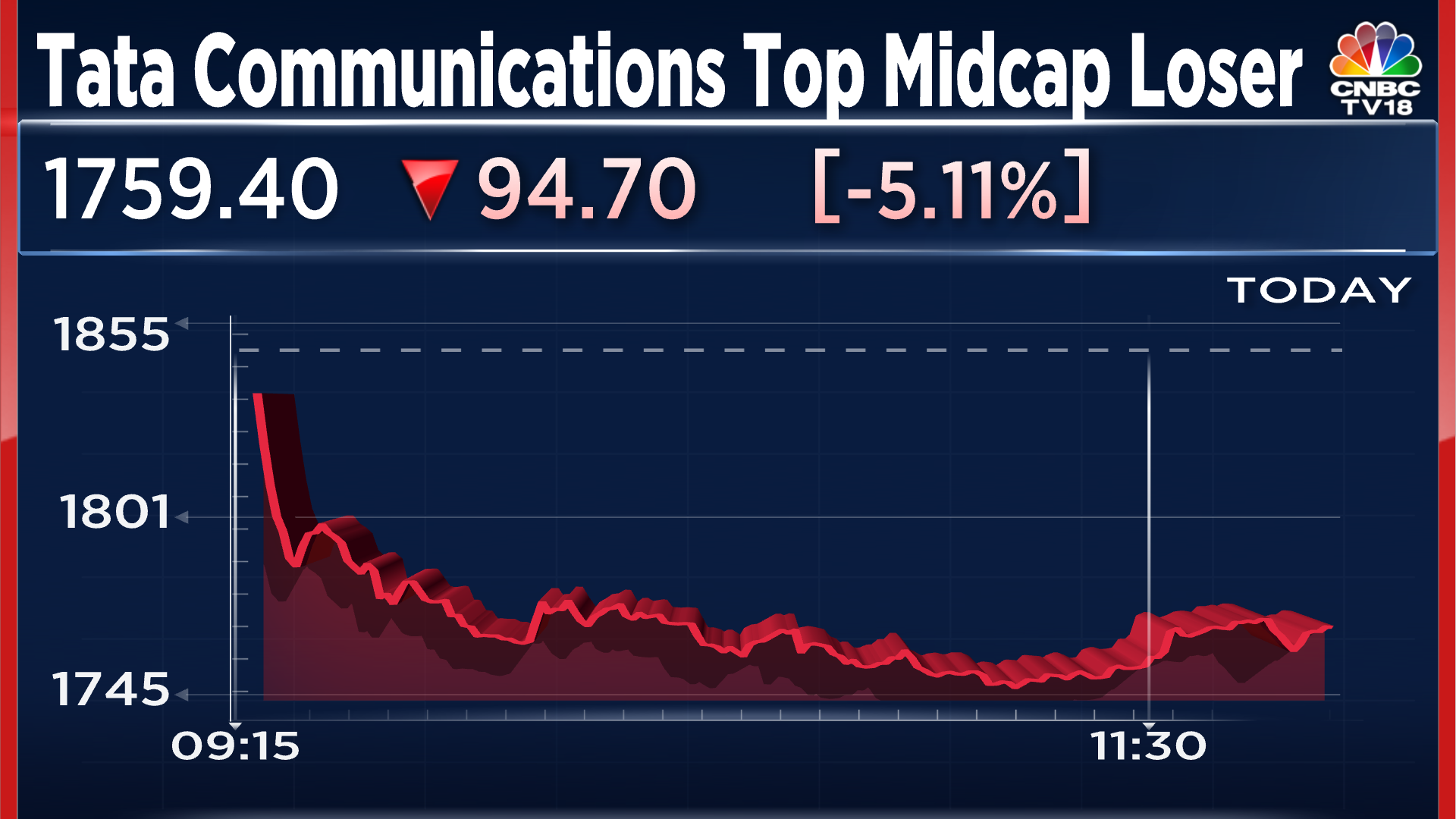

Tata Communications shares extend losses for eighth straight day, down over 5%

Summary

Tata Communications Share Price | The stock has fallen around 14% in the last eight days. This is the stock’s longest losing streak since October 2023, when it was in the red consecutively from October 11 to October 26.

Tata Communications shares extended losses for the eighth consecutive day on Friday, April 19, 2024. The stock is also the top Nifty Midcap loser, trading over 5% lower around noon.

The stock has fallen around 14% in the last eight days. This is the stock’s longest losing streak since October 2023, when it was in the red consecutively from October 11 to October 26.

Kotak Institutional Equities has maintained a ‘sell’ rating on the Tata Communications stock reducing its fair value to ₹1,525 from the previous ₹1,595.

It says the company’s organic data revenue growth further moderated to 4.8%. This is on the back of continued headwinds from the global slowdown. The company’s management has indicated that the funnel remains robust, but order booking has been weaker than expected on global headwinds and delayed decision making.

The company’s margin have declined 160 basis points from the previous quarter and are down 410 bps from the previous year. The company’s management expects the margin to recover in the present fiscal year. It has reiterated its ambition of doubling data revenue for FY27 and getting back to 23-25% EBITDA margin in the medium term. The brokerage says both these ambitions remain a tall ask.

The company’s EBITDA% came in at 18.56% in the March quarter. It was between 22% to 25.5% in the last three quarters of the previous fiscal.

The company reported its quarterly results earlier this week. It witnessed a 1.5% dip in net profit at ₹321.2 crore in the March quarter, compared to the previous year’s ₹326 crore.

Revenue from operations increased 24.6% to ₹5,691.7 crore against ₹4,568.7 crore in the corresponding period of the preceding fiscal.

At the operating level, EBITDA rose 2.1% to ₹1,056.3 crore in the fourth quarter of this fiscal over ₹1,034.3 crore in the corresponding period in the previous fiscal. EBITDA margin stood at 18.6% in the reporting quarter compared to 22.6% in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation, and amortisation.

The company’s board of directors recommended a final dividend of ₹16.7 apiece, with a face value of ₹10 each, for FY24. The dividend, if approved by the shareholders at the ensuing annual general meeting, will be paid to the eligible shareholders after the meeting’s conclusion.

The company’s consolidated revenue for the fiscal year increased 17.5% to ₹20,969 crore. The data revenue crossed the ₹17,000-crore mark, growing 21.9% on a full-year basis. The digital portfolio witnesses broad-based growth across all offerings, improving 55.4% on a full-year basis.

The stock was trading 5.16% at ₹1,758.7 apiece at 12.05 pm on April 19. The stock is down 7.84% in the past month. However, it has gained 47.53% in the past year.

Also Read: Ashish Kacholia picks 3.17% stake in pharma stock that has rallied 300% in 12 months

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter