Indian smartphone market sees 15% annual growth in 2024 first quarter: Report

Summary

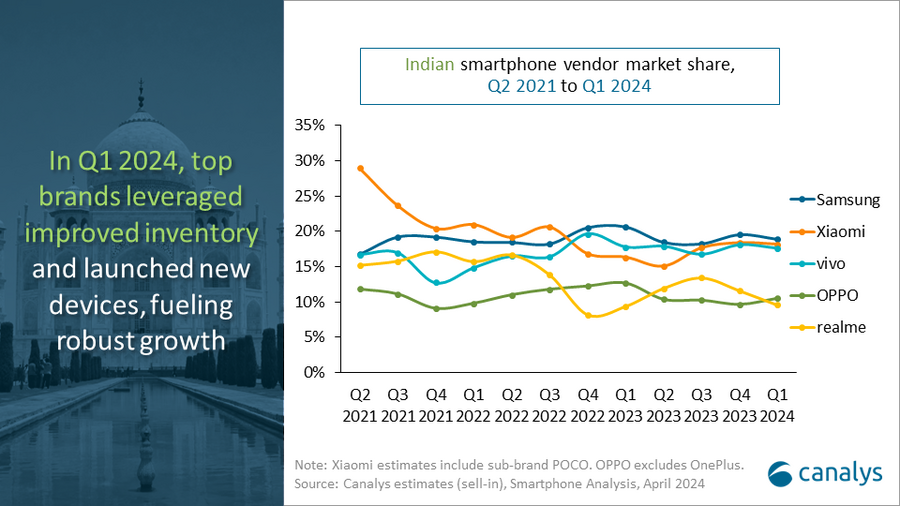

Samsung maintained its top spot with a 19% share and 6.7 million units shipped. Xiaomi was second, shipping 6.4 million units, primarily due to its ongoing mass-market 5G strategy. vivo claimed third position with 6.2 million units shipped.

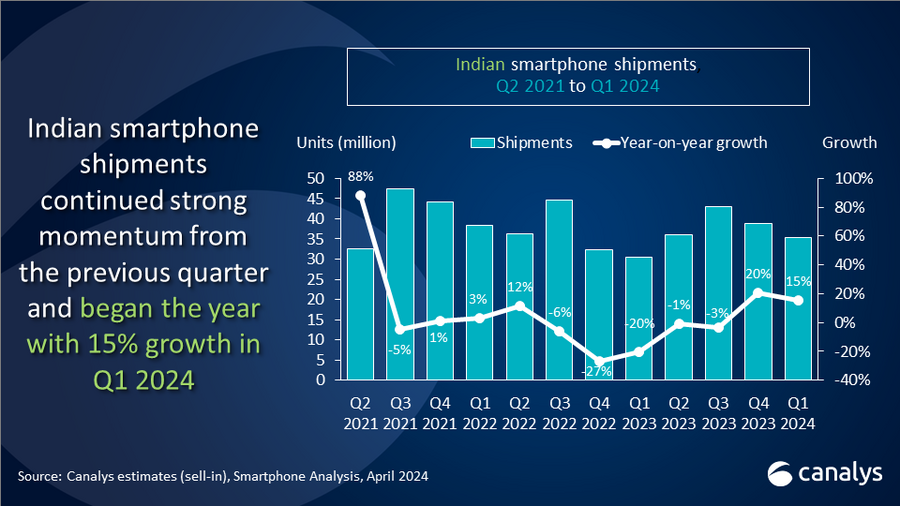

The Indian smartphone market saw a 15% annual growth in the January-March quarter of 2024, according to a report by technology market analyst firm Canalys. The firm attributes this growth to inflationary pressures, weak demand, and stockpiled inventory witnessed in 2023.

A total of 35.3 million units were sold in the country, out of which Samsung shipped 6.7 million, maintaining its top spot with a 19% share. Xiaomi was second, shipping 6.4 million units, primarily due to its ongoing mass-market 5G strategy. vivo claimed third position with 6.2 million units shipped.

“OPPO (excluding OnePlus) and realme completed the top five with shipments of 3.7 million and 3.4 million units, respectively,” Canalys stated in its report.

“While most brands achieved double-digit growth in Q1, brands outside the top five continue to challenge the market share of leading players,” said Canalys Senior Analyst Sanyam Chaurasia. “Vendors’ price correction and promotional strategies towards the end of Q4 2023 assisted inventory management in Q1.”

Chaurasia also attributed the growth to Republic Day sales in January, when brands leveraged promotions to push their latest offerings.

“Samsung’s latest flagship Galaxy S24 had a stronger volume than its predecessor, owing to lucrative pre-booking offers on upgrade value, Samsung Finance+ and extensive AI features marketing. Xiaomi saw a robust Q1 resurgence fueled by the Redmi 13C 5G and Redmi Note 13 5G series, along with POCO’s early launch of the X6 series. OPPO saw a modest decline, having streamlined its portfolio with fewer new releases in the mid-high price ranges,” Chaurasia added.

According to Chaurasia, Motorola, Infinix, and Apple achieved high double-digit growth, narrowing the market share gap from top players. “Apple’s growth was driven by the iPhone 15 models, which received multiple price cuts and promotional deals on e-commerce platforms,” he said.

“Mass-market brands are prioritising value-driven strategies in response to sluggish demand growth in the volume-driven segment,” said Chaurasia. “In Q1, brands such as Xiaomi, vivo, and OPPO introduced their latest models — Redmi Note 13, V30, and Reno 11 series — at a higher price compared to the previous generation models.”

Price hikes are also said to be expected to continue as operational pressures rise due to higher component costs, despite import duty reductions on a few parts.

| Indian smartphone shipments and annual growth | |||||

| Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

| Samsung |

6.7 |

19% |

6.3 |

21% |

6% |

| Xiaomi |

6.4 |

18% |

5.0 |

16% |

29% |

| vivo |

6.2 |

18% |

5.4 |

18% |

14% |

| OPPO |

3.7 |

10% |

3.9 |

13% |

-4% |

| realme |

3.4 |

10% |

2.9 |

9% |

17% |

| Others |

8.9 |

25% |

7.1 |

23% |

25% |

| Total |

35.3 |

100% |

30.6 |

100% |

15% |

| Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. Source: Canalys Smartphone Analysis (sell-in shipments), April 2024 |

|||||

Also read: Nokia sees stronger H2 after Q1 comparable profit grows less than expected

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter