Anupam Rasayan posts over 44% fall in Q4 net profit

Summary

Chemicals maker Anupam Rasayan India Ltd on Saturday posted a 44.26% fall in its consolidated net profit to ₹40.46 crore for the fourth quarter of 2023-24 on poor sales. Its net profit stood at ₹72.63 crore a year earlier. The total income fell to ₹413 crore in the January-March quarter of 2023-24 compared to ₹504.2 …

Continue reading “Anupam Rasayan posts over 44% fall in Q4 net profit”

Chemicals maker Anupam Rasayan India Ltd on Saturday posted a 44.26% fall in its consolidated net profit to ₹40.46 crore for the fourth quarter of 2023-24 on poor sales. Its net profit stood at ₹72.63 crore a year earlier.

The total income fell to ₹413 crore in the January-March quarter of 2023-24 compared to ₹504.2 crore in the year-ago period, a regulatory filing said.

For the full fiscal 2023-24, Anupam Rasayan posted a 23% drop in consolidated net profit to ₹167.4 crore against ₹216.8 crore in the previous fiscal.

The total income declined to ₹1,505.3 crore from ₹1,610.4 crore in the said period. Anupam Rasayan Managing Director Anand Desai said the chemical industry, including speciality chemicals, has faced significant headwinds during the last year.

Also Read: Ujjivan SFB Q4 Results | Net profit up 7% to ₹330 crore, declares dividend of ₹1.5

However, despite the de-growth in the top line, the company has been able to sustain its profitability and maintain margins at 27% levels on a full-year consolidated basis.

“We believe that headwinds in the industry may continue for the next two quarters. However, the financial year 2025 will be a year of growth for us with our major focus on polymer and pharmaceutical space,” he added.

Shares of Anupam Rasayan India Ltd ended at ₹781.25, down by ₹3.15, or 0.40% on the BSE.

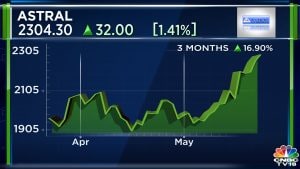

Also Read: Astral Q4 Results | Pipe maker declares dividend of ₹2.25, profit slides 12%

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter