Uday Kotak loses more than what he earned in 2023 as the bank’s shares slump

Summary

The net worth of the country’s richer banker declined by $1.3 billion on Thursday — which was more than what he earned last year.

The massive selloff in Kotak Mahindra Bank shares wiped out close to ₹40,000 crore of investor wealth on Thursday (April 25). Noticeably, the founder Uday Kotak, who owns nearly 26% stake in the bank bore the heaviest brunt from the sell-down.

The net worth of the country’s richer banker declined by $1.3 billion on Thursday — which was more than what he earned last year. According to the Bloomberg Billionaires Index, the banker’s fortune increased by $942 million in 2023 to $14.6 billion.

While his fortune swelled by $3.3 billion in 2019, during the next year it surged further by $1.6 billion to $16.4 billion. However, the years 2021 and 2022 were not so good for the banker as he witnessed a decline of $1.4 billion and $1.2 billion, respectively. The data further shows that his average net worth over the last three years stood at $14.4 billion.

Also Read: Uday Kotak forecasts global turbulence and prolonged high rates worldwide

Shares of Kotak Mahindra Bank tumbled 11% on Thursday after the Reserve Bank of India (RBI) banned the private lender from adding new customers through its digital channels and from issuing new credit cards. Thursday’s drop in the bank’s shares was the biggest single-day fall since March 2020. Analysts expect the RBI’s action will have a near-term drag on the lender’s shares.

According to Morgan Stanley, the impact on lender’s earnings will likely be limited over the next few quarters, as the bank is diversified and can accelerate growth in other segments to sustain earnings momentum. “We believe RBI’s move will weigh on the stock price in the near term,” said Morgan Stanley.

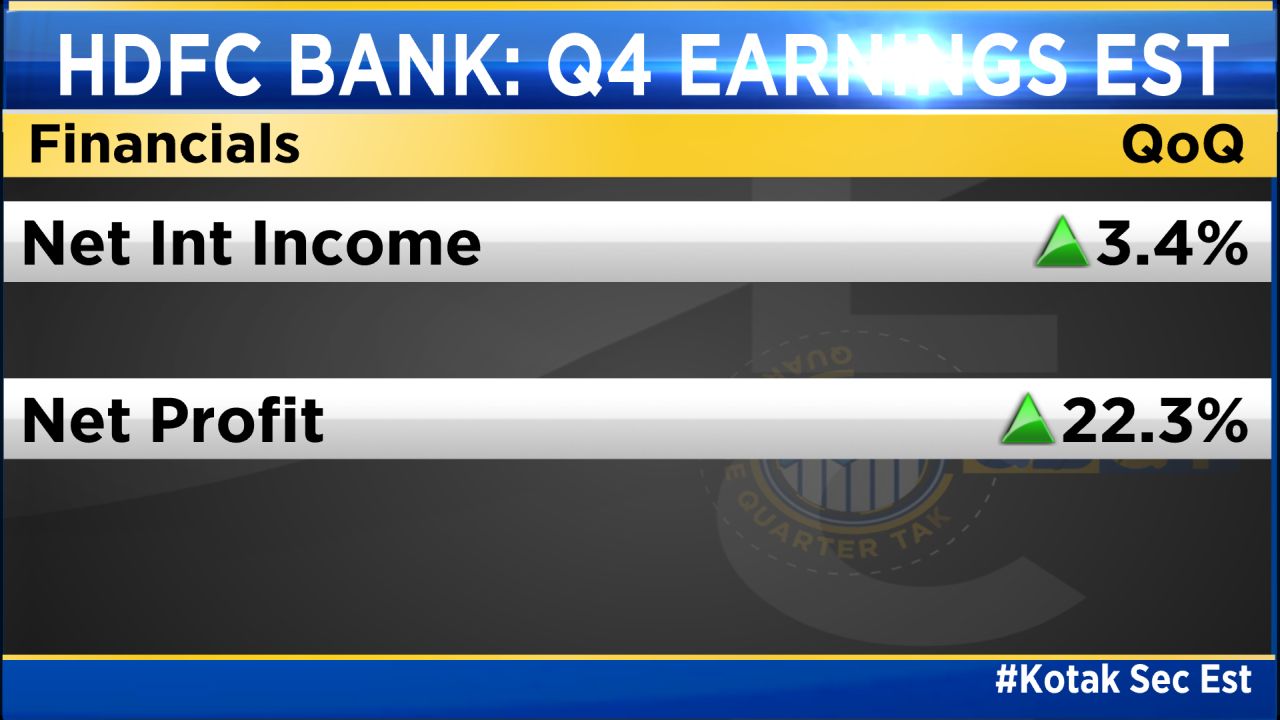

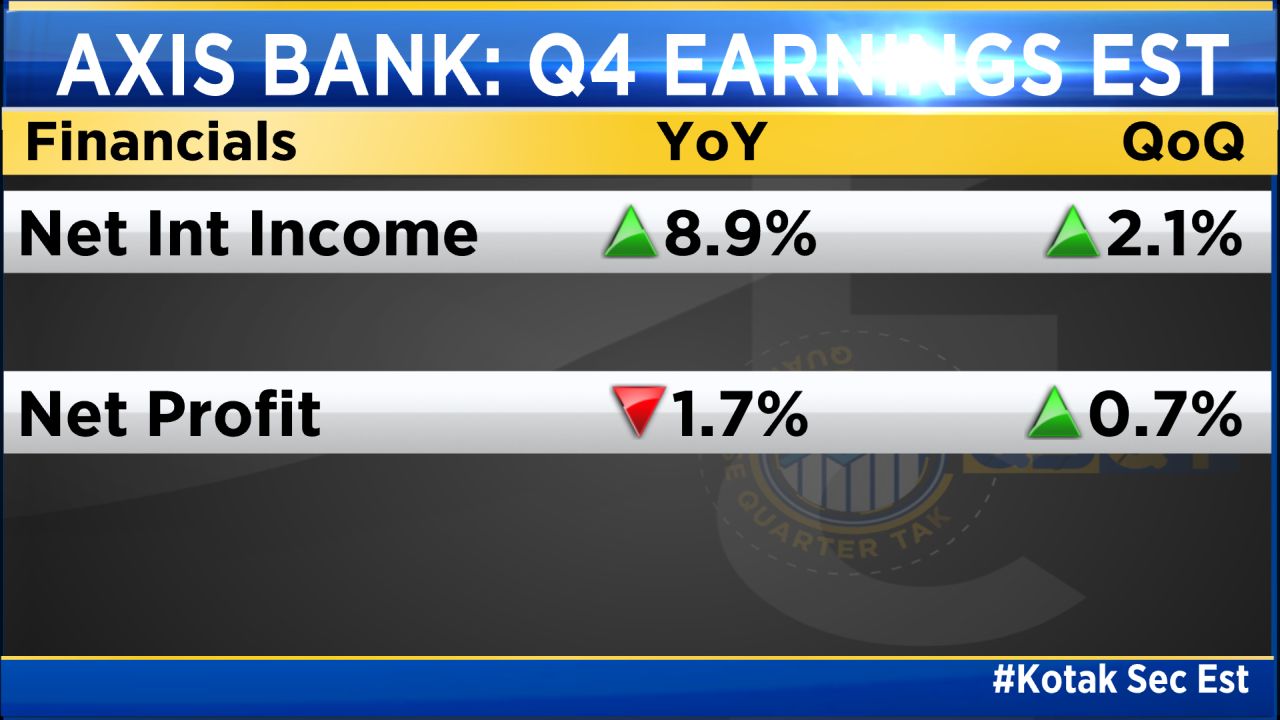

Additionally, the sell-off in Kotak Mahindra bank stock also resulted in its rival Axis Bank beating the former’s market capitalisation. However, it’s not for the first time that Axis Bank toppling Kotak Mahindra Bank in market valuation. Axis Bank had done so in September 2016 as well, when both the lenders had a market capitalisation of about ₹1.5 lakh crore.

Interestingly, Axis Bank was less than half the size of Kotak Mahindra Bank in November 2021. Since then, Axis Bank has added close to ₹1.5 lakh crore to its market valuation. In comparison, Kotak Mahindra witnessed a market cap erosion to the tune of ₹74,000 crore rupee during the same period.

Also Read: ‘Enjoying life as a private citizen’ — Uday Kotak on retirement

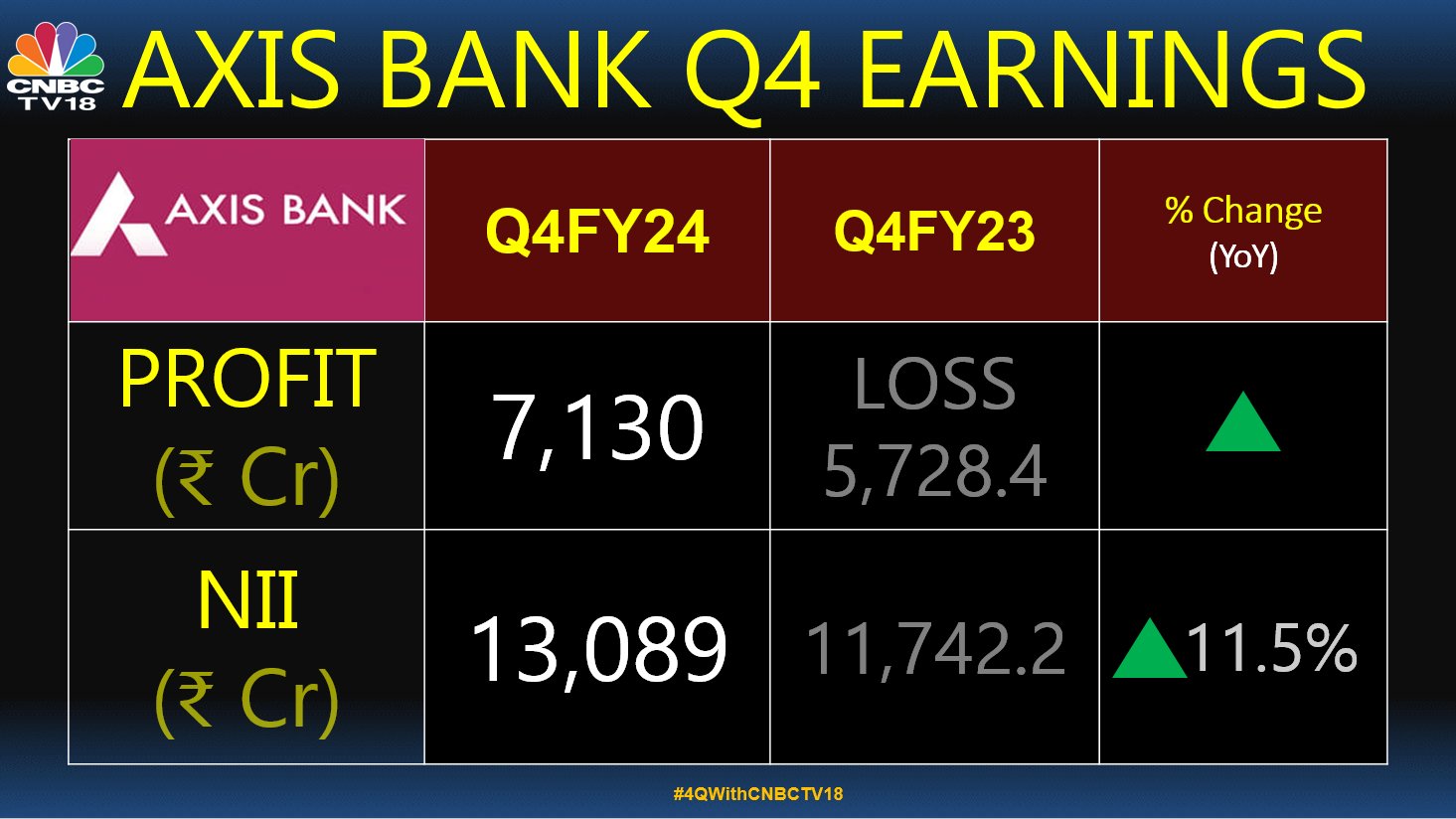

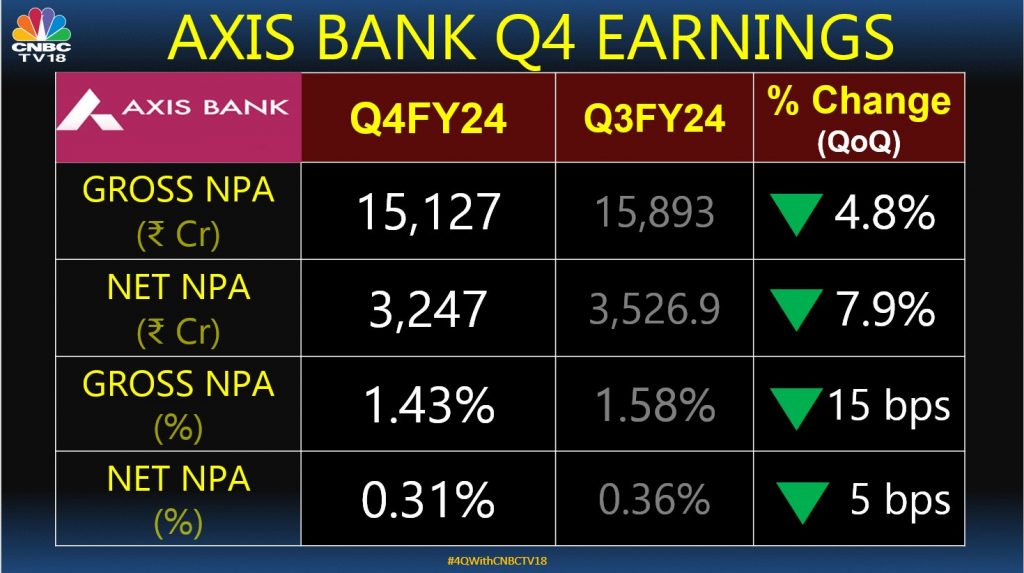

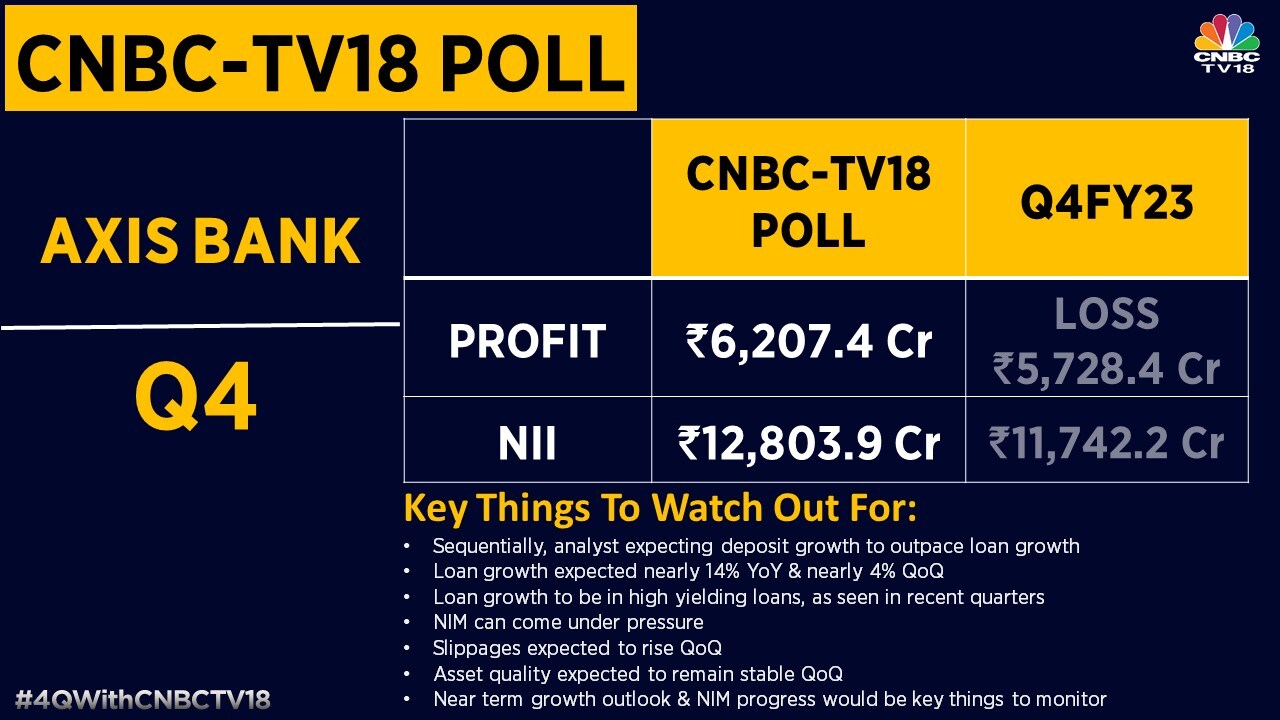

While the stock of Kotak Mahindra plummeted more than 10% in Thursday’s trade, shares of Axis Bank surged 6% after better-than-expected March quarter earnings bolstered investor sentiment. The gauge for bank stocks —the Nifty Bank index closed 1% higher at 48,494.95 points.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter