India’s Supply Chain & Logistics Resets

Summary

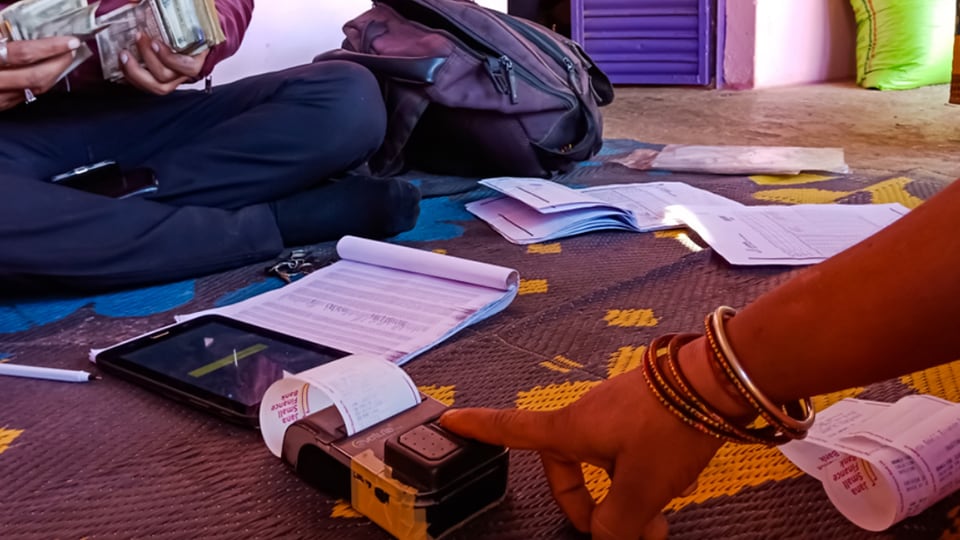

The challenges faced by India’s logistics and supply chain management were exacerbated by the Covid-19 pandemic. Although supply chains managed to recover sufficiently to provide the basic equipment needed for the economy to function, larger questions remain about the efficacy of our logistics infrastructure. Remedial steps must now be taken by corporates and companies across …

The challenges faced by India’s logistics and supply chain management were exacerbated by the Covid-19 pandemic. Although supply chains managed to recover sufficiently to provide the basic equipment needed for the economy to function, larger questions remain about the efficacy of our logistics infrastructure. Remedial steps must now be taken by corporates and companies across the board to ensure their supply chains remain unaffected by similar upheavals in the future, while delivering sustained value to consumers at the same time. On this episode of The Making With Shereen Bhan, we take a look at how these particular objectives might be achieved, and the abiding lessons of the pandemic for the logistics and supply chain industry.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter