UCO Bank targets 12-14% credit growth in FY25, margin of around 3%

Summary

Ashwani Kumar, MD & CEO of UCO Bank also discussed the bank’s targets for NPAs, credit deposit ratio, and fundraising plans.

UCO Bank is targeting credit growth of around 12-14% and net interest margin (NIM) of 2.9-3.0% for the the current financial year (FY25).

The bank had a good January-March performance with a jump in margin and improvement in asset quality.

Ashwani Kumar, MD & CEO of UCO Bank expects gross non-performing assets (GNPA) at around 2.75% and net NPA of 0.9% in FY25.

Kumar said while the bank is well capitalised, the board has approved a ₹400 crore fundraising to help bring down the government stake in the bank.

“Since our government holding is 95%, to bring it down to 75% we have taken Board approval and after the approval of the AGM, we will go to the market at an opportune time, and in multiple tranches, not at one go,” he said.

Below is the verbatim transcript of the interview:

Q: What are your targets for FY25 when it comes to loan growth when it comes to names, and at the same time when it comes to your asset quality?

A: The target for the current year’s credit growth will be around 12-14%; last year also did a growth of around 16%. So, 12-14% growth target will be there. Net interest margin (NIM), we have given a guidance of 2.90-3% and we will continue with that guidance for this year. We achieved an NIM of 3.12%. Now the NIM will continue to be around 2.9-3%. So far as asset quality is concerned, we have already improved our asset quality to 3.48 from 4.78 last year, and we will try to make it to 2.75 in this year, and net NPA, our endeavour will be to bring it further down from 0.89%.

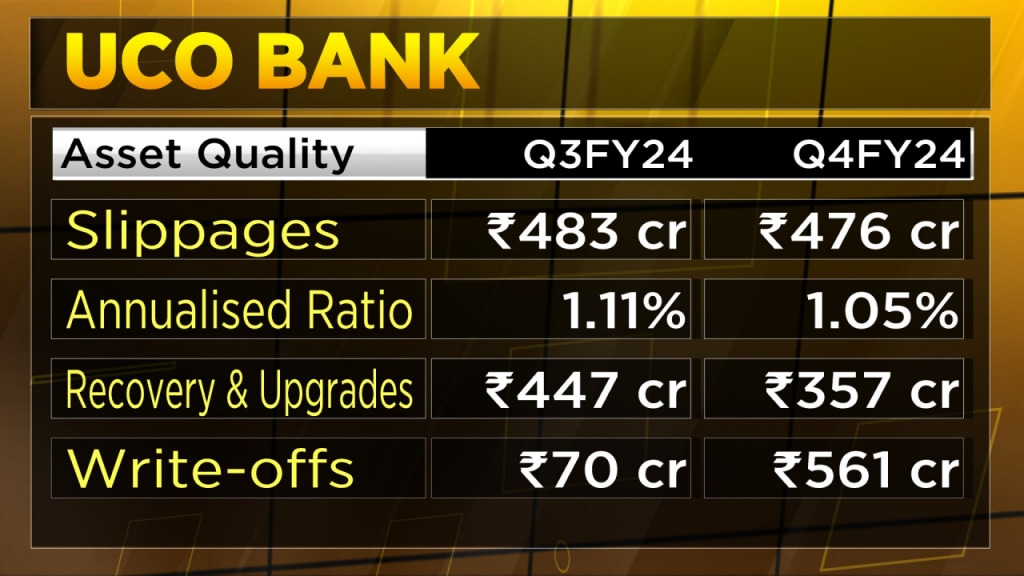

Q: Two-part question on the asset quality. Slippages ₹476 crore is marginally lower as compared to ₹483 crore last quarter. What is your outlook on slippage going ahead?

A: If you look at our slippages in the year 2022-23, it was around 1.70% over slippage ratio, and this current year our slippage ratio is around 1.10% and our endeavour will be to bring it further down maybe somewhere around 1% slippage ratio in this year and we are targeting upgradation of around 25% of the account which slipped last year.

Q: Slippages, you expect this figure to probably continue. Are you guiding for maybe ₹470-450 odd crore in the next couple of quarters. Will it rise, will it reduce. What is the quarterly run rate?

A: It will be in the same range because the book is also growing, annual percentage will come down and slippages will be in the same range expectedly though we don’t have any large chunky accounts where we expect some slippage, but there are certain agriculture accounts, MSME accounts which are slipping and then getting upgraded also. So, slippages will be in this range.

Q: I wanted your thoughts on your credit deposit ratio. That has increased. What is the number that you would be comfortable with going forward?

A. If you look at our CD ratio, it was around 64% in the last financial year and now it is around 71%. Our endeavor will be to reach 75% CD ratio during this year.

Q: For the fundraise, you have an approval for about ₹400 crores and multiple modes are open to be explored. Could you give us a sense of the time at which you are looking to raise funds? What could be the amount? And what will you be looking at; a QIP or an FPO?

A. If you look at our CRAR (capital to risk-weighted asset ratio), it is around 17%. As far as the growth part is concerned, the bank does not need further capital raise. But since our government holding is 95%, to bring it down to 75% we have taken Board approval and after the approval of the AGM, then we will go to the market at the opportune time in multiple tranches, not at one go.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter