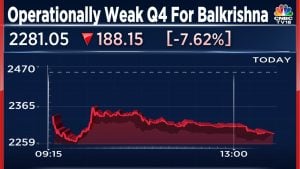

Balkrishna Industries shares drop over 7% despite strong growth in Q3 net profit

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Balkrishna Industries Share Price | In its third quarter earnings results released after market hours on Wednesday, the leading tyre producer reported a single digit growth in revenue from operations. The company’s revenue from operations increased 5% on a year-on-year (YoY) basis to ₹2,274.4 crore for the quarter ended on December 31, 2023, compared to ₹2,165.6 crore in the same period a year ago.

Balkrishna Industries Ltd shares dropped more than 7% on Thursday, January 25, despite the company reporting a robust growth in net profit for the December quarter.

In its third quarter earnings results released after market hours on Wednesday, the leading tyre producer reported a single digit growth in revenue from operations. The company’s revenue from operations increased 5% on a year-on-year (YoY) basis to ₹2,274.4 crore for the quarter ended on December 31, 2023, compared to ₹2,165.6 crore in the same period a year ago.

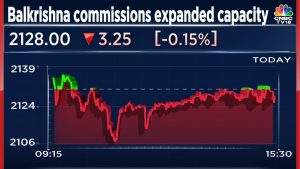

The off-highway tyre major’s sales volume also showed a decent increase in the December-ended quarter, rising 9% from last year to 72,749 MT, recovering in the third quarter of this fiscal. The figure is still down 8% from last year for the nine months ended December 31, 2023 at 2,10,000 MT.

The company’s net profit, witnessed a 181.71% growth in the December to ₹305.4 crore as opposed to a net profit of ₹108.4 crore in the corresponding period of the preceding fiscal, as per the company’s stock exchange filing.

The company’s earnings before interest, taxes, depreciation, and amortisation (EBITDA) grew 101% to ₹540.6 crore in the third quarter of this fiscal compared to ₹269.3 crore in the same period a year ago.

The EBITDA margin too jumped to 23.8% in the reporting quarter, in comparison to 12.4% reported in the same quarter last fiscal.

Further, Balkrishna Industries’ board also declared a third interim dividend of ₹4 per equity share or 200% on shares having a face value of ₹2 each for FY24, with the record date set as February 2, 2024.

Shares of Balkrishna Industries were trading 6.9% lower at ₹2,523.9 per piece on BSE at 12:25 pm.

Also Read: HPCL Q3 Results: Shares fall 7% after profit, revenue miss expectations

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter