Poly Medicure expects strong growth, margin expansion in FY25

Summary

Shares of Poly Medicure Ltd ended at ₹1,649.15, down by ₹4.65, or 0.28% on the BSE.

Medical consumables company Poly Medicure Ltd’s Managing Director Himanshu Baid on Saturday (May 18) said he anticipates robust growth and margin expansion in the upcoming fiscal year.

Regarding export growth, Baid remarked, “The exports have been doing well, and especially our European business has been growing very steadily, with a growth of around close to 40% there in Europe.”

He also noted a robust growth rate of around 18% in the Indian market, although expressing a desire for stronger growth domestically. Discussing margin outlook, Baid projected, “We would see a margin expansion of around 100 to 150 basis points. We are maintaining EBITDA guidance close to 26 to 28%.”

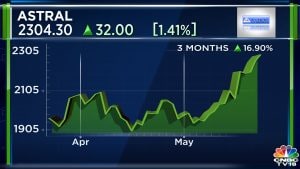

Also Read: Astral Q4 Results | Pipe maker declares dividend of ₹2.25, profit slides 12%

In terms of revenue projection, Baid said, “Last year, we suffered due to imports from China. But as the industry got regulated and BIS standards are in place, we are very confident now. We are expecting to close around 140 to 250 Crore this year.”

Further, Baid said, “We have ₹150 crore of net cash in the company right now. Also, we have taken approval from the board to raise additional funding in the company ₹ 800 crore. We got an approval in March. So we are also seeing some inorganic opportunities. No, of course, nothing is finalized now. But that’s the plan.”

Poly Medicure reported a 16.24% year-on-year (YoY) increase in net profit at ₹68.36 crore for the fourth quarter that ended March 31, 2024. In the corresponding quarter, Poly Medicure posted a net profit of ₹58.81 crore, the company said in a regulatory filing.

Also Read: NHPC Q4 Results | Net profit declines 16% to ₹550 crore, declares dividend

The company’s revenue from operations rose 23.21% to ₹378.07 crore as against ₹306.85 crore in the corresponding period of the preceding fiscal. The board has recommended a dividend of ₹3 per equity share (60%) of ₹5 each for the financial year 2023-24, subject to the approval of shareholders.

Shares of Poly Medicure Ltd ended at ₹1,649.15, down by ₹4.65, or 0.28% on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter