Bottomline: The Great FX F&O Slumber Party!

Summary

The currency derivatives mess is not about the death of a market segment on stock exchanges. It is about the complete failure of our watchdogs to ensure that rules under their watch are followed.

The exchange traded foreign currency derivative trading mess is a case study in regulatory oversight and all from RBI to SEBI to stock exchanges and brokerages are to blame.

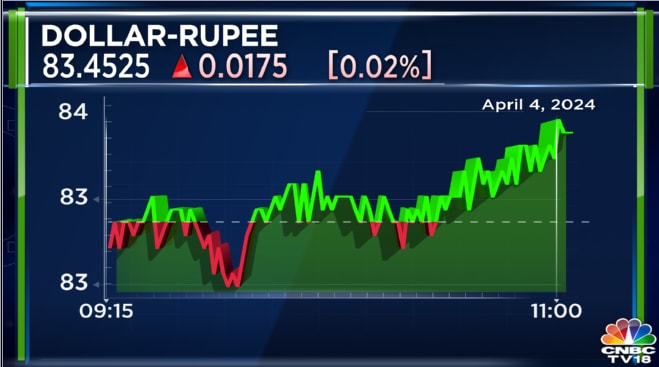

How does what’s happening in a ₹500 lakh crore turnover market get missed for 14 years? That’s a question RBI, SEBI and stock exchanges must answer. And, if it wasn’t missed, why the sudden wake-up call?

On April 5, RBI Governor Shaktikanta Das clarified that there was no change in regulations on currency derivatives trading. To emphasise his point, he added: “No one can say this is new”.

The previous evening RBI in a press release stated currency derivatives regulations are guided by the Foreign Exchange Management Act, 1999, and reiterated in 2000 and 2020 which mandate: “currency derivative contracts involving the INR – both over-the-counter (OTC) and exchange traded – are permitted only for the purpose of hedging of exposure to foreign exchange rate risks.”

The release went on to add: “As announced in the Statement on Developmental and Regulatory Policies dated December 08, 2023 the regulatory framework governing the hedging of foreign exchange risks was comprehensively reviewed in 2020 with a view to ushering in a principle-based regime. Based on this comprehensive review, public consultations, feedback received from market participants and experience gained since then, the regulatory framework has been made more comprehensive in respect of all types of transactions – OTC and exchange traded – under a single Master Direction to enhance operational efficiency and ease access to foreign exchange derivatives.” What this suggests is that key stakeholders would have been consulted in 2020. So, why was no action taken for four years?

SEBI on its part also doesn’t seem out of line on its understanding of the regulations. In its annual report for FY2023, the markets regulator said: “Currency derivatives, which include futures and options contracts, are used to manage foreign exchange risks arising out of fluctuations in currency rates. In India, currency futures and options were launched in August 2008 and October 2010, respectively. Currently, these are available for trading on four currency pairs viz. US Dollars (USD-INR), Euro (EUR-INR), Great Britain Pound (GBP-INR) and Japanese Yen (JPY-INR). The cross-currency pairs such as EUR-USD, GBP-USD and USD-JPY are also permitted for trading.”

So, since 2010 trading in currency derivatives has been permitted knowing that these instruments are meant for hedging underlying exposure risk ONLY. The only relaxation provided by RBI in 2014 was in terms of disclosure. The RBI states: “For the purpose of ease of doing business, the RBI’s A.P. (DIR Series) Circular No. 147 dated June 20, 2014 permitted users of ETCDs to take positions up to USD 10 million per exchange without having to provide documentary evidence to establish the underlying exposure but did not provide any exemption from the requirement of having the exposure.”

While this limit was consequently raised to $100 million, there was no relaxation in the rules on hedging. This begs the question: Didn’t SEBI, Stock Exchanges, Brokers know that they couldn’t trade in such contracts without underlying exposure? To expect that they were unaware requires a leap of faith.

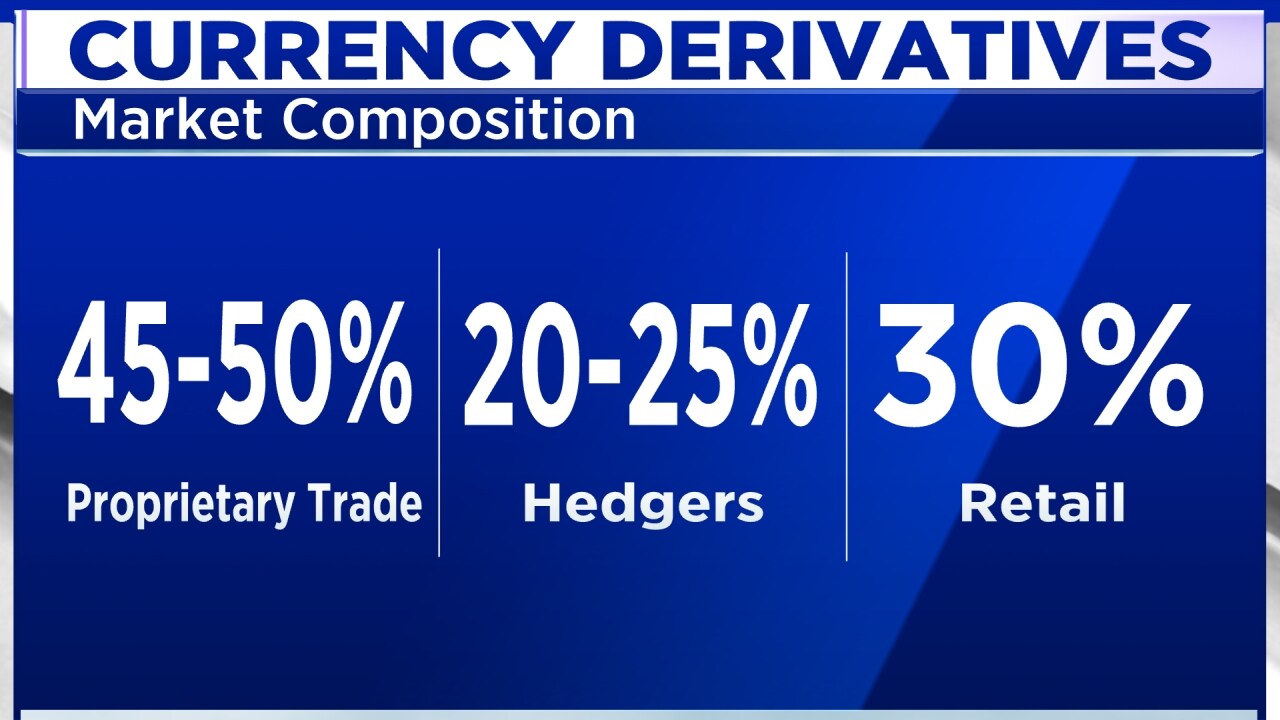

THE PROPRIETARY FLAG

One big red flag is the share of proprietary trades in the total turnover on stock exchanges. Data published in SEBI’s annual report of FY2023 reveals that these account for almost 88% of the total turnover on NSE, the exchange with 85% share of the total turnover in such contracts. It would also seem odd that such published information was not noticed by anyone at RBI.

The least one would have expected any of the regulating bodies—Stock Exchanges, SEBI or RBI—to do is enquire into the nature of such trades to ascertain whether these were done to hedge underlying exposures.

| SHARE IN FX F&O (FY23) | |||

| Category | BSE | NSE | MSEI |

| Proprietary | 87.70% | 66.70% | 3.60% |

| FPI | 2.90% | 9.50% | 12.40% |

| Banks | 0.00% | 0.50% | 49.60% |

| Corporate | 3.80% | 5.30% | 34.40% |

| Others | 5.60% | 18% | 0.00% |

Source: SEBI Annual Report FY2023

Also, it isn’t like this segment was so small to not have drawn any regulatory attention. The sharp jump in turnover and the size of the market should have been enough cause to invite scrutiny. The turnover in the currency derivatives segment jumped by over 60% to Rs 446 lakh crore in FY2023.

| FX DERIVATIVE TURNOVER (Rs cr) | |||

| Exchange | FY22 | FY23 | Share % |

| BSE | 64,54,526.00 | 62,71,864.00 | 14.07 |

| NSE | 2,11,75,555.00 | 3,80,86,873.00 | 85.42 |

| MSEI | 90,270.00 | 2,31,435.00 | 0.52 |

| Total | 2,77,20,351.00 | 4,45,90,171.00 | 100.00 |

Source: SEBI Annual Report FY2023

THE SPOILS OF OVERSIGHT

Who gained from this convenient oversight? This is also something to be aware of. No, it’s not just the brokers. Stock Exchanges led by NSE have earned transaction charges on every trade. Even SEBI has got a share of the spoils as has the Government via GST. And all this for years on end from something that is fundamentally illegal. That’s astounding.

| CHARGES ON FX F&O TRADES | ||

| Charges | FX Futures | FX Options |

| Brokerage | lower of 0.03% or Rs 20 / trade | Rs 20 / trade |

| Transaction – NSE | 0.0009% | 0.035% |

| Transaction – BSE | 0.0009% | 0.001% |

| SEBI Charge | Rs 10 /crore | |

| GST# | 18% | 18% |

#On Brokerage + SEBI Charges + transaction charges | Source: Zerodha.com

TIME FOR INTROSPECTION

Given how things have panned out, it is time for regulators to take a closer look at what is going on under their watch. Are there other areas where norms are similarly being violated at scale? How is it they missed this violation in the currency derivatives market? Do they need to review their supervisory systems and practices?

The currency derivatives mess is not about the death of a market segment on stock exchanges. It is about the complete failure of our watchdogs to ensure that rules under their watch are followed.

We only hope another oversight of such scale won’t occur again.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter