April Auto Sales LIVE Updates: Bajaj Auto’s sales up 17% YoY, Mahindra sees 13% rise

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Automakers, including Maruti Suzuki, Mahindra and Mahindra, Tata Motors, Bajaj Auto and Hero Motocorp, among others, report their monthly sales data on the first of each month.

April Auto Sales LIVE Updates: Some automobile companies reported their April sales numbers. With waiting periods in the cars or passenger vehicles segment going down, modest growth is expected in the segment. In contrast, two-wheelers are likely to have witnessed good growth on the back of marriage season, according to analysts. The truck segment shall see mid-single-digit growth, analysts indicated.

Here’s how the leading automakers in India performed in April:

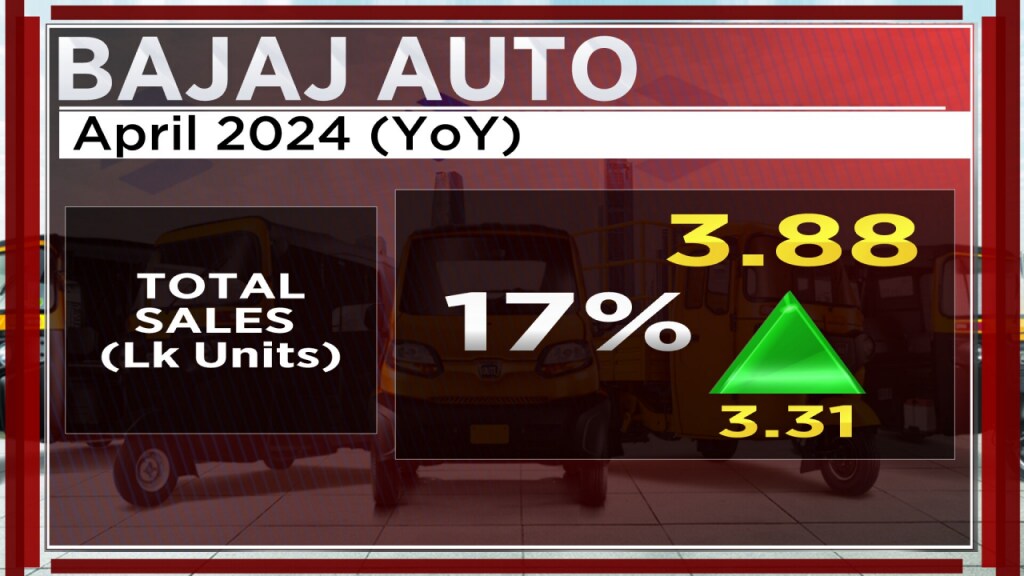

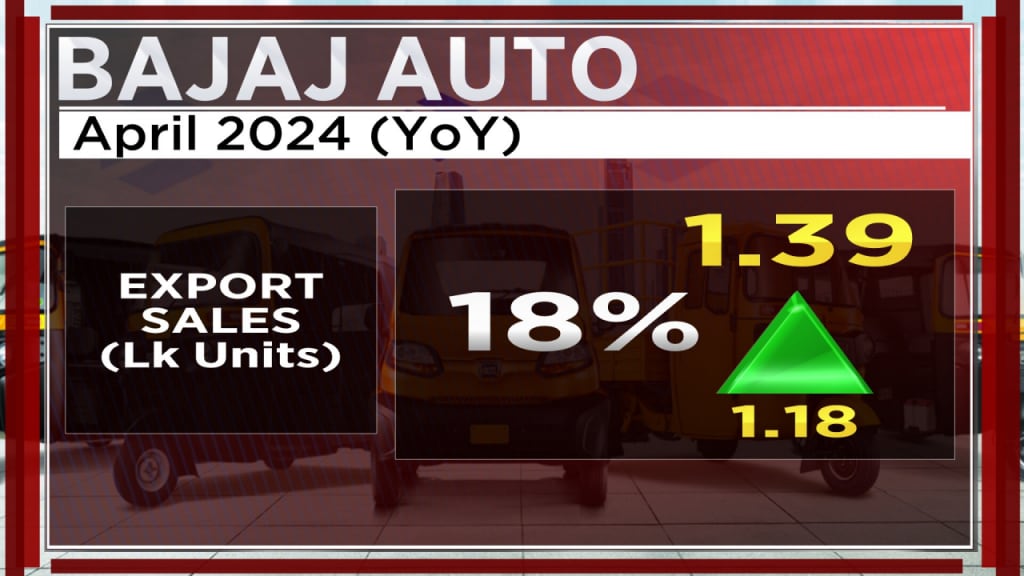

Bajaj Auto

Bajaj Auto reported a rise in sales that surpasses estimates, primarily driven by a robust domestic performance. The total sales have seen a year-on-year (YoY) increase of 17%, reaching 3.88 lakh units.

The domestic sales have matched the total sales growth, with a 17% YoY increase, amounting to 2.49 lakh units. However, the company’s exports, while up by 18% YoY at 1.39 lakh units, have remained a concern as they were lower than the estimates.

Mahindra & Mahindra

Mahindra & Mahindra (M&M) reported a higher than estimated increase in sales. The total auto sales have seen a year-on-year (YoY) rise of 13%, reaching 70,471 units.

The SUV segment continues to lead the auto sales, with an 18% YoY increase, amounting to 41,008 units. This growth in the SUV segment has significantly contributed to the overall rise in auto sales. Meanwhile, the company’s tractor sales have also seen a modest YoY increase of 2%, with 37,039 units sold.

Ashok Leyland

Commercial vehicle manufacturer Ashok Leyland announced a 10% rise in total wholesale figures for April, reaching 14,271 units. This is an increase from the 12,974 units sold in the same month the previous year. The company’s domestic sales also saw a growth of 9%, with 13,446 units sold last month, compared to 12,366 units in April 2023.

In the medium and heavy commercial vehicle segment, the domestic market witnessed a 16% increase in sales. The company sold 8,611 units, a significant rise from the 7,422 units sold in the same month last year. However, the light commercial vehicle segment experienced a slight dip of 2% in sales, with 4,835 units sold, down from 4,944 units in the corresponding month the previous year.

Hero MotoCorp

Hero MotoCorp reported sales of 533,585 motorcycles and scooters in April 2024, a significant increase of 34.7% compared to April 2023, when it sold 396,000 units. This also represents a sequential growth of 9% over March 2024, during which the company sold 490,415 units.

Honda Cars India

Honda Cars India has reported a significant 42% increase in sales for April, selling 10,867 units compared to 7,676 units in the same month last year. The company’s Vice President (Marketing & Sales), Kunal Behl, attributed the lower production volumes in April to the transition of Elevate and City production to six-airbag standard variants.

In the domestic market, the automaker sold 4,351 units last month, a decrease from the 5,313 units sold in April the previous year. However, overseas sales saw a substantial increase, with 6,516 units sold compared to 2,363 units in April last year.

Behl highlighted the significant role of the Elevate model in boosting the company’s export volume, which grew by a remarkable 175% over the same period last year. The dispatches were aligned with the planned production volumes, he added.

Royal Enfield

Royal Enfield, the motorcycle manufacturer, has reported a 12% increase in total sales for April, with 81,870 units sold compared to 73,136 units in the same month the previous year.

The company’s domestic sales saw a 9% rise, with 75,038 units sold last month, up from 68,881 units in the year-ago period.

Meanwhile, Royal Enfield’s exports experienced a significant 61% increase, with 6,832 units exported last month, a substantial rise from the 4,255 units exported in April the previous year.

Maruti Suzuki India

Maruti Suzuki India (MSI) has reported a 4.7% increase in total sales for April, with 1,68,089 units sold compared to 1,60,529 units in the same month the previous year.

Domestic passenger vehicle sales remained steady, with 1,37,952 units sold last month, slightly up from 1,37,320 units in the year-ago period. However, sales of mini segment cars, including the Alto and S-Presso, saw a decline, with 11,519 units sold as against 14,110 units in April the previous year.

Sales of compact cars, such as the Baleno, Celerio, Dzire, Ignis, Swift, Tour S, and WagonR, also experienced a drop, with 56,953 units sold last month compared to 74,935 units in the year-ago month. In contrast, utility vehicles, including the Brezza, Ertiga, S-Cross, and XL6, saw an increase in sales, with 56,553 units sold last month, up from 36,754 units the previous year.

Hyundai Motor India

Hyundai Motor India has reported a 9.5% year-on-year increase in total sales for April, with 63,701 units sold compared to 58,201 units in the same month the previous year.

Domestic sales saw a modest 1% increase, with 50,201 units sold last month, up from 49,701 units in the year-ago period. This marks the fourth consecutive month of domestic sales exceeding 50,000 units, according to Hyundai Motor India’s COO, Tarun Garg.

Meanwhile, exports experienced a significant 59% increase, with 13,500 units exported in April this year, a substantial rise from the 8,500 units exported in April the previous year. Garg highlighted the role of models like the Creta, Venue, and Exter in driving growth, with SUVs contributing to 67% of the automaker’s domestic sales.

Toyota Kirloskar Motor

Toyota Kirloskar Motor has reported a 32% year-on-year increase in total sales for April, with 20,494 units sold compared to 15,510 units in the same month the previous year. The company’s domestic sales accounted for the majority of these sales, with 18,700 units sold last month. Meanwhile, exports totalled 1,794 units.

This growth was achieved despite a week-long maintenance shutdown from April 6, which was necessary for the upkeep of machinery and equipment to sustain operational efficiencies, productivity, and safety, according to the company.

MG Motors India

MG Motors India has reported a slight 1.45% year-on-year decline in retail sales for April, with 4,485 units sold compared to 4,551 units in the same month the previous year.

The company highlighted the significant role of its electric vehicle (EV) portfolio, which contributed to 34% of the total units sold during this period.

Ola Electric

Ola Electric has expanded its market share to over 50% in April, selling 33,934 electric two-wheelers, despite a broader 52% slump in overall EV two-wheeler sales to 64,013 units from the preceding month, according to data from the Vahan website.

This overall decline in sales is attributed to April being a seasonally slow sales period and demand tapering down post-festive season. However, Ola Electric’s sales have also come down by 34.8% month-on-month. Last year in April, Ola Electric sold nearly 22,068 units.

TVS Motor sales up 25% in April at 3,83,615 units

TVS Motor Company on Wednesday said its total sales increased 25% year-on-year to 3,83,615 units in April 2024 as compared with the same month last year. The company had dispatched 3,06,224 units to its dealers in the same month last year, TVS Motor Company said in a statement.

Total two-wheeler sales last month stood at 3,74,592 units as against 2,94,786 units recorded in April 2023. Two-wheeler sales in the domestic market grew by 29 per cent to 3,01,449 units last month from 2,32,956 units in April 2023.

Total exports registered a growth of 12% with sales increasing from 71,663 units in April 2023 to 80,508 units last month. Three-wheeler sales declined to 9,023 units in April 2024 from 11,438 units in the same month last year.

Eicher Motors

Eicher Motors’ total VE Commercial Vehicles sales fall 18.1% to 5,377 units against 6,567 units in the previous year.

Atul Auto

Atul Auto’s total sales in April rose to 1,692 units, up from 715 units in the corresponding month a year ago.

Tata Motors sales rise 11.5% to 77,521 units in April

Tata Motors on Wednesday said its total wholesales rose 11.5% year-on-year to 77,521 units last month as compared with 69,599 units in April 2023. The company’s total domestic dispatches rose 12% to 76,399 units last month as against 68,514 units in April 2023, the auto major said in a statement. Total passenger vehicle sales rose 2% to 47,983 units last month from 47,107 units in April 2023. Total commercial vehicle sales stood at 29,538 units last month, a jump of 31% as compared to 22,492 units in April 2023.

Escorts Kubota

Escorts Kubota reported a year-on-year decline in the total tractor sales in April. The domestic tractor sales came at 7,168 units, 1.2% lower than 7,252 units sold in April 2023.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter