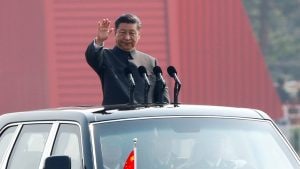

Xi Jinping pledges to strengthen economic recovery after tough year

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

In his speech, Xi repeated that China will “surely be reunified,” alluding at Taiwan, which split with the mainland in 1949 at the end of a civil war but Beijing still claims as its own.

Chinese President Xi Jinping vowed to strengthen economic momentum and deliver on job creation, acknowledging some companies and citizens had a difficult 2023 in a rare admission of headwinds the country is facing.

While touting China’s achievements in his New Year’s message, the leader noted “some enterprises had a tough time” and “some people had difficulty finding jobs and meeting basic needs” in the past year.

“We will consolidate and strengthen the momentum of economic recovery, and work to achieve steady and long-term economic development,” Xi said in a televised address on Sunday.

The government’s goal is about “delivering a better life for the people — our children should be well taken care of and receive good education, our young people should have the opportunities to pursue their career and succeed, and our elderly people should have adequate access to medical services and elderly care,” he said.

Improving people’s well-being has been a key part of the social contact the Communist Party has relied on for its ruling. The new year sees China entering a pivotal period as policymakers try to boost growth, stabilize a crisis in the property market and prevent the world’s second-largest economy from sleepwalking into deflation.

Beijing is expected to target a growth goal of around 5% again in 2024, although achieving that will be harder due to a higher base.

Investor confidence has plummeted as concerns over Beijing’s opaque policymaking persisted and higher interest rates overseas spurred capital outflows. A recent crackdown on the gaming industry sparked a $80 billion meltdown, while foreign investors recorded their smallest-ever annual purchases of Chinese stocks.

Signs of weakness in the economy have increased recently with factory activity shrinking in December to the lowest level in six months, likely adding pressure on policymakers to act urgently to inject impetus to the economy.

Xi on Sunday touted Chinese “manufacturing prowess” with a list of projects including the domestically-built C919 passenger jet, a made-in-China cruise ship, space programs, maned submersibles, and electric cars.

China’s most-powerful leader since Mao Zedong continued to break Communist Party norms, making his fewest overseas trips — only four — in a non-pandemic year since taking power. He delayed a key economic meeting held every five years to chart the country’s reform.

Xi also abruptly ousted his defense minister, as well as top rocket force leaders, as turmoil rippled through the upper echelons of the nation’s military. Beijing also removed its foreign minister, without explanation, adding to the instability.

The new year also brings fresh geopolitical risks from elections in the US and Taiwan.

In his speech, Xi repeated that China will “surely be reunified,” alluding at Taiwan, which split with the mainland in 1949 at the end of a civil war but Beijing still claims as its own.

Taiwan’s hotly-contested election on January 13 will decide how the island of more than 23 million people will respond to Beijing’s moves. The incumbent Democratic Progressive Party seeks to strengthen Taipei’s ties with Washington, while the opposition Kuomintang — an increasingly close second in the most recent polls — is Beijing’s preferred negotiating partner on the island.

“All Chinese on both sides of the Taiwan Strait should be bound by a common sense of purpose and share in the glory of the rejuvenation of the Chinese nation,” Xi said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter