Maruti Suzuki likely to begin mass production of EVs for India in FY26: RC Bhargava

Summary

Maruti’s sales performance is largely being driven by the SUV segment, says chairman RC Bhargava.

Maruti Suzuki India will likely begin mass production of electric vehicles (EVs) for the Indian market only in FY26 (April-March 2025-26), said RC Bhargava, Chairman of the country’s largest passenger car maker.

In an exclusive interview with CNBC-TV18, Bhargava said the company’s best-ever sales performance is being driven largely by the sport utility vehicle (SUV) segment as “it will be a while before the entry-level segment revives”.

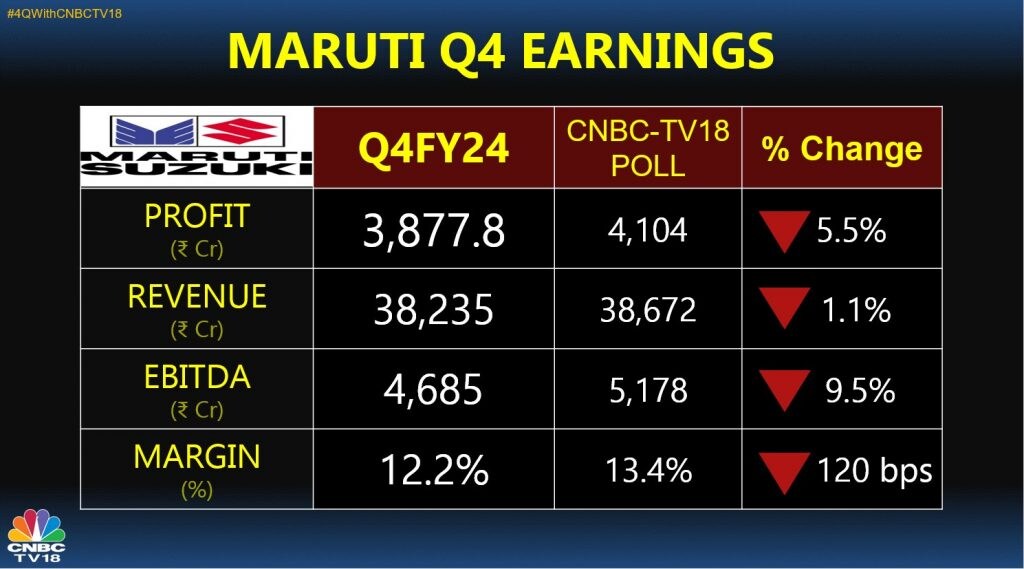

He does not foresee the need to raise product prices this year given the cost-cut initiatives are working in their favour. However, Bhargava feels it is “futile to try and predict margins in such uncertain times.”

Below are the excerpts of the conversation:

Q: Could you just run us through the performance across segments? Where have you seen the maximum strength, where have you seen pick up and what do you expect for FY25?

A: In the last two years what has been happening is that the SUV segment has been the fastest growing segment. The bulk of our growth has also come from that segment, whether in numbers, topline or profits.

The entry-level segment has not revived, in fact, it has gone down a bit. I think it will take maybe a couple of years more before we see any movement there.

Q: As we start a new financial year, what is your expectation for the SUV segment? Is it expected to remain as strong as it has been last year?

A: The trend will continue this year at least with the SUV segment leading the entire sales of cars in India. I don’t think there is any reason to think that there will be a change in consumer thinking or behaviour regarding what they want in this segment.

As I said the entry-level segment, the small car segment buyers are still not coming back to the car market. Amongst those who buy cars in the more expensive brackets, the sedans fundamentally are losing ground to the SUVs and I don’t see this trend changing.

Q: Could you tell us what Maruti’s plans, and ambitions are on EV side in FY25?

A: FY24-FY25 we are not going to have very much in the way of electric cars at all. The plan is to start production towards the end of this financial year and mass production follows a little bit after the start of production. Also, I believe the commitment is that the bulk of the first lot of production will be exported to Europe. So, the domestic market will get electric cars in numbers from Maruti only after April 2025.

Also Read | Maruti Suzuki will have to offer more discounts, says analyst after Q4 results miss estimates

Q: Commodity prices have moved higher recently, and forecasts show that across the board, commodities will remain pretty strong. Is the market strong enough to take price increases as and when it is required? What’s your sense? Can you improve on these margins? The Street in the fourth quarter was expecting a margin of about 13.5%. Will the direction of travel be in that 13% plus kind of range?

A: It is still not very clear what is going to happen to commodity prices. Some items are going up, but some items are not going up, they are still coming down. What the net result will be, I think you will have to wait a bit longer to see the impact of the Iran-Israel situation, and what happens to China.

If electric car sales continue to fall the world over, the total car market will come down globally. This will mean less demand for various materials and that could also have an impact on material prices. If the Yen continues to weaken against the dollar, it always helps us in terms of material costs. Other factors which are important are that as a company, we have to continue our efforts to reduce costs everywhere.

Also Read | Maruti Suzuki declares dividend of Rs 125 per share, the highest-ever in its history

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter