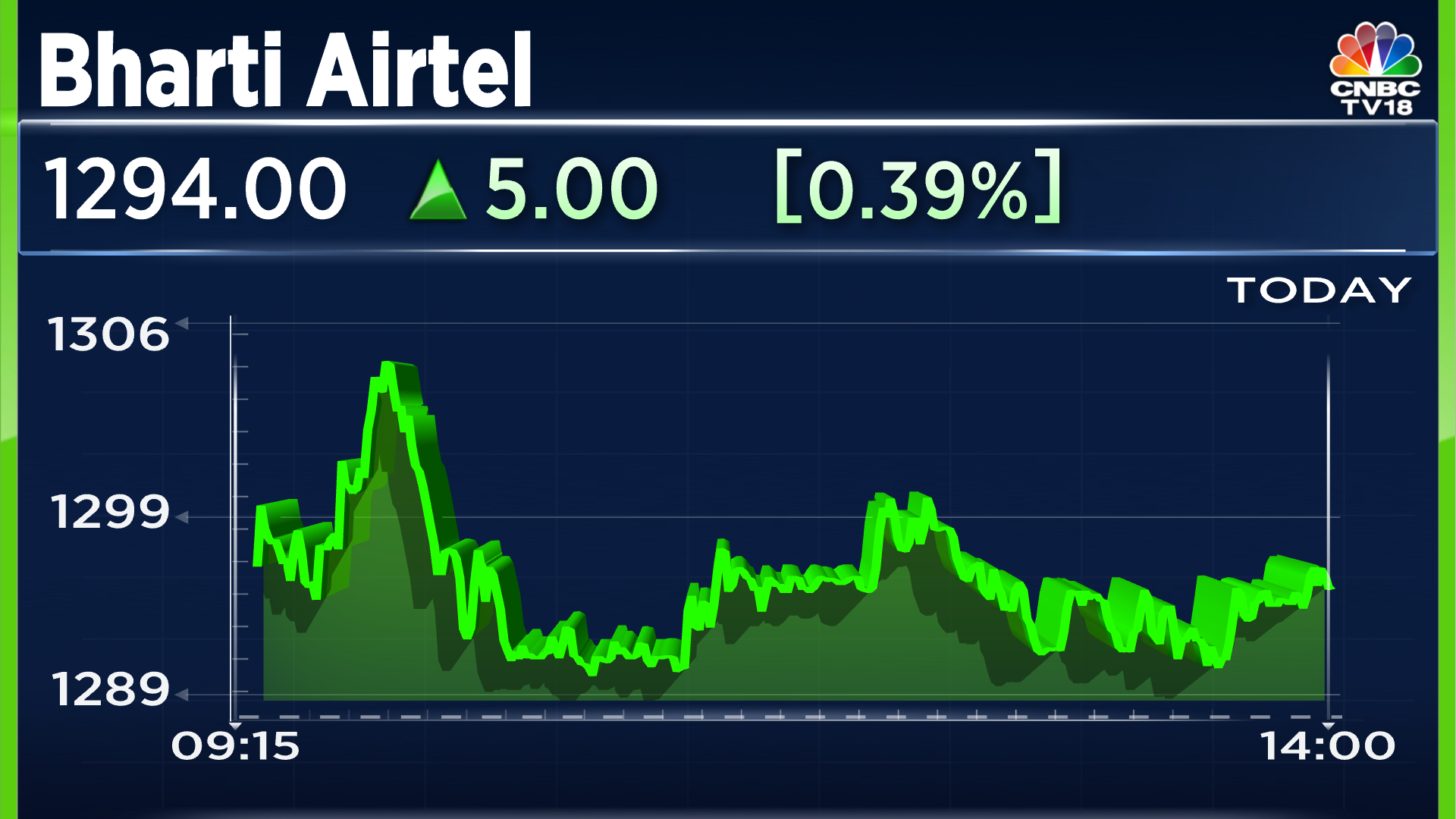

Also Read | Bharti Airtel says not in any discussion with Vodafone Group for Indus Towers stake

Kapoor thinks the Indian telecom market needs higher pricing.

“We are on the lowest end of the spectrum on pricing when you compare it across the globe,” he said.

According to Purushothaman, the sector is doing well because it is the foundation of the digital economy.

“From a sector perspective, you might have seen quarter-on-quarter (QoQ) growth, improvement in the sector not only from a tariff perspective but also steady subscription growth. The tariffs have improved and that has helped to improve the average revenue per user (ARPU) for most of the operators,” he said.

For more, watch the accompanying video

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter