Here are two reasons why this IT stock is down 10% after Q4 results

Summary

What came as a negative surprise was L&T Technology Services lowering its EBIT margin guidance by more than 100 basis points to 16% in FY25 due to front-loading of investment.

Eight of 10 stocks in the Nifty IT index were in the green on April 26. Of the two in red, one declined as much as 10% to the day’s low after the companies announced results for the January to March 2024 quarter.

L&T Technology Services’ (LTTS) shares traded at ₹4,772.25, almost 8% lower from the previous close on NSE.

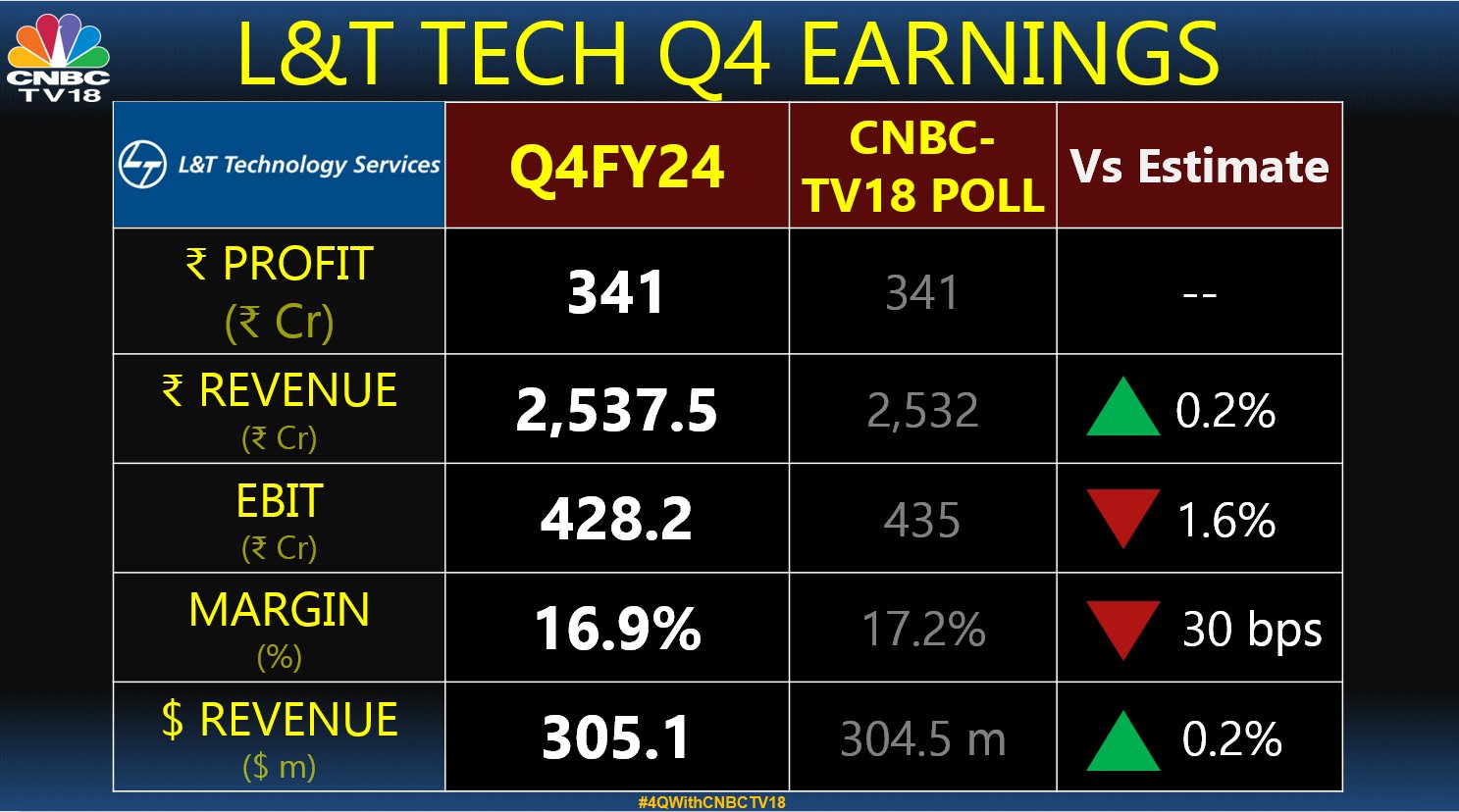

The decline in IT stock comes after the company’s fourth-quarter results. While the profit and revenue were in line with CNBC-TV18 poll expectations, the margin and earnings before interest and taxes (EBIT) were amiss.

What also came as a negative surprise was MD & CEO Amit Chadha-led LTTS lowering the EBIT margin guidance by more than 100 basis points to 16% in FY25 due to front-loading of investment. “We would like to change EBIT margin guidance of 18% from H1FY26 to medium term,” the company’s management told CNBC-TV18.

The margin miss along with the stock trading at 32 times the FY26 PE, which means it is expensive, are the two reasons why the L&T Technology Services shares have been declining.

Brokerage firm Morgan Stanley has an underweight call on the stock with a target price of ₹4,200, implying a 19% downside from the closing price on April 25.

The firm said weak revenue growth guidance was baked into buy-side estimates, however, a reset of margin expectations came as a negative surprise.

Given the stock’s year-to-date outperformance and cut to EPS estimate, the analyst said it expects the stock to underperform.

Citi, meanwhile, has given a sell rating on the stock and cut the target price to ₹4,070. It pointed out that the company maintains its aspiration to achieve a $1.5 billion revenue run rate by the end of FY25.

In a post-earnings chat with CNBC-TV18, Chadha pointed out that profit after tax (PAT) went from ₹1,000 crore to ₹1,300 crore in about two years and this will continue to go on and increase.

“We are making investments in our business in a deliberative manner to make sure that we are able to capture the opportunity that’s there because ER&D can benefit. And we can benefit from the ER&D hype cycle if we make the right investments. So, we see margins at 17% levels in the medium term, and then 18% is aspirational from there on.”

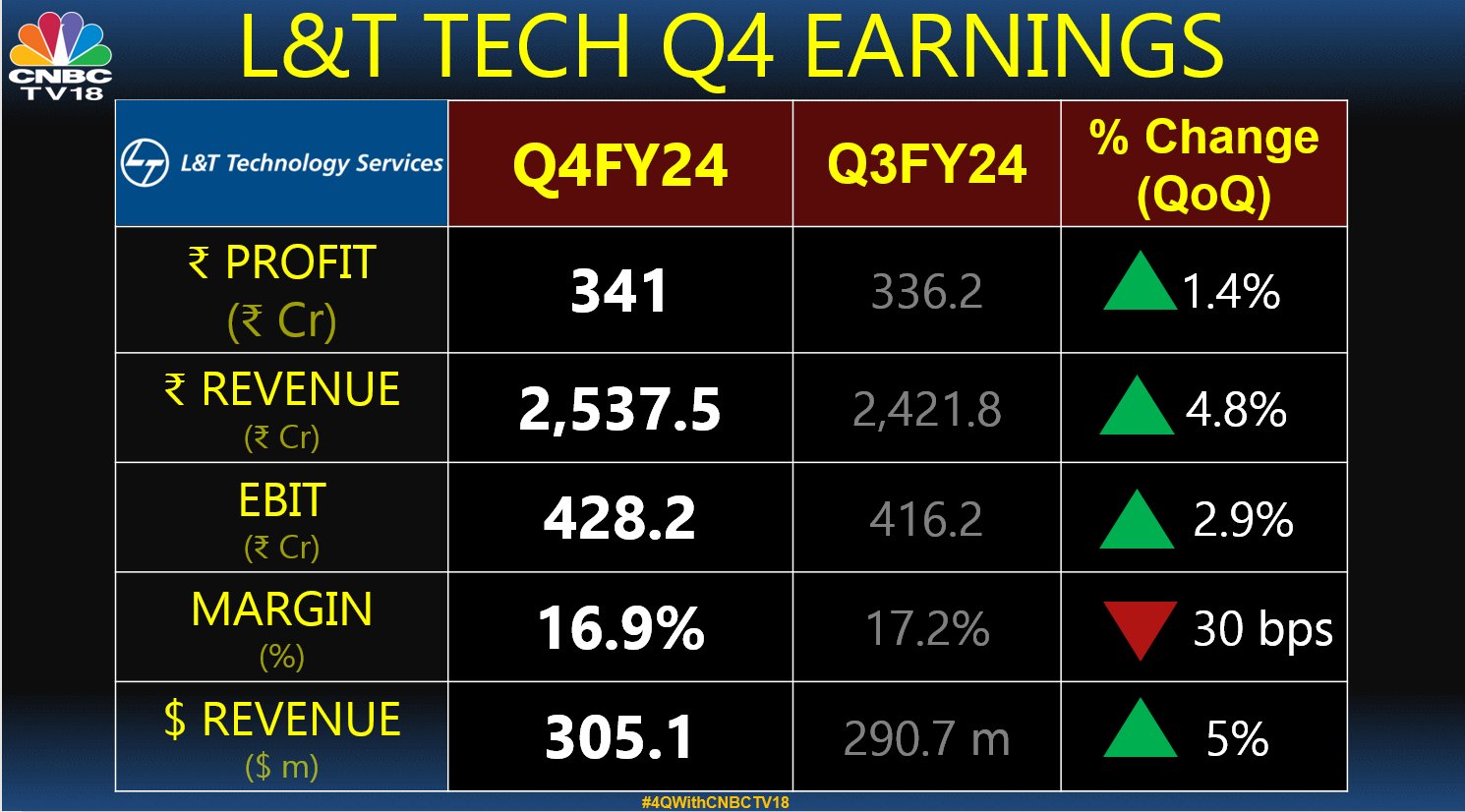

In terms of revenue, L&T Tech’s current quarter is probably the best in the industry and definitely better when compared to many of its other quarters.

“We’ve had. 5.1% sequential growth, 17.9% growth in constant currency… The next year, a lot of positive spending is coming to us in the software-defined vehicles area. We now work for eight of the top 10 automotive R&D spenders. We are also seeing a lot more work coming to us in oil and gas, CPG and chemicals because they are spending big time,” he added.

Track latest stock market updates on CNBCTV18.com’s blog here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter