Family vs professional owned businesses: Boon or bane?

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Family businesses can be more resilient but they are not fool proof.

Infosys co-founder Narayana Murthy once believed mixing family with business is not the right approach. It’s a belief he held so strongly that he actively discouraged his wife, Sudha Murty, from joining Infosys in any professional capacity.

While Murthy has changed his stance — he calls it “wrongly idealistic” now — in the years since the founding of Infosys, his son Rohan Murty is not going get a play at the software giant built by his father.

Murthy, in his younger days, was an outlier in a country where, even today, more than eight out of ten companies in India (in line with the global average) are owned and managed by the founder’s family.

Some of the world’s biggest companies controlled by the founders or their family members include Google, Tesla, Softbank, Samsung, and Louis Vuitton, to name a few.

Our readers in India would be familiar with the conglomerates run by the Ambanis, Adanis, Birlas, Mittals, Bajajs and many more.

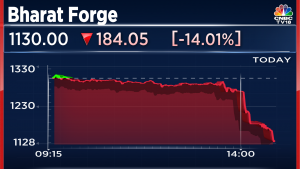

Bharat Forge’s Baba Kalyani is part of the overwhelming majority of Indian businessmen who believe in owning a family business. “When you have a family who is involved in business, the amount of passion they bring to it, the ability to work as many hours as is required to make it happen is all there, which necessarily may not be there when you have somebody from the outside,” he argues in an exclusive interview to CNBC-TV18’s Managing Editor Shereen Bhan.

His son Amit Kalyani serves as Deputy Managing Director at Bharat Forge, a company he joined in 1999.

What does data tell us about the efficiency of family businesses?

“In India, substantial wealth creation has historically been attributed to large promoter families,” said a recent newsletter by investment firm Marcellus, which referenced a Credit Suisse study, focused on the phenomenon of “owner-operator” businesses, said,

The Credit Suisse report in question was based on an exclusive “Family 1000” dataset, encompassing 1,000 major family-owned businesses spanning the Americas, Europe, and Asia Pacific. A big chunk of the sample was from Asia Pacific.

It found that, since 2006, the global “Family 1000” universe has consistently returned 300 basis points more than the average (adjusted for sectoral deviations). The trend that holds true across all regions, according to Credit Suisse.

What works for family-owned businesses?

Credit Suisse found that family businesses have lesser risk appetite and are more focussed on generating profits than other businesses that are run by professionals. “Family-owned businesses can be shown to spend less than their non-family-owned counterparts on research and development (R&D),” the global investment bank noted in its March 2023 report.

The report found that these companies enjoy stronger human and social capital, and a potentially more efficient operating model. “We believe these factors help to enhance the ability of family-owned firms to transform an innovative idea into a profitable proposition more effectively than non-family-owned companies,” the Credit Suisse study highlighted.

So, businesses run by families are good at controlling costs and making more money. Their customers and clients tend to have a higher trust in the business because the family has a serious skin in the game.

Family-owned businesses can afford to have a much longer vision for the company whereas professionals may be hamstrung by the short-term growth aspirations of the shareholders they’re answerable to.

The decisions can be faster at a family-run business due to the lack of layers and bureaucracy. The underlying family values provide a consistency to the culture of the organisations they own.

Take the case of Baba Kalyani. “I am glad that my son is there with me because it is also a lot of support, to have your family in business, especially if they are engaged, they are qualified, they know what they are doing and they have a vision of what they want to achieve,” he said,

Amit Kalyani has been working with Bharat Forge since 1999, starting his career in manufacturing and moving on to IT and finance. He has been the group’s executive director since May 2004.

These, and many other, advantages aside, being an outsider with a stake in family-run businesses comes with a few risks too.

Conflicts of interest, lesser checks and balances, as well as nepotism are among the top reasons often cited by critics.

Checks and balances

In India, regulators have tried to make governance more transparent with many measures. For instance, at least one in three directors on every Board have to be independent. However, this has not always been effective.

In May 2018, the Securities and Exchange Board of India (SEBI) decided to separate of the roles of Chairman and Managing Director at the top 500 listed companies with effect from April 2020.

However, the said provision was later deferred by SEBI for two years, i.e., from April 1, 2022. But the pressure from the industry forced the market regulator to make the decision voluntary.

Lack of diversity

Only 63% Indian family business leaders surveyed by consulting firm PwC said that they have formal governance structures like shareholder agreements, family constitutions and protocols, and even wills. The global average on this count is 65%.

The same survey showed that 31% of the companies worldwide, and at least one in four Indian family-run firms, have no women on the board at all.

This number doesn’t reveal the regional disparity. For instance, another survey (of 357 Indian companies) by SP Jain Institute of Management and Research showed that active female participation was 97.8% in South India compared to 41% in the western part of the country.

Succession

And, one of the biggest concerns has been succession. While the owners of Reliance Industries, the Aditya Birla Group, the Piramal Group and JSW Group have fortified succession in their own companies, the same is not true for a big chunk of India Inc.

“A majority of family businesses were still undecided about the timing when the succession would take place, while a smaller proportion of respondents stated clearly that they did not want to “let go”,” the SPJIMR survey found.

Baba Kalyani believes that it’s the American way to have a CEO who typically serves an eight-year term to avoid the risk of stagnation.

But this is not something Kalyani himself holds with. “Now I am here for 52 years and I haven’t seen things getting stagnated, maybe they would have been better if I had retired after 8 years,” Kalyani said.

Kalyani who recently turned 75, says he’s in no mood to retire.

“The day I think, I don’t enjoy it that day I am gone,” Kalyani told CNBC-TV18.

Adaptability

Many family-run businesses have also been less agile in adapting to social and technological changes. Conflicts within the family have also been a huge risk for other stakeholders.

The challenges multiply in an era of an unprecedented pace of social and technological changes.

It can be particularly daunting for the older promoters who aren’t empathetic to the aspirations and preferences of the new generation of customers as well as the people working for them.

The problem has been so acute in the startup space that the phrase ‘founder’s syndrome’ was born a few years ago. The term is used to describe the inordinate amount of authority that a founder assumes and is often seen taking the ‘my way or the highway’ attitude.

As the CNBC-TV18 columnist Srinath Sridharan points out, the founder’s syndrome can make it tough for companies to embrace new ideas, allow independent opinions to reflect the hard realities, and even to attract the right talent.

These are important points to remember for stakeholders in family businesses. Family businesses can be more resilient but they are not fool proof.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter