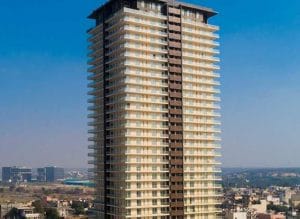

Strong end-user demand driving residential market growth, says Mahindra Lifespaces MD Arvind Subramanian

Summary

“We are in advanced conversations in a couple of situations in the redevelopment societies, redevelopment space in Mumbai and if all things go well, we should see some positive movement in the next couple of months,” Arvind Subramanian, MD & CEO, Mahindra Lifespaces said.

[wealthdesk shortname=”Mahindra Life” isinid=”INE813A01018″ bseid=”532313″ nseid=”MAHLIFE” sector=”Construction & Contracting – Civil” exchange=”nse”]

Arvind Subramanian, MD & CEO, Mahindra Lifespaces is continuing to see strong end-user demand, which is driving the residential markets. “It has been a fantastic quarter two seasonally. Particularly in the Mumbai market, the quarter two tends to be softer because of the monsoons and other factors but this year we have seen a very strong growth sequentially from quarter four onwards,” Subramanian told CNBC-TV18.

The Mumbai property registrations have come in strong with over 20 percent year-on-year (YoY) growth. August traditionally records a sequential drop in registrations but it has been the best August in the last 10 years.

Shares of Mahindra Lifespace Developers touched their 52-week high for a second consecutive day on Tuesday. The stock, however, gave up gains to touch an intraday low of Rs 528.05, down 2.13 percent on the BSE.

“A lot of our growth depends on continued land acquisition,” said Subramanian. The realty firm on Monday said it was looking to acquire a few land parcels this fiscal year to build housing projects with sales potential of Rs 3,000-4,000 crore.

Also Read: Mahindra Lifespace eyes land parcels to build housing projects with Rs 4,000 crore sales potential

The company is holding on to its target of Rs 2,500 crore bookings with 4 million sq ft of volumes. “That is our first milestone in our growth journey. We do see strong tailwinds and do believe that we are well on course to hit that target. Last couple of years we did just under Rs 700 crore in FY21 and over Rs 1,000 crore in FY22. So, we expect to maintain similar growth this year as well,” he explained.

Going into next year, the order pipeline is looking very strong for the company.

In terms of quarter one bookings, he said, “We must recognise there were two very strong launches in that quarter – Mahindra Eden in Bangalore and Mahindra Luminare in Gurgaon. Both of them contributed very strongly. We don’t expect to have such similar launches in the subsequent quarters.”

On redevelopment projects in Mumbai societies, he said, “We are in advanced conversations in a couple of situations in the redevelopment societies, redevelopment space in Mumbai and if all things go well, we should see some positive movement in the next couple of months.”

Mahindra Lifespaces is participating in a couple of resolution processes and is looking at some distressed assets, particularly some transactions that are going through a resolution process.

When asked about the geographies the company is looking at, he replied, “Currently there are Mumbai-based assets but we are keeping an eye on Pune and Bangalore which are the other two residential markets of interest to us.”

For the full interview, watch the accompanying video

Catch the latest stock market updates with CNBCTV18.com’s blog

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter