Trade Setup for May 9: Nifty remains on the edge ahead of weekly expiry as banks drag

Summary

All eyes will remain on banking stocks on Thursday as State Bank of India reports its results.

It is not very often that you get to see the Nifty ending at the exact same level it had closed the previous day. It happened on Wednesday. Not a smidge here, nor there. While the index did slip below the 22,200 mark at one point, it staged a recovery from the lows of 22,185. Autos and Metals contributed to that recovery.

PSU Banks too, after shedding nearly ₹1 lakh crore in market capitalisation across Monday and Tuesday, staged a rebound ahead of State Bank of India’s results on Thursday.

The India VIX though, showed no signs of cooling off. That index continues to remain above the mark of 17 and gained for the ninth day in a row. Wednesday’s no move day means that the Nifty remains 500 points below its recent record high of 22,794.

Thursday will not only be the weekly options expiry for the Nifty 50 contracts, but a slew of Nifty and broader market names will also be announcing their results.

Stocks like L&T, Tata Power, TVS Motor, Godrej Agrovet, Sula Vineyards among others will react to results reported after market hours on Wednesday.

On Thursday, stocks like State Bank of India, Asian Paints, BPCL among the Nifty names and HPCL, MGL, PNB, Quess Corp, Rain Industries, Relaxo Footwear among the broader markets will report numbers. In fact, HPCL and BPCL will also consider proposals to issue bonus shares.

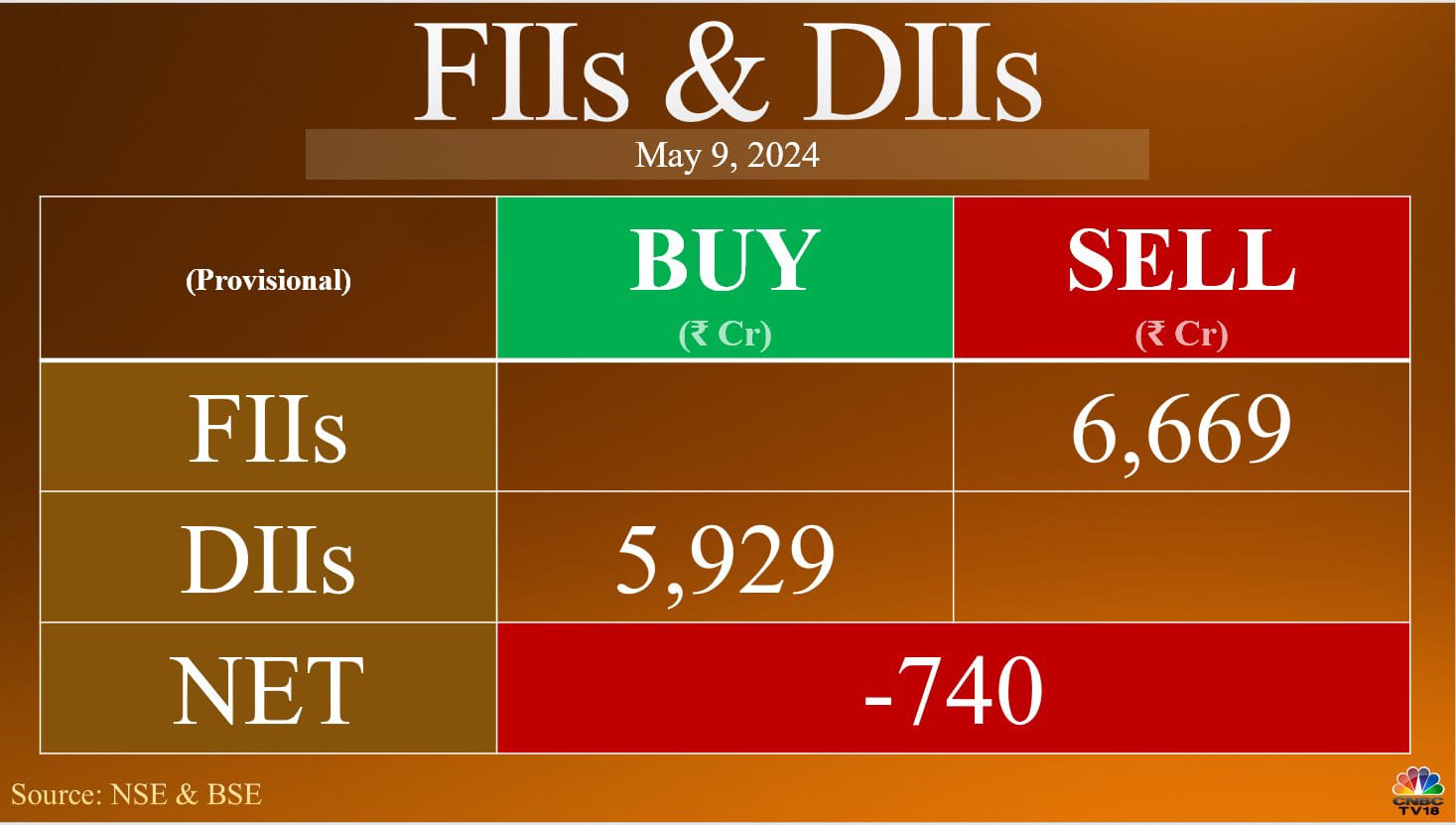

For Wednesday’s trading session, foreign investors continued to remain heavy sellers in the cash market, while domestic investors were net buyers.

The short-term texture of the market still remains on the weak side, said Shrikant Chouhan of Kotak Securities. He believes that the 50-DMA around 22,350 will be the key level to watch as till the time it remains below that level, the Nifty can retest levels of 22,150 – 22,100.

Nagaraj Shetti of HDFC Securities also agreed that the short-term Nifty trend remains weak but the index is showing signs of a higher bottom formation at around 22,200 levels. That remains the immediate support for the Nifty, while immediate resistance on the upside is at 22,500.

As long as the Nifty remains below the 22,400 mark, this short-term weakness will persist, as per Hrishikesh Yedve of Asit C Mehta Investment Intermediates. He expects the index to find strong support between levels of 22,100 – 22,000 and expects a consolidation between the 22,000 and 22,800 range.

The Nifty Bank continues to remain the underperformer and despite the support from PSU banks, the index failed to find any signs of a rebound as private banks continued to put pressure on the downside. The index did slip below the 48,000 mark intraday but found support near the crucial 47,800 levels. All eyes will remain on the index on Thursday as SBI reports its earnings for the March quarter. In five trading sessions, the Nifty Bank has corrected nearly 2,000 points from the record high of 49,974.

Kunal Shah of LKP Securities said that the next support for the index remains at 47,770, which coincides with the 50-Day Moving Average. 48,250 remains the immediate hurdle on the upside, above which, the index can move towards levels of 48,400 and 48,500.

The immediate swing support for the Nifty Bank is at 47,740, said Asit C Mehta’s Neeraj Sharma. In case the Nifty Bank maintains its support level, a relief rally towards 48,400 – 48,600 is possible.

What Are The F&O Cues Indicating?

Nifty 50’s May futures added 1.2% or 1.2 lakh shares in Open Interest on Wednesday. They are trading at a premium of 91.35 points from 79.3 points earlier. On the other hand, Nifty Bank’s May futures added 0.9% or 20,250 shares i Open Interest on Wednesday. Nifty 50’s Put-Call Ratio remains unchanged at 0.77 from 0.78.

Canara Bank and Piramal Enterprises are two new stocks in the F&O ban, along with Aditya Birla Fashion, Biocon, Vodafone Idea, Balrampur Chini, GMR Airports, SAIL, PNB and Zee Entertainment.

Nifty 50 on the Call side for May 9 expiry:

On the Call side, the Nifty 50 strikes between 22,300 and 22,500 have seen Open Interest addition for today’s weekly expiry.

| Strike | OI Change | Premium |

| 22,400 | 26.4 Lakh Added | 35.25 |

| 22,300 | 18.9 Lakh Added | 76.4 |

| 22,500 | 16.7 Lakh Added | 14.95 |

| 22,350 | 12 Lakh Added | 53.2 |

Nifty 50 on the Put side for May 9 expiry:

On the Put side, the Nifty 50 strikes between 22,100 and 22,300 have seen Open Interest addition for today’s expiry.

| Strike | OI Change | Premium |

| 22,200 | 25.7 Lakh Added | 32.35 |

| 22,100 | 22.4 Lakh Added | 14.15 |

| 22,300 | 13.7 Lakh Added | 67.75 |

These stocks added fresh long positions on Wednesday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Bharat Forge | 16.04% | 31.95% |

| Chambal Fertilisers | 4.26% | 19.93% |

| TVS Motor | 2.11% | 15.93% |

| Max Financial Services | 1.45% | 15.76% |

| ABB India | 4.17% | 14.75% |

These stocks added fresh short positions on Wednesday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| Pidilite | -4.63% | 39.70% |

| Voltas | -5.02% | 27.97% |

| Piramal Enterprises | -2.75% | 13.90% |

| Canara Bank | -3.36% | 13.72% |

| Asian Paints | -2.71% | 13.05% |

Short covering was seen in these stocks on Wednesday, meaning an increase in price but decline in Open Interest:

| Stock | Price Change | OI Change |

| Navin Fluorine | 0.74% | -12.15% |

| Gujarat Gas | 1.61% | -9.28% |

| Lupin | 0.86% | -3.47% |

These are the stocks to watch out for ahead of Thursday’s trading session:

- L&T: Ended FY24 with order inflow growth of 30%, above the 20%+ guidance. Revenue growth also above 20%, beats the 12% to 15% guidance. FY25 order inflow growth seen at 10%, topline growth seen at 15%, while core margins seen at 8.25%. For the March quarter, net profit stood at ₹4,396 crore, higher than the CNBC-TV18 poll of ₹4,267 crore and up 10.3% from last year. Revenue up 15% to ₹67,078 crore, higher than then estimate of ₹66,280 crore. EBITDA margin of 10.8%, lower than the poll of 11.4% and down 90 basis points from 11.7% last year. Board also declares a final dividend of ₹28 per share.

- Bank of Baroda: RBI lifts restrictions on BoB World with immediate effect. The bank will now resume onboarding new customers through the BoB World application. The RBI, in October 2023 had suspended onboarding of customers onto BoB World citing certain supervisory concerns in the mobile banking onboarding process.

- Tata Power: Revenue up 27.3% from last year to ₹15,847 crore. EBITDA up 21% to ₹2,331 crore. EBITDA margin down 70 basis points to 14.7% from 15.4%. Net profit up 15.2% to ₹895 crore. 4.3 GW cell and module manufacturing facility in Tirunelveli has commenced production and commercially produced around 130 MW of modules in the quarter. Renewable portfolio capacity at 10 GW, inclusive of 5.5 GW in the implementation pipeline. Tata Power Renewable Energy Ltd.’s utility scale EPC order book is at 2.6 GW and is worth ₹13,400 crore. Rooftop solar and group captive EPC order book is at ₹2,900 crore.

- TVS Motor: Net profit of ₹485.4 crore, lower than the CNBC-TV18 poll of ₹540 crore. Revenue of ₹8,168.8 crore is higher than the poll of ₹8,020 crore. EBITDA of ₹926 crore also higher than the estimate of ₹897 crore. EBITDA margin of 11.3% is 30 basis points higher than the 11% projection. Margin expanded by 100 basis points year-on-year and EBITDA grew by 36.2%. EBITDA for the quarter is the highest ever. Overall two-wheeler and three-wheeler sales including exports grew by 22% from last year. EV sales grew by 15%. Achieved record sales of 4 million units in financial year 2024.

- Piramal Enterprises: Disbursals up 30.5% to ₹8,910 crore. AUM growth of 7.6% year-on-year but down 2.8% sequentially to ₹68,845 crore. Gross NPA at 2.37% from 2.41% sequentially. Net NPA at 0.83% from 1.1% sequentially. Net Interest Margin at 6.8% from 7.8% last year. Cost-to-Income ratio at 221.5% from 59.2% last year and 80.7% sequentially. Net Income at ₹1,361, up 19.5% year-on-year. Operating loss of ₹1,653.6 crore from profit of ₹465 crore last year. The board has also proposed to merger Piramal Enterprises with its subsidiary Piramal Capital & Housing Finance and rename the combined entity as Piramal Finance Ltd. For every one share of Piramal Enterprises, shareholders will get one share of Piramal Finance and subject to RBI approval, one Non-Convertible, Non-Cumulative, Non-Participating Redeemable preference share worth ₹67 of Piramal Finance.

- BSE: Consolidated net profit up 20.7% to ₹106.9 crore. Consolidated revenue of ₹544.8 crore from ₹259 crore last year. Board recommends final dividend of ₹15 per share. Record date for final dividend fixed as June 14. Board also approves steps for disinvestment of its holding in its wholly-owned subsidiary BSE Institute Ltd.

- Sula Vineyards: Net profit down 4.2% to ₹13.6 crore. Revenue up 8% to ₹131.7 crore. EBITDA down 4.2% to ₹29.5 crore. EBITDA margin at 24.1% from 27.2% last year. Elite and Premium wine share rises to an all-time high of 75.1% from 71.7% a year ago. Wine tourism revenue grew in double digits for the fifth quarter in a row. Opened Milestone Cellars by Sula, the first standalone tasting room / wine bar outside the winery campuses. ND Wines acquisition completed in record time and work is about to begin on expanding the current 120 square feet bottle shop to a 3,600 square feet wine tourism destination near the Gujarat border.

- Godrej Agrovet: Net profit at ₹65.5 crore from ₹23.5 crore last year. Revenue flat at ₹2,134.3 crore. EBITDA nearly doubles to ₹148 crore. EBITDA margin at 6.9% from 3.6% last year. Profit growth driven by strong performance of the domestic crop protection business, structural turnaround of the dairy business, market share gains in animal feed and volume and margin growth in branded products for the poultry business. Domestic crop protection business was aided by higher volumes of in-house and in-licensed products. Animal feed business saw double-digit volume growth in cattle feed and fish feed categories. Dairy business returned to profitability. Astec Life had a challenging year as it was impacted by acute demand-supply imbalance. Board also declares dividend of ₹10 per share.

- Gujarat State Petronet: Net profit up 22.2% from ₹663.1 crore. Revenue up 5.9% to ₹4,522.2 crore. EBITDA up 12.2% to ₹959.8 crore. EBITDA margin at 21.2% from 20% last year. Volumes at 33.37 MMSCMD from 25.08 MMSCMD last year. Gas transportation revenue up to ₹501.1 crore from ₹421.5 crore.

- Kalpataru Projects: Net profit up 20.7% to ₹169 crore. Revenue up 22.3% to ₹5,971 crore. EBITDA up 36.1% to ₹452 crore. EBITDA margin at 7.6% from 6.8%. Consolidated order book at all-time high of ₹58,415 crore. Standalone net debt declined by 29% sequentially to ₹1,833 crore. Additional L1 for projects worth over ₹5,000 crore. Successful in foraying into large value projects in oil & gas pipeline, airport, T&D and underground metro rail tunnelling. Proposes dividend of ₹8 per share.

- Bajaj Consumer Care: Net profit down 12.1% at ₹35.6 crore, revenue down 3.8% to ₹240 crore. EBITDA down 16.8% to ₹34.7 crore, EBITDA margin down to 14.5% from 16.7%. Board approves buyback of up to ₹166.5 crore at ₹290 per share, which is a 11.6% premium to Wednesday’s closing price.

- Home First Finance: Disbursements up 26.8% from last year to ₹1,101.9 crore. AUM growth of 34.7% year-on-year to ₹9,697.8 crore. Gross NPA and Net NPA flat at 1.7% and 1.2% respectively. NIMs fall to 5.4% from 6.1% last year. Net Interest Income up 20.4% to ₹121.46 crore. Net profit up 30.4% to ₹83.5 crore.

- NBCC: Gets work orders worth ₹400 crore in Chhattisgarh and Kerala.

- Rail Vikas Nigam: Gets order worth ₹167.3 crore from South Eastern Railway.

- WPIL: To consider stock split on May 25, 2024.

- Juniper Hotels: Signs term loan and working capital facility agreement worth ₹491 crore with ICICI Bank. Out of this agreement, ₹416 crore is for refinancing the existing loans from JP Securities Asia, while the rest will be used for general working capital requirements.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter