Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Shares of Home First Finance Company India ended at ₹895.05, up by ₹16.30, or 1.85% on the BSE.

Affordable housing financier Home First Finance Company India Ltd on Wednesday (May 8) reported a 30.5% year-on-year (YoY) jump in net profit at ₹83.5 crore for the fourth quarter that ended March 31, 2024.

In the corresponding quarter, Home First Finance Company posted a net profit of ₹64 crore, the company said in a regulatory filing. The company’s revenue from operations increased 37.9% to ₹3,127.6 crore as against ₹2,268.4 crore in the corresponding period of the preceding fiscal.

Net interest income (NII), which is the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors, rose 22.4%, coming at ₹136.8 crore against ₹111.8 crore in the corresponding quarter of FY23.

Also Read: L&T declares final dividend of ₹28 per share with Q4 net profit beating estimates

For FY24, Home First Finance witnessed a surge in disbursements, recording a total of ₹3,963 crore for the fiscal year 2024, marking a year-on-year growth of 31.5%. The Asset under Management (AUM) for Home First Finance stood at ₹9,698 crore, reflecting a year-on-year growth of 34.7%.

Notably, housing loans continue to be the primary focus area for Home First Finance, contributing 86% to the total AUM. The Expected Credit Loss (ECL) provision as of March 2024 stood at ₹71 crore, resulting in a total provision to loans outstanding ratio of 0.9%.

Furthermore, the Gross Non-Performing Assets (GNPA) to Total Provision Coverage Ratio (PCR) improved to 50.9% in March 2024. Home First Finance’s total borrowings, including debt securities, amounted to ₹7,302 crore as of March 2024.

Also Read: Tata Power Q4 Results | Net profit jumps 15% to ₹895 crore, declares dividend of ₹2

Despite an increase in the cost of borrowings to 8.2%, representing an 80 basis points rise year-on-year, the company maintains a healthy liquidity position, with ₹2,055 crore in liquidity reserves as of March 2024.

Furthermore, Home First Finance demonstrates robust capital adequacy, with a Total Capital to Risk-weighted Assets Ratio (CRAR) of 39.5% and Tier I capital at 39.1% as of March 2024. The company’s net worth stood at ₹2,121 crore.

The results came after the close of the market hours. Shares of Home First Finance Company India ended at ₹895.05, up by ₹16.30, or 1.85% on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Shares of Navneet Education Ltd ended at ₹159.95, up by ₹2.55, or 1.62% on the BSE.

Navneet Education Ltd on Wednesday (May 8) said it has signed a definitive agreement with Venturi Partners, marking the divestment of a partial stake in K12 Techno Services Private Ltd for ₹225.2 crore.

“We have been informed by our subsidiary, Navneet Learning LLP, that it has entered into a definitive agreement with Venturi Partners on May 8, 2024, for divestment of its partial stake of 5.12% (on a fully diluted basis) in K12 Techno Services Private Limited for a consideration of ₹225.18 crore,” according to a stock exchange filing.

The agreement, finalised on May 8, 2024, sees Navneet Education’s subsidiary, Navneet Learning LLP, parting ways with 5.12% of its stake in K12 Techno Services.

Also Read: RBI tells NBFCs to ‘strictly adhere’ to cash disbursal limits as per IT rules

Navneet Learning LLP will retain a significant 14.35% stake in K12 Techno Services. Notably, Navneet Education continues to maintain a 93.0% stake in its subsidiary, Navneet Learning LLP.

Gnanesh (Sunil) D. Gala, Managing Director, Navneet Education, said, “Navneet Learning LLP has cumulatively invested ₹118.59 crore in K12 Techno, and today marks the 1st part exit of our stake which is in line with the thesis of value creation we had originally envisaged while investing in K12 Techno.”

EY acted as the exclusive financial advisor on this transaction, the company added. Shares of Navneet Education Ltd ended at ₹159.95, up by ₹2.55, or 1.62% on the BSE.

Also Read: Baba Kalyani expects defence vertical revenue to grow nearly 60% in FY25

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

With this milestone, the engineering giant also joined in the ultra-elite club which already include names like Reliance Industries, Tata Motors, TATA Steel, Tata Consultancy Services and Hindalco Industries.

Larsen & Toubro (L&T) on Wednesday, May 8, became the sixth private firm from the non-financial sector to report a full year revenue of at least ₹2 lakh crore. The company’s revenues for FY24 increased by 21% to ₹2.21 lakh crore, aided by execution of a large order book in the Projects & Manufacturing businesses.

With this milestone, the engineering giant also joined in the ultra-elite club which already include names like Reliance Industries, Tata Motors, TATA Steel, Tata Consultancy Services and Hindalco Industries.

While the largest company — Reliance Industries — clocked a revenue of Rs 9 lakh crore in FY24, the trailing 12-month revenue for Tata Motors and Tata Steel stand at ₹4.2 lakh crore, and ₹2.3 lakh crore, respectively. Bangalore-based gold retailer — Rajesh Exports is not included in the sample considering the nature of its business.

At ₹95,086 crore, revenues from international business constituted 43% to the L&T’s total revenues in FY24. The increased overseas revenue was largely driven by a ramp up in execution of multiple international projects.

The consolidated net profit of the company surged by 25% to ₹13,059 crore. However, the profit included an exceptional gain (net of tax) of ₹94 crore, attributed to the divestment of stake in L&T Infrastructure Development Projects Limited.

During the year, the company received orders worth ₹3.02 lakh crore at the group level, registering a robust year on year (Y-o-Y) growth of 31%. According to the company, orders were received from different segments like Onshore & Offshore verticals in Hydrocarbon, Metros, Urban Transit Systems, Airports, Roads & Bridges, Residential, Renewables, Transmission & Distribution and the Precision Engineering sectors.

Of the total orders, international orders stood at ₹1.63 lakh crore, which is 54% of the total order inflow.

However, the company expects a slowdown in order inflow during the current fiscal due to national election and global geopolitical tensions. The company garners a significant chunk of its revenue from government orders.

“We expect revenue growth to be at around 15% for fiscal year 2025,” Shankar Raman, CFO said post earnings call. He further added that orders momentum will resume in second half of FY25.

Shares of Larsen & Toubro have rallied as much as 47.2% over the last one year. In contrast, the benchmark Nifty50 has generated a return of 22.1% during the same period.

Also read: L&T declares final dividend of ₹28 per share with Q4 net profit beating estimates

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

This is the fifth instance over the last 20 years in which the benchmark closed at the same level without even a tick difference. After June 2005, the Nifty50 ended at the same level in May 2014, October 2016, and March 2017, according to data sourced from Bloomberg.

It’s quite abnormal for a benchmark index comprising large and most liquid stocks to close at the same level as the previous day’s close. However, Wednesday, May 08, was one of those days where the benchmark Nifty50 closed at 22,302.50 points, which is exactly the same level as the previous close.

Interestingly, this is the fifth instance over the last 20 years in which the benchmark closed at the same level without even a tick difference. After June 2005, the Nifty50 ended at the same level in May 2014, October 2016, and March 2017, according to data sourced from Bloomberg.

However, if one goes beyond 20 years, the same had happened twice in 1997 and thrice in 1999. Similarly, the index closed at the same level in January 2001 and October 2002 as well.

| Dates at which the Nifty50 closes at the same level | |

| Date | Points |

| 19-06-1997 | 1159.8 |

| 16-07-1997 | 1183.35 |

| 29-06-1999 | 1191.3 |

| 07-07-1999 | 1243.7 |

| 15-07-1999 | 1317.7 |

| 15-01-2001 | 1286.75 |

| 04-10-2002 | 948.2 |

| 01-06-2005 | 2087.55 |

| 14-05-2014 | 7108.75 |

| 27-10-2016 | 8615.25 |

| 31-03-2017 | 9173.75 |

| 08-05-2024 | 22302.5 |

|

Source: Bloomberg

|

|

The Nifty50 index, which comprises the top 50 companies in the country, was launched in April 1996. The index is a well-diversified yardstick including companies from various sectors so that it can reflect the overall market condition. The dominance of these companies is evident in their market valuation itself. These top companies contribute 45% to the NSE‘s total market capitalisation, which stands at ₹397 lakh crore as of Wednesday’s close.

The index has generated an annualised return of 11.6% since its inception with a dividend yield of 1.2%. The Nifty50 is computed using free float market capitalisation method and under this method, only those shares which are available for trade are considered for the calculation.

A total of 13 sectors form part of the index with companies from financial services alone contributing more than a third to the total weight. While Oil, Gas & Consumable Fuels sector has 12.7% weight, the information technology also enjoys similar weight at 12.3%.

Among the index constituents, HDFC Bank boast the highest weigh of 11.5%, which was followed by Reliance Industries and ICICI Bank. While RIL commands a weight of about 10% on the Index, the second largest private lender ICICI Bank enjoys a weight of 8.1%.

Also read: BSE Q4 Results | Stock exchange offers dividend of ₹15, net profit up 21%, revenue doubles

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The gross non-performing assets stood at 4.76% in the March quarter against 4.16% in the December quarter. Net NPAs came at 2.26% against 2.19% quarter-on-quarter. Shares of ESAF Small Finance Bank Ltd ended at ₹60.10, down by ₹0.36, or 0.60%, on the BSE.

Thrissur-based ESAF Small Finance Bank (SFB) on Wednesday (May 8) reported a 57.2% year-on-year (YoY) dip in net profit at ₹43.4 crore for the fourth quarter that ended March 31, 2024.

In the corresponding quarter, ESAF Small Finance Bank posted a net profit of ₹101.4 crore, the bank said in a regulatory filing.

Net interest income (NII), which is the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors, increased 18.4%, coming at ₹590.7 crore against ₹498.9 crore in the corresponding quarter of FY23.

The gross non-performing assets (NPAs) stood at 4.76% in the March quarter against 4.16% in the December quarter. Net NPAs came at 2.26% against 2.19% quarter-on-quarter (QoQ). Provisions stood at ₹226.2 crore against ₹137.8 crore QoQ and ₹82.3 crore YoY.

The results came after the close of the market hours. Shares of ESAF Small Finance Bank Ltd ended at ₹60.10, down by ₹0.36, or 0.60%, on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Sula recommended a final dividend of ₹4.50 per share. Its shares closed up 1% ahead of results. The Mumbai-headquartered company’s consolidated net profit fell to ₹13.6 crore in January-March from ₹14.2 crore a year ago.

Sula Vineyards, India’s biggest winemaker by revenue, reported a 4.2% drop in fourth-quarter profit on Wednesday, as mounting expenses overshadowed steady demand for its premium brands such as Rasa and Dindori.

The Mumbai-headquartered company’s consolidated net profit fell to ₹13.6 crore in January-March from ₹14.2 crore a year ago.

The rapid growth of restaurants and increasing incomes have nudged India’s rising well-to-do young crowd towards wine consumption.

Sula’s revenue rose nearly 10% to ₹131.7 crore in the quarter on a 14% jump in wine sales.

However, the cost of raw materials, which include grapes, sugar and yeast, surged nearly 9% to ₹88.8 crore, hurting its profit.

The winemaker’s earnings before interest, tax, depreciation and amortisation margin contracted to 25.3% from 26.4% a year ago.

The company’s wine tourism segment grew more than 31%.

“Wine tourism is a top priority and we are expanding fast,” CEO Rajeev Samant said in a statement.

Sula recommended a final dividend of ₹4.50 per share. Its shares closed up 1% ahead of results.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The company’s EBITDA rose 12.2% to ₹959.8 crore in the fourth quarter of this fiscal over ₹855.2 crore in year-ago period. Shares of Gujarat State Petronet Ltd ended at ₹294.20, up by ₹3.65, or 1.26%, on the BSE.

Gujarat State Petronet Ltd (GSPL) on Wednesday (May 8) reported a 22.2% year-on-year (YoY) increase in net profit at ₹663.1 crore for the fourth quarter that ended March 31, 2024.

In the corresponding quarter, Gujarat State Petronet posted a net profit of ₹542.8 crore, the company said in a regulatory filing. The company’s revenue from operations increased 5.9% to ₹4,522.2 crore against ₹4,270.1 crore in the corresponding period of the preceding fiscal.

The company’s EBITDA rose 12.2% to ₹959.8 crore in the fourth quarter of this fiscal over ₹855.2 crore in year-ago period.

Also Read: L&T declares final dividend of ₹28 per share with Q4 net profit beating estimates

The EBITDA margin stood at 21.12% in the reporting quarter against 20% in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation, and amortisation.

The board of directors of the company has recommended a dividend of ₹5 per equity share of ₹ 10 each (i.e. at the rate of 50%) for the financial year 2023-24.

The results came after the close of the market hours. Shares of Gujarat State Petronet Ltd ended at ₹294.20, up by ₹3.65, or 1.26%, on the BSE.

Also Read: BSE Q4 Results | Stock exchange offers dividend of ₹15, net profit up 21%, revenue doubles

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

All eyes will remain on banking stocks on Thursday as State Bank of India reports its results.

It is not very often that you get to see the Nifty ending at the exact same level it had closed the previous day. It happened on Wednesday. Not a smidge here, nor there. While the index did slip below the 22,200 mark at one point, it staged a recovery from the lows of 22,185. Autos and Metals contributed to that recovery.

PSU Banks too, after shedding nearly ₹1 lakh crore in market capitalisation across Monday and Tuesday, staged a rebound ahead of State Bank of India’s results on Thursday.

The India VIX though, showed no signs of cooling off. That index continues to remain above the mark of 17 and gained for the ninth day in a row. Wednesday’s no move day means that the Nifty remains 500 points below its recent record high of 22,794.

Thursday will not only be the weekly options expiry for the Nifty 50 contracts, but a slew of Nifty and broader market names will also be announcing their results.

Stocks like L&T, Tata Power, TVS Motor, Godrej Agrovet, Sula Vineyards among others will react to results reported after market hours on Wednesday.

On Thursday, stocks like State Bank of India, Asian Paints, BPCL among the Nifty names and HPCL, MGL, PNB, Quess Corp, Rain Industries, Relaxo Footwear among the broader markets will report numbers. In fact, HPCL and BPCL will also consider proposals to issue bonus shares.

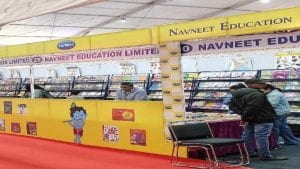

For Wednesday’s trading session, foreign investors continued to remain heavy sellers in the cash market, while domestic investors were net buyers.

The short-term texture of the market still remains on the weak side, said Shrikant Chouhan of Kotak Securities. He believes that the 50-DMA around 22,350 will be the key level to watch as till the time it remains below that level, the Nifty can retest levels of 22,150 – 22,100.

Nagaraj Shetti of HDFC Securities also agreed that the short-term Nifty trend remains weak but the index is showing signs of a higher bottom formation at around 22,200 levels. That remains the immediate support for the Nifty, while immediate resistance on the upside is at 22,500.

As long as the Nifty remains below the 22,400 mark, this short-term weakness will persist, as per Hrishikesh Yedve of Asit C Mehta Investment Intermediates. He expects the index to find strong support between levels of 22,100 – 22,000 and expects a consolidation between the 22,000 and 22,800 range.

The Nifty Bank continues to remain the underperformer and despite the support from PSU banks, the index failed to find any signs of a rebound as private banks continued to put pressure on the downside. The index did slip below the 48,000 mark intraday but found support near the crucial 47,800 levels. All eyes will remain on the index on Thursday as SBI reports its earnings for the March quarter. In five trading sessions, the Nifty Bank has corrected nearly 2,000 points from the record high of 49,974.

Kunal Shah of LKP Securities said that the next support for the index remains at 47,770, which coincides with the 50-Day Moving Average. 48,250 remains the immediate hurdle on the upside, above which, the index can move towards levels of 48,400 and 48,500.

The immediate swing support for the Nifty Bank is at 47,740, said Asit C Mehta’s Neeraj Sharma. In case the Nifty Bank maintains its support level, a relief rally towards 48,400 – 48,600 is possible.

These stocks added fresh long positions on Wednesday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Bharat Forge | 16.04% | 31.95% |

| Chambal Fertilisers | 4.26% | 19.93% |

| TVS Motor | 2.11% | 15.93% |

| Max Financial Services | 1.45% | 15.76% |

| ABB India | 4.17% | 14.75% |

These stocks added fresh short positions on Wednesday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| Pidilite | -4.63% | 39.70% |

| Voltas | -5.02% | 27.97% |

| Piramal Enterprises | -2.75% | 13.90% |

| Canara Bank | -3.36% | 13.72% |

| Asian Paints | -2.71% | 13.05% |

Short covering was seen in these stocks on Wednesday, meaning an increase in price but decline in Open Interest:

| Stock | Price Change | OI Change |

| Navin Fluorine | 0.74% | -12.15% |

| Gujarat Gas | 1.61% | -9.28% |

| Lupin | 0.86% | -3.47% |

These are the stocks to watch out for ahead of Thursday’s trading session:

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The EBITDA for FY23 rocketed 103% to ₹399.9 crore from ₹197.4 crore in the previous year, with the EBITDA margin expanding to 29% from 24%. Shares of BSE Ltd ended at ₹2,815.00, up by ₹7.55, or 0.27%, on the BSE.

India’s leading stock exchange BSE on Wednesday (May 8) reported a 20.7% year-on-year (YoY) jump in consolidated net profit at ₹106.9 crore for the fourth quarter that ended March 31, 2024.

In the corresponding quarter, BSE posted a net profit of ₹88.6 crore, the company said in a regulatory filing. The company’s consolidated revenue from operations surged 110.04% to ₹544.8 crore against ₹259 crore in the corresponding period of the preceding fiscal.

The BSE said it has registered an 86% YoY growth in net profit to ₹411 crore for the financial year 2023-24 from ₹221 crore in FY23. Also, the exchange recorded its highest-ever revenue of ₹1,618 crore, marking a growth of 70% from the preceding fiscal.

Also Read: Pidilite Industries declares dividend of ₹16 per share, misses Q4 profit estimates

For FY24, BSE traded 11.3 billion contracts in the equity derivatives segment, since its relaunch on May 15, 2023, generating a total revenue of ₹176 crore. The total number of transactions in BSE StAR MF grew by 55% to reach 41.1 crore transactions during FY24 from 26.5 crore last year, with BSE continuing a market share of 89%.

The consolidated operating EBITDA for FY23 jumped 103% to ₹399.9 crore from ₹197.4 crore in the previous year, with the EBITDA margin expanding to 29% from 24%, the company added.

“We have created a strong portfolio of businesses, a rapid pace of innovation, and a strategy that is well understood. Now it’s time to widen and deepen our existing product offerings, and we feel that we are on the right track,” BSE MD and CEO Sundararaman Ramamurthy said.

The exchange said S&P Dow Jones Indices LLC is in discussion with the BSE for divestment of its equity stake in Asia Index Private Limited, a 50-50 joint venture with BSE. “This will be an important area of focus in the coming year,” the BSE said.

Also Read: Gujarat Gas declares dividend of ₹5.66 per share as Q4 numbers beat estimates

The exchange has declared a final dividend of ₹15 per equity share of face value of ₹2 each. This is subject to the approval of shareholders at the upcoming annual general meeting.

The results came after the close of the market hours. Shares of BSE Ltd ended at ₹2,815, up by ₹7.55, or 0.27%, on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously