Apollo Hospitals targets ₹500 crore revenue from diagnostics; talks on for e-pharmacy stake sale

Summary

Apollo Hospitals Managing Director said the diagnostics business did very well, and the company is on track to deliver ₹500 crore revenue just from diagnostics.

Apollo Hospitals Enterprise is actively engaging in stake sale talks for its omnichannel business, Apollo 24/7, the company’s Managing Director, Suneeta Reddy said while emphasising the importance of fair valuation.

“We have built a lot of value in this company and it should be valued appropriately so that all stakeholders benefit,” Reddy said in an exclusive conversation with CNBC-TV18 on Friday (November 10).

Apollo plans to raise $200 million by diluting a 5-7% stake in the Omnichannel business. The business is expected to reach operational breakeven by the March quarter of the financial year 2024.

Reddy also highlighted the success of the company’s diagnostics business, which is on track to generate ₹500 crore in revenue. Apollo Hospitals plans to expand by opening 200 new diagnostic centres.

Reddy pointed out that these centres “are already EBITDA (earnings before interest, tax, depreciation, and amortisation) positive, with a margin of 9.8%, which is expected to expand as we set up our clinical labs.”

Apollo Hospital posted a 14.2% year-on-year (YoY) increase in net profit at ₹233 crore for the July-September quarter, lower than Street estimates. The revenue, however, was better-than-expected at ₹4,846.9 crore, a 14% YoY growth. EBITDA was at ₹627 crore compared to ₹565 crore the previous year, with the margin at 12.9% versus 13.3%.

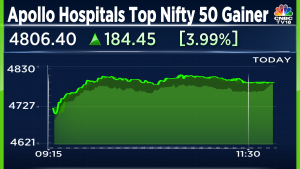

Shares of Apollo Hospitals Enterprise were trading 1.09% lower at ₹5,239.80 apiece on the NSE during Friday’s noon deals.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter