Vedanta shares may rally another 40%; Brokerages bullish post Q4 results

Summary

Impressed by Vedanta’s fourth quarter results, a couple of analysts have even upped their Ebitda estimates. The mining major’s consolidated Ebitda in the fourth quarter came 4% above Street estimates, mainly led by higher margins in the oil and gas division.

Anil Agarwal-led Vedanta Ltd’s performance in the fourth (January-March) quarter of financial year 2024 came largely as anticipated across segments, said a few brokerages, who raised share price targets for the stock post March quarter results.

Impressed by Vedanta’s fourth quarter results, a couple of analysts have even upped their Ebitda (operational profit) estimates. The mining major’s consolidated Ebitda in the fourth quarter came 4% above Street estimates, mainly led by higher margins in the oil and gas division.

“We are jacking up Vedanta’s FY25E/26E Ebitda by 18%/23% factoring in higher commodity prices and lower CoP (conformity of production) in aluminium. We believe the company’s debt peaked out in FY24,” said Nuvama Institutional Equities while raising its target price on the stock to ₹542 from earlier ₹394.

Kotak analysts have also increased their FY25 and FY26 EBITDA estimates by 14% and 17%, respectively. “We have increased consolidated Ebitda by 14%/17% for FY2025/26E mainly led by higher aluminum (6%/8%) and zinc (8%/5%) price forecast for FY2025/26E.”

Kotak maintains a ‘Sell’ rating on Vedanta due to rich valuations but has increased its target price to ₹320 per share from ₹255 apiece earlier on higher earnings.

For brokerage firm Motilal Oswal, Vedanta’s March quarter performance came largely in-line with expectations. Extending the maturity of bonds at the holding company by three years offers the company adequate liquidity comfort in the near term, Motilal said adding that the capex plans are progressing well, leading to further cost savings.

Motilal has marginally increased its Ebitda estimates by 4% in FY26 to incorporate the improving outlook. The brokerage has a ‘Neutral’ rating on Vedanta with a revised target price of ₹360 per share.

Rising commodity price to bolster growth

The outlook for financial year 2025 looks good on solid commodity prices and focus on cost reduction.

Analysts at Nuvama believe that Vedanta is best placed to ride rising commodity prices. Rising commodity prices not only improves cash flows, but open up the potential of increasing the valuation multiple too as debt overhang shall subside significantly.

Despite marginal delays, the brokerage said that Vedanta will complete its alumina, aluminium, and international zinc expansion during FY25, which will provide visibility around volume growth and cost reduction FY26 onwards.

As per Kotak, Vedanta’s expansion projects in the aluminum division—smelter, refinery and captive coal mines should complete in stages over the next 12-18 months, a key growth driver over FY25-26 estimates.

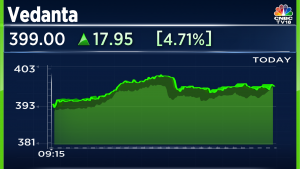

Shares of Vedanta Ltd. were trading 2.83% higher at ₹391.85 apiece today. In the last one month, the Vedanta stock has gained nearly 46%. In six months, the stock is up 85%.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter