Cyient MD says there are delays in client spending but no project cancellations

Summary

Krishna Bodanapu, Executive VC & MD of Cyient said the company is cautiously forecasting high single-digit revenue growth for the current financial year (FY25).

Cyient’s Executive Vice Chairman and MD, Krishna Bodanapu, says there are some delays in discretionary spending by clients, but the company has so far not faced any project cancellations.

The Hyderabad-based IT solutions provider reported a 28% sequential growth in profit at ₹197 crore for the January-March quarter.

Bodanapu stated that the company is cautiously forecasting high single-digit revenue growth for the current financial year (FY25).

Read the verbatim transcript of the interview below:

Q: The high single digit growth guidance that you have given out, it has disappointed the street. Can you tell us because your FY24 constant currency revenue growth was around 12.6%, that too missed your own guidance of 13-13.5%? Are we staring at another year where perhaps you could see slower growth than the previous one and what are the big trends looking like now?

A: The guidance that we gave was based on the conditions that we see in the market. In the market, generally in the industries that we are in, calls for this prudence. We did grow 12.5%. Last year, of course, there was an acquisition benefit that was there in that number. But looking at what the market looks like and just being prudent about it, this is the number that we have a line of sight to deliver. Let me be candid about that to say that we have a line of sight to deliver this number. Therefore, it is what we are looking at for the year. Talking about trends, there is a bit of weakness in some sectors, for example, the communication sector has not fully recovered, and you would see that in various results that have come out. The aerospace sector, we had seven quarters of growth, but we had one flat quarter this quarter. But that is expected. We will see some decent growth for next year there. But the big wildcard for us is how the communication sector will recover because having said that there are again some good sectors where we are seeing growth, we have a sector that focuses on sustainability-related industries, that is doing very well, the automotive sector, though small for us, is doing very well. We are well-positioned in the semiconductor sector. But there is still a bit of a challenge in the communication sector, which is about a third of our business. Taking all this into account we think that this is a prudent target for us.

Q: You also said that the conditions in the market call for prudence. Can you just elaborate a little more on that in terms of clients’ spending, how is it now, is it worse off than what we saw 6-8 months ago, are orders getting deferred? You gave us a sectoral view, but any more qualitative views on client spends etc?

A: In general, there is a bit of a delay in some of the spending. The good news is that we still have not seen any cancellations, or we have not seen any stoppage of an existing project or things like that. But it’s a bit sectoral so I will not get into the detail here. But, in general, customers are cautious; customers in the sectors that we operate in are a bit more cautious than they were, say, 6 to 8 months ago. They are still talking about technology deployment, and the capabilities that we do well in the projects that we can support. I would say there was not a mass uncertainty, if I may use that word, but there is definitely a bit of trepidation in certain sectors where people do not necessarily want to make the spend right now or the spend decision. But having said that we are still seeing the conversations leading up to the spending decision and we are quite confident that during the year, of course, assuming that macro remains more or less as it is, during the year we will start the order flow again holding up quite nicely.

Also Read | Cyient Q4 Results | Net profit surges 28.5% over third quarter

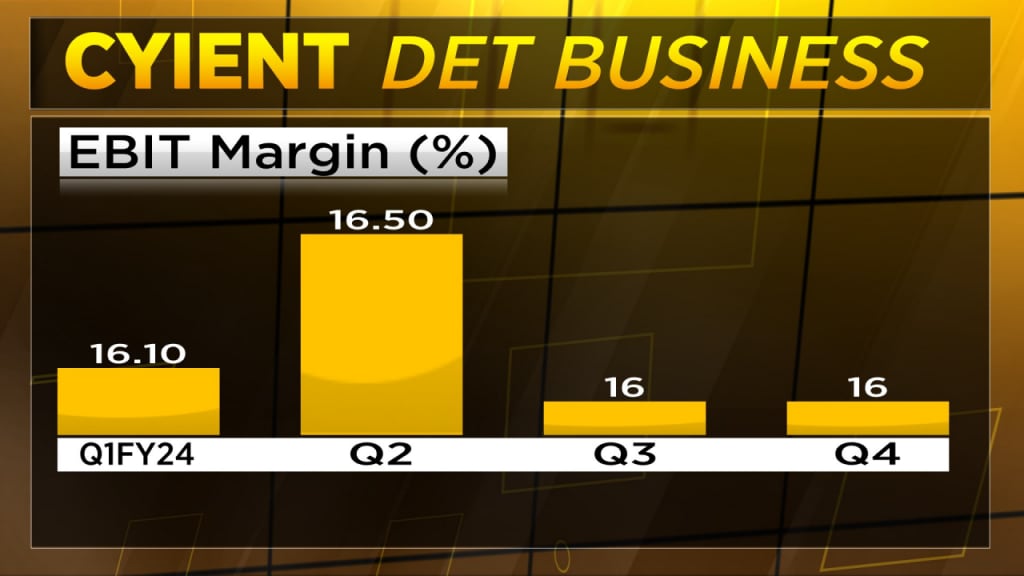

Q: We were talking to the TCS CEO earlier and we were talking about the dichotomy, the economy seems to be all the data points, the macro stuff that you spoke about is all looking good and as you were saying, even for TCS, and you were also saying that people are delaying in making those decisions, right? So, I don’t know if you want to address that dichotomy. If you do, please go ahead. But I also want you to address the digital, engineering, and technology (DET) margin. I mean, the guidance for FY25 is 16%. You have laid out aspiration to get to about 18% and 20% over the medium and long term. So, what happens to that, is that still on track?

A: I think that’s an interesting point to bring up – the dichotomy and we are definitely seeing that and some of the dichotomy is also because of the relative nature. If you look at how the economies were coming out of COVID, we were seeing a lot more spending because there was a bit of pent-up or delayed spending from 2020-21 timeframe. So, in that sense in the broader technology sector you do feel a bit of dichotomy. But also, I would say the good news still is there is a lot of technology evolution that is happening, and this technological evolution means that people will have to put in that money, that resource behind implementing the new capabilities, etc, to ride the technology wave. So, in that sense late 2022-2023 we saw some of the pent-up demand. Right now, there is just a bit more stability that is coming in. Most economies are doing reasonably well; in India it is a different story but of course, our client base is not very India-centric, and therefore, the extraordinary growth that we are seeing in India doesn’t necessarily translate to our business. But if we can grow in that high single digits considering what we are seeing right now, it’s a good situation just coming out of, all said and done one or two good years, and therefore, we can see a good trajectory going forward. That also ties into the margin, because our aspiration still remains to be in the 18-20 range, but we have a line of sight, but that also comes as long as we have some good growth because we will have to continue to invest a little bit into making sure that the growth happens, be it around sales, be it around technology development and that is a very important point because a lot of the growth is coming because of evolution in technology. I mean, all of you have heard about generative artificial intelligence (AI) and those kinds of technologies, which also means that we have to put the training and the effort behind us to make sure that we are prepared for that. So that will remain as long as we come back a little bit into the teens for the growth trajectory. And the second thing is, once the shift, which is happening quite a bit of the traditional mechanical data work moving into technology work, because then our investments into some of the things like training, etc, can actually come down a little bit. So that remains, but this is not the year for us to hold back on some of the investments that we will made both from the go-to-market perspective, but also retraining and rescaling people.

Q: Transportation for you is aerospace, which has been doing well, and you have a railway that has been degrowing. I think it’s been under some pressure. So, could you tell us out of this entire mix, how much is coming in from aero, how much is coming in from rail and what have been the growth rates out there and how do you see it shaping up?

A: Aero is the predominant part, it is about 80%, but rail, we have been degrowing, we have some very specific customer issues, but also industry level issues where a significant consolidation is going on in the rail sector. There are a lot of acquisitions that have happened, there is also a lot of divestitures because of the acquisitions in the sense that anti-competitive laws in various countries are kicking in. So, there is just a lot of churn in the rail sector right now. Having said that our aerospace business this year grew 20% year on year compared to last year. So that is great growth for a large part of that business, and we see that continuing into next year; while the Q4 was a bit tepid for the aerospace business, we are seeing that growth is coming back, we won some really good deals that we talked about yesterday also, not just renewables, but significant additions. I spoke about a deal with Airbus on the investor call yesterday, Deutsch Aircraft is a new customer which we also made a press release around and also, we are swaying quite nicely into some of the emerging trends in aerospace like urban air mobility, electric propulsion and so on so forth. So, aerospace will continue, and rail is where we are still a bit wait and watch or cautious because various things are still going on and things have to settle.

Also Read | K Krithivasan of TCS expects margins to sustain at current levels

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Click here to follow Lok Sabha Elections 2024 Phase 2 Voting Live updates

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter