IDFC First Bank Q4 Earnings | Net profit of ₹724.3 crore below Street estimates, down 9.8% from FY23

Summary

IDFC First Bank Share Price | The lender’s net interest income too were below Street estimates. In the March quarter, the bank’s NII was at ₹4,468.9 crore, while the Street had estimated it to come in at ₹4,502.2 crore. However, it was 24% more than the previous year’s ₹3,596.8 crore.

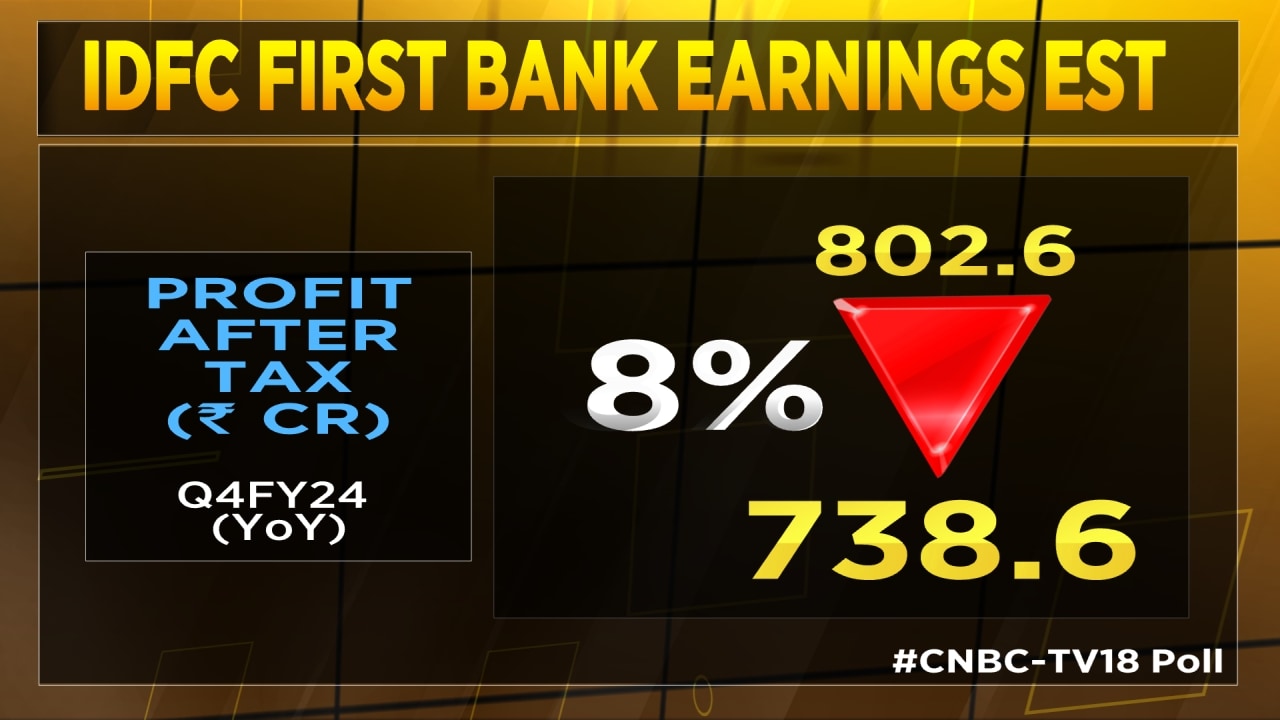

IDFC First Bank of Saturday, April 27, reported its fourth quarter earnings for the 2023-2024 financial year. It’s net profit came in at ₹724.3 crore, a little below CNBC-TV18 poll’s ₹738.6 crore.

Its net profit was also 9.8% lower than the previous fiscal’s ₹802.6 crore.

#4QWithCNBCTV18 | #IDFCFirstBank Q4

–Net Profit At Rs 724.3 Cr Vs CNBC-TV18 Poll Of Rs 738.6 Cr pic.twitter.com/TEkUDEANnH

— CNBC-TV18 (@CNBCTV18Live) April 27, 2024

The lender’s net interest income too were below Street estimates. In the March quarter, the bank’s NII was at ₹4,468.9 crore, while the Street had estimated it to come in at ₹4,502.2 crore. However, it was 24% more than the previous year’s ₹3,596.8 crore.

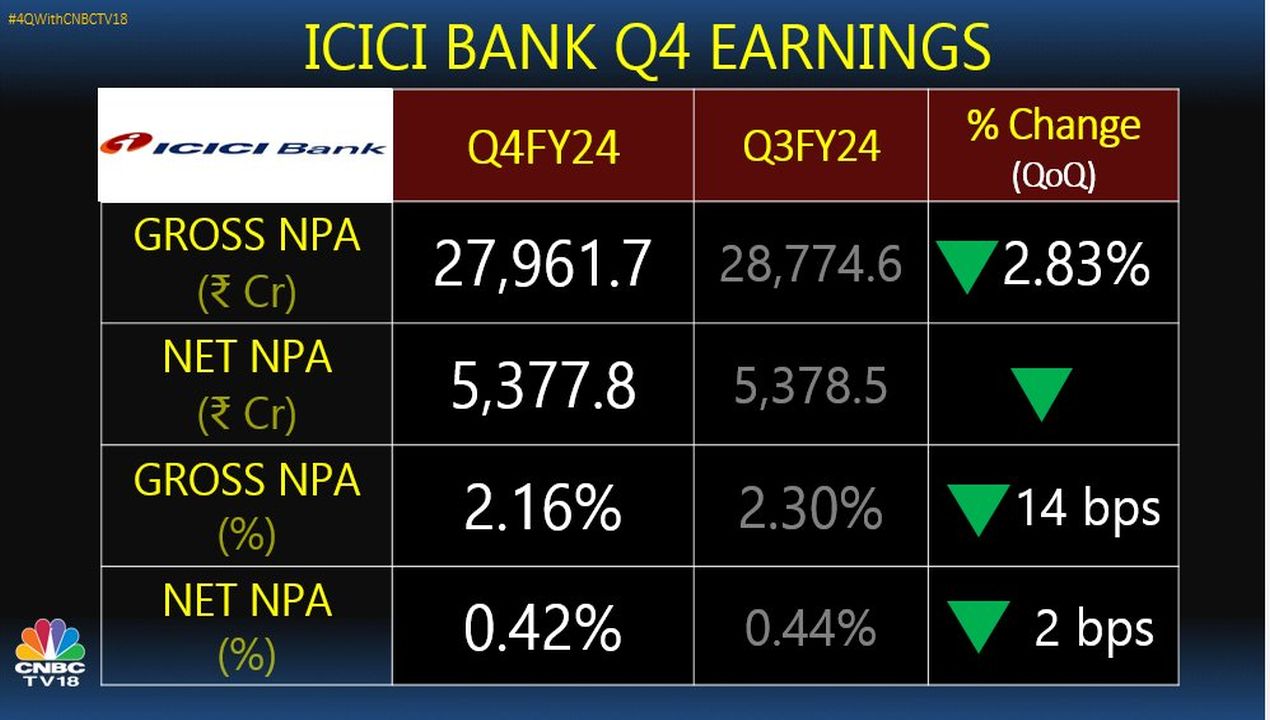

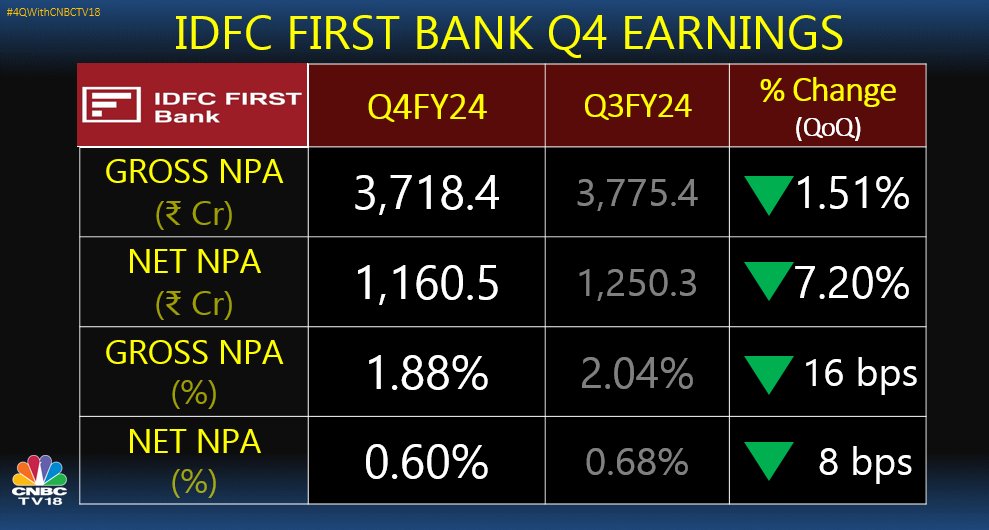

IDFC First Bank’s gross non-performing assets (NPA) decreased by 1.51% at ₹3,718.4 crore, from the previous year’s ₹3,775.4 crore. It’s gross NPA% was down 16 bps in the March quarter at 1.88% from the previous year’s 2.04%.

The lender’s net NPA too decreased by 7.2% to ₹1,160.5 crore from FY23’s ₹1,250.3 crore. Its net NPA% was down 8 bps to 0.6% from the previous year’s 0.68%.

IDFC First Bank shares ended 1.56% higher at ₹84.7 apiece on Friday, April 26. The stock has gained 12.33% in the past month and 37.84% in the past year.

Also Read: ICICI Bank Q4 Earnings | Net profit gains over 17% to ₹10,707.5 crore, up 3.7% from Street estimates

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter