ABB India is now valued at one-fifth of its foreign parent as stock climbs to fresh-high

Summary

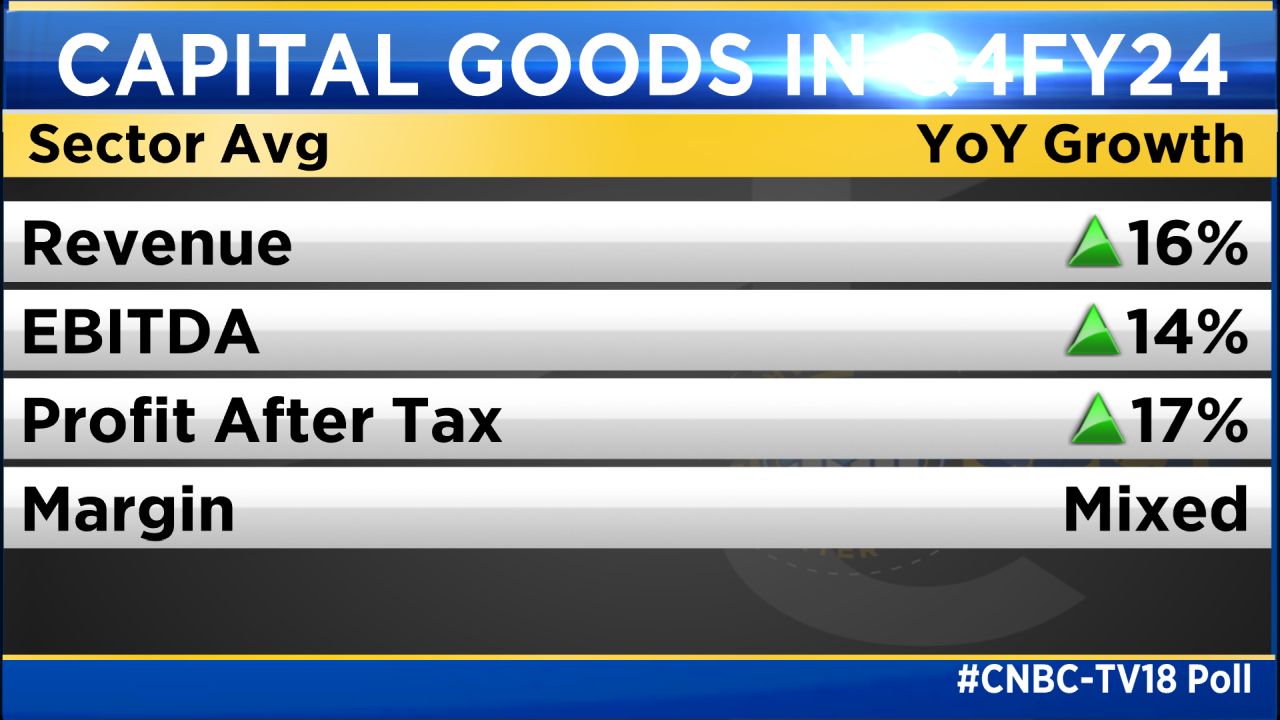

During the quarter ended March 2024, the revenue of ABB India increased by 28% year on year (YoY) to ₹3,080 crore, aided by strong order conversion across all divisions.

The market capitalisation of ABB India surged past the $20 billion mark for the first time on Monday after better-than-expected March quarter earnings saw its stock surge the most in seven years. Shares of ABB India rallied as much as 11.2% to close the session at ₹7,984.25 on the NSE.

This is in comparison with a market valuation of $98.9 billion commanded by its Switzerland-based parent, ABB Ltd. Both the parent and subsidiary saw their stocks hit record highs in Monday’s trade.

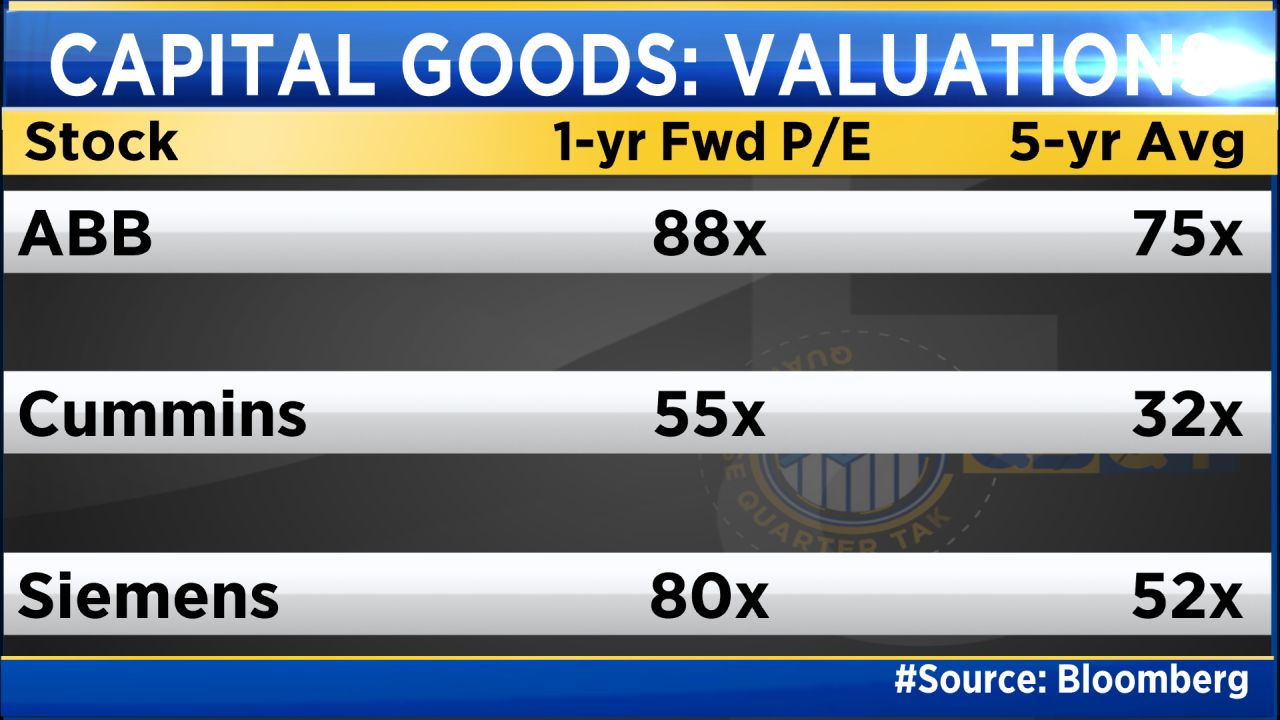

However, the Indian arm had revenue of $1.3 billion in FY23, which was less than 4% of its parent’s full-year net sales, Bloomberg data shows. Nevertheless, the Indian subsidiary commands a premium valuation over its global parent. The stock of ABB India is trading at 98 times its FY25 earnings, against close to 22x commanded by ABB Ltd.

During the quarter ended March 2024, the revenue of ABB India increased by 28% year on year (YoY) to ₹3,080 crore, aided by strong order conversion across all divisions. While direct sales contributed 59% of the top line, the remaining 41% came through partners. Further, the company’s EBITDA margin expanded 652 basis points YoY to 18.3%. The net profit for the quarter grew by 88% to ₹459 crore.

Jefferies, which has a “buy” rating on the stock with a 12-month target price of ₹8,845 observes that ABB India’s March quarter EBITDA was 52% higher than its expectations as margins expanded by 650 bps YoY to 18.3% vs expectations of 12.2%. “Order flows rose 15% YoY and are likely to pick up further after elections in 2HCY24,” the foreign brokerage wrote in an investor note. Jefferies further added that the company’s release indicates that there is no material one-off in margins.

Switzerland-based ABB operates in more than 100 countries across Europe, the Americas and the Asia, Middle East and Africa (AMEA) region. Europe and the Americas together account for over 70% of sales.

Shares of ABB India have rallied as much as 71% since the beginning of 2024, against less than 2% returns yielded by the benchmark Nifty50.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter