Tata Consumer CEO discusses revenue targets, new businesses, and more | Q&A

Summary

Sunil D’Souza, MD & CEO of Tata Consumer Products, also discussed the company’s strict nutrition and product quality standards given the increasing monitoring by the country’s food regulator.

Sunil D’Souza, MD & CEO of Tata Consumer Products, says the integration of the two recently-acquired businesses, Organic India and Capital Foods, is on track. “Generating value out of that is priority number one.”

In a conversation with CNBC-TV18 following the company’s fourth quarter results, D’Souza talked about the company’s strict nutrition policy and top-notch product quality.

He also outlined the segment-wise revenue targets for the current financial year (April to March 2024-25).

Below is the verbatim transcript of the interview:

Q: What is the key guidance for FY25 and the scalability of the acquisitions etc?

A: Coming specifically to our targets for next year, the single biggest important objective is we have done two acquisitions. One, we closed during the last financial year and the other we closed just this month, which is Organic India. Integrating them, we have said that we will integrate it in 100 days, and that is on track. Capital Foods’ frontend-backend is done and now it is for value creation. Organic India, we are starting on the frontend-backends. Again, we will complete the whole integration in 100 days. Generating value out of that is priority number one. Priority number two would be jump-shifting the volume growth in India, specifically, focusing on beverages.

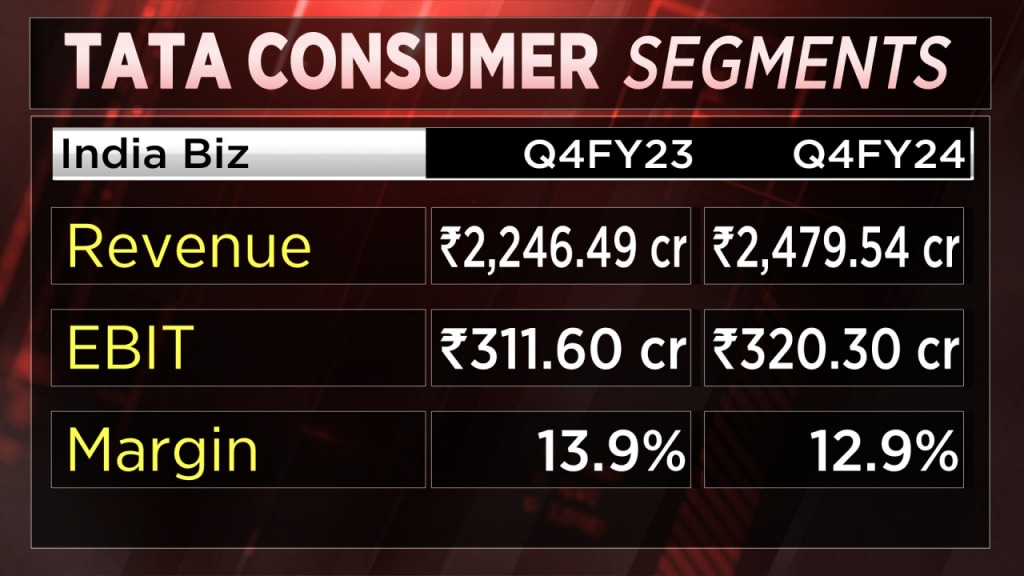

Salt, we have always maintained, that about 5% will be the secular long-term growth in volume, we are at four. So almost there. The growth businesses, we have said now with Capital Foods, and Organic coming in would be 30% of the portfolio, delivering a 30% growth, I think focusing on that. We have said 15% EBITDA (earnings before interest, tax, depreciation, and amortisation) is par now, and we have got to improve from there.

We have got to continue to improve our working capital days, we have said double-digit topline growth and EBITDA ahead of the topline. RoC last year was a very pleasing figure. Last quarter, we upped by 380 bps. Continuing to work on that number. Most importantly, continuing to fuel all the pieces that will drive growth, advertising and promotion, innovation, distribution, and most importantly building out that talent for the next leap forward.

Q: So, let’s get a little more specific about the numbers. You said double-digit revenue growth is what you are targeting. If you could tell us what does that mean? Is it mid-teens, low teens, low double-digit, or above 20% sort of growth that you are targeting? If you could break that up for both India as well as international and in India as well, what would beverages grow at, and what would food grow at?

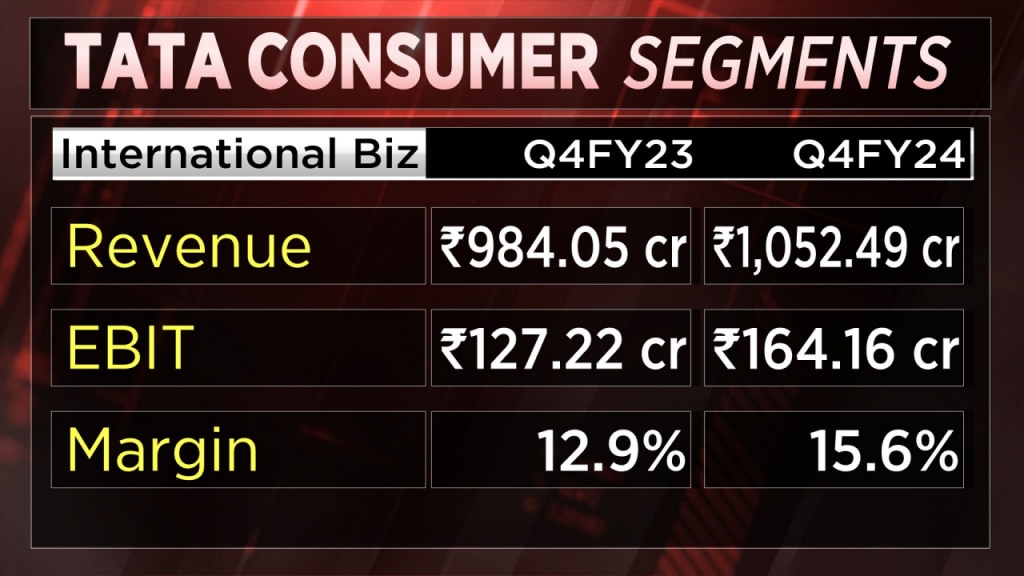

A: So, beverages, if I take the base core business, volume at about mid-single digits, a couple of basis points on value. Similarly for salt, mid-single digits, and a couple of points on value. The growth businesses, which now account for 30% of India growing at 30%, would be the guidance. And our international businesses, we said mid to high single-digit growth while continuing to deliver top-notch margins. That would be broadly what we would look at.

Q: On international, what kind of margins are sustainable over the next year? And you said 15% is your benchmark for the entire year. Last quarter, you did about 16.1%. So, should we see an improvement of upwards of 16% in FY25 given the scale-up of your acquisitions too?

A: For the full year we have delivered 15.3%, I would target upward revision from 15.3 for the full year. There will be a little bit of ups and downs, but broadly we are very confident that 15.3 is the base now and we will continue to improve from there.

Also Read | Tata Consumer Products Q4 Results | Net profit dips 22.5%, misses estimates

Q: Let’s talk about Capital Foods. The two months that were integrated in this financial year did about ₹80-85 crore of revenue. If we were to look at it being now available in 95% of your overall distribution chain, it amounts to about ₹100-120 crore per month in terms of revenue. So, are those targets that you are looking for in FY25 when it comes to Capital Foods, around ₹1,000-1,200 crore on the topline? For Organic, what is the revenue target for this year?

A: For Capital Foods, we have delivered about ₹85 crore of topline for the first two months, but you have to also remember that for the first two months, there was a lot of integration work in process. We re-indexed a lot of channel inventory, we restructured a lot of systems and processes out there. Now going forward, as I said the focus will be on value creation, distribution, expansion, fueling, advertising and most importantly, they have got to one very strong brand and one decently strong brand – Ching’s Secret is strong and Smith & Jones, we have got to polish it a bit. However, a good innovation pipeline for both of these expands the innovation pipeline. On the Organic India piece, the critical piece, as I said was only 24,000 outlets; getting it to our distributors, work has already started, expanding the distribution and jump-shifting the topline. I think those would be the big focuses.

Q: If around ₹1,200 crore, which is about ₹100 crore per month possible for Capital Foods in FY25 and what is the aspirational revenue target for Organic in FY25?

A: I think about ₹650-700 crore is where Capital Foods ended for the last year given all the upheavals of the fact that they were in the market for a long time and then we had a lot of channel correction, etc. I would say significant double-digit growth on Capital Foods is what we would be targeting. Organic India, including international delivered about ₹350 crore of revenue. Again, a substantial double-digit increase from there is what we are targeting.

And you are right. When these two businesses come in our percentage, EBITDA margins should improve significantly. Capital Foods, already in the first two months we are seeing gross margins, more or less where we expected them, which is a significant increase to what we have on our portfolio. Organic India goes one step further, especially with a supplement portfolio etc.

Q: When we spoke around the same time last year, you had given a guidance of ₹1,000 crore for FY24 for NourishCo because of seasonal issues, etc. You are short of that, at around ₹825. What is the realistic target for NourishCo in FY25?

A: NourishCo remains on a very strong wicket. We have added about 50% more outlets from where we started for the year. Our innovation is now 20% of their revenue. We had guided for ₹900-1000 crore for the year but ultimately fell a little bit short because it is a very anecdotal piece in India/ Especially in the north, summer starts when Holi starts and Holi was about 20 days behind where it was last year, and this will be a good summer so far. So, I would expect topline growth to be significant; 30% plus would be the guidance for us going forward.

Q: For Starbucks, the fourth quarter growth was at 7% versus the full-year growth of 12%. Are you expecting it to pick up at some point?

A: If you look at the QSR (quick service restaurant) space in India, it runs through a slightly rough patch in Q3-Q4. Overall traffic has been the issue not as much as the average ticket. But we remain focused on the longer-term opportunity for Starbucks in India. Yes, overall, revenue growth was a bit tepid, but the good part is that March was better than February in terms of traffic in outlets and April so far has been better than March. So, we remain confident that this business will come back.

Q: With 1,000 stores by the end of FY28, would it make sense to list Tata Starbucks separately outside of TCPL?

A: Right now, our task is cut out to deliver those 1,000 stores by FY28 and a profitable business at that. We remain focused on that. We will make decisions on what we want to do in the long term at a later point in time.

Q: We have seen a lot more news around spices. Food regulators coming in for prepared dishes, etc., the quantum of sugar. Would you have any comment on this to make from where you stand at the portfolio level? Would there be a risk for some of your products on this as well?

A: A couple of points on that. As the economy develops and consumers become more aware, we would expect regulatory standards to go up. So, it’s no surprise that it is starting to pick up. Second, we are a Tata company, we are very clear that we will follow regulations. Most importantly, we have set ourselves a clear nutritional policy in all our products, making sure that what we offer to consumers is in line with long-term aspirations while making sure that our quality standards are top-notch. Tata name denotes trust, and we will deliver that trust to consumers.

For more details, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter