Mphasis CEO: AI, customer experience, and data modernisation dominate deal pipeline

Summary

Nitin Rakesh, MD & CEO, and Manish Dugar, CFO of Mphasis, spoke with CNBC-TV18 about the company’s deal pipeline, changes in client spending trends, and strategy for future growth.

Nitin Rakesh, MD & CEO, and Manish Dugar, CFO of Mphasis, spoke with CNBC-TV18 about the company’s deal pipeline and client spending trends.

Rakesh outlined that the majority of deals in the pipeline are concentrated in four key areas.

Firstly, there is a significant emphasis on AI-led operations aimed at infusing advanced technology into both IT and business processes.

Secondly, transforming customer experiences and optimizing contact center operations are pivotal, especially for large banking clients who manage extensive service operations.

Thirdly, there’s a rising demand for data modernisation and data engineering, essential steps for any enterprise looking to implement AI solutions effectively.

Lastly, modernisation across the board is gaining traction, with an increased focus on accelerating cloud and data projects using new technological platforms.

Below is the verbatim transcript of the interview:

Q: All numbers are bang in line – revenues, margins, etc. But deal wins is what I want you to talk about to start. You took about $180 million in new deals, and you described by saying that about 75-80% of this was from new-generation services. So, talk to us a little bit about that and there has also been a little bit of concern whether deal win momentum is starting to slow down a bit, and how this will look in FY25.

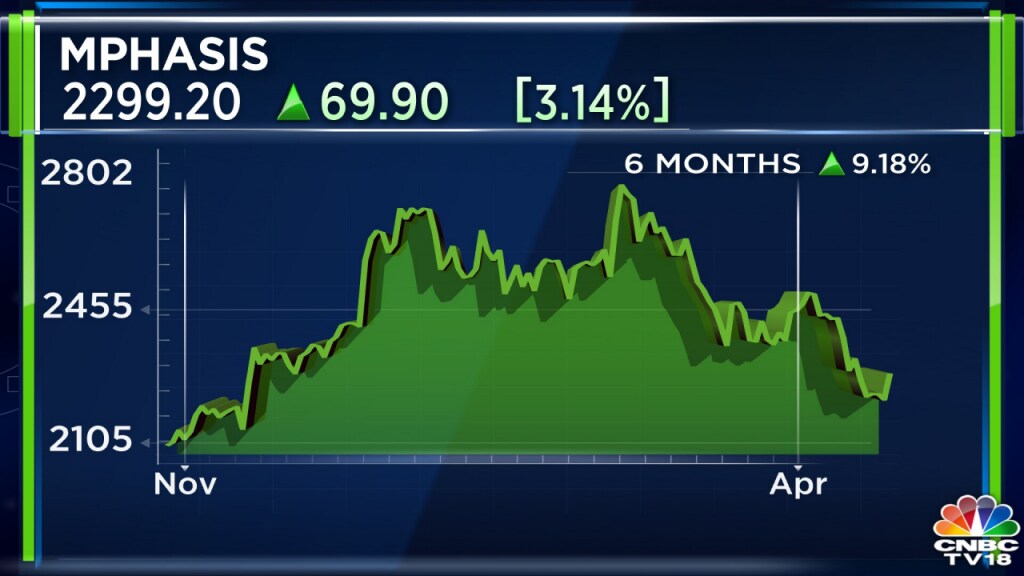

Rakesh: For the full year, trailing 12 months (TTM), FY24 over FY23 we had about 5% expansion in total contract value (TCV), all net new. We had a bumper Q1, $700 plus million in deals in that quarter. Obviously, as that happens you rebuild the pipeline through the phases and start converting. So that is one little nuance. We are still consuming a lot of the order books that we sold in the preceding three quarters, in addition to $177 million we sold this quarter. Second, there is an interesting nuance that we have noticed in the last three-four months. The shorter duration, zero to 10 million deals have picked up quite nicely, in fact, on a dollar basis probably the highest we have seen in the last four quarters – that is an early sign for two things, one, some discretionary spending coming in, these are quick bursts deals that convert to revenue very quick and give you, in a year, growth opportunity versus a large deal that is typically a 3-5 year deal and sometimes takes up to 6-12 months to ramp up to. So, that is the nuance that you have to keep in mind as you think about that number per se., we are pretty confident that on a TTM average basis, we will probably revert back to that kind of an average number over the next four quarters as well. Obviously, there will be some lumpiness in some of the larger deals between various quarters of FY25. So, I think that is kind of where we are. We definitely are very pleased with the performance of Q4. It’s a great way to start a new financial year.

Q: Is there a way to guide on the deal wins for FY25?

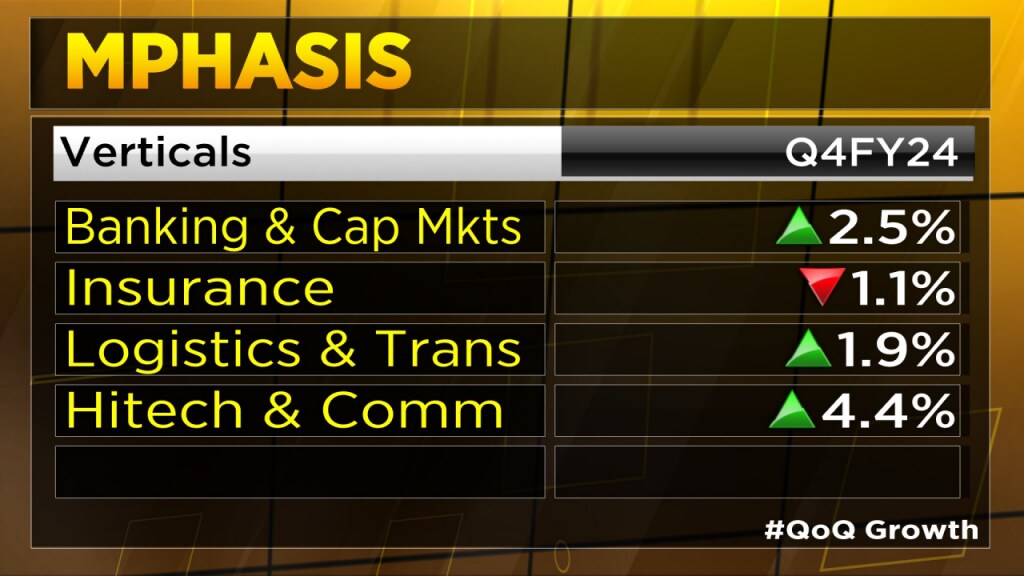

Rakesh: It’s a little difficult to guide on a quarterly or a full-year basis except that as I mentioned that pipeline is up about 5% on a sequential basis. So that should give you a sense and bulk of the deals in the pipeline are in four major areas. There is a strong focus on artificial intelligence (AI) led ops, which is how do you infuse tech into running operations, both IT and business, customer experience transformation sits right there, and contract centres is a very large focus area for a transformations standpoint right now, especially for large banks because they have some really large operations in that space. We have also seen very big uptick in data modernisation, data engineering deals because that is kind of a precursor to every enterprise trying to implement an AI solution. And finally, I think modernisation is starting to pick up steam because clients are fading out if there is a way for them to accelerate some of their programs around cloud and data using some of these new tech platforms because they can also impact your operating costs and you can reallocate costs from one program to the next. So, necessarily doesn’t require additional funding.

Q: You said smaller and shorter duration deals have picked up, what number was that?

Rakesh: Zero to $10 million; basically, less than $10 million deals.

Q: Is this good news, is this bad news, does it mean that people do not want to commit to larger spends?

Rakesh: I would say, in light of pipeline expansion and large deal expansion in the pipeline, I do not think it is bad news. I think it’s mostly good news because I am reading that as, and we have seen that actually play out in Q4 as well as in the current quarter that gives us the opportunity to see some early signs of quick spend or discretionary spend, which means you do not have to commit to a three year programme; you have got a $10 million funding or a $5 million funding, you want to implement a certain program and you going to get it done in the next 6-9 months or the first phase of the programme. So, it is a combination of a little bit more confidence on the client’s right to take programmes that necessarily do not require a large outlay and by definition, consumption ability for these in the shorter duration is higher. So broadly, for us, at least we are seeing it as a positive.

Q: The pipeline between BFS and non-BFS – how is it looking right now? Where are you seeing the maximum amount of recovery come through in terms of orders?

Dugar: On an overall level pipeline has grown by five percentage points, and especially if I look at the BFS segment, there also we have seen 19% growth. From a contract win perspective, we had called out that this quarter will be a quarter of growth led by BFS and TMT. And as Rakesh mentioned other than the fact that the overall size of the TCV and the pipeline has become bigger, we have also started seeing green shoots in terms of short-term deals and shorter deals, which contribute a lot more to the revenue in the immediate years. So, overall basis, BFS has started showing signs of positive from where we were maybe a couple of quarters back.

Q: On the margin front what is the guidance right now for FY25?

Dugar: On a reported basis, we will be in the range of 14.6% to 16% and given that acquisitions are impacting almost by 1.1 percentage points right now, that translates to a range of 15.7 to 17.1% versus the 15.25% to 16.25% range that we are given for the last year. This is in keeping with our philosophy of margin being in a narrow and stable band while investing for growth with a northward bias as the gains came.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Click here to follow Lok Sabha Elections 2024 Phase 2 Voting Live updates

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter