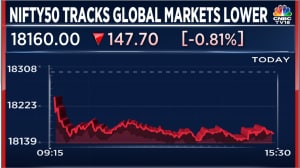

Trade setup for Nov 24: Nifty50 likely to stay rangebound in near term as monthly F&O series draws to a close

Summary

Trade setup for Thursday, November 24: A decisive rise past 18,400 is likely to open up a new all-time high on the Nifty50, say experts. Here’s what the technical charts suggest.

Indian equity benchmarks were poised for a positive opening on Thursday tracking global markets, a day after extending gains to a second straight session aided by buying interest in financial and healthcare shares.

Globally, optimism on a moderating pace and magnitude of COVID-era hikes in benchmark interest rates drove the gains, though investors stared at rising infections and the consequent lockdowns in China.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a small negative candle on the daily chart, reflecting the inability to sustain the highs, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He said one could expect more rangebound moves in the market soon, within the 18,400-18,100 zone.

Shah also said that long as the banking index holds the support zone of 42,500-42,400, it is in a buy-on-dips mode.

Key levels to watch out for

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| SUNTV | 1,695,000 | 497.1 | 1.59% | 286.90% |

| GNFC | 1,001,000 | 629.2 | 5.31% | 257.01% |

| GMRINFRA | 57,802,500 | 39.2 | 2.75% | 76.84% |

| TORNTPOWER | 1,585,500 | 544 | 1.88% | 72.94% |

| PNB | 126,736,000 | 50.65 | 4.54% | 69.50% |

Long unwinding

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| HONAUT | 15,930 | 40,477.30 | -1.29% | -85.31% |

| SBILIFE | 2,155,500 | 1,229.60 | -0.25% | -76.17% |

| PIDILITIND | 874,000 | 2,698.40 | -0.35% | -70.91% |

| SIEMENS | 863,500 | 2,767 | -1.59% | -70.54% |

| IBULHSGFIN | 26,204,000 | 124.9 | -0.75% | -70.40% |

(Increase in price and decrease in open interest)

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| DABUR | 5,543,750 | 551.95 | 0.97% | -74.39% |

| SUNTV | 7,599,000 | 493.8 | 1.13% | -70.25% |

| FEDERALBNK | 34,960,000 | 134.15 | 1.78% | -66.39% |

| CUMMINSIND | 1,028,400 | 1,356 | 1.55% | -66.10% |

| GODREJCP | 2,991,000 | 845.45 | 0.33% | -64.93% |

(Increase in price and decrease in open interest)

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| IBULHSGFIN | 14,448,000 | 126.15 | -0.51% | 124.72% |

| POWERGRID | 12,260,700 | 216.85 | -1.34% | 115.99% |

| IPCALAB | 713,050 | 865.8 | -0.29% | 105.47% |

| HONAUT | 12,870 | 40,912.70 | -0.90% | 101.75% |

| TITAN | 2,727,750 | 2,619.90 | -0.17% | 65.49% |

(Decrease in price and increase in open interest)

52-week highs

A total of 18 stocks in the BSE 500 universe — the broadest index on the bourse — touched the milestone on Wednesday:

| AEGISLOG | EASEMYTRIP | INDIANB | RCF |

| BANKBARODA | GESHIP | IRCON | RHIM |

| BANKINDIA | HAL | KALPATPOWR | VSTIND |

| CANBK | HUDCO | MAZDOCK | |

| CASTROLIND | IIFL | PNB |

52-week lows

On the other hand, 15 stocks hit 52-week lows:

| AMBER | JCHAC | ROSSARI |

| AVANTI | MFSL | SANOFI |

| DELHIVERY | MOTILALOFS | SHILPAMED |

| GLAXO | PAYTM | SIS |

| INDIGOPNTS | QUESS | SONACOMS |

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter

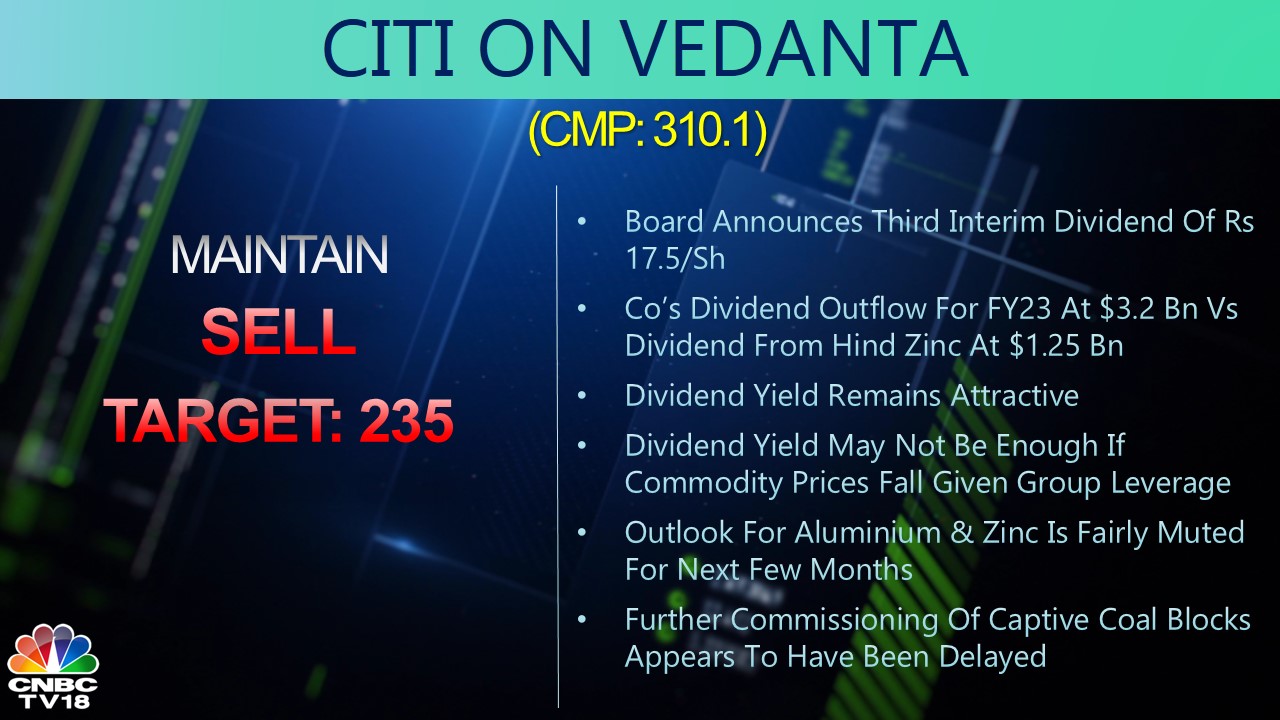

The stock has rewarded investors with a return of 10 percent in the past one month, a period in which the

The stock has rewarded investors with a return of 10 percent in the past one month, a period in which the