M&M focussing on production ramp-up to deliver vehicles faster

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Rajesh Jejurikar, Executive Director and CEO of Auto and Farm Sectors at Mahindra & Mahindra talked about the strong performance of the SUV lineup led by successful launches and high demand.

Rajesh Jejurikar, Executive Director and CEO of Auto and Farm Sectors at Mahindra & Mahindra discussed the company’s impressive quarterly performance and key growth drivers, such as sports utility vehicles (SUVs) and electric vehicles (EVs), among others, in an interview with CNBC-TV18.

Jejurikar expects mid- to high-teens growth in the SUV segment backed by successful launches and high demand.

As a leader in the SUV segment, the company wants to play a critical role in growing the electric vehicle (EV) segment, he said.

Over the next few months, he said, the focus will be on ramping up as much as possible to bring the waiting period down for customers.

These are the edited excerpts of the interview:

Q: Your guidance for FY25-26 looks good. On the sports utility vehicle (SUV) side, you have got an open order book of about 2-2.5 lakh vehicles. Tell us what will it be end the year with, and what is your expectation there because that is the big growth driver – utility vehicles and SUVs.

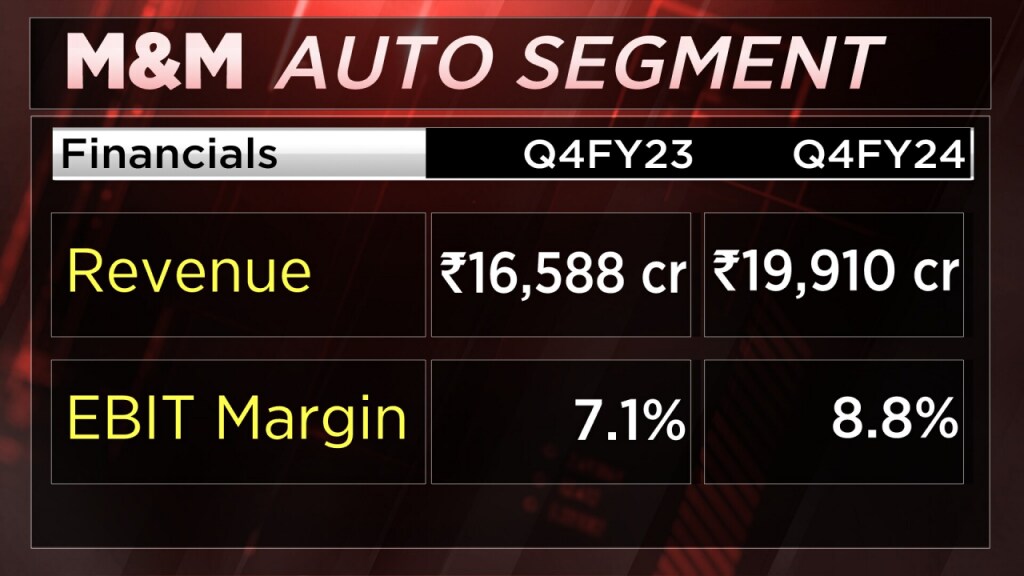

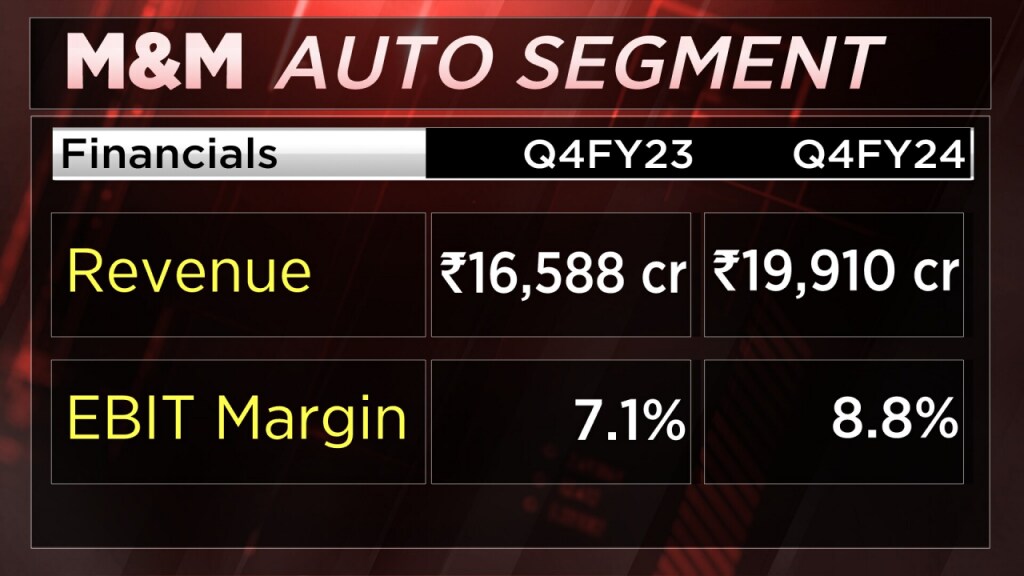

A: Yes, we do feel good about the results that we have put out for FY24 and for the quarter (Q4FY24) as well. The auto business has been a key driver of performance. We have seen some very strong momentum on the auto side, on the margin management but also on the performance of our SUV and light commercial vehicle (LCV) portfolio both. What is happening on the SUV portfolio is we have had some very successful launches. Thar did very well, the XUV700 did very well, the ScorpioN did well and we also had Scorpio Classic stay in momentum. On April 29, we launched the XUV3XO and that again has got a very exciting response. We opened bookings on May 15, and got bookings of over 50,000 in an hour. A lot of excitement in our showrooms even now. Our showrooms are running full and even on weekdays we are seeing a lot of excitement. It is a very strong value proposition with many exciting first in the category.

On the 200,000 plus booking number, 50,000 of that is what we have added through the XUV3XO, but the Scorpio portfolio remains very strong, and our existing products remain strong as well. We do want to bring the size of this open booking number down because we don’t think that is what customers want anymore. Over the next few months our focus will be on ramping up as much as we can to bring the waiting period down for our customers and on the 3XO in particular, we already have produced 10,000 vehicles and we will start deliveries on May 26th.

Q: Just a little more on the way this whole SUV portfolio is playing out for you. I think you ended the year with a market share of 18%. Where do you see this move considering the strong demand and also tell us about what the levers will be in terms of adding to the topline on the automotive segment? Is it going to be more volume led growth? What about pricing? I mean blended pricing on the SUV portfolio, what was the increase in FY24, and do you think you can push through more price increases because there is such strong demand?

A: Let me break this up. First, the SUV growth expectations we have put out for FY25 are in the mid to high teens – that is on the back of what we believe has been a good 3XO launch and a new Thar which will come later in the year. So, we do have two new products which will help us get to meet mid to high teens. So, we think this would be a much higher growth than what the industry will have in FY25. We would aim to gain market share; to put market share in context we look at it on two parameters, we look at revenue market share, we do that because our average selling price is way above the industry average. So, we do look at what our revenue market share is and we have been number one by way of revenue market share over the last many quarters including the last quarter. We are number two by way of volume market share and given the fact that we have a specialised authentic adventure ready SUVs, being number two in an industry, which is now 60% of the passenger vehicle market is very credible and we feel good about being able to be at that level of market share. Coming to the price increase question, we have taken some price increases through the year, managed our costs well, and that has helped us get a very good margin increase by way of our auto budgets. As you have seen Q4, we improved the auto margins to 8.8%. There is a very thin line on what is the right extent of price increase that any player should take, or any brand should take. And we always believe that it is going to be very well calibrated. We have to make sure we don’t lose our strength. Our strength is that we offer a lot of technology and a lot of features at a very good price, and I don’t think we are going to do anything to take away the basic brand strength, which is our ability to do that. So, short-term price increases can seem very good to have a bottomline impact, but over the last few quarters we have demonstrated our ability to keep growth going, keep demand strong, and to manage our margins through a combination of pricing and costs.

Q: Phenomenal growth is what you have seen in the SUV business. So, let’s focus on tractors though. We have an election, some kind of a slowdown is possible in the first half of the year. But for the year, the industry growth is what you are penciling in around is 5%. Will you outgrow the industry and if yes, what is it take your market share too because it skimmed off a little bit by 100 basis points at around 39.5%. Tell us more about the volume growth you are targeting and market share in the tractor segment?

A: Let me get the market share question out of the way first. So, for the full year, FY24, we grew market share by 0.4% which is 40 basis points. That is a very credible achievement given that we are already 42% plus kind of player. The Q4 is explained by a decision we took to moderate our level of stock and bring it down to appropriate levels with a stock correction call. It’s not a loss of retail momentum. In fact, in April, the tractor market share gained significantly and was at a level of over 46%. So, the quarter market share of Q4 is just an aberration based on the stock correction decision that we took; I am talking about the dealers’ stock correction. We have said that the growth for the industry will be 5% for the year FY25. There are several positive drivers at the moment, the most significant one being the monsoon forecast, which show a reasonably good spread, good timing and except a couple of states, the rainfall will be overall good. The other positive sentiment is the farmers terms of trade where output inflation right now is higher than input inflation and that really enables the sentiment of farmers to buy and start bringing cash in. We expect the second half to start picking up growth momentum. So, you did talk about elections. We don’t think elections fundamentally disrupt demand. It’s just an aberration, and there is a deferment. This is a buying season and hopefully June will see a recovery, but May does see some kind of a disruption because many people are busy with the election. So, second half of the year given all the positive parameters to see a positive growth based on how the monsoon start coming in, we may put out a new forecast in July but at this point of time, we are seeing the industry at plus 5, but many positive green shoots, if I could call it that.

Q: Let’s focus on the EBIT per vehicle – that as well has moved up. For autos it’s holding at around 92,000 mark and for the farm equipment space it is at around 215,000 which has moved up as well. Do you think you can better both these two numbers on a per vehicle EBIT that you are making?

A: Without giving any kind of guidance, let’s look at and answer this question with a demonstration of our track record. We have improved our EBIT margins significantly over the last few quarters. And the tractor EBIT margin continues to be strong in spite of a volume downturn, which really is an indication that we are doing many things to manage our costs well and balance between pricing and costs. Commodity prices have been a bit benign too and that has helped us on the tractor side in Q4. So, we would keep the balance right between growing margins, and keeping demand market share and volumes intact and that is what we would aspire to do that keep improving our margins with the right actions, high focus on cost management, appropriate pricing decisions which do not disrupt our ability to grow or lose the ability to gain market share.

Q: Let’s just talk about electric vehicles (EVs) because that is going to be the next is the new thing, maybe not completely new thing. But you have big investment plans over ‘25 and ‘27, you are looking at spending some Rs 37,000 crore, that is the investment you will make. It’s a big step up from what you have done between ‘22 and ‘24. I think you are saying that there will be some seven new electric vehicles, although you have spoken about this in the past. Could you talk to us a little bit about this? How is the thinking evolving, is this investment largely going to go into the electric vehicle sort of space and is the model there set because penetration here in India is still very low. So, there is a risk of being very early also. So, you got to kind of calibrate when some of these products are developed and hit the market. Globally as well in some of the big markets, EV penetration, maybe it’s just cyclical, has kind of stalled. Just your thoughts briefly.

A: First, just to clarify that Rs 27,000 crore is what we said is the total auto capex over the three years and Rs 5,000 crore was for the farm equipment business. Out of that Rs 12,000 crore was for the electric SUV portfolio. We believe that we, as a leading auto OEM in the country and with global aspirations as well need to make the right investments to create future ready product portfolio and we have been working on that over the last couple of years. A key part of that is creating a new in glow platform which is a born electric platform. We have showcased some of the products that we will bring out through 2025-2026. And we believe that as a leader in the SUV space we would want to play a critical role in growing the electric vehicle category. Categories grow when you have exciting products. We have demonstrated that on the internal combustion engine (ICE) SUV side. We believe that our exciting product offerings are what have been the key driver for us to gain volume, gain market share in the segment. We will be hoping and aiming to do the same with our EV portfolio. We would start launching products in a calibrated way starting in the quarter one of calendar 2025. The products really do have standout design, they are going to be very high on tech and software and are fun to drive. The electric is quiet, and they have excellent acceleration. So, we remain very excited about the opportunity. You also spoke about the EV penetration in India as compared to around the world. In India, it’s at a very nascent stage. Countries around the world are seeing some kind of slowdown after they have crossed 15-20% penetration. We are at 2% penetration. So, there is enough of an upside. We believe that by 2027, 20-30% of our portfolio will be electric SUVs. Given that the balance 70% or 80% will still be ICE, we continue to invest in exciting ICE products because that will still three years from now be a critical part of our portfolio. So, in a way we will have a very strong ICE and EV portfolio three years from now.

Q: Will there be any cannibalisation, sort of EV eating into ICE as the new launches roll out – that is a little natural to expect, right? How do you see both playing out starting that first quarter of next calendar year when we get the EV launches from M&M?

A: Of course, there will be some cannibalisation. We don’t rule that out at all and that is something we are comfortable with. As you shared, not necessarily at the date of launch, but as we have on our ICE product portfolio. We do build margins incrementally as we build volumes. We would expect on a steady state basis the margin per unit of ICE and the margin per unit of electric vehicles would be the same. Now not as a percentage because there is a denominator effect, but as a per unit margin, they would on a steady state basis like to like be comparable, in which case we won’t worry about cannibalisation, we give customers the choice and one of the reasons we have decided to sell both ICE and electric from the same dealership in the same showrooms is to give customer the choice of whether they want to buy our ICE portfolio or our EV portfolio and customers will choose based on their needs. A lot of our customers are multi car owners, don’t hence have to worry so much about range anxiety, have charging infra at home and in the office and of course the new portfolio has a very good range as well.

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter