Kotak Mahindra Bank to see de-rating post RBI action? Here’s what analysts said

Summary

Shares of Kotak Mahindra Bank have underperformed so far in 2024, declining 3.5%, compared to the Nifty Bank, that has remained flat.

Brokerage firm Macquarie has called Reserve Bank of India’s actions of private lender Kotak Mahindra Bank Ltd., “a significant setback.” The firm expects a medium-term de-rating for Kotak Mahindra Bank, similar to HDFC Bank’s de-rating that took place after the regulator’s actions on India’s largest private lender in 2020.

Macquarie highlighted in its note that a lot of savings accounts are opened through Kotak Bank’s 811 digital channel and majority of the unsecured products are also done digitally.

The ban on digital on-boarding is bound to affect growth over the medium-term, Macquarie wrote in its note.

On Wednesday evening, the Reserve Bank of India directed Kotak Mahindra Bank to stop issuing fresh credit cards and also onboard new clients through its digital channels.

Macquarie highlighted that Kotak Mahindra Bank seems reluctant in opening branches and less than 350 branches being opened in the last four years is also an issue.

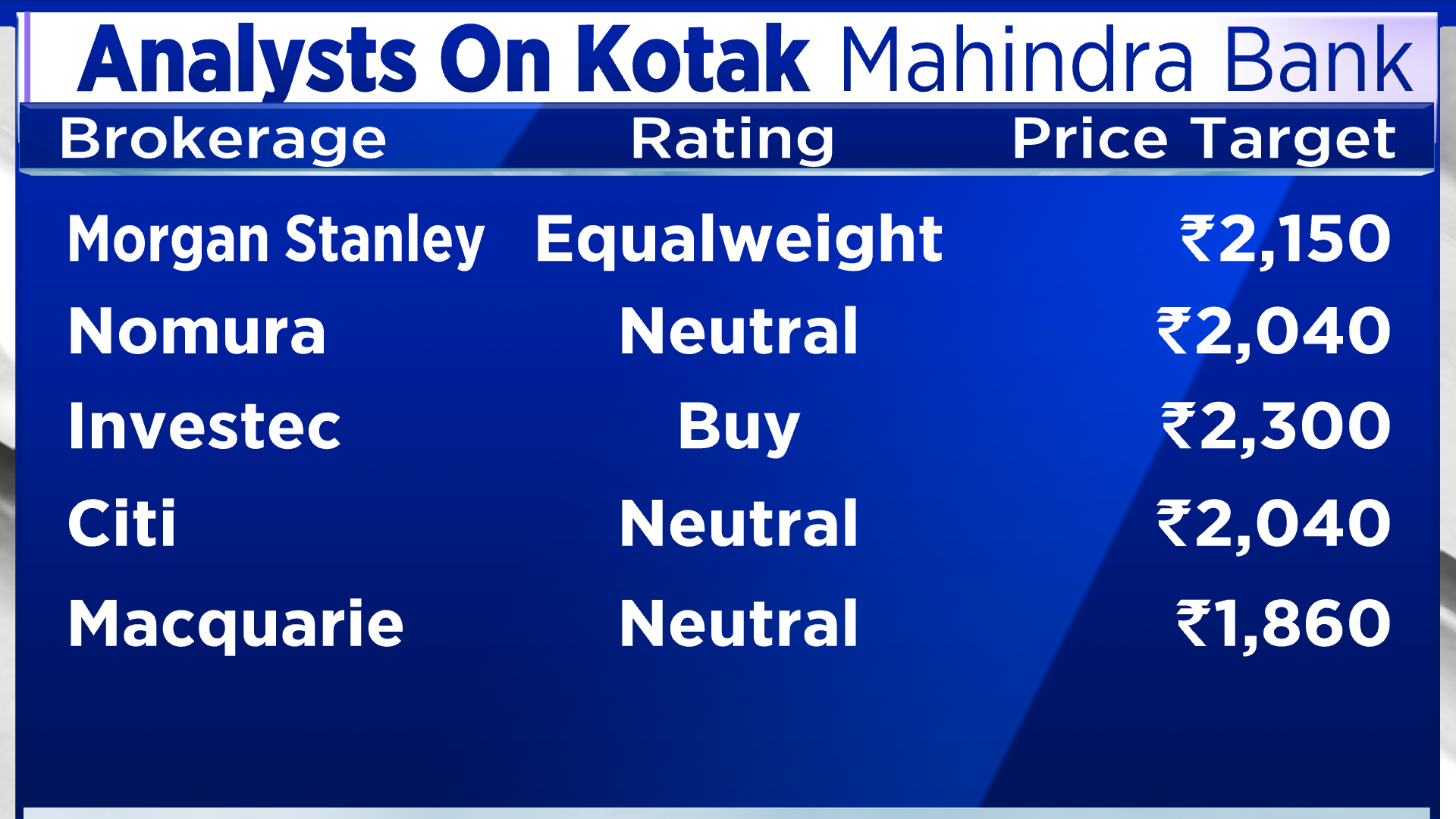

The brokerage remains neutral on Kotak Mahindra Bank with a price target of ₹1,860, which almost the same as the stock’s closing price on Wednesday.

Nomura also remains neutral on Kotak Mahindra Bank with a price target of ₹2,040. Although the brokerage sees limited impact on RBI’s curbs on the lender’s business and profitability, it does see a reputational impact on the lender.

“We will watch for how this matter resolves itself, especially considering the strongly worded nature of RBI’s release,” the brokerage wrote.

Nomura highlighted that credit cards constitute nearly 4% of the bank’s overall loans and were growing at 52% year-on-year as of the December quarter. The brokerage also said that the restrictions on the issuance may impede with the bank’s medium-term objective of scaling-up unsecured retail loans to mid-teens of its loan book.

Jefferies though has cut its price target on Kotak Mahindra Bank to ₹1,970 from ₹2,050 earlier. The brokerage continues to retain its “hold” recommendation on the lender. Jefferies highlighted similar issues faced by HDFC Bank in 2020, which took around 9-15 months for resolution.

The brokerage said that in case the resolution takes more than six months, it can affect the lender’s revenue and costs.

CLSA also echoed Nomura’s views that the impact on Kotak Bank’s profit is likely to be modest unless it stays in place for long. It further highlighted that the digital platform’s contribution to total savings deposits is only 8%.

While credit cards is a fast-growing segment, it contributes only 4% to the total loan book and given that its a high Return on Assets (RoA) business, the profit contribution will be in high-sigle-digits, according to CLSA.

The brokerage retained its “outperform” rating on the stock with a price target of ₹2,100.

Citi also wants Kotak Mahindra Bank to accelerate the pace of branch expansion and said that the RBI actions will adversely impact the lender’s growth, Net Interest Margin (NIM) and fee income.

It remains “Neutral” on Kotak Mahindra Bank with a price target of ₹2,040.

Shares of Kotak Mahindra Bank have gained 5% so far in the last one month but have underperformed so far in 2024, declining 3.5%.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter