Meet Rishad Premji, Wipro’s next chief

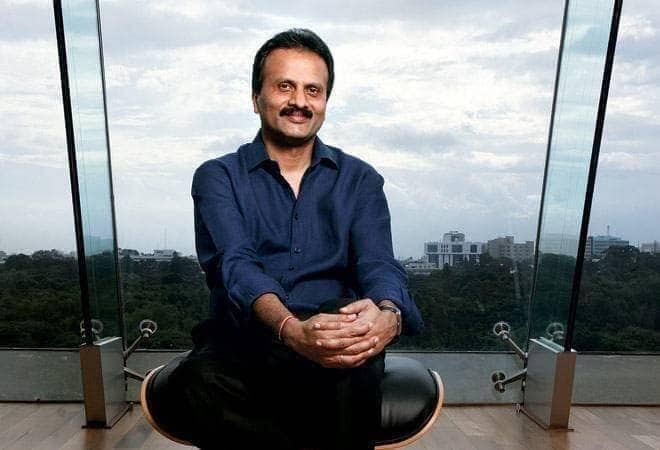

CCD’s VG Siddhartha no more: Stress and downturn equal part of entrepreneur’s journey, says Marico’s Harsh Mariwala

Cafe Coffee Day founder VG Siddhartha has been laid to rest. His last rites were performed at his father’s coffee estate in Chethanahalli in Karnataka. Thousands of people, including politicians from across party lines, paid their last respects to the coffee entrepreneur.

Siddhartha’s body was found by fishermen on Wednesday morning on the banks of the Netravati River, around 36 hours after he went missing from a bridge near Mangaluru in Karnataka.

In a letter purportedly written by him to the Cafe Coffee Day board, Siddhartha complained about pressure from one private equity investor and harassment from Income Tax Department.

Siddhartha’s death has sent shockwaves across India Inc. Several young entrepreneurs are taking to Twitter blaming the unfavourable business climate in the country for Siddhartha’s death.

CNBC-TV18 talked to Harsh Mariwala, chairman of Marico, corporate lawyer HP Ranina, and Mohit Saraf, senior partner, L&L Partners for their views on the matter.

Mohit Saraf, senior partner, L&L Partners

“We must realise that under Indian law there is no principle of coercion. Whatever people agree they need to abide by that and I think we must realise that Siddhartha has built up a big empire. He had lawyers with him all throughout, so he was well advised throughout on the transaction documents so what he agreed with a private equity in what they were trying to enforce on him, if they were trying to.

“Therefore, there is nothing wrong in it. In my view that is the reason he blamed the tax department, they were also following 281. This 281 has been in law since 1975. Same thing is for lenders so the problem is when first generation promoters, when they are raising debt at the holding company level they don’t care about the cash flows they feel that their business is going to do so well that they will be able to service debt. Here he couldn’t service debt. I would blame the board, the governance and not private equity and lenders.”

Harsh Mariwala, chairman of Marico

“There are three key learnings for me one is high sense of governance from the entrepreneur’s point of view and there is no scale. Some people think, when I am large I have to have high sense of governance so that is one number.

“Second is risk taking. Every businesses has risk but you need to dream big but feet on the ground and you need to ensure that the level of risk you are taking you can digest and your business should be able to handle that.

“Third is in spite of taking all the risk there will always be some downturn, stress, things may not go as per plan and then how do you mitigate that and how do you manage that stress part of it is also an equal part of entrepreneur’s journey.”

HP Ranina, corporate lawyer

“The biggest problem in India is that tax disputes go on for years together and there are cases which are still pending in the Supreme Court which were filed maybe two decades ago. Now this is a very serious problem and unless they set up special benches of the courts nothing is going to move.

“One of the problems which we are facing in the high court is that the high court hears the matter maybe few days in a year and very rarely special benches is constituted to dispose of tax matters. Now, on issues of attachment of property, 281 B and other provisions there have been cases where courts have taken this matter out of term and in many cases people have got relief so even where attachment is made in you can show that mala fide is involved in making the attachment then courts have certainly given relief.

“So in this particular case I am little surprised that how a person of his eminence could not have immediately approached a court and got some relief as far as attachments are concerned.”

Looking to invest in stock market? Here are 10 things to know before you start investing

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

You can never be sure in the stock market, as sometimes it moves as per the investor sentiment. Over the long-term, investors like Warren Buffett, Carl Icahn have placed their biggest bets on companies out of favour or during times of market stress.

Stock markets can be bizarre for a lot of people who are not accustomed to the nuances of its working. The charts, graphs, stock movements can be as overwhelming as the trading floor and sometimes it may all appear to be just gibberish. However, understanding the basics makes all the difference.

Here are ten tips or topics for the budding investor in you:

- Buy low, sell high. It sounds very simple, yet things getting cheaper may feel like a bad thing. However, this fact is not mutually exclusive: the current bull market will end, and over almost any long-term horizon stocks have proven to be beneficial investments that generally grind higher, Steve Schaefer of Forbes writes.

- You can never be sure in the stock market, as sometimes it moves as per the investor sentiment. Over the long-term, investors like Warren Buffett, Carl Icahn have placed their biggest bets on companies out of favour or during times of market stress. While long-term gains for stocks at large have historically been a safe bet, individual companies are inherently riskier, Schaefer says.

- Since you are starting out, it is best to familiarise yourself with the exchange filings available on the website of the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). All the listed companies have to file about every single detail related to company finances to potential conflicts and risks with the Securities and Exchange Board of India (Sebi) which are made available on the exchanges. Regulatory filings will also detail any senior management changes, acquisitions, and stock transactions by executives or board members. While many weathered investors can make their own mind about investing in a stock, others have to still do our homework.

- Think about long-term investment opportunities. Trading based on quarterly earnings and economic data points on the automated trading platform is not a good strategy for a budding investor. Invest in stocks or sectors which have given a better result in the long-term despite them being dismissed by the market and weakened by the economic conditions and industry dynamics.

- Dividend-paying stocks aren’t immune from declines, but they do offer a degree of insulation that others don’t, says Schaefer, citing the example of investor Kevin O’Leary. Shark Tank investor O’Leary said that a bulk of S&P 500 companies’ returns over the years have come from dividend payout and not from price appreciation.

- There is not a single perfect metric that can differentiate between the good and the bad stock. Be it a professional or an amateur like yourself, everyone has their different set of yardstick with which they measure the financial health of a company. It could be price-earnings ratios to dividend yields and profit margins.

- There is no thumb rule in the stock market when it comes to differently priced stocks. A triple or quadruple-digit priced stock may be expensive to buy for a new investor but buying a relatively lower valued stock in 100 units may not be a better strategy. Think of investing like grocery shopping — there’s a reason you go to the store with a list instead of just deciding what to buy based on price tags, Schaefer advises.

- Selling stocks that you have held on to for less than a year will trigger a short-term capital gains tax as ordinary income. Taxes, therefore, can take a bite out of your profits earned.

- Make sure you know the stocks, as well as the type of buy or sell order properly before entering the trade. A market order, for instance, will be executed as soon as possible, whatever the prevailing market price. A limit order, by contrast, will only complete the transaction within price parameters you’ve established, says Schaefer.

- Take market news with a whole shaker of salt, Schaefer said. The stock market has been grappled with the news of the global trade wars for over a year now which has made many stocks dull and has slowed down the global economy. As an investor, the news flow driving day-to-day gyrations in the market should be taken as interesting reading rather than a reason to make or change strategy.

Disclaimer: The views and investment tips expressed by investment experts are their own and not that of the website or its management. Users are advised to check with certified experts before taking any investment decisions.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

LIVE TV

Shows

View AllMost Reads

View Alltoday's market

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

Currency

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Question 1 of 5

What coins do you think will be valuable over next 3 years?

Answer Anonymously

Should Elon Musk be able to buy Twitter?

Andhra govt’s 75% reservation for locals should not be mandatory, says Amara Raja Group chairman

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The passage of the Employment of Locals in Industries and Factories Bill in the AP Assembly means that all private establishments in the state will need to satisfy the government’s proposed 75-percent quota for locals in their respective enterprises.

Last week, the Andhra Pradesh government set the wheels in motion to implement what has largely been seen as a protectionist and possibly anti-industry piece of legislation: 75 percent reservation for locals in the private sector. The passage of the Employment of Locals in Industries and Factories Bill in the AP Assembly means that all private establishments in the state will need to satisfy the government’s proposed 75-percent quota for locals in their respective enterprises.

In an exclusive interview, Ramachandra Naidu Galla, chairman of one of Andhra Pradesh’s biggest manufacturing industries, the Amara Raja Group, sat down with CNBC-TV18’s Jude Sannith, to discuss the legislation.

Galla feels the Andhra government could have merely issued an advisory and not made the state’s proposed 75 percent reservation for locals, a law. The Amara Raja Group chairman also shared insights on the slowdown in the automobile sector, reports of a price war between Amaron and Exide, and how the company is preparing for an era of electric mobility.

Edited excerpts from the conversation:

The Andhra Pradesh Assembly has passed the Employment of Locals in Industries and Factories Bill, which mandates that the private sector allows for 75 percent reservation for locals in workplaces. As a business house based in the state, how do you react to the law?

Politicians make manifestos to create hope, but soon after the election is over the question is: how are you going to implement your manifesto? I congratulate Chief Minister Jaganmohan Reddy for keeping his promises. It isn’t a bad idea to create more jobs, especially in India with 1.3 billion people. We need as many jobs as possible.

Many industry voices say that the problem with Andhra Pradesh’s 75 percent reservation law is that the definition of ‘local’ is still unclear — whether it refers to inhabitants of the state or those in the vicinity of a newly established factory. Do you think this grey area needs to be ironed out as soon as possible?

It’s very important to define the lower category when it comes to the definition of ‘local’. It still isn’t defined properly and it’s very important that the government clarifies so that there is no fear or negativity among industries that are already here, and for newer industries that will invest in the state. If ‘local’ means the radius of a plant, it (reservation) may or may not be possible. It’s very difficult to find skilled or unskilled workers around your plant, and this changes from industry to industry. Some industries need specialised experience and knowledge, and may not have a single person with these skills in this area. They may say “you could train the people you hire”, but you can’t buy experience in a shop. There is a long time that is needed to train people. The skills that a machine tool operator needs take a long time to master. The person at the next level could also take six or seven years to master these skills. Some people learn quickly and some don’t.

What is interesting to note, however, is that you at the Amara Raja Group have been well within this proposed quota for a while, now. At last count, you had nearly 91 percent of your factory employees from Andhra Pradesh…

While that is true, the Amara Raja Group can’t be taken as an example when making a law. We came here with a commitment to rural and local development, and initiated. We put in efforts to train local people. Today, 90 percent of our employees is from Andhra Pradesh and 75 percent is from Chittoor. More than 95 percent of our employees is a first-time employee in their respective families. We have even built our own skill-development centre, with classrooms, computer labs, science labs and workshops. This isn’t an investment because we are hoping people will join us. We are launching another training institute in the state, and a third one in Amaravati.

So, let’s settle this debate once and for all: are you saying if the definition of local is with relation to the entire state as opposed to the vicinity of a factory, the reservation law could be implemented better?

Even if you take a local panchayat, district or a state level, we can’t expect new industries and multi-national enterprises that are investing in the state, to investing in training people in special skills too. So, instead of mandating a reservation law, the state government could have issued an advisory, telling us “this is what we expect you to do”. The state government has to ensure jobs in the state, and that is fine. But at the same time, making it a compulsion is not a good idea. If an existing industry is already conforming to this quota, the government could also announce some incentives so as to encourage newer companies to benefit from these incentives.

Many states have been talking about bringing in reservation for locals in the private sector, especially in factories. The Andhra Pradesh government has gone about walking the talk. As an industrialist, do you feel this protectionist mindset on part of individual states sets an unhealthy precedent?

No industry wants to have people from far away to come and work in its plants. Local employment is more advantageous, it also avoids the burden of other expenses. So, if a state believes it has the best talent, no industry is going to go away (to hire new talent). I can’t say if this (reservation) is a good precedent or not, but my advice is to make it more of an advisory than mandatory. Making it mandatory could scare some investors. Everyone could then begin looking at their own states. When evaluating potential investments in a certain state, every investor thinks of ease of doing business, returns, long-term gains, market reach and access to suppliers. But labour is also extremely important. That is why unfavourable labour laws and industrial policies could potentially lead to unfavourable investment decisions as far as a state is concerned. So, the principle is good but it may not exactly be friendly for a state’s business environment.

Moving away from reservation politics: it’s been a tough time for India’s automobile industry. The slowdown has not only impacted automobile manufacturers, but also battery manufacturers. Has this caused you at Amaron to fall back on the after-sales market?

The strength of an economy lies in its automobile industry, and this is the case around the world. But these economic cycles are very common, and this downturn is merely temporary. The fact is: the slowdown in the auto industry is impacting the battery industry as far as OEM accounts are concerned. While after-sales market is a separate story, we want to please OEMs and work with them in terms of technical development. However, we have begun laying focus on after-sales market and export verticals, today. We can’t expect automobile sales to be better this year but the after-sales market is still very stable. The after-market sales will grow in line with what OEM market growth rates were like, two years ago. This trend has shown stability and continuity.

What we have been reading about though, is that two big players in the automobile battery space — Amaron and Exide — have been engaged in intense competition when it comes to prices. Do you see an all-out price war breaking out between the two of you?

I don’t think there will be a price war anytime. Both companies are very mature, and don’t target business based on price wars. This strategy only leads to short-term gains — like stocks in a department store that go on discount. When you look at mature companies, we always look long-term. However, having said that, customers are intelligent and we cannot think about exploiting them. The moment they realise that your price is more for the same battery, you are going to lose out. So, in the pursuit of competition, we attempt to stabilise prices and keep them in control — and not to overwrite a competitor’s prices. If my competitor brings prices down, I start waking up and ask myself what mistakes I’m making. So, without calculating and analysing how to compete, we can’t foolishly begin cutting prices.

Even as we speak, you are currently setting up a lithium ion battery-assembly plant. Do you think the transition to electric mobility will be on expected lines, for automobile and battery manufacturers, alike?

India cannot afford to sleep anymore (when it comes to electric mobility). To promote electric mobility, the government needs to be active and provide benefits instead of expecting industry to take initiative. We are confident of our order book, in the lithium ion battery-assembly business. In-house manufacturing of these batteries is going to take some time. From raw material to cell-making, capital investments are too high. Even companies that have already made their foray in cell-making, based in America and Europe, have made huge investments and built massive capacities. Now, if we were to invest this kind of money, plant capacities are still going to be meagerly used because these volumes haven’t made their presence felt in India. While we are buying lithium ion cells and integrating them with the battery, all other components are locally made. We have already begun supplying these batteries to two-wheelers and three-wheelers. We are currently working in R&D to develop electric batteries of 750 volts.

For years, you’ve been seen as an Andhra-based company. Your major plants, for instance, are located in Tirupati and Chittoor. Do you have plans of expanding outside this geography by way of your manufacturing footprint?

While we are located in Andhra Pradesh, we are located in every nook and corner of the country. When we began expanding and evaluating costs, we realised that the market is one. So, it didn’t matter where set up our plants. When Chinese products are spread across the world, there is no reason why we can’t make our products in Andhra Pradesh at reach every corner of the country. If you’re suggesting this is the case because we have been supported by the Andhra Pradesh government, the answer is no. We haven’t expected any support from anybody. Our intention was to set up shop here, and run our business from this state. We will remain an Andhra-based manufacturing company, but not because we’ve received support from this government.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

LIVE TV

Shows

View AllMost Reads

View Alltoday's market

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

Currency

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Question 1 of 5

What coins do you think will be valuable over next 3 years?

Answer Anonymously

Should Elon Musk be able to buy Twitter?

CCD’s VG Siddhartha dies: India has lost a true home-grown entrepreneur, says HDFC’s Deepak Parekh

More than 24 hours after Cafe Coffee Day (CCD) founder VG Siddhartha went missing, his body was found near Karnataka’s Netravathi river. Siddhartha was missing since Monday evening and is believed to have committed suicide.

CNBC-TV18 spoke to veteran corporate leader and chairman of HDFC Deepak Parekh on Siddhartha’s death and the message it sends to India Inc, private equity investors and tax authorities.

Parekh said: “The unfortunate news of VG Siddhartha is indeed a shock to all of us having known him professionally and personally for many years. It pains me to realise the mental agony that he must have been undergoing. He was unassuming, he was gentle and soft spoken. India really has lost a true home-grown entrepreneur.”

In a letter for his disappearance on Monday, Siddhartha left a letter alleging harassment from tax officials and pressure from private equity (PE) partners .

Talking about PE and tax administration, Parekh said: “They are doing their job, the tax department is doing their job and private equity have to do their job. If an entrepreneur gives a commitment that he will exit in certain number of years and if he doesn’t do so I guess the banker will go after the client or a PE will go after the customer because it is not their money, it is third party money which they are managing.”

He added: “There are various compulsions for a PE, for a bank, tax people so individually they do their jobs and businessmen must understand that they should only expand or grow or acquire to the extent they have capability.”

Speaking about tax disputes, Parekh said: “Tax disputes will always be there, interpretation of tax laws be always be different. We have to try and solve it in a shorter period of time because these tax cases go on and on for many years. So we should shorten that process so one can move on.”

On ease of doing business, he said: “We are improving in the index, World Bank Index, we have improved significantly. Our honourable prime minister has also said that India should come under 50 in the rank.

“I think the government is trying to do as much as they can and we should support whatever is happening but these legislative issues whether it is NCLT [National Company Law Tribunal], whether it is tax, whether it is Sebi [Securities and Exchange Board of India], I think should speed up because immediate decisions are necessary.”

CSR rule violations can now land company officials in jail

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

If companies violate the rules they will face a penalty of Rs 50,000 to Rs 25 lakh and the officer responsible could even get a jail term of up to three years.

The Indian parliament on Tuesday cleared amendments to Companies Act which translate to stricter laws for corporate social responsibility (CSR) spending by corporates.

After the amendment, violation of the corporate social responsibility rules could land company officials in jail. If companies violate the rules they will face a penalty of Rs 50,000 to Rs 25 lakh and the officer responsible could even get a jail term of up to three years.

Moreover, companies will also have to explain where the money is being spent and they have been given a three-year window to adhere to this rule.

Speaking in parliament, Finance Minister Nirmala Sitharaman said, “Gandhiji’s trusteeship principle is that legitimate profit-earning cannot be devoid of social responsibility.”

CNBC-TV18’S Shereen Bhan discussed the impact of the tightened rules with Rumjhum Chatterjee who is on the CII CSR Committee, Dinesh Kanabar of Dhruva Advisors, Amit Vatsyayan, partner at EY India, Abhishek Humbad founder of Goodera and Amit Tandon of IIAS.

According to Chatterjee, the government has considered the recommendations of various stakeholders. “We are glad to see that our recommendation on making sure that projects that have been started and could not be finished have now got the flexibility to be rolled over for 3 years. The penal provision is something that has surprised us a little, we also think it is an extreme step,” he noted.

Kanabar said: “If you look at CSR provisions the world over, they have been looked at more in terms of reporting. The EU countries, for example, mandate more about reporting so that corporates are encouraged to spend and demonstrate that they are contributing to the society.”

Vatsyayan pointed out that the government had tried responding to some of the practical issues. “Some of the companies would come and say that we have not been in operation for the last 3 years, so how do we calculate that and I think the amendment is now providing that. It has also said that if you have not allocated the money for a particular project then you have to give that money up after the end of financial year within 6 months to Schedule 7. As far as the penal issue is concerned, earlier also the reporting of the CSR was as per the provision of Section 134 of the Companies Act which also had the same penal provision. So, what has been done is a natural extension of what was there earlier,” he said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

LIVE TV

Shows

View AllMost Reads

View Alltoday's market

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

Currency

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Question 1 of 5

What coins do you think will be valuable over next 3 years?

Answer Anonymously

Should Elon Musk be able to buy Twitter?

Wall Street rises at open on Apple boost; Fed in focus

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

US stocks opened higher on Wednesday, lifted by Apple’s shares, as the iPhone maker’s upbeat earnings eased concerns over the impact of the US-China trade war, while investors awaited an almost certain cut in interest rates by the Federal Reserve.

US stocks opened higher on Wednesday, lifted by Apple’s shares, as the iPhone maker’s upbeat earnings eased concerns over the impact of the US-China trade war, while investors awaited an almost certain cut in interest rates by the Federal Reserve.

The Dow Jones Industrial Average rose 46.65 points, or 0.17%, at the open to 27,244.67. The S&P 500 opened higher by 3.04 points, or 0.10%, at 3,016.22. The Nasdaq Composite gained 17.18 points, or 0.21%, to 8,290.80 at the opening bell.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

LIVE TV

Shows

View AllMost Reads

View Alltoday's market

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

Currency

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Question 1 of 5

What coins do you think will be valuable over next 3 years?

Answer Anonymously

Should Elon Musk be able to buy Twitter?

Rupee settles 6 paise higher at 68.79 vs USD ahead of Fed meet outcome

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The rupee recovered from early lows to settle higher by 6 paise at 68.79 against the US dollar on Wednesday amid uncertainty ahead of the outocme of US Federal Reserve meeting.

The rupee recovered from early lows to settle higher by 6 paise at 68.79 against the US dollar on Wednesday amid uncertainty ahead of the outocme of US Federal Reserve meeting.

Forex traders said the rupee is trading in a narrow range as market participants are awaiting cues from the outcome of the Federal Open Market Committee (FOMC) meeting later on Wednesday.

At the interbank foreign exchange (forex), the domestic currency witnessed heavy volatility. The local unit opened lower at 68.89 a dollar and touched a low of 68.94 later.

The rupee made a recovery later in line with gains in equity markets and touched a day’s high of 68.76 to US dollar.

The local unit finally closed at 68.79 against the American currency, registering a rise of 6 paise over its previous close of 68.85.

Traders said market participants were trading a cautious path as the US-China trade talks ended without a breakthrough.

The 12th round of talks between top trade officials of the two countries ended without a breakthrough in Shanghai after US President Donald Trump’s twitter tirade against Beijing.

“My team is negotiating with them now, but they always change the deal in the end to their benefit,” Trump tweeted.

The rupee has risen by 24 paise or 0.34 per cent in July in its second month of gains.

“Rupee appreciated for second consecutive month amid strong foreign fund flow in debt market, foreign direct investment and stable crude oil prices,” said V K Sharma, Head PCG & Capital Markets Strategy, HDFC Securities.

According to Sharma, India’s bonds are headed for their best month since 2016, largely due to the probable rate cut by the RBI in the next meeting in August.

He further added that Budget announcement of shifting some borrowing offshore has been another reason behind rising bonds.

The 10-year government bond yield was at 6.37 per cent on Wednesday.

The Reserve Bank of India on Tuesday evening eased curbs on overseas commercial borrowing for companies and non-bank lenders. They will be allowed to raise foreign-currency debt with an average maturity of at least 10 years for working capital requirement, Sharma said.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.03 per cent to 98.08.

Brent crude futures, the global oil benchmark, rose 0.63 per cent to trade at USD 65.13 per barrel.

Foreign institutional investors (FIIs) remained net sellers in the capital markets, pulling out Rs 1,497.07 crore on Wednesday, according to the provisional data.

Meanwhile, on the domestic market front, the 30-share BSE Sensex settled 83.88 points or 0.22 per cent higher at 37,481.12. The broader NSE Nifty ended 32.60 points or 0.29 per cent up at 11,118.00.

Meanwhile, Financial Benchmark India Private Ltd (FBIL) set the reference rate for the rupee/dollar at 68.7500 and for rupee/euro at 76.5751. The reference rate for rupee/British pound was fixed at 83.5445 and for rupee/100 Japanese yen at 63.31.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

LIVE TV

Shows

View AllMost Reads

View Alltoday's market

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

Currency

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Question 1 of 5

What coins do you think will be valuable over next 3 years?

Answer Anonymously

Should Elon Musk be able to buy Twitter?

Fiscal deficit crosses 61% of budgeted target in first three months of 2019-20

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

India’s fiscal deficit in the three months ending in June stood at Rs 4.32 trillion rupees ($62.80 billion), or 61.4 percent of the budgeted target for the current fiscal year, government data showed on Wednesday.

India‘s fiscal deficit in the three months ending in June stood at Rs 4.32 trillion rupees ($62.80 billion), or 61.4 percent of the budgeted target for the current fiscal year, government data showed on Wednesday.

Net tax receipts in the first three months of the fiscal year were Rs 2.51 trillion, while total expenditure was Rs 7.22 trillion, government data showed.

The government has set a fiscal deficit target of 3.4 percent for 2019/20, same as 2018/19.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

LIVE TV

Shows

View AllMost Reads

View Alltoday's market

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

Currency

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Question 1 of 5

What coins do you think will be valuable over next 3 years?

Answer Anonymously

Should Elon Musk be able to buy Twitter?

Google Pay to now send SMS alerts for secure transactions

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

To help users easily identify any suspicious transactions, Google Pay will now send app notifications as well as SMS to inform users each time they receive a collect request to highlight that approving the request will deduct money from their bank accounts.

To help users easily identify any suspicious transactions, Google Pay will now send app notifications as well as SMS to inform users each time they receive a collect request to highlight that approving the request will deduct money from their bank accounts.

“We are mindful that at Google Pay, users are entrusting us with their most sensitive asset – their money. We are conscious of the responsibility that comes with this trust,” Ambarish Kenghe, Director, Product Management, Google Pay said in a blog post on Wednesday.

“The above security features, and a lot more ongoing work in this direction, are a small example of how we keep our users safe,” Kenghe said.

In the last two years, instant bank-to-bank transfers via Unified Payments Interface (UPI) have become the preferred form of payment for millions of Indians, with many users adopting digital payments for the first time.

Google Pay comes equipped with several of Google’s security infrastructure including scam protections.

It uses Machine Learning-based scam prevention models, and also displays explicit “scam” or “stranger” warnings if a user receives a request from someone suspicious or not in their contacts, Google said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

LIVE TV

Shows

View AllMost Reads

View Alltoday's market

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

Currency

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Question 1 of 5

What coins do you think will be valuable over next 3 years?

Answer Anonymously

Should Elon Musk be able to buy Twitter?